Huma

Founded Year

2011Stage

Series D | AliveTotal Raised

$367.6MValuation

$0000Last Raised

$80M | 2 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+8 points in the past 30 days

About Huma

Huma specializes in digital health technology, focusing on advancing digital-first care and research in the healthcare sector. The company offers a range of AI-powered healthcare solutions, including remote patient monitoring systems, decentralized clinical trials, and companion apps designed to support patients through treatment and drug therapies. Huma's products are used by various sectors, including healthcare systems, pharmaceuticals, and medtech industries. Huma was formerly known as Medopad. It was founded in 2011 and is based in London, United Kingdom.

Loading...

Huma's Product Videos

ESPs containing Huma

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The decentralized clinical trials platforms market specifically encompasses software and technology solutions designed to facilitate and manage remote clinical trials. These platforms integrate various components such as telemedicine, mobile health applications, and wearable device data collection to enable trial activities without frequent site visits. By streamlining remote participation, these …

Huma named as Highflier among 15 other companies, including ObvioHealth, Medable, and Medidata.

Huma's Products & Differentiators

Software as a Medical Device, Companion Apps

Huma’s enterprise-level regulated platform gathers real-world evidence, reduces readmission rates, and builds stronger, longer-term relationships with care providers and customers. Huma’s regulated, scalable platform enables the continuous collection of high-quality patient data across a wide range of therapeutic areas and care pathways, reducing readmissions. Support across 60 countries, our clinically-proven platform can effectively optimise global MedTech and Pharma deployments and extend data collection across diverse patient populations. Huma’s highly configurable platform offers the flexibility needed to demonstrate device efficacy and support regulatory submissions through near real-time data capture at both an individual and population level.

Loading...

Research containing Huma

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Huma in 12 CB Insights research briefs, most recently on Sep 11, 2024.

