Konfio

Founded Year

2013Stage

Line of Credit - IV | AliveTotal Raised

$1.036BLast Raised

$100M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-60 points in the past 30 days

About Konfio

Konfio is a financial technology company that specializes in providing financial solutions and payment services to small and medium-sized enterprises (SMEs). The company offers products such as business credit, corporate cards, and payment terminals. Konfio primarily serves the SME sector, offering tools and resources to help businesses grow and manage their finances. It was founded in 2013 and is based in Mexico City, Mexico.

Loading...

Loading...

Research containing Konfio

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Konfio in 3 CB Insights research briefs, most recently on Nov 17, 2022.

Mar 30, 2022

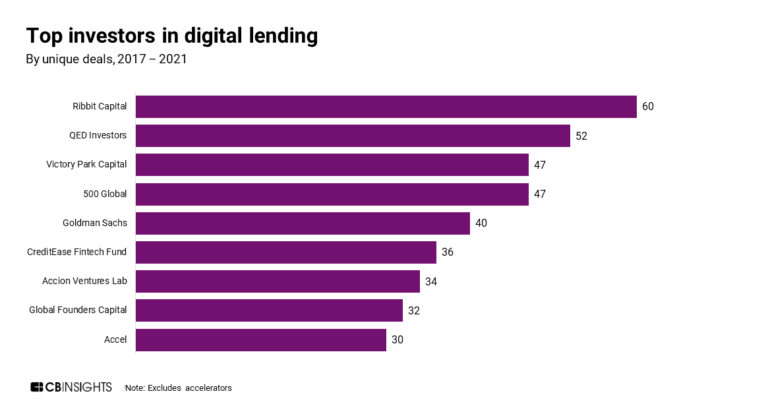

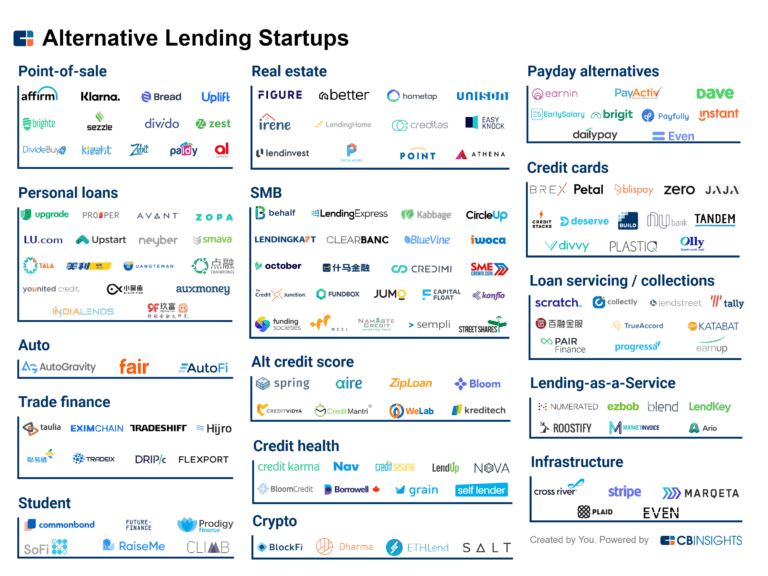

140+ startups shaping the digital lending spaceExpert Collections containing Konfio

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Konfio is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Lending

