Matillion

Founded Year

2011Stage

Series E - IV | AliveTotal Raised

$310.32MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-44 points in the past 30 days

About Matillion

Matillion offers a productivity platform for data teams, operating in the data management and cloud computing industry. The company offers services that enable both coders and non-coders to move, transform, and orchestrate data pipelines. Its primary customer segments include the financial services, healthcare, life sciences, retail, communications and media, and technology and software industries. It was founded in 2011 and is based in Manchester, United Kingdom.

Loading...

ESPs containing Matillion

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

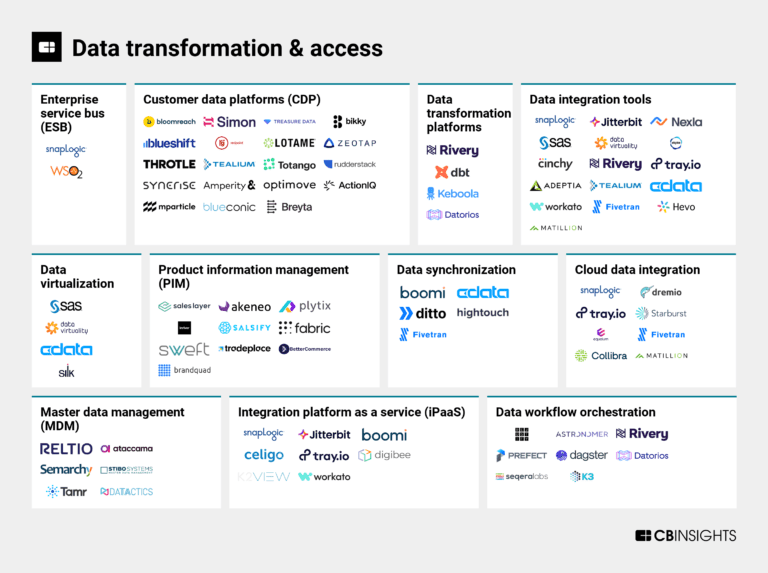

The cloud data integration market involves moving data from various sources to cloud destinations. Technology vendors in this market offer solutions that allow large and complex datasets to be moved in a secure manner. They enable organizations to overcome data silos, achieve data interoperability, and harness the benefits of cloud computing for data processing and analytics.

Matillion named as Challenger among 15 other companies, including Google Cloud Platform, Snowflake, and Microsoft Azure.

Loading...

Research containing Matillion

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Matillion in 1 CB Insights research brief, most recently on Aug 4, 2023.

Aug 4, 2023

The data transformation & access market mapExpert Collections containing Matillion

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Matillion is included in 2 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Fintech

13,398 items

Excludes US-based companies

Latest Matillion News

Sep 4, 2024

Entrepreneurs and investors fear Labour government will squeeze venture capital and start-ups UK start-ups raised $21.3bn last year. © Andy Rain/EPA/Shutterstock Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter. UK venture capitalists and entrepreneurs have warned that the Labour government’s signal that it will raise taxes risks stifling the country’s technology industry. Executives and investors are worried that chancellor Rachel Reeves will raise capital gains tax and tighten the tax treatment of carried interest, the performance fees that fund managers receive from asset sales. “The societal worry around a major change to capital gains tax is a disincentive for building new businesses and taking risk, which is the very thing this country needs to improve its economic health,” said Matthew Scullion, founder of UK software group Matillion, which has been valued at over $1bn. “If anything makes the UK less attractive for talent — and increasing taxes will do so — the country as a whole will end up losing,” added Taavet Hinrikus, the co-founder of London-listed fintech Wise who now runs European tech investor Plural. Prime Minister Sir Keir Starmer’s warning last week that the wealthiest “should bear the heavier burden” gave the strongest signal yet that the government will seek to raise taxes in the October Budget. Capital gains and inheritance taxes are the most likely to go up, according to tax advisers. Reeves has ruled out hiking other taxes that are the UK’s main revenue raisers, such as income tax, national insurance and VAT. A Treasury spokesperson said: “Following the spending audit, the Chancellor has been clear that difficult decisions lie ahead on spending, welfare and tax to fix the foundations of our economy and address the £22bn hole in the public finances left by the last government. Decisions on how to do that will be taken at the Budget in the round.” Capital gains tax for business disposal is at a rate of 20 per cent, while carried interest is currently taxed as a capital gain at a rate of 28 per cent, rather than the highest bracket of income tax, which is 45 per cent plus national insurance. The new government had already put the private equity industry on notice with a call for evidence that closed on Friday about plans to change the tax treatment of carried interest. Private equity executives have warned that radical action could spur an exodus of dealmakers from Britain. Venture capitalists typically make minority investments in early-stage companies, in the expectation that a small number will become breakaway successes. Rising taxes on carried interest would slice the share of profits that venture investors take home from successful deals, while an increase in capital gains tax would hurt founders who sold stakes in their businesses. These investors argue that they should be treated differently to private equity managers, who tend to borrow money to acquire more mature companies and make operational improvements. “We are reliant on these very few hits,” said Haakon Overli, co-founder of UK venture investor Dawn Capital. Overli said that bringing capital gains tax in line with income tax “would hit us so hard . . . if suddenly 45 per cent of it goes away our economic model ceases to work.” Recommended Hinrikus said that a distinction needed to be made between venture capital and private equity. “We need to think about the long-term horizon and risk nature of venture capital, which should not be taxed in the same way as the buyout of a bakery chain. We’re investing in innovation and bringing capital into the UK,” he said. Scullion at Matillion said that while he could “tolerate” and “understand” a small increase in capital gains tax, if it went up in line with income tax “there’d be a very material feeling of you’re taking the mick.” In such a scenario “I will very materially consider leaving the country,” he said. “I don’t want to do it and it would make me sad but there’s at least a 50 per cent chance that we will leave.” The UK is the venture investing capital of Europe, and worldwide behind only the US and China. UK start-ups raised $21.3bn last year, according to researcher Dealroom. The majority of VC investment in the UK has come from sources outside of Europe. Investors warned that Labour’s mooted tax hikes — which come on top of the abolition of the non-dom regime that allows foreigners to avoid tax on their overseas income — comes as other countries are trying to make themselves more attractive to higher earners and entrepreneurs. “It’s a globally competitive world and you can’t have the UK be uncompetitive,” said Brent Hoberman, one of the UK’s most prominent tech investors, noting that the abolition of the non-dom regime was already making the UK less attractive for foreigners. Copyright The Financial Times Limited 2024. All rights reserved.