Aug 21, 2024

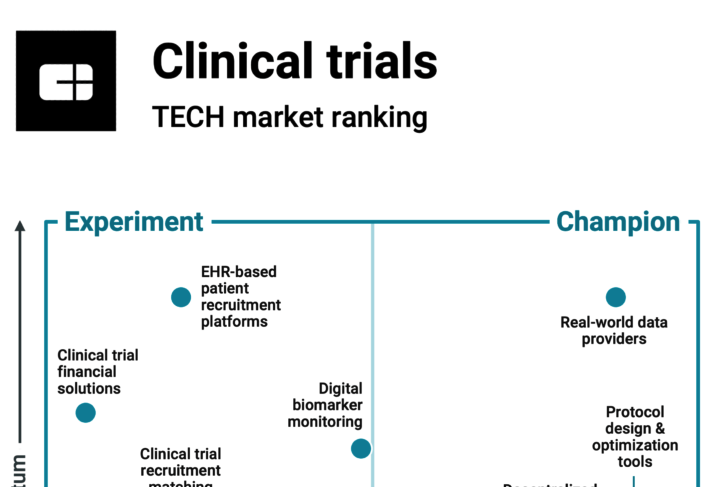

The clinical trials tech market map

Aug 15, 2023

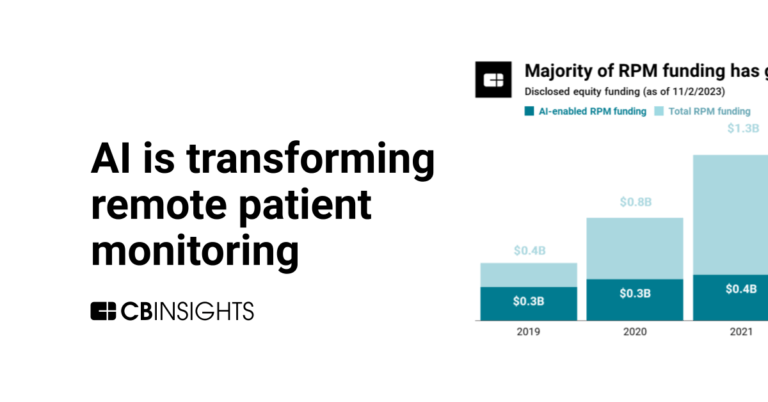

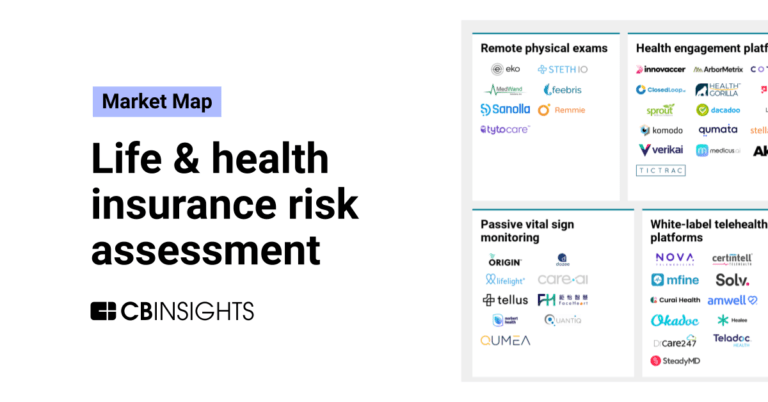

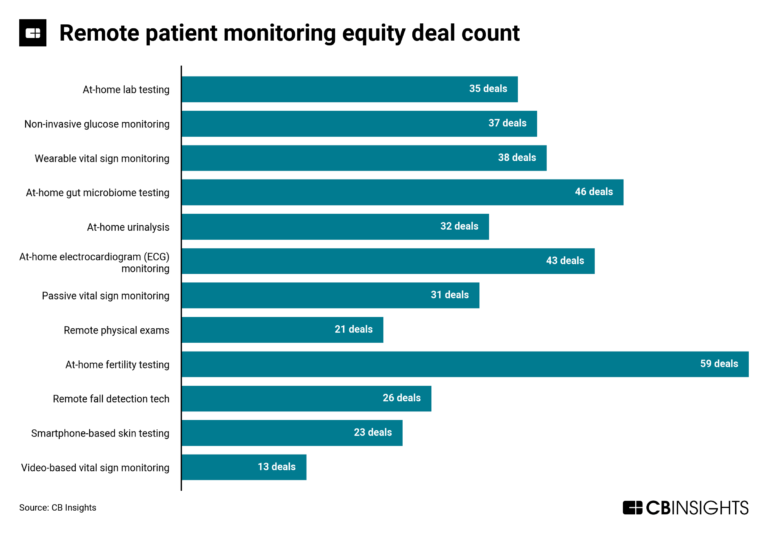

The remote patient monitoring market map

Aug 10, 2023

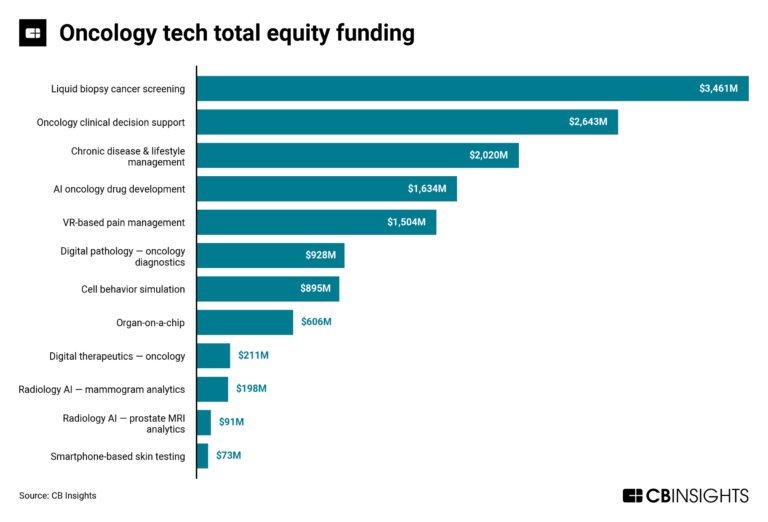

The oncology tech market mapExpert Collections containing Huma

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Huma is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

AI 100

100 items

Artificial Intelligence

14,653 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Value-Based Care & Population Health

1,067 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Digital Health

11,060 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

2,916 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Huma Patents

Huma has filed 7 patents.

