Modern Treasury

Founded Year

2018Stage

Series C - II | AliveTotal Raised

$183.12MValuation

$0000Last Raised

$50M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-63 points in the past 30 days

About Modern Treasury

Modern Treasury specializes in payment operations and money movement solutions within the financial technology sector. The company offers APIs for real-time financial reconciliation, bank integrations, and AI-assisted money management. Modern Treasury's products are designed to serve finance teams, product teams, and engineering teams, enhancing payment processes and financial data management. It was founded in 2018 and is based in San Francisco, California.

Loading...

ESPs containing Modern Treasury

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The automated payments reconciliation market provides a streamlined and efficient solution for reconciling payments. Auto reconciliation refers to the automated process of matching incoming payments with corresponding invoices or transactions, eliminating the need for manual reconciliation efforts. By automating the reconciliation process, businesses can save time, reduce errors, and improve finan…

Modern Treasury named as Challenger among 15 other companies, including Stripe, Ramp, and GoCardless.

Modern Treasury's Products & Differentiators

Payments

For companies building money movement products, Payments provides a single API and web app to manage the entire cycle of money movement, from initiating and receiving payments to reconciliation and booking to the General Ledger. It lets customers manage multiple bank payment methods like ACH, Wire, RTP, SEPA, BACS, checks and any other method supported by their bank through one integration.

Loading...

Research containing Modern Treasury

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Modern Treasury in 7 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Modern Treasury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Modern Treasury is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

2,003 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

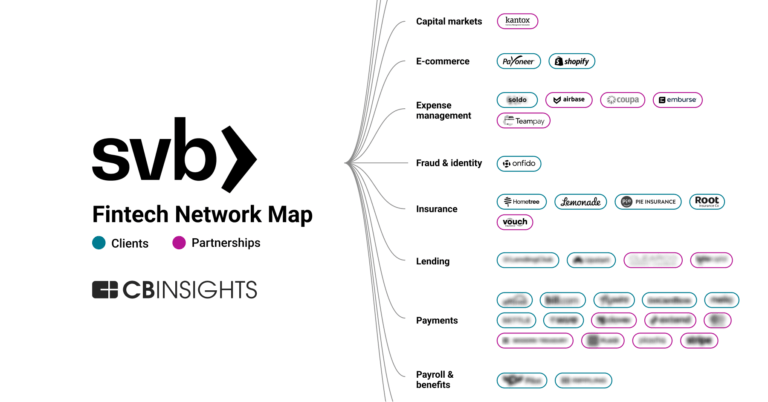

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Modern Treasury News

Aug 15, 2024

Share this post: Modern Treasury , essential infrastructure for the new era of payments, has announced that it has expanded instant payments support for mutual customers of six leading banks — Bank of America, Cross River, JPMorgan Chase, PNC Financial Services, U.S. Bank and Wells Fargo. Instant payments, powered by the first new payment rails in the U.S. in more than four decades, enable businesses to move money faster and gain real-time insights into money movement as they track payments from initiation to receipt. Instant payments use the FedNow service, developed and launched by the Federal Reserve in July 2023, and the RTP® network, launched in 2017 by The Clearing House. So far, over 1,000 banks and credit unions have signed on with either the RTP or FedNow networks, or both, and instant payment volume continues to grow. “Money is moving swiftly toward a real-time future, and seeing customers use Modern Treasury to enable instant payments with some of the largest banks in the U.S. is a testament to the accelerating adoption of these exciting new payment rails,” said Sam Aarons, Modern Treasury Co-founder and CTO. “By making instant payments easier to access for our customers, we’re helping them deliver better customer experiences while enabling real-time insight into cash flow.” Modern Treasury helps its customers access instant payment capabilities by expanding support for these rails with banks. It enables a faster way to move funds via new payment rails than traditional ACH, wire, or check. In addition to providing support for sending instant payments, Modern Treasury also supports the ability to access the “Request for Payment (RFP)” capability at a growing number of banks. As the adoption and coverage of RFP grows, customers can leverage it for faster, irrevocable, 24×7 pay-ins while also using it to address ACH’s insufficient funds risk. The Modern Treasury platform powers instant payments for companies in industries like healthcare, payroll, real estate, investing, and insurance. Today, Modern Treasury’s customers move over $1 billion in instant payments volume annually. They also rely on the platform for eligibility checks to determine if counterparties can receive instant payments, to get real-time visibility into payment status and cash balances, and to automatically reconcile and ledger transactions. “Real estate requires the ability to move money quickly, accurately, and securely. Instant payments fulfill all three of those requirements, enabling us to deliver faster brokerage payouts and escrow settlements, which can now occur 24/7/365, all while reducing transaction fees,” said Bob Taylor, Vice President of Centralized Escrow Accounting for Stewart Title, a Modern Treasury customer. “We fully expect this to become a competitive differentiator in our industry, and we’re pleased to lead the way.” “With the rise of new payment use cases and heightened customer expectations, the demand for faster payments in the U.S. is growing. Financial institutions of all sizes are leveraging the RTP network’s increasing volume and enhanced capabilities, such as RFP, to develop digital services for their corporate and retail customers,” said Rusiru Gunasena, Senior Vice President of RTP Product Development at The Clearing House. “We look forward to continued growth through integrations with companies like Modern Treasury.” People In This Post News News Fintech Insurtech News

Modern Treasury Frequently Asked Questions (FAQ)

When was Modern Treasury founded?

Modern Treasury was founded in 2018.

Where is Modern Treasury's headquarters?

Modern Treasury's headquarters is located at 77 Geary Street, San Francisco.

What is Modern Treasury's latest funding round?

Modern Treasury's latest funding round is Series C - II.

How much did Modern Treasury raise?

Modern Treasury raised a total of $183.12M.

Who are the investors of Modern Treasury?

Investors of Modern Treasury include Benchmark, Altimeter Capital, Quiet Capital, SVB Capital, NewView Capital and 10 more.

Who are Modern Treasury's competitors?

Competitors of Modern Treasury include Fennech Financial, WhenThen, Ledge, Treasury Prime, Nilus and 7 more.

What products does Modern Treasury offer?

Modern Treasury's products include Payments and 4 more.

Who are Modern Treasury's customers?

Customers of Modern Treasury include Pipe, Settle and Trip Actions.

Loading...

Compare Modern Treasury to Competitors

Moov develops a money movement platform to provide an all-in-one payment solution for businesses in the financial technology domain. The company offers services that enable businesses to accept, store, send, and spend money through a single platform, simplifying the integration of payment systems. Its platform is designed to handle the entire payment process, from processing and issuing to compliance and multi-party transactions, without the need for multiple vendors. The company was founded in 2018 and is based in Cedar Falls, Iowa.

Atlar specializes in financial management for modern finance teams, operating within the financial technology sector. The company offers a platform that manages cash, processes payments, and integrates with ERP systems to provide real-time financial data and analytics. Atlar's platform serves various sectors, including finance, treasury, and product teams within mid-market and enterprise organizations. Atlar was formerly known as Avantir. It was founded in 2022 and is based in Stockholm, Sweden.

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Orum focuses on financial services technology, providing solutions for fast and reliable payments. The company offers a platform for payment orchestration and instant bank account verification, aiming to optimize money movement and improve business transactions. Orum's services are utilized by various sectors including insurance, marketplaces, brokerage firms, and creator platforms. It was founded in 2019 and is based in New York, New York.

Sila operates as a financial technology company focused on providing a payment platform. The company offers a range of services including fast money transfers, identity verification, fraud prevention, and bank account linking. These services are primarily targeted towards the fintech industry. It was founded in 2018 and is based in Portland, Oregon.

Trovata specializes in automating cash management processes within the financial technology sector. The company provides solutions for cash flow analysis, cash reporting, cash forecasting, cash positioning, transaction search, and payments, aimed at simplifying financial data aggregation and enhancing decision-making for businesses. Trovata's platform serves various sectors within the economy, including treasury, finance, accounting, and the C-suite, by offering a modern approach to managing cash operations and strategic insights. It was founded in 2016 and is based in Solana Beach, California.

Loading...