Loadsmart

Founded Year

2014Stage

Series D | AliveTotal Raised

$345.2MValuation

$0000Last Raised

$200M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+8 points in the past 30 days

About Loadsmart

Loadsmart specializes in logistics and transportation services, focusing on freight brokerage and technology solutions. The company offers a suite of services including managed transportation, next-generation transportation management systems (TMS), and dock scheduling software, all designed to optimize freight operations and enhance efficiency. Loadsmart's products cater to shippers, carriers, and warehouses, providing tools for freight procurement, real-time tracking, and asset visibility. Loadsmart was formerly known as Disruptive Logistics, LLC. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

Loadsmart's Product Videos

ESPs containing Loadsmart

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The transportation management systems (TMS) market offers solutions for managing various modes of transportation, including commercial carriers, less-than truckload shipping, and parcel and mail shipments. These systems help optimize freight, bill pay, audit, and digital carrier networks; automate workflows such as order entry, routing, and resource allocation; and enable real-time visibility of i…

Loadsmart named as Challenger among 15 other companies, including SAP, Oracle, and E2open.

Loadsmart's Products & Differentiators

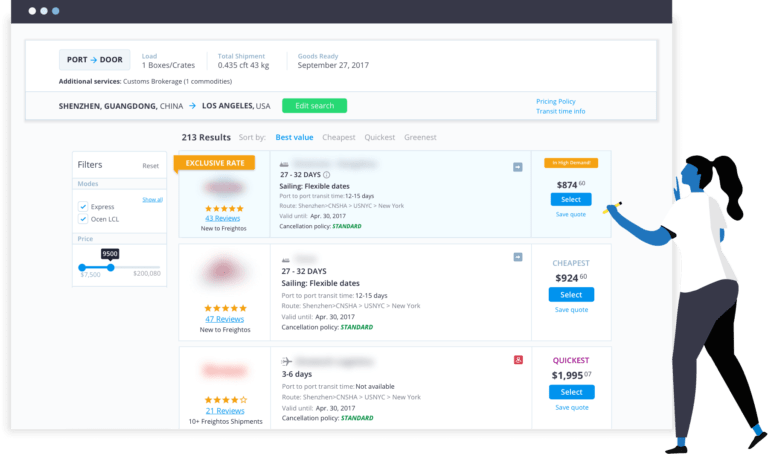

ShipperGuide

ShipperGuide is a Self-Service Freight Management Software that empowers shippers of all sizes to plan, procure and execute freight in one place. That means a single portal to manage upcoming shipment requirements, get spot and contract rates, identify high-performing carriers, and tender and track loads from pickup to delivery.

Loading...

Research containing Loadsmart

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Loadsmart in 7 CB Insights research briefs, most recently on Mar 21, 2024.

Expert Collections containing Loadsmart

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

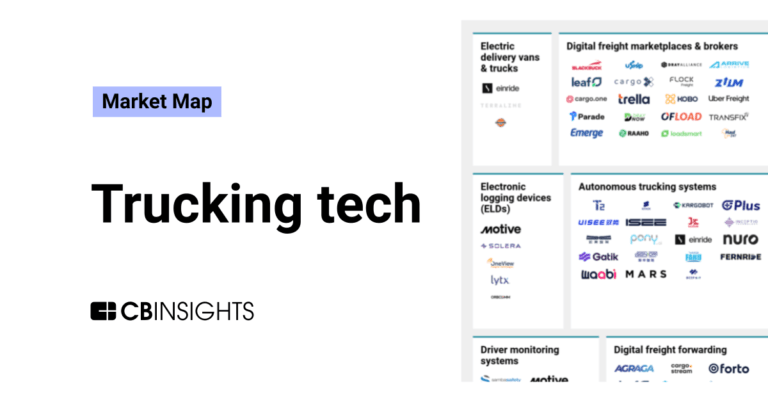

Loadsmart is included in 4 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

5,558 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

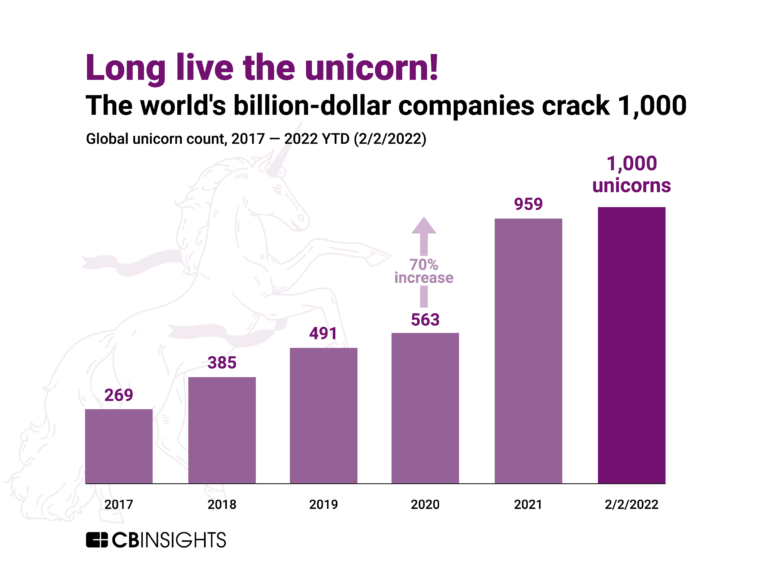

Unicorns- Billion Dollar Startups

1,244 items

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

AI 100

100 items

The winners of the 4th annual CB Insights AI 100.

Latest Loadsmart News

Sep 12, 2024

FreightWaves Click to close the product launchpad ATRI analysis finds drivers experienced detention in 39.3% of stops (Source: ATRI) The American Transportation Research Institute recently released a report detailing the impacts and costs associated with truck driver detention. ATRI’s report defined detention as, “any time spent at a customer facility in which a driver is waiting for active operations to commence or resume is operationally considered detention, this research follows a standard industry definition of detention as any dwell time longer than 2 hours.” Key findings of the study, “Costs and Consequences of Truck Driver Detention: A Comprehensive Analysis,” included that while detention is slightly improving overall, it’s still pervasive. “Though the frequency of stops with detention dropped by 6.5 percentage points between 2014 and 2023, drivers still experienced detention in 39.3 percent of all stops,” the report states. “Drivers experienced detention times of more than four hours in 4.9 percent of all stops.” Another challenge is that although most carriers have a form of detention fee, it’s often not billed or paid. The report added that only 75% of the time did carriers invoice customers, and only 55% of those invoices were paid. Refrigerated carriers received the most in detention fees but only for 36% of all detention incidents. Specialized carriers experienced 45.9% of all incidents while truckload carriers were slightly lower at 43.5%. Regarding ways to mitigate detention, the report highlights five recommendations from respondents: negotiating detention fees, arriving early, using trailer-based approaches like drop-and-hook, increasing customer communication and finally, if nothing else works, refusing service. Excessive inventories put all eyes on upcoming Class 8 order season A Thursday release by ACT Research is hyping an upcoming order season that hasn’t been as important since fall 2016. August order and build volumes are reaching their annual low point before September, when OEMs open up next year’s order books. Complicating this annual trend are excessive inventories and cloudy demand outlooks. Kenny Vieth, president and senior analyst at ACT Research said in the release, “A year ago, the total Class 8 inventory was 61,800 units. At the end July 2024, the Class 8 inventory was a record 88,800 units, an increase of 27,000 units y/y. The increase has not been supported by demand, pushing stocks significantly above an inventory-to-retail sales inferred level.” Vieth adds that the medium-duty market, which includes classes 5-7, is also experiencing near-record inventories at 101,900 units, an increase of 24,100 units from 77,800 in July 2023. Vieth concludes: “We are sitting in the lull before a hoped-for sustained surge as ‘order season’ gets underway. September is the month in which seasonal factors flip from accretive to dilutive, though September’s factors are modest. The ‘season’ gets underway in earnest starting in October. While inventories are ultimately a headwind, the path of orders is foundational at this juncture: backlogs are low, and BL/BU ratios for Class 8 and trailers indicate unsustainable production levels relative to backlog support. Strong orders in Q4 and into Q1 are imperative.” Market update: Loadsmart rate forecast predicts September peak (Chart: Loadsmart) A recent Loadsmart monthly market update for August saw a 19.17% month-over-month increase in its pricing index compared to July. The report said Labor Day saw rates spike in some areas as capacity tightened but added that Labor Day is not historically known for causing price spikes. Loadsmart’s volumes index also rose 20.1% m/m in August, with a spike in the last week of the month due to pre-holiday demand. Loadsmart’s model predicts that spot prices will rise from $2.81 in August to $2.93 in September, the peak price in 2024. After September, the report notes, prices are forecast to stabilize and remain around the $2.80 range for Q4. The report adds, “From a macroeconomic standpoint, there is no demand catalyst to drive a sustained long-term uptrend. Consequently, our projections continue to interpret the recent rate increases as seasonal.” One potential reason for the increases in volumes is consumer goods data, which saw shipments increase in July and August. Loadsmart theorizes that “we could be experiencing a peak season pull-ahead, similar to last year,” adding, “Consequently, rate behavior is expected to closely follow last year’s pattern, when prices peaked in September before declining by 2-5% in the Q4.” FreightWaves SONAR spotlight: Reefer roller coaster, dry van doldrums (Source: FreightWaves SONAR) Summary: The days leading up to and following Labor Day create roller coaster conditions for the reefer truckload segment. In the past week, reefer outbound tender rejection rates fell 65 basis points w/w from 10.29% on Sept. 2 to 9.64% but had a range between 10.29% on the high end and 9.06% on the low end. Part of this whipsaw movement came from a decline in outbound tender volumes following Labor Day, but the following week saw a surge in volumes. ROTVI rose 383.62 points or 32.9% from 1,166.7 points on Sept. 2 to 1,550.32 points as shippers resumed operations and tendering following the holiday. Compared to the positive seasonal bumps of the reefer segment, the larger-volume dry van segment saw a boost in volumes but lower tender rejection rates as truckload capacity came back online following the Labor Day weekend. Dry van outbound tender rejection rates were nearly flat, up 3 bps w/w from 4.28% on Sept. 2 to 4.31%. The notable tell that the dry van segment continues to struggle with overcapacity lies in the middle of that week, when VOTRI dipped to 3.96% on Sept. 4, the first time since May 16 that VOTRI was below 4%. Dry van outbound tender volumes also saw a boost during the past week following shippers’ resuming operations and saw a boost, up 1,883.07 points or 27.13% w/w, from 6,940.25 points to 8,823.32. This whipsaw is common following a holiday but should normalize by this time next week. The Routing Guide: Links from around the web

Loadsmart Frequently Asked Questions (FAQ)

When was Loadsmart founded?

Loadsmart was founded in 2014.

Where is Loadsmart's headquarters?

Loadsmart's headquarters is located at 175 West Jackson Boulevard, Chicago.

What is Loadsmart's latest funding round?

Loadsmart's latest funding round is Series D.

How much did Loadsmart raise?

Loadsmart raised a total of $345.2M.

Who are the investors of Loadsmart?

Investors of Loadsmart include BlackRock, SoftBank Latin America Fund, The Home Depot, CSX, Janus Henderson Investors and 11 more.

Who are Loadsmart's competitors?

Competitors of Loadsmart include Kargo, SemiCab, NEXT Trucking, Transfix, Freightos and 7 more.

What products does Loadsmart offer?

Loadsmart's products include ShipperGuide and 4 more.

Loading...

Compare Loadsmart to Competitors

CargoX is a technology company focused on revolutionizing the cargo transportation sector through digital solutions. The company offers a comprehensive logistics platform that simplifies operations for carriers, shippers, and truck drivers by providing services such as digital freight documentation, risk management, cargo tracking, and secure freight payment systems. It was founded in 2013 and is based in Sao Paulo, Brazil.

Flock Freight provides a freight carrier network. The company offers freight shipping services, including shared truckload, less than truckload, full truckload, and consolidation services. It primarily serves the supply chain and logistics industry. Flock Freight was formerly known as AuptiX. It was founded in 2015 and is based in Encinitas, California.

Leaf Logistics operates as a company focused on freight coordination in the logistics industry. The company offers a platform that enables shippers, carriers, and brokers to plan, schedule, and move freight efficiently, reducing empty miles and securing stable rates. The platform primarily serves the freight and logistics industry. It was formerly known as LogisticsExchange. It was founded in 2017 and is based in New York, New York.

BlackBuck is India's largest trucking platform, operating in the logistics and transportation sector. The company offers a suite of digital solutions designed to address the critical pain points of truckers and shippers, including load matching, payments, driver behavior analysis, and financial services. While primarily serving the trucking ecosystem, BlackBuck's digital infrastructure caters to a wide range of needs for truckers, from finding loads to managing finances. It was founded in 2015 and is based in Bengaluru, India.

Ezyhaul is a technology company that focuses on transforming the road freight industry. The company offers an online platform that allows clients to make hassle-free bookings for a wide range of ground transport and services, including domestic short haul, long haul, distribution, container haulage, and cross border shipments. Ezyhaul primarily serves the B2B sector, connecting shippers with transporters and providing carriers with opportunities to grow their business and increase the utilization of their vehicles. It was founded in 2016 and is based in Kuala Lumpur, Malaysia.

Yimidida offers a cloud-based logistic service provider. The company enables its customers to deliver products of any size to various places throughout China. It also offers payment collection, delivery tracking, transport insurance, return receipts, and more. It was founded in 2015 and is based in Shanghai, China.

Loading...