The 3 most popular patent topics include:

- smartwatches

- arteries of the head and neck

- arteries of the upper limb

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/6/2019 | Blood pressure, Arteries of the upper limb, Arteries of the head and neck, Vascular diseases, Hypertension | Application |

Application Date | 2/6/2019 |

|---|---|

Grant Date | |

Title | |

Related Topics | Blood pressure, Arteries of the upper limb, Arteries of the head and neck, Vascular diseases, Hypertension |

Status | Application |

Latest Huma News

Sep 17, 2024

Principal Financial Group Inc. Takes $83,000 Position in Humacyte, Inc. (NASDAQ:HUMA) Posted by MarketBeat News on Sep 17th, 2024 Principal Financial Group Inc. acquired a new position in shares of Humacyte, Inc. ( NASDAQ:HUMA – Free Report ) during the second quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm acquired 17,196 shares of the company’s stock, valued at approximately $83,000. A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. Bank of New York Mellon Corp raised its holdings in shares of Humacyte by 62.7% during the 2nd quarter. Bank of New York Mellon Corp now owns 254,013 shares of the company’s stock worth $1,219,000 after acquiring an additional 97,931 shares during the period. ARS Investment Partners LLC purchased a new position in Humacyte during the second quarter worth about $559,000. Virtu Financial LLC purchased a new position in Humacyte during the first quarter worth about $197,000. Anson Funds Management LP acquired a new position in Humacyte in the 1st quarter valued at about $156,000. Finally, Vanguard Group Inc. grew its stake in shares of Humacyte by 28.7% in the 1st quarter. Vanguard Group Inc. now owns 4,019,681 shares of the company’s stock valued at $12,501,000 after buying an additional 896,415 shares during the period. Institutional investors and hedge funds own 44.71% of the company’s stock. Get Humacyte alerts: Humacyte Stock Down 6.4 % NASDAQ:HUMA opened at $5.28 on Tuesday. Humacyte, Inc. has a 52 week low of $1.96 and a 52 week high of $9.97. The stock’s fifty day moving average is $6.93 and its two-hundred day moving average is $5.56. The stock has a market capitalization of $628.76 million, a price-to-earnings ratio of -5.28 and a beta of 1.47. The company has a quick ratio of 5.41, a current ratio of 5.41 and a debt-to-equity ratio of 0.61. Want More Great Investing Ideas? Humacyte ( NASDAQ:HUMA – Get Free Report ) last posted its earnings results on Tuesday, August 13th. The company reported ($0.27) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.23) by ($0.04). Research analysts anticipate that Humacyte, Inc. will post -1.09 EPS for the current year. Analysts Set New Price Targets A number of research analysts recently commented on the company. Cantor Fitzgerald reiterated an “overweight” rating and issued a $7.00 price objective on shares of Humacyte in a report on Tuesday, July 2nd. EF Hutton Acquisition Co. I raised Humacyte to a “strong-buy” rating in a research note on Monday, September 9th. Benchmark reiterated a “buy” rating and set a $15.00 price target on shares of Humacyte in a report on Thursday, September 5th. Finally, BTIG Research boosted their price objective on shares of Humacyte from $8.00 to $11.00 and gave the company a “buy” rating in a report on Monday, July 15th. One research analyst has rated the stock with a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company’s stock. According to data from MarketBeat.com, the stock currently has a consensus rating of “Buy” and an average price target of $8.60. Insider Transactions at Humacyte In related news, Director Brady W. Dougan sold 352,112 shares of Humacyte stock in a transaction that occurred on Thursday, August 29th. The shares were sold at an average price of $6.35, for a total value of $2,235,911.20. Following the completion of the transaction, the director now owns 3,677,262 shares in the company, valued at $23,350,613.70. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website . In other Humacyte news, Director Brady W. Dougan sold 352,112 shares of the firm’s stock in a transaction that occurred on Thursday, August 29th. The shares were sold at an average price of $6.35, for a total value of $2,235,911.20. Following the completion of the transaction, the director now owns 3,677,262 shares of the company’s stock, valued at approximately $23,350,613.70. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link . Also, Director Brady W. Dougan sold 252,676 shares of the business’s stock in a transaction on Tuesday, August 27th. The stock was sold at an average price of $6.71, for a total transaction of $1,695,455.96. Following the completion of the transaction, the director now owns 4,306,464 shares of the company’s stock, valued at approximately $28,896,373.44. The disclosure for this sale can be found here . Over the last quarter, insiders have sold 1,084,153 shares of company stock valued at $6,869,996. 23.10% of the stock is currently owned by corporate insiders. About Humacyte Humacyte, Inc engages in the development and manufacture of off-the-shelf, implantable, and bioengineered human tissues for the treatment of diseases and conditions across a range of anatomic locations in multiple therapeutic areas. The company using its proprietary and scientific technology platform to engineer and manufacture human acellular vessels (HAVs) to be implanted into patient without inducing a foreign body response or leading to immune rejection. Further Reading

