LetsGetChecked

Founded Year

2015Stage

Series D - II | AliveTotal Raised

$283MLast Raised

$20M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-50 points in the past 30 days

About LetsGetChecked

LetsGetChecked is a virtual care company that operates in the healthcare sector. The company provides telehealth services, pharmacy services, and at-home laboratory tests for a variety of health conditions. These services are primarily aimed at individuals seeking to manage their health from home. It was founded in 2015 and is based in Dublin, Ireland.

Loading...

LetsGetChecked's Product Videos

ESPs containing LetsGetChecked

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

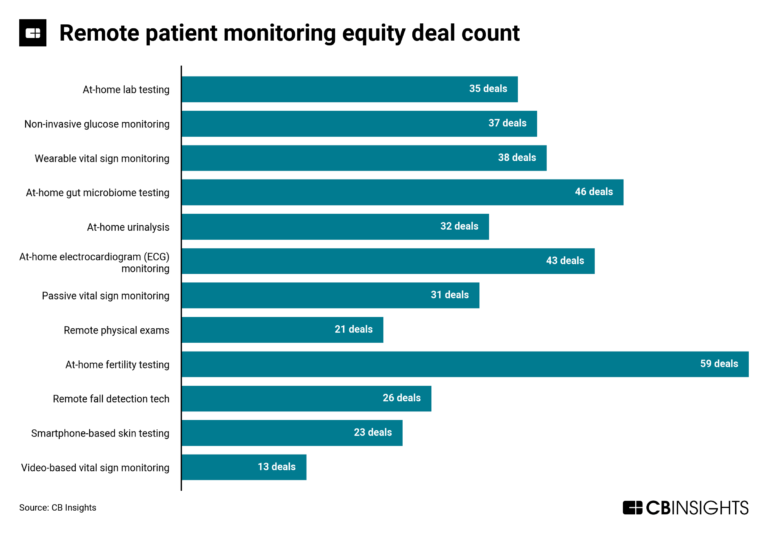

The at-home fertility testing market offers solutions for women who are trying to conceive or manage their hormonal health. These solutions go beyond self-reported ovulation tracking by using biomarkers to help determine fertility. Companies in this market offer products such as at-home ovulation test strips, basal body thermometers for ovulation tracking, or at-home testing kits that are then pro…

LetsGetChecked named as Leader among 15 other companies, including LabCorp, Ro, and Glow.

LetsGetChecked's Products & Differentiators

Home lab testing

Providing easy-to-understand and actionable health insights for over1200 biomarkers from the comfort of home. Powered by our high-complexity labs around the world.

Loading...

Research containing LetsGetChecked

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned LetsGetChecked in 4 CB Insights research briefs, most recently on Aug 15, 2023.