2,271 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,231 items

Fintech

13,396 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Konfio News

Sep 16, 2024

Top 6 Unicorns in Mexico Gina MarrsSeptember 16, 2024 Mexico has become a great location for startups, especially those operating in the tech industry. It was ranked second in Latin America in terms of entrepreneurial ecosystems in the beginning of 2024, jumping two spots from the year before. Globally, Mexico is now 37th in the world . According to research conducted by PWC, venture capital investment in Mexico has increased by four times since 2017 and there are also significantly more new companies emerging every year. Mexico City, Guadalajara and Monterrey are the top three cities in the country in terms of numbers of startups and investors. However, while investors are increasing, most startups still receive small amounts of investment from family and friends. Indeed, while the landscape certainly is improving dramatically and quickly, Mexico still has a way to go. As of the beginning of 2024, Mexico City now has a total of eight unicorns. After the country’s massive increase in venture capital in 2019, Mexico finally became home to its first-ever unicorn. Kavac achieved its $1 billion status in 2020 after having received a funding injection of $400 million. The industries in Mexico with the highest growth rates are beauty and wellness; transportation and mobility; agriculture; information technology; financial services; and business services. Here are the top 6 unicorns in Mexico. Clip is a digital payment platform that is designed to assist businesses increase sales and ultimately, growing their businesses. The platform allows for payments to be accepted from all types of credit and debit cards and contactless technology. It avoids monthly fees and minimal sales, making the process easier for businesses with fewer hoops to jump through. Founded in Mexico City in 2012, Clip was founded by Adolfo Babatz and Vilash Poovala and has now been through a total of 10 funding stages and has 30 different investors. Having received a total of just under $400 million, Clip now has about 800 employees. Konfio, valued at $1.3 billion, is the developer of an online lending platform designed to offer micro-business loans. It offers a service that is designed to complement traditional financial analysis. It gives clients access to credit options by combining data and technology to measure their credit scores. The aim is to help people who often aren’t able to receive loans and other services from traditional banks, helping them grow their businesses when they otherwise may not have been able to. The business was founded by David Arana and Francisco Sanchez in 2013. Based in Mexico City , Konfio now has about 800 employees and 16 different investors.

Konfio Frequently Asked Questions (FAQ)

When was Konfio founded?

Konfio was founded in 2013.

Where is Konfio's headquarters?

Konfio's headquarters is located at Avenue Horacio 1844, Floor 8, Mexico City.

What is Konfio's latest funding round?

Konfio's latest funding round is Line of Credit - IV.

How much did Konfio raise?

Konfio raised a total of $1.036B.

Who are the investors of Konfio?

Investors of Konfio include J.P. Morgan Chase, 500 Latam, Ford Foundation, Citibanamex, U.S. International Development Finance Corporation and 22 more.

Who are Konfio's competitors?

Competitors of Konfio include Creze, Tribal Credit, Albo, Klar, R2 and 7 more.

Loading...

Compare Konfio to Competitors

Fondeadora provides digital banking services. The company offers a mobile banking application and an international master-card debit card that helps users to spend, store, and move money. It primarily serves the financial services industry. The company was founded in 2011 and is based in Mexico City, Mexico.

Albo is an electronic funds institution that offers financial services for personal and business needs. The company provides personal and business debit accounts, loans, payroll services, and facilitates cryptocurrency transactions, all managed through a single app. Albo primarily serves individuals and small to medium-sized businesses with their financial management and growth. It was founded in 2016 and is based in Mexico City, Mexico.

AlphaCredit provides credit lines to individuals and small companies in Mexico and Colombia via a programmed deduction system, which has low default rates thus allowing for low-interest rates.

Klar is a financial services company offering credit card services, personal savings, and investment products. The company provides credit cards with no annual fees, savings accounts with daily growth, and flexible investment options with competitive returns. Klar's offerings are designed to cater to individuals seeking accessible financial products and tools for managing their finances. It was founded in 2019 and is based in Mexico City, Mexico.

Finve is a business financing platform in Mexico that aims to connect SMEs (small & medium enterprises) to investors. Per the company, they offer yields between 8% and 30% annually and aim to minimize volatility and risk through diversification.

Kubo Financiero is a financial entity that operates in the personal finance sector, offering a range of financial services. The company provides online personal loans, fixed-term investment opportunities, debit card services, and tools for managing expenses through an application. It was founded in 2012 and is based in Mexico City, Mexico.

Loading...