Monzo

Founded Year

2015Stage

Series I - II | AliveTotal Raised

$1.862BValuation

$0000Last Raised

$190M | 5 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+58 points in the past 30 days

About Monzo

Monzo operates a digital banking platform focused on personal finance management. The company offers personal and joint accounts, allowing users to track income, manage spending, and save money through an integrated mobile app. Monzo primarily serves individuals looking for an easy-to-use banking solution. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Loading...

ESPs containing Monzo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital financial wellness market consists of fintechs that deliver combinations of financial products, including banking, investing, loans, and P&C insurance, as well as planning tools such as goals-based planning, account aggregation, asset allocation, and budgeting tools. These companies often have B2C and B2B2C distribution models. While digital financial wellness companies may offer compl…

Monzo named as Highflier among 14 other companies, including SoFi, MoneyLion, and Revolut.

Loading...

Research containing Monzo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Monzo in 8 CB Insights research briefs, most recently on Aug 30, 2024.

Expert Collections containing Monzo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Monzo is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,396 items

Excludes US-based companies

Digital Banking

1,008 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

The financial planning market map

75 items

Latest Monzo News

Sep 23, 2024

{ Carlesi said: “Today’s announcement is a tremendous achievement for Revolut. Ten million customers across the UK makes us one of the largest payments businesses in the market, and we are incredibly grateful to our growing customer base, who continue to use Revolut more and more.”

Monzo Frequently Asked Questions (FAQ)

When was Monzo founded?

Monzo was founded in 2015.

Where is Monzo's headquarters?

Monzo's headquarters is located at 5 Appold Street, London.

What is Monzo's latest funding round?

Monzo's latest funding round is Series I - II.

How much did Monzo raise?

Monzo raised a total of $1.862B.

Who are the investors of Monzo?

Investors of Monzo include CapitalG, Hedosophia, GIC, Passion Capital, Tencent and 27 more.

Who are Monzo's competitors?

Competitors of Monzo include Wamo, Monese, Kroo, Atom Bank, Tandem and 7 more.

Loading...

Compare Monzo to Competitors

Starling Bank is a digital bank focused on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, England.

N26 provides a mobile banking platform. It gives customers a solution to control finances. The company allows users to open an N26 account directly from their phone or computer. It also offers insights into spending habits. The company was founded in 2013 and is based in Berlin, Germany.

Revolut is a financial technology company offering a suite of money management tools. It provides services such as international money transfers, currency exchange, stock trading, and savings accounts. Revolut caters to both personal and business financial needs, with a focus on providing more control and visibility over users' finances. It was founded in 2015 and is based in London, United Kingdom.

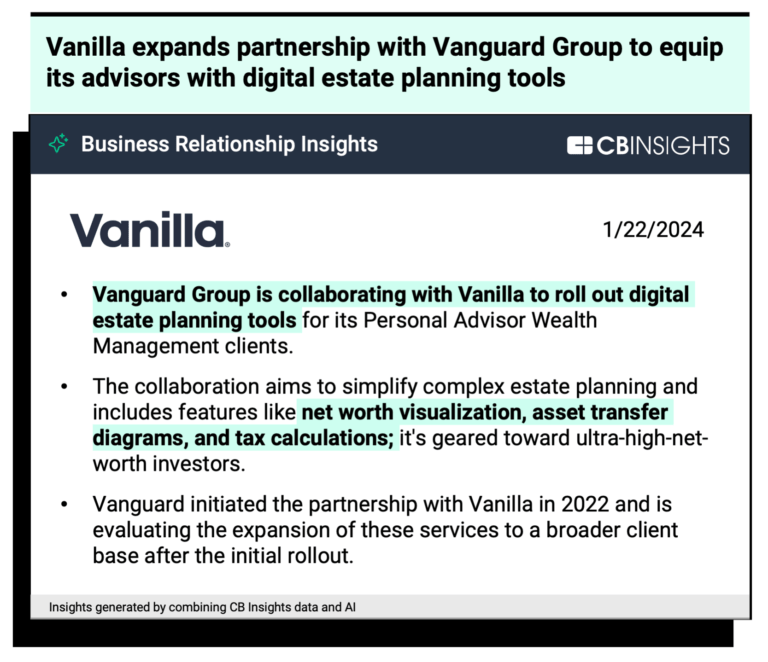

