Ledgy

Founded Year

2017Stage

Series B | AliveTotal Raised

$33.95MLast Raised

$22.81M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-59 points in the past 30 days

About Ledgy

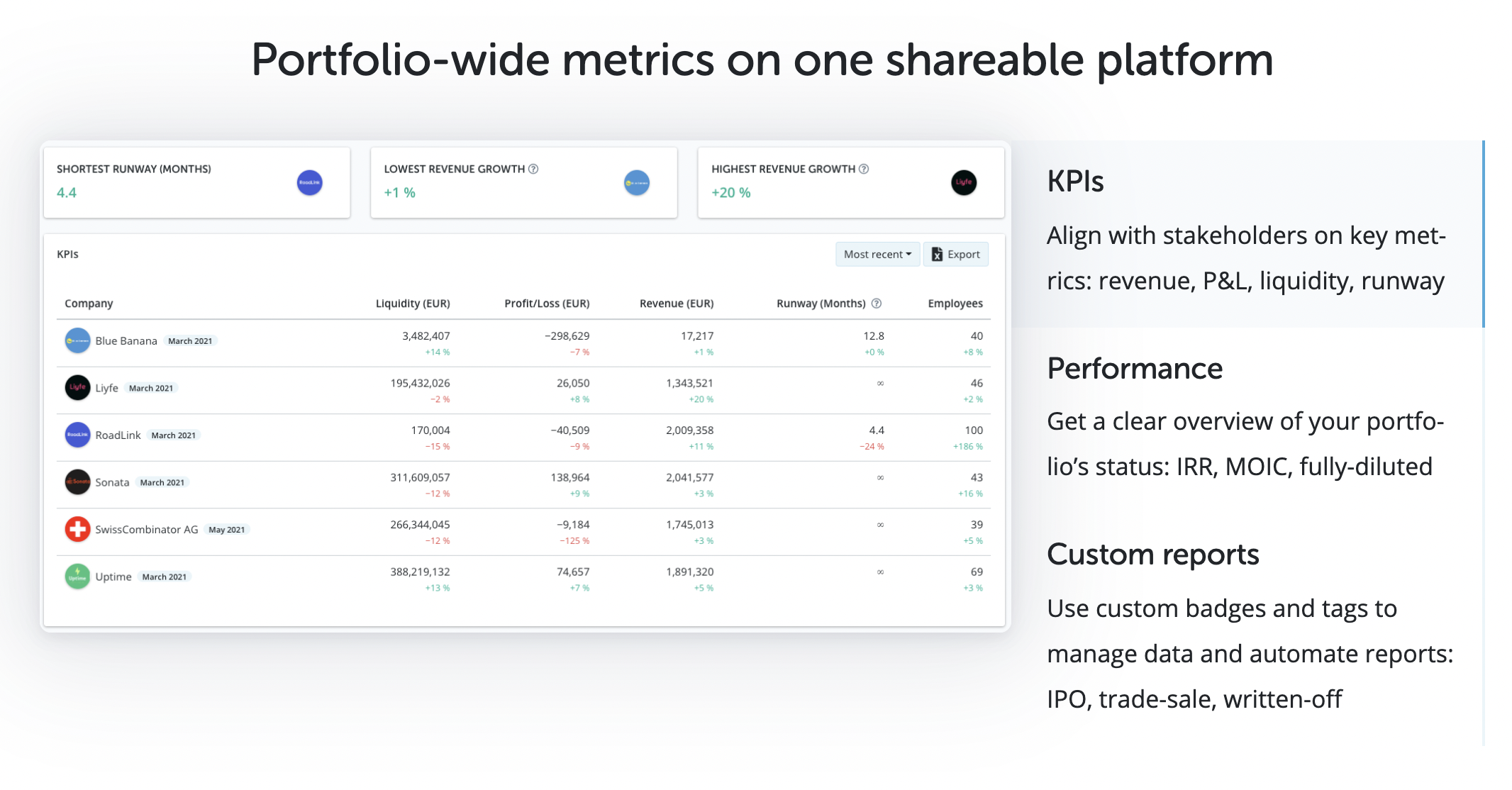

Ledgy is an equity management platform that specializes in streamlining equity-related processes for businesses. The company offers solutions for cap table management, equity plan automation, and financial reporting, designed to simplify workflows, ensure compliance, and enhance employee engagement through intuitive dashboards. Ledgy's platform is tailored to serve various sectors, including HR and compensation, finance and accounting, and legal and operations. It was founded in 2017 and is based in Zurich, Switzerland.

Loading...

Ledgy's Product Videos

ESPs containing Ledgy

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The equity management market enables individuals and institutions to manage, track, and optimize their ownership stakes in various assets, such as stocks and shares. Equity management tools offer a range of benefits, including portfolio diversification, risk mitigation, and performance monitoring. They empower investors to make data-driven decisions, align their equity strategies with financial go…

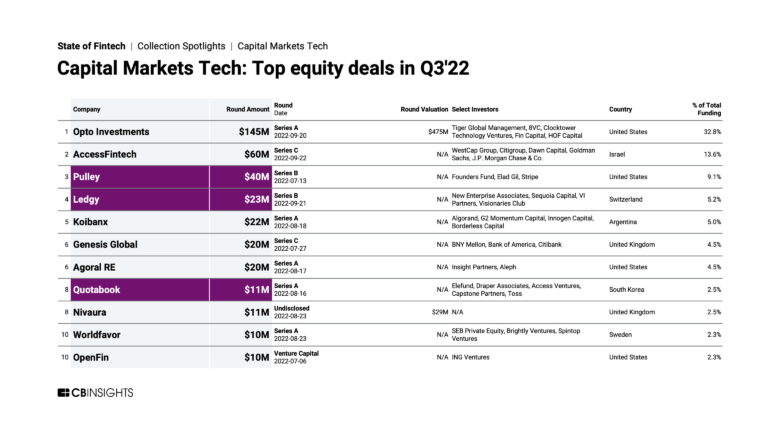

Ledgy named as Leader among 9 other companies, including Carta, Pulley, and Qapita.

