Mercury

Founded Year

2017Stage

Series B | AliveTotal Raised

$150.93MValuation

$0000Last Raised

$120M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-21 points in the past 30 days

About Mercury

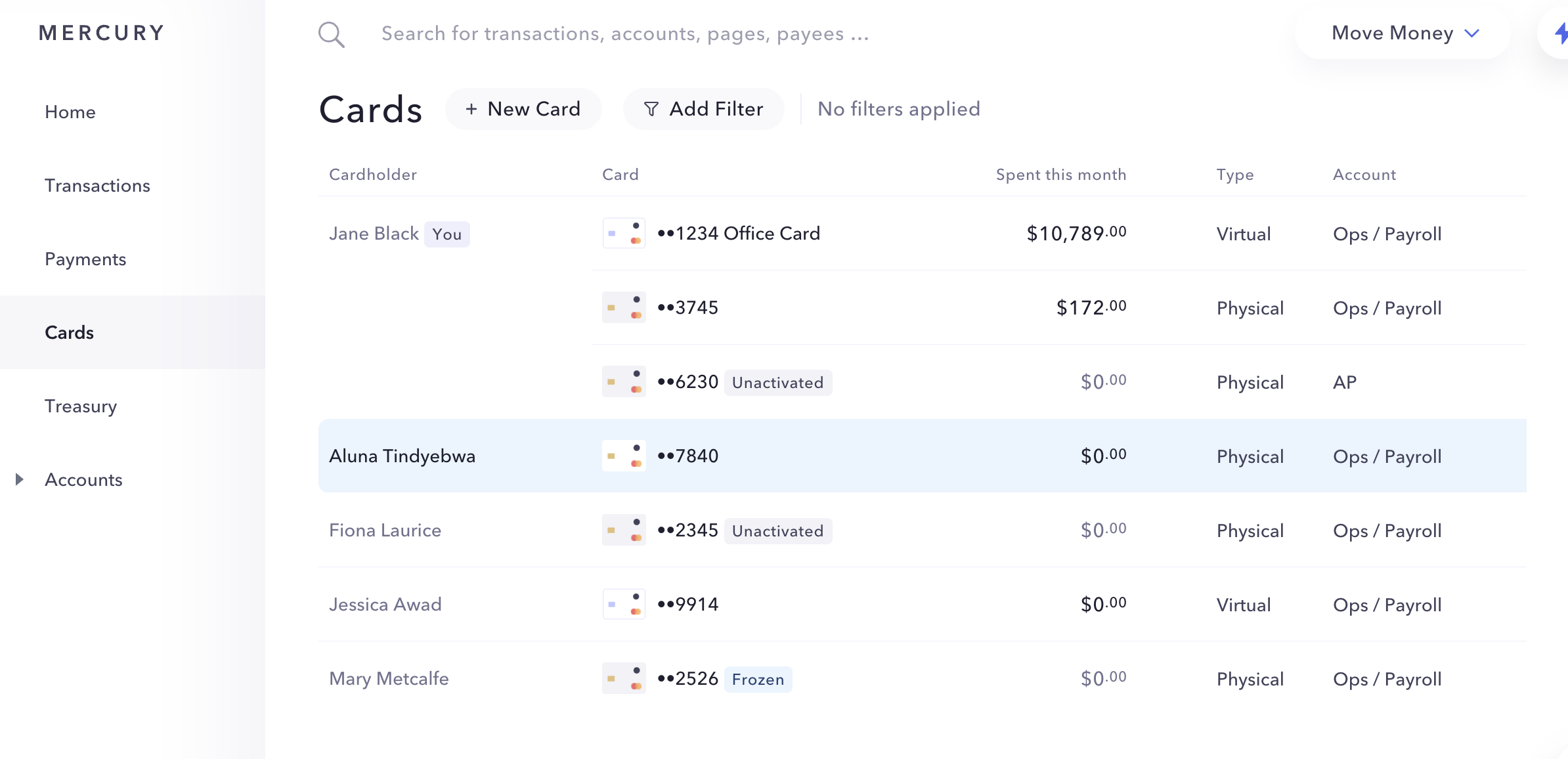

Mercury operates as a financial technology company. It offers banking accounts, currency exchange, debit cards, and international wires with operational support in the form of team management, tool integration, relevant insights on business finances, and more to its customers. It combines Federal Deposit Insurance Corporation (FDIC) insured checking and savings accounts with technology tools like cashflow analytics, intuitive dashboards, and payments. It was founded in 2017 and is based in San Francisco, California.

Loading...

Mercury's Product Videos

Mercury's Products & Differentiators

Business Checking Account

Designed with startups in mind, Mercury offers scalable digital tools — plus, every account provides read-write application programming interface access to truly customize your banking.

Loading...

Research containing Mercury

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mercury in 2 CB Insights research briefs, most recently on Dec 13, 2021.

Expert Collections containing Mercury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mercury is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

1,586 items

Future Unicorns 2019

50 items

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,008 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Mercury Patents

Mercury has filed 51 patents.

The 3 most popular patent topics include:

- cooling technology

- engine technology

- videotelephony

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/28/2022 | 9/3/2024 | Liquid crystals, Electromagnetism, Electronic circuits, Electrical engineering, Phases of matter | Grant |

Application Date | 2/28/2022 |

|---|---|

Grant Date | 9/3/2024 |

Title | |

Related Topics | Liquid crystals, Electromagnetism, Electronic circuits, Electrical engineering, Phases of matter |

Status | Grant |

Latest Mercury News

Sep 10, 2024

Teal co-founders, CEO Ian Crosby and design lead Adam Saint. Acquisition comes mere months after Vancouver startup announced an $11 million CAD seed round. Share: Vancouver-based seed-stage startup Teal has been acquired by US-based FinTech firm Mercury for an undisclosed amount, the latter announced in a statement Friday. The acquisition comes mere months after the accounting tech startup announced it had raised an $11 million CAD ($8 million USD) seed round. Teal was founded last year by CEO Ian Crosby and design lead Adam Saint, both of which also co-founded Bench Accounting and later worked at e-commerce giant Shopify. In a statement, Mercury said Crosby, Saint, and the Teal team will join Mercury as part of this acqusition. Crosby’s LinkedIn profile now states he is Mercury’s head of accounting products while Saint’s profile has not been updated. Mercury declined to provide further details about the acquisition to BetaKit. BetaKit reached out to Crosby and Saint for more details but did not hear back by press time. “Accountants are important partners in the Mercury ecosystem. Now, as part of Mercury, Teal’s incredible talent, technology and expertise will strengthen what we’re doing to transform banking into a lever that helps ambitious companies operate at their best,” Mercury posted to LinkedIn . Teal provides out-of-the-box tools to help vertical software-as-a-service (VSaaS) companies launch accounting platforms, including app code repositories and native integrations with external data sources. Their goal was to help those VSaaS companies give their small-to-medium-sized business customers the ability to more easily draw insights into things like real-time cash flow, per-product profitability, access tax filings, and support from live bookkeepers. After founding Bench together in 2010, Saint left the startup in 2016 to work in various roles. He became part of Shopify’s user experience advocacy before working as a product designer for Quora. Crosby led Bench as CEO for 10 years before departing in early 2022 to join Shopify , first as product director of Shopify’s business banking offering and then as head of financial services. The duo reunited in April 2023 to create Teal. Founded in 2017, Mercury provides business banking services layered with its own FinTech offerings. The startup raised $120 million at a $1.62 billion valuation in a Series B round backed by Andreessen Horowitz in 2021. Mercury reportedly attracted more than 26,000 customers following the collapse of Silicon Valley Bank in 2023. According to reporting from The Information , the Federal Deposit Insurance Corp. (FDIC) has also scrutinized one of Mercury’s partner banks for possible violations of anti–money-laundering and counterterrorism financing regulations. FDIC reportedly chastised the bank for what it claims is a lack of oversight over Mercury, citing international account openings and Mercury’s compliance system flagging a curiously low number of suspicious transactions. Feature image courtesy Teal.

Mercury Frequently Asked Questions (FAQ)

When was Mercury founded?

Mercury was founded in 2017.

Where is Mercury's headquarters?

Mercury's headquarters is located at 660 Mission Street, San Francisco.

What is Mercury's latest funding round?

Mercury's latest funding round is Series B.

How much did Mercury raise?

Mercury raised a total of $150.93M.

Who are the investors of Mercury?

Investors of Mercury include Andreessen Horowitz, CRV, Clocktower Technology Ventures, Sapphire Ventures, Coatue and 40 more.

Who are Mercury's competitors?

Competitors of Mercury include Found, Grasshopper, Treasure, Nearside, NorthOne and 7 more.

What products does Mercury offer?

Mercury's products include Business Checking Account and 4 more.

Who are Mercury's customers?

Customers of Mercury include and undefined.

Loading...

Compare Mercury to Competitors

Novo develops a financial platform. It offers neo-banking facilities without traditional physical branch networks. It provides zero-balance accounts, business checking and debit card access, lending services, and more. The platform caters to small and medium enterprises (SMEs). Novo was formerly known as CLEAR Bank. The company was founded in 2016 and is based in Miami, Florida.

Lili focuses on providing business finance solutions. The company offers a range of services including business banking, smart bookkeeping, invoice and payment management, and tax planning tools. It primarily serves the fintech industry. The company was founded in 2018 and is based in New York, New York.

Oxygen is a financial technology company focused on providing mobile banking solutions for personal and business finances. It offers services such as cashback rewards, virtual cards, early payroll access, and tools for business incorporation and invoicing. Oxygen primarily serves consumers, freelancers, solopreneurs, and small to medium-sized businesses with its financial products. It was founded in 2017 and is based in Princeton, New Jersey.

Bluevine is a financial technology company that specializes in providing business banking solutions. The company offers business checking accounts with high-yield interest, accounts payable automation, and extensive FDIC insurance, as well as business loans and credit cards designed to meet the needs of small businesses. Bluevine primarily serves the small business sector with its suite of financial products. It was founded in 2013 and is based in Jersey City, New Jersey.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and treasury services that include high-yield deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises, providing them with tools to control and track company spending in real-time. Brex was formerly known as Veyond. It was founded in 2017 and is based in San Francisco, California.

Loading...