Huma Frequently Asked Questions (FAQ)

When was Huma founded?

Huma was founded in 2011.

Where is Huma's headquarters?

Huma's headquarters is located at 21-24 Millbank, London.

What is Huma's latest funding round?

Huma's latest funding round is Series D.

How much did Huma raise?

Huma raised a total of $367.6M.

Who are the investors of Huma?

Investors of Huma include Leaps by Bayer, Hitachi Ventures, HAT, AstraZeneca, SBRI Healthcare and 17 more.

Who are Huma's competitors?

Competitors of Huma include Aktivo, Doccla, Feel Therapeutics, Luscii, Lenus and 7 more.

What products does Huma offer?

Huma's products include Software as a Medical Device, Companion Apps and 3 more.

Who are Huma's customers?

Customers of Huma include UCB, AstraZeneca, Bayer, Tamer and NHS.

Loading...

Compare Huma to Competitors

Evidation focuses on harnessing real-world health data to measure and improve health outcomes. The company offers a digital health measurement and engagement platform that utilizes data science and machine learning to provide health guidance, treatments, and tools. Evidation primarily serves life sciences companies, government bodies, and academic institutions. It was founded in 2012 and is based in San Mateo, California.

Validic is a technology company specializing in health IoT platforms and EHR-integrated solutions for personalized remote patient care. The company offers a comprehensive ecosystem of connected health devices and apps, alongside an EHR-embedded application designed to make personal health data meaningful and actionable for clinicians and patients. Validic primarily serves the healthcare industry, including health systems, providers, payers, wellness companies, pharmaceuticals, health IT companies, and manufacturers of apps and devices. Validic was formerly known as Motivation Science. It was founded in 2010 and is based in Durham, North Carolina.

PhysIQ specializes in remote patient monitoring and data analytics within the healthcare and life sciences sectors. The company offers a platform that leverages artificial intelligence and wearable biosensors to continuously monitor patients and provide personalized medical insights, aiming to improve patient outcomes and assist in clinical trials. PhysIQ primarily serves healthcare providers and life sciences companies, offering solutions for virtual care, hospital-at-home models, and decentralized clinical research. PhysIQ was formerly known as VGBio. It was founded in 2005 and is based in Chicago, Illinois.

Holmusk is a data analytics and health technology company focused on behavioral health. The company offers a real-world evidence platform that leverages AI-powered analytics and digital solutions to improve research and care in behavioral health. Holmusk's main services include providing access to a comprehensive behavioral health database, advanced data analytics software, and an electronic health records platform designed for psychiatry practices. It was founded in 2015 and is based in New York, New York.

NeuroFlow is a digital health company focused on integrating behavioral health with physical health across various care settings. The company offers workflow automation, patient engagement solutions, and applied AI to facilitate remote patient monitoring, improve risk stratification, and support collaborative care. NeuroFlow primarily serves healthcare providers, payors, and the federal government with its HIPAA-compliant, cloud-based tools designed to enhance population behavioral health and reduce the cost of care. It was founded in 2017 and is based in Philadelphia, Pennsylvania.

Spire Health focuses on remote patient monitoring in the healthcare sector, specializing in the management of chronic respiratory diseases. The cpmpany's main service includes the use of health tag sensors that capture medical-grade physiological data, which is monitored by licensed medical staff to identify and respond to changes in patient health. The technology is primarily utilized by healthcare providers to enhance patient care for conditions such as heart failure, asthma, sleep disorders, and anxiety. It was founded in 2013 and is based in San Francisco, California.

Loading...