Ledgy's Products & Differentiators

Equity Management

All equity workflows in one single platform

Loading...

Research containing Ledgy

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ledgy in 1 CB Insights research brief, most recently on Nov 11, 2022.

Nov 11, 2022

3 capital markets trends to watchExpert Collections containing Ledgy

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ledgy is included in 3 Expert Collections, including Capital Markets Tech.

Capital Markets Tech

1,118 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

SMB Fintech

1,231 items

Fintech

13,396 items

Excludes US-based companies

Latest Ledgy News

Jul 22, 2024

CONTENT POSTED BY MEMBERS DOES NOT NECESSARILY REFLECT THE OPINION OR BELIEFS OF ALPHAMAVEN AND HAS NOT ALWAYS BEEN INDEPENDENTLY VERIFIED BY ALPHAMAVEN. IT DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY INTERESTS OF ANY FUND OR ANY OTHER SECURITIES. ANY SUCH OFFERINGS CAN BE MADE ONLY IN ACCORDANCE WITH THE TERMS AND CONDITIONS SET FORTH IN THE INVESTMENT'S PRIVATE PLACEMENT MEMORANDUM. PRIOR TO INVESTING, INVESTORS ARE STRONGLY URGED TO REVIEW CAREFULLY THE PRIVATE PLACEMENT MEMORANDUM (INCLUDING THE RISK FACTORS DESCRIBED THEREIN), THE LIMITED PARTNERSHIP AGREEMENT AND THE SUBSCRIPTION DOCUMENTS, TO ASK SUCH QUESTIONS OF THE INVESTMENT MANAGER AS THEY DEEM APPROPRIATE, AND TO DISCUSS ANY PROSPECTIVE INVESTMENT IN THE FUND WITH THEIR LEGAL AND TAX ADVISERS IN ORDER TO MAKE AN INDEPENDENT DETERMINATION OF THE SUITABILITY AND CONSEQUENCES OF AN INVESTMENT. ALPHAMAVEN

Ledgy Frequently Asked Questions (FAQ)

When was Ledgy founded?

Ledgy was founded in 2017.

Where is Ledgy's headquarters?

Ledgy's headquarters is located at Forrlibuckstrasse 190, Zurich.

What is Ledgy's latest funding round?

Ledgy's latest funding round is Series B.

How much did Ledgy raise?

Ledgy raised a total of $33.95M.

Who are the investors of Ledgy?

Investors of Ledgy include b2venture, VI Partners, Visionaries Club, Sequoia Capital, New Enterprise Associates and 15 more.

Who are Ledgy's competitors?

Competitors of Ledgy include Capbase, Capdesk, Upstock, J.P. Morgan Workplace Solutions, Trustwise and 7 more.

What products does Ledgy offer?

Ledgy's products include Equity Management.

Who are Ledgy's customers?

Customers of Ledgy include Getir, Kry, Tide, Wefox and Wallapop.

Loading...

Compare Ledgy to Competitors

Carta focuses on ownership and equity management solutions. The company offers a range of services including equity management, compensation management, and venture capital solutions, which help businesses manage their equity, build their businesses, and invest in future companies. It primarily serves sectors such as investment funds, law firms, and companies in various stages of growth. It was formerly known as eShares. It was founded in 2012 and is based in San Francisco, California.

Shareworks is a company that focuses on providing workplace financial solutions, operating within the financial services industry. The company offers a range of services including equity plan administration, retirement readiness programs, deferred compensation plan services, and executive services, all designed to help employees achieve their financial goals and companies to grow. The company primarily serves sectors such as private companies, public companies, and strategic partners. It was founded in 1999 and is based in New York, New York.

J.P. Morgan Workplace Solutions Workplace is a holistic tech and service-based offering that allows employees to easily navigate their workplace incentives. From stock plan management powered by Global Shares and financial education to wealth building and more, the solutions help companies attract and retain employees. Its primary customers are startups, tech unicorns, and enterprise brands. The company was formerly known as Global Shares. It was founded in 2005 and is based in Clonakilty, Ireland. J.P. Morgan Workplace Solutions operates as a subsidiary of J.P. Morgan.

Pulley operates as an equity management platform for fundraising. The company offers solutions including cap table management, fundraising modeling, crypto and tokens, communications hub, and more. It primarily serves the financial service sector. The company was founded in 2019 and is based in Oakland, California.

Nth Round specializes in equity management solutions for the private market sector. The company offers a platform that facilitates cap table management, shareholder communications, and administrative workflows for equity and ownership. Nth Round primarily serves family businesses, private companies, venture capital and private equity funds, and real estate businesses. It was founded in 2018 and is based in Philadelphia, Pennsylvania.

Upstock is a company specializing in equity management solutions within the financial technology sector. They offer RSU-based equity plans and a platform for real-time tracking and management of worker equity, designed to empower founders and team members to align and achieve collective success. Upstock primarily serves startups, legal experts, contractors, and companies looking to integrate equity into their compensation and culture. It was founded in 2019 and is based in Wilmington, Delaware.

Loading...