Aug 15, 2023

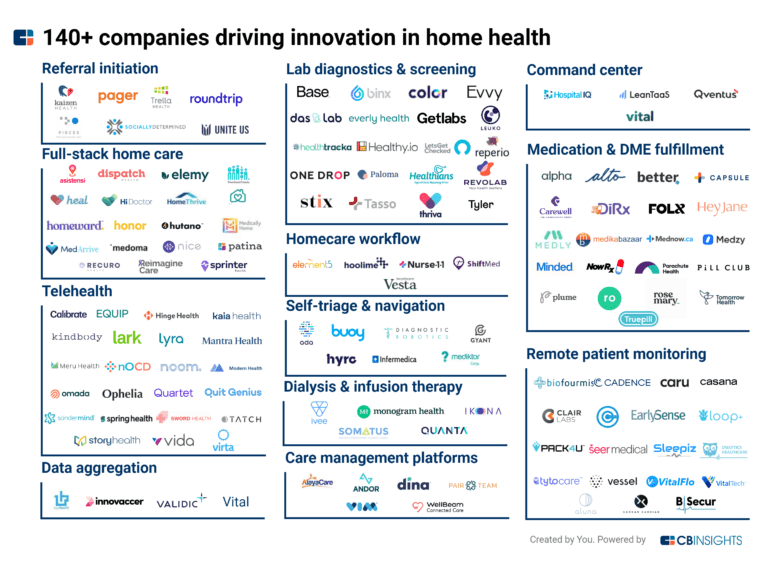

The remote patient monitoring market map

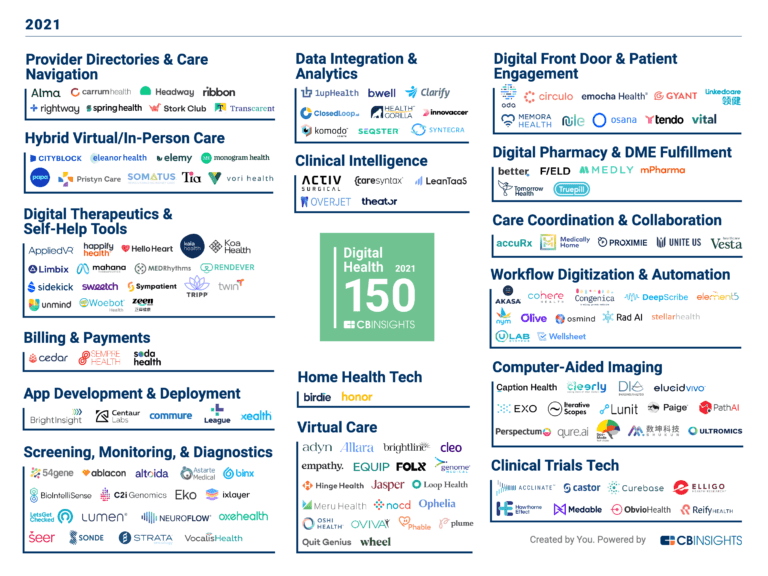

Dec 8, 2021 report

The Digital Health 150: The Top Digital Health Companies Of 2021Expert Collections containing LetsGetChecked

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

LetsGetChecked is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Health 50

450 items

The most promising digital health startups transforming the healthcare industry

Digital Health

11,067 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

2,916 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Women's Health Tech

585 items

This collection includes companies applying technology to address a spectrum of physical, mental, and social well-being concerns specific to women. Examples include companies in reproductive health, maternal care, fertility tracking, and menopause support.

Latest LetsGetChecked News

Sep 16, 2024

Startup Buying Power — VC-Backed Companies Are Hunting For More Startups Views: 1 It’s not exactly a shopping spree, but with overall M&A down, more startups are hunting for other VC-backed companies in the U.S. In fact, startups buying other startups is on pace to make up the largest slice of the M&A pie in years when it comes to overall VC-backed, U.S.-based startup dealmaking. This is a noteworthy development in the current environment where venture capitalists and their limited partners are thirsting for liquidity amid a frozen IPO pipeline and quiet M&A market. Through the first two-thirds of the year, 252 deals were consummated involving startups buying other startups in the states, per Crunchbase data . That number represents 39% of all M&A deals for U.S.-based startups — the highest percentage in at least a decade. The percentage is especially striking when considering from 2015 to 2020, startups buying other startups in the states never made up more than 29% of all M&A deals for U.S.-based startups. Last year, that number was 35%. Such deals this year also are outpacing 2023’s deal count numbers — which saw only 296 deals total. Biggest deals Of course, representing a larger portion of M&A in a year when dealmaking is down won’t make most investment bankers turn their heads. However, it is important to note that aside from the aberration of 2021 and then 2022, startups are on pace to buy more startups in the U.S. than in any other year in the past decade. Also, while there have yet to be any billion-dollar deals of startups buying U.S.-based startups this year like Databricks ’ $1.3 billion acquisition of OpenAI competitor MosaicML in 2023, there have been some notable ones. The three biggest acquisitions dollar-wise to date are: In June, AI-driven market intelligence platform AlphaSense raised $650 million in funding at a $4 billion valuation while also announcing it had acquired expert research startup Tegus for $930 million. Just last month, unicorn LetsGetChecked acquired digital pharmacy startup Truepill for $525 million. It was reported LetsGetChecked plans to raise approximately $150 million via a convertible note offering to help finance the deal. In March, cloud cybersecurity firm Wiz bought cloud threat prevention startup Gem Security for $350 million in a cash deal. Just two months later, Wiz locked up the biggest cybersecurity round of the year thus far as it raised $1 billion at a $12 billion valuation. More buying power Those deals also likely illustrate some trends as to why more startups are buying startups domestically. First off — and likely most obviously — is the size of many VC-backed companies now. All three acquirers are unicorns — $1 billion valuation or more — and Wiz’s valuation is a whopping $12 billion. Companies can reach such high valuations more easily than ever as venture has poured into the market — it is now a significant asset class — and allows startups to stay private longer and get bigger. As those companies grow, they simply begin to act more as we expect large public companies, including their desire for inorganic growth for innovation, talent or even revenue. In fact, LetsGetChecked’s deal reportedly was mainly through stock — a very public company-like move. The other common trait of the above three deals — which relates to the first — is these companies’ ability to raise capital when necessary to complete a deal. Both AlphaSense and LetsGetChecked raised (or reportedly raised) cash in connection with consummating their deals. Wiz raised a massive round just months after its Gem acquisition. Of course, there are other reasons too. Valuations on many startups have dropped in recent quarters as the venture market has cooled, which likely has made some VC-backed companies in the U.S. more easily persuaded to sell. However, the trends of more mature, venture-backed companies hitting high valuations and looking to become bigger, and those companies being able to raise large sums of cash when necessary, likely is not changing anytime soon. With that being the case, you can expect more startups eyeing their brethren for dealmaking in the future. Related Crunchbase Pro lists:

LetsGetChecked Frequently Asked Questions (FAQ)

When was LetsGetChecked founded?

LetsGetChecked was founded in 2015.

Where is LetsGetChecked's headquarters?

LetsGetChecked's headquarters is located at Unit 3 Adelphi House, Dublin.

What is LetsGetChecked's latest funding round?

LetsGetChecked's latest funding round is Series D - II.

How much did LetsGetChecked raise?

LetsGetChecked raised a total of $283M.

Who are the investors of LetsGetChecked?

Investors of LetsGetChecked include Transformation Capital, Casdin Capital, Morgan Health, Optum Ventures, Qiming Venture Partners and 8 more.

Who are LetsGetChecked's competitors?

Competitors of LetsGetChecked include Ash, OrangeBiomed, Hurdle, Genomelink, imaware and 7 more.

What products does LetsGetChecked offer?

LetsGetChecked's products include Home lab testing and 3 more.

Loading...

Compare LetsGetChecked to Competitors

Everly Health is a digital health platform specializing in diagnostics-driven care and the healthcare sector. The company offers at-home testing kits and digital tools for diagnosing and managing recurring health conditions, providing results online. Everly Health primarily serves the healthcare ecosystem, including individual consumers and enterprise clients. Everly Health was formerly known as Everly Well. It was founded in 2015 and is based in Austin, Texas.

Thriva operates as a healthcare platform providing personalized health tests. It is a digital health business providing tests to monitor and track a range of biomarkers, from gut health to heavy metals to hormones, to help people understand the state of their health. It offers finger-prick blood tests that can be done at home. The company was founded in 2015 and is based in London, United Kingdom.

Helix works as a population genomics company operating in the healthcare and life sciences sectors. The company provides solutions that enable health systems, public health organizations, and life science companies to integrate genomic data into patient care and public health decision-making. Its primary customers are health systems, public health entities, and life science companies. It was founded in 2015 and is based in San Mateo, California.

Molecular You is a developer of a digital personalized health platform designed to deliver comprehensive health information and individualized health action plans. Molecular You leverages a multi-biomarker analytics platform that includes proteomic and metabolomic data to create highly accurate predictive risk profiles for over 26 health conditions. Molecular You's AI-powered platform analyzes a comprehensive set of over 250 biomarkers to provide early detection of potential health risks and deliver personalized nutrition, exercise, and supplement recommendations through a user-friendly web interface. This approach not only enhances individual health outcomes but also supports healthcare providers in delivering value-based care by improving health assessment, patient engagement, and preventative health strategies. Through its emphasis on precision medicine, Molecular You advances the field of personalized medicine by tailoring health insights and interventions to each individual's unique molecular profile. It was founded in 2014 and is based in Vancouver, Canada.

Safe Health is a digital healthcare company that operates in the health and diagnostics industry. The company offers a platform that enables decentralized 'connected diagnostics' as part of clinical workflows, allowing patients to test themselves at home and automating care. This service primarily caters to the healthcare industry. It is based in Los Angeles, California.

Healthy.io develops a healthcare technology company. The company offers services such as home urinalysis and digital wound care, enabling patients to conduct tests and manage their health at their convenience using their smartphones. It primarily serves the healthcare industry, providing solutions that help healthcare providers and systems improve patient interactions and access to care. It was founded in 2013 and is based in Tel Aviv, Israel.

Loading...