Medable

Founded Year

2012Stage

Series D | AliveTotal Raised

$533.75MValuation

$0000Last Raised

$304M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-44 points in the past 30 days

About Medable

Medable specializes in providing digital clinical trial software solutions within the healthcare and pharmaceutical sectors. The company offers a comprehensive platform that facilitates the management of clinical trials, including tools for remote data collection, electronic consent (eConsent), patient-reported outcomes (ePRO), and clinical outcome assessments (eCOA), all designed to streamline the trial process and enhance data quality. Medable was formerly known as Dermatrap. It was founded in 2012 and is based in Palo Alto, California.

Loading...

ESPs containing Medable

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

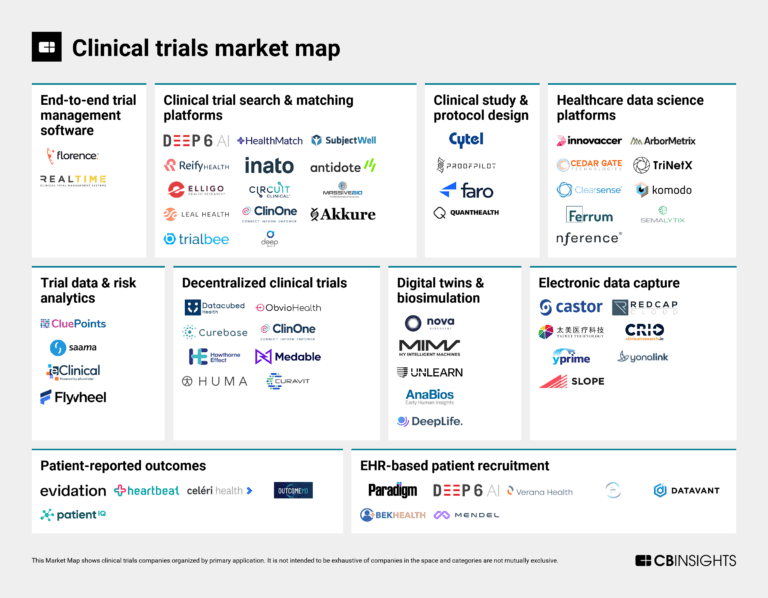

The decentralized clinical trials platforms market specifically encompasses software and technology solutions designed to facilitate and manage remote clinical trials. These platforms integrate various components such as telemedicine, mobile health applications, and wearable device data collection to enable trial activities without frequent site visits. By streamlining remote participation, these …

Medable named as Leader among 15 other companies, including ObvioHealth, Huma, and Medidata.

Medable's Products & Differentiators

Medable Platform

To create a seamless experience for site and patients, all of our products are integrated into a single platform. The core Platform contains portals for the site, patient, and sponsor in both web and mobile modalities.

Loading...

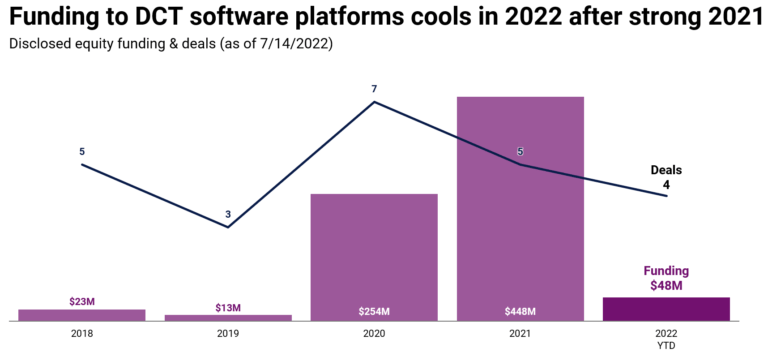

Research containing Medable

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Medable in 6 CB Insights research briefs, most recently on Aug 21, 2024.

