NIUM

Founded Year

2014Stage

Series E | AliveTotal Raised

$314.1MValuation

$0000Last Raised

$50M | 4 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-3 points in the past 30 days

About NIUM

NIUM specializes in modern money movement within the financial technology sector. Its main offerings include a platform for cross-border payments, card issuance services, and banking-as-a-service solutions, designed to facilitate global financial transactions for businesses. NIUM primarily serves financial institutions, travel companies, payroll providers, spend management platforms, and global marketplaces. NIUM was formerly known as InstaReM. It was founded in 2014 and is based in Singapore.

Loading...

NIUM's Product Videos

ESPs containing NIUM

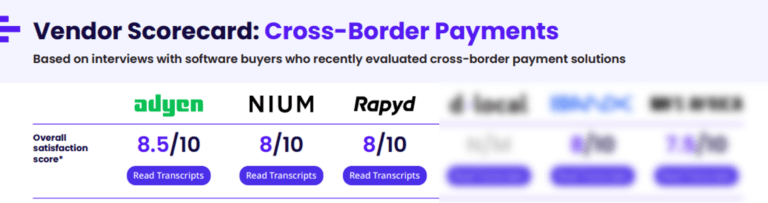

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

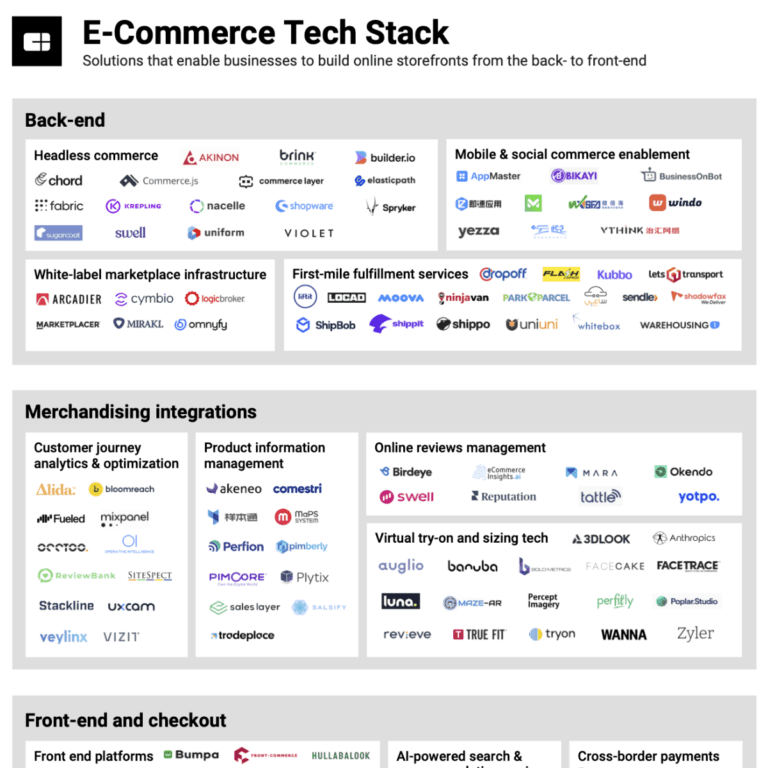

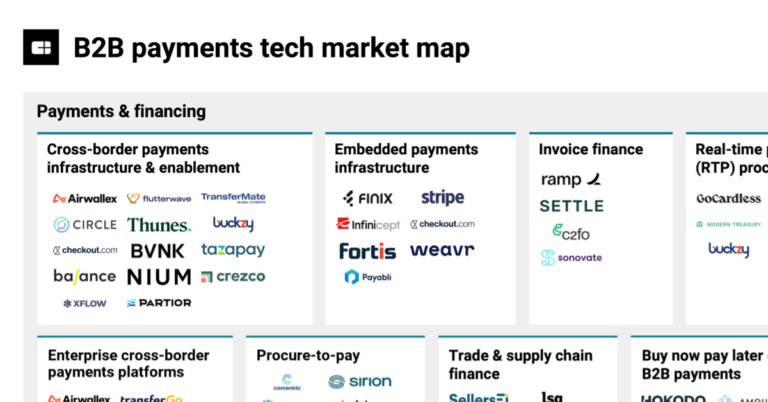

The cross-border payments infrastructure & enablement market allows businesses to send and accept global payments on their own websites and payment platforms. The companies in this market offer APIs that allow businesses to process payments across currencies and platforms (such as mobile), make payouts, verify user identities, issue credit cards, and more. Some companies also enable businesses to …

NIUM named as Leader among 15 other companies, including FIS, Adyen, and Checkout.com.