Matillion Frequently Asked Questions (FAQ)

When was Matillion founded?

Matillion was founded in 2011.

Where is Matillion's headquarters?

Matillion's headquarters is located at Two New Bailey, Stanley Street, Manchester.

What is Matillion's latest funding round?

Matillion's latest funding round is Series E - IV.

How much did Matillion raise?

Matillion raised a total of $310.32M.

Who are the investors of Matillion?

Investors of Matillion include Databricks Ventures, Snowflake Ventures, Citi Ventures, Scale Venture Partners, Sapphire Ventures and 9 more.

Who are Matillion's competitors?

Competitors of Matillion include CData, Data Virtuality, Vaultspeed, Prophecy, Rivery and 7 more.

Loading...

Compare Matillion to Competitors

Fivetran is a global leader in automated data movement, focusing on data integration and ELT processes within the technology sector. The company offers a platform that extracts, loads, and transforms data from various sources into cloud data destinations, enabling efficient and reliable data centralization. Fivetran primarily serves sectors that require robust data analytics and operational efficiency, such as finance, marketing, sales, and support. It was founded in 2012 and is based in Oakland, California.

Adverity focuses on data management and operations. The company offers an integrated data platform that enables businesses to connect, manage, and use their data at scale, blending disparate datasets such as sales, marketing, and advertising. It primarily serves sectors such as marketing, engineering, and analytics. Adverity was founded in 2014 and is based in Vienna, Austria.

Montara is a DataOps platform specializing in data development and lifecycle management. The platform offers tools for data modeling, validation, pipeline management, observability, and governance, aimed at enhancing collaboration and efficiency for data teams. Montara primarily serves the data analytics and engineering sectors, providing solutions to streamline data transformation and ensure data quality. It was founded in 2020 and is based in Milpitas, California.

AgileData.io focuses on simplifying data management for data consultants, operating in the data services and SaaS industry. The company offers a low-code platform that streamlines the processes of collecting, combining, and consuming data, aiming to transform data consultants into data entrepreneurs. AgileData.io primarily serves data consultants and small data consultancies looking to scale their businesses without incurring high costs. It was founded in 2019 and is based in Wellington, New Zealand.

Rivery offers a data extract, transform, load (ELT) pipeline, and integration platform. It automates data ingestion, transformation, and orchestration. Its data pipelining and management approach incorporates automation and actionable logic into traditional data ETL/ELT processes. It primarily sells to sectors such as the marketing data management industry. The company was founded in 2017 and is based in New York, New York.

primeNumber is a data technology company that develops trocco, a software-as-a-service (SaaS)-based data integration service that enables engineers to automate the data acquisition process and systemN, a general-purpose data engineering platform as a service (PaaS) platform. The company was founded in 2015 and is based in Tokyo, Japan.

Loading...