Aug 21, 2024

The clinical trials tech market map

Aug 1, 2023

The clinical trials market map

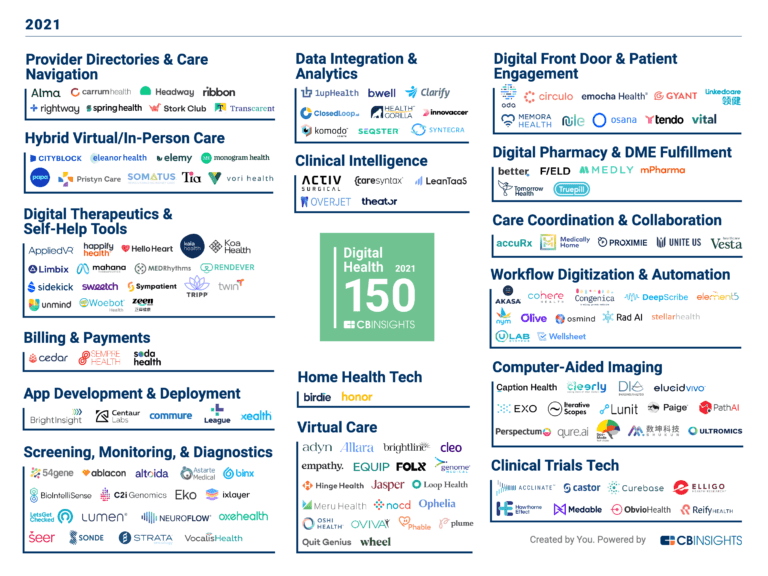

Dec 8, 2021 report

The Digital Health 150: The Top Digital Health Companies Of 2021Expert Collections containing Medable

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Medable is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Conference Exhibitors

5,302 items

Digital Health 50

300 items

The winners of the second annual CB Insights Digital Health 150.

Digital Health

11,060 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

2,916 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Medable Patents

Medable has filed 5 patents.

The 3 most popular patent topics include:

- health informatics

- healthcare occupations

- medical terminology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/21/2022 | 2/13/2024 | Computer security, Information privacy, Data security, Computer network security, Access control | Grant |

Application Date | 6/21/2022 |

|---|---|

Grant Date | 2/13/2024 |

Title | |

Related Topics | Computer security, Information privacy, Data security, Computer network security, Access control |

Status | Grant |

Latest Medable News

Sep 11, 2024

The Global Virtual Clinical Trials Market Forecast: $7.12 Billion by 2029, Future Growth Analysis Opportunities Assessment – Arizton Advisory & Intelligence Posted on With Non-Interventional Segment Leading at 18.33% CAGR and Major Players Investing in Innovation. According to Arizton’s latest research report, the virtual clinical trials market is growing at a CAGR of 17.93% during 2023-2029. Market Size (2023): USD 2.64 Billion CAGR (2023-2029): 17.93% Geographical Analysis: North America, Europe, APAC, Latin America, and Middle East & Africa The global virtual clinical trials market report highlights data on 32 vendors, revealing a highly fragmented landscape dominated by large corporations. Despite this dominance, there are significant opportunities for new entrants in the market. While major players like Dassault Systèmes, Medable, Science 37, THREAD, Castor, Clinical Ink, IQVIA, and Icon Plc hold over 50% of the market share, many emerging and smaller companies are entering the field with innovative virtual clinical trial solutions. These leading vendors are actively investing in and developing new tools, positioning themselves to maintain their market leadership through ongoing engagement and innovation. Non-Interventional the Fastest Growing Segment with A CAGR of 18.33% Interventional clinical trials involve assigning patient participants to groups receiving specific treatments to assess the impact of medical interventions on their health. These trials, spanning from Phase I to Phase III, are prevalent and account for a significant portion of the market share, driving substantial revenue growth. Digital tools such as eConsent and eSignature are increasingly utilized to enhance patient engagement and enrollment in interventional studies. After administering medical products, researchers often conduct video calls to communicate with participants and gather their feedback. Virtual clinical trials are particularly effective for less complex interventional studies, especially in therapeutic areas with established safety profiles and endpoints that can be assessed remotely. Prominent areas for virtual trials include dermatology, respiratory conditions, gastrointestinal issues, central nervous system disorders, endocrinology, immunology, cardiovascular diseases, and rare conditions. These fields present promising opportunities for virtual clinical trials. The design of interventional clinical trials involves a systematic approach to remotely collect data within the trial framework, incorporating electronic consent (eConsent), randomization, and the collection of safety and efficacy data for investigational products. The first virtual interventional clinical trial was conducted in England in 2020, significantly accelerating participant recruitment. Virtual trials utilize digital technology to streamline trial delivery and recruitment processes, potentially transforming the future landscape of clinical research. North America Dominates Virtual Clinical Trials Market: Key Region to Watch for Investment Opportunities In 2023, North America commanded a dominant 54% share of the global virtual clinical trials market. The US leads the market due to its advanced clinical trial infrastructure, high levels of digitalization, extensive adoption of Internet of Things (IoT) technologies in healthcare, and a significant rise in telemedicine and telehealth services. The country’s widespread acceptance of technology in healthcare management further solidifies its leading position. In 2023, North America conducted approximately 14,500 clinical trials, with a high prevalence of decentralized trials. The region had already established a robust foundation for virtual and decentralized clinical trials before the pandemic, making it well-positioned to lead in this space. Major players in the US, such as IQVIA, Medable, Science 37, and Thread Research, are driving the decentralization of clinical trials. Additionally, emerging companies are seeing notable growth due to the increasing demand for clinical trials in the region. Favorable regulatory guidelines, government support, and rising investment in clinical research are key factors fueling this growth. Immunology Diseases About Us: Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services. We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts. Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports. Media Contact