NIUM's Products & Differentiators

Payout

The most advanced means to send money around the world and deliver to bank accounts/proxy methods, cards, e-wallets. Pay employees or build functionality that delights customers from anywhere in the world – all with a single API based solution. With access to 190+ countries, and over 100 currencies Nium’s scale allows limitless growth.

Loading...

Research containing NIUM

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned NIUM in 12 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

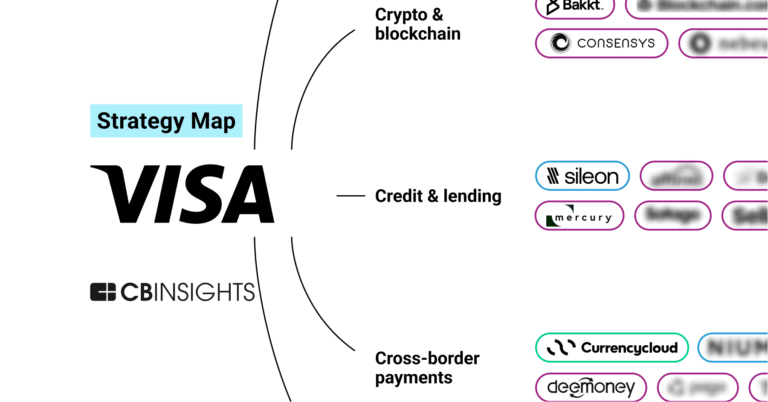

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market mapExpert Collections containing NIUM

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

NIUM is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

1,648 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

849 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

108 items

Latest NIUM News

Sep 10, 2024

Dear reader, The merger of Singapore’s dating pioneers Lunch Actually and Paktor comes at a time when dating app usage is facing significant challenges, with growing user fatigue and disillusionment. According to the latest Singles Dating Survey, dating app fatigue is driven by frustration over superficial interactions, fake profiles, and the emotional toll of ghosting. […] The post Ecosystem Roundup: Paktor, Lunch Actually merge | Nium delays IPO plans | Charge+ bags U$8M appeared first on e27.

NIUM Frequently Asked Questions (FAQ)

When was NIUM founded?

NIUM was founded in 2014.

What is NIUM's latest funding round?

NIUM's latest funding round is Series E.

How much did NIUM raise?

NIUM raised a total of $314.1M.

Who are the investors of NIUM?

Investors of NIUM include Bond, Tribe Capital, NewView Capital, Moore Capital Management, Global Founders Capital and 23 more.

Who are NIUM's competitors?

Competitors of NIUM include CURREN•C Group, TerraPay, Tranglo, Merchantrade, TransferGo and 7 more.

What products does NIUM offer?

NIUM's products include Payout and 2 more.

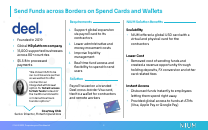

Who are NIUM's customers?

Customers of NIUM include Kasikorn Bank, Deel and eTraveli Group.

Loading...

Compare NIUM to Competitors

ZEPZ focuses on providing digital payment solutions. The company offers services enabling users to send money securely with options for bank deposit, cash collection, mobile airtime top-up, and mobile money. ZEPZ primarily serves the global payments industry. Zepz was formerly known as WorldRemit. It was founded in 2010 and is based in London, United Kingdom.

Airwallex develops a global financial platform focusing on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

MoneyGram operates as a financial services company. The company offers services such as sending money to various locations worldwide, depositing money into bank accounts, and transferring funds to mobile wallets. It primarily serves individuals who need to send or receive money internationally. MoneyGram was formerly known as Integrated Payment Systems, It was founded in 2003 and is based in Minneapolis, Minnesota.

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Rapyd is a fintech company specializing in global payment processing and financial technology solutions. The company offers a platform for businesses to accept payments online, send payouts, and manage multi-currency accounts, with a focus on simplifying financial transactions across borders. Rapyd's services cater to various sectors including eCommerce, marketplaces, and the gig economy. Rapyd was formerly known as CashDash. It was founded in 2016 and is based in London, England.

Worldpay provides electronic payment processing services to merchants and financial institutions. It offers merchant acquiring and payment processing services, such as authorization and settlement, customer service, chargeback and retrieval processing, and interchange management for national merchants, and regional and small-to-medium-sized businesses. The company was founded in 1993 and is based in London, United Kingdom.

Loading...