Lydia

Founded Year

2011Stage

Series C | AliveTotal Raised

$260.33MValuation

$0000Last Raised

$100M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+70 points in the past 30 days

About Lydia

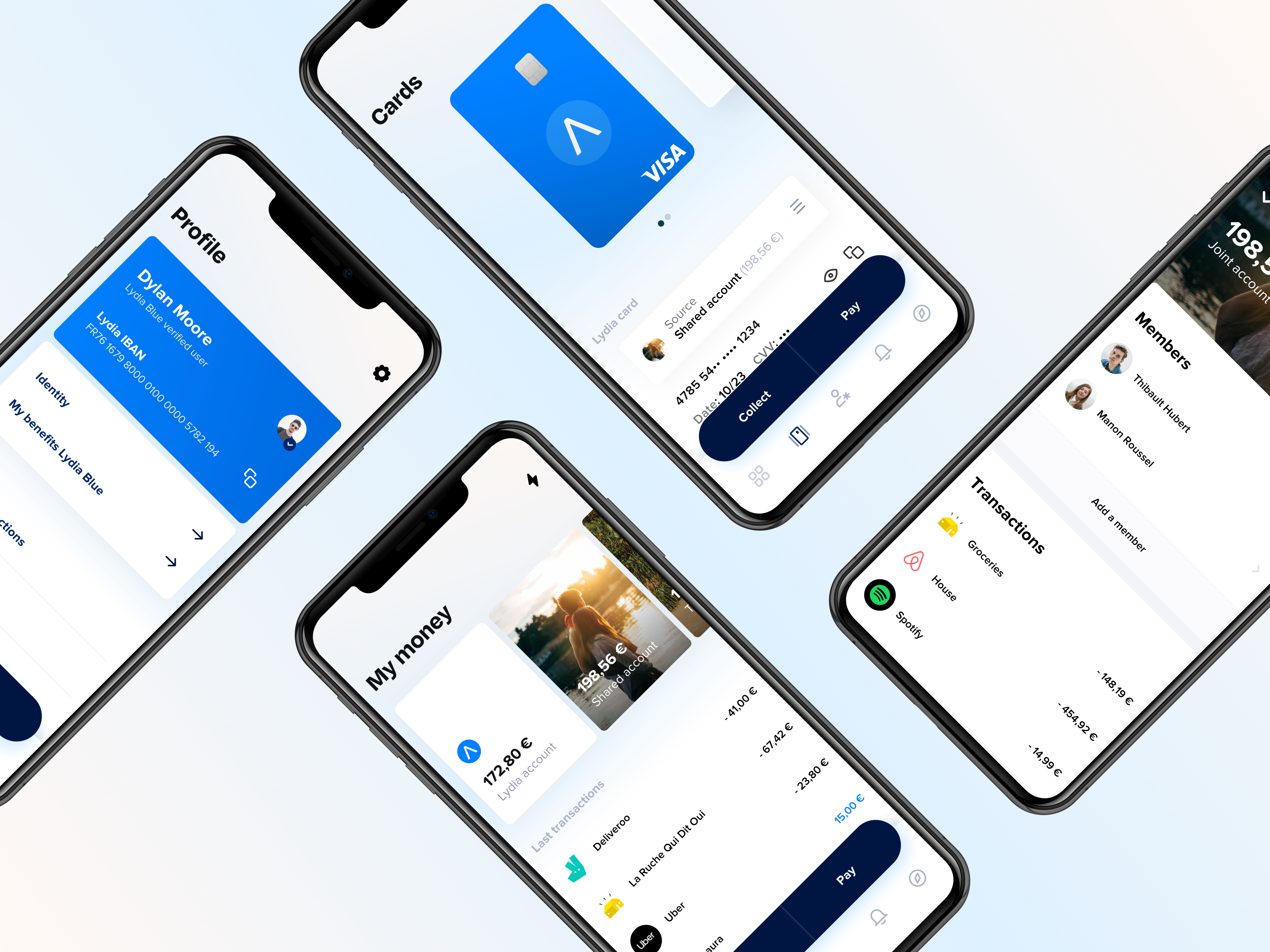

Lydia is a financial technology company specializing in mobile and digital banking services. The company offers a range of products including a digital current account, multi-account management, and tools for shared expenses, catering to the needs of modern consumers seeking efficient and secure online financial management. Lydia's services are designed to facilitate everyday banking, instant money transfers, and secure online payments without fees on international transactions. It was founded in 2011 and is based in Paris, France.

Loading...

Lydia's Product Videos

Lydia's Products & Differentiators

Lydia Free

A current account for occasional use

Loading...

Research containing Lydia

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Lydia in 1 CB Insights research brief, most recently on Feb 23, 2022.

Expert Collections containing Lydia

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Lydia is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Digital Banking

1,008 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Lydia Patents

Lydia has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/28/2013 | 12/2/2014 | Grant |

Application Date | 6/28/2013 |

|---|---|

Grant Date | 12/2/2014 |

Title | |

Related Topics | |

Status | Grant |

Latest Lydia News

Jun 4, 2024

By PYMNTS | June 4, 2024 | Card-issuing platform Marqeta has expanded its partnership with French payments firm Lydia . This extended collaboration, announced Tuesday (June 4), will see Marqeta power Lydia’s European digital banking super app Sumeria . This app has introduced new capabilities including a remunerated current account, and plans to expand quickly throughout Europe with Marqeta’s help, the companies said in a news release. “Even though many traditional banks now have digital offerings, they’re still not the personalized, digital-first experiences that people are seeking from their banking partners,” said Cyril Ciche , CEO at Lydia. “Marqeta has enabled us to challenge the norms of traditional banking and payments and create more flexible and streamlined experiences for our cardholders.” Lydia launched Sumeria last month, saying it was investing more than 100 million euros ($108.8 million) and hiring 400 people in three years to become a major player in this sector in France before expanding to other parts of Europe. While Lydia was started in 2013 to launch a mobile payments app, Sumeria aims to become a “simple and accessible banking super app ” that will let users receive, spend and manage money anywhere in Europe, the company said on its website. “We are convinced that technology (cloud, mobile, …) is not an end in itself, but a way to simplify life, through everyday details,” the company said on the page. “This is also how we see the current account: it should not be a trendy gadget, and above all, it should not make you captive to an application, a system, a bank. … It should solve a real problem.” Meanwhile, research by PYMNTS Intelligence finds that a notable number of consumers in the U.S. and Australia are using apps to manage an array of activities , with banking apps emerging as the most popular. “In a typical month, 64% of U.S. consumers and 78% of those in Australia use apps to manage their banking,” PYMNTS wrote recently. “More than half of respondents in each country also use mobile apps to track spending and shop for groceries. This digital familiarity is likely the reason that 35% of U.S. consumers said they would be interested in using an everyday app, and 25% of their counterparts in Australia said the same,” PYMNTS wrote. For American consumers, the interest level varies by age, with millennials and bridge millennials demonstrating particularly high levels of interest. In Australia, Generation Z to Generation X consumers both showed the highest levels of interest. Recommended

Lydia Frequently Asked Questions (FAQ)

When was Lydia founded?

Lydia was founded in 2011.

Where is Lydia's headquarters?

Lydia's headquarters is located at 14 avenue de l'Opéra, Paris.

What is Lydia's latest funding round?

Lydia's latest funding round is Series C.

How much did Lydia raise?

Lydia raised a total of $260.33M.

Who are the investors of Lydia?

Investors of Lydia include Tencent, Accel, Founders Future, Dragoneer Investment Group, Echo Street Capital and 10 more.

Who are Lydia's competitors?

Competitors of Lydia include Tide, Monese, Monzo, Adro, Orange Bank and 7 more.

What products does Lydia offer?

Lydia's products include Lydia Free and 2 more.

Loading...

Compare Lydia to Competitors

N26 provides a mobile banking platform. It gives customers a solution to control finances. The company allows users to open an N26 account directly from their phone or computer. It also offers insights into spending habits. The company was founded in 2013 and is based in Berlin, Germany.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Starling Bank is a digital bank focused on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, England.

Bunq focuses on providing financial services. The company offers a range of banking products including savings accounts, full bank accounts, and multi-currency banking, all accessible through a mobile application. Bunq primarily serves individual consumers and businesses looking for modern, hassle-free banking solutions. It was founded in 2012 and is based in Amsterdam, Netherlands.

Atom Bank is a financial institution that provides an online banking platform focusing on personal and business banking services. The company offers savings accounts, residential and commercial mortgages, and business loans. It primarily serves individuals looking for savings options and businesses seeking financing solutions. Atom Bank was founded in 2014 and is based in Durham, United Kingdom.

Allica Bank specializes in financial services for established businesses, focusing on banking solutions within the financial sector. The company offers a range of products including business current accounts, savings accounts, asset finance, commercial mortgages, and growth finance. Allica Bank caters primarily to small and medium-sized enterprises with a suite of financial products designed to meet their banking needs. Allica Bank was formerly known as CivilisedBank. It was founded in 2014 and is based in London, United Kingdom.

Loading...