Medable Frequently Asked Questions (FAQ)

When was Medable founded?

Medable was founded in 2012.

Where is Medable's headquarters?

Medable's headquarters is located at 525 University Avenue, Palo Alto.

What is Medable's latest funding round?

Medable's latest funding round is Series D.

How much did Medable raise?

Medable raised a total of $533.75M.

Who are the investors of Medable?

Investors of Medable include GSR Ventures, Sapphire Ventures, Tiger Global Management, Blackstone, Western Technology Investment and 13 more.

Who are Medable's competitors?

Competitors of Medable include ObvioHealth, Huma, Aparito, Healint, Science 37 and 7 more.

What products does Medable offer?

Medable's products include Medable Platform and 2 more.

Who are Medable's customers?

Customers of Medable include GSK and Syneos.

Loading...

Compare Medable to Competitors

THREAD is a company that focuses on providing a decentralized clinical trial platform in the healthcare and life sciences industry. The company offers a platform and supporting services that enable biopharma, CROs, and life science organizations to remotely capture data from participants and sites during, in-between, and in lieu of in-clinic visits. The platform includes features such as electronic consent (eConsent), electronic clinical outcome assessment (eCOA), sensors, reminders, and telehealth virtual visits. It was founded in 2005 and is based in Tustin, California.

Curebase provides a range of software tools designed for clinical trial recruitment, consent, and data collection processes. Curebase primarily serves the clinical research industry, including CROs, research sites, and study participants. The company was founded in 2017 and is based in San Francisco, California.

Reify Health is a company focused on improving the clinical trial process within the healthcare industry. The company offers cloud-based software that accelerates patient enrollment in clinical trials, thereby facilitating the development of new therapies. Reify Health primarily serves the healthcare and biopharma industries. The company was formerly known as ZeroSum Health. It was founded in 2012 and is based in Boston, Massachusetts.

Castor is a medical research data platform. It provides decentralized clinical trial solutions to control clinical trial design. It analyzes, manages, and organizes medical data collected from multiple electronic records. The company was founded in 2012 and is based in New York, New York.

Medidata specializes in providing a unified platform for clinical research within the life sciences sector. The company offers a range of products and solutions designed to streamline clinical trials, including data management, clinical operations, and patient engagement technologies. Medidata's platform serves various sectors, including biopharma, medical device companies, and academic research organizations. It was founded in 1999 and is based in New York, New York. Medidata operates as a subsidiary of Dassault Systemes.

Evidation focuses on harnessing real-world health data to measure and improve health outcomes. The company offers a digital health measurement and engagement platform that utilizes data science and machine learning to provide health guidance, treatments, and tools. Evidation primarily serves life sciences companies, government bodies, and academic institutions. It was founded in 2012 and is based in San Mateo, California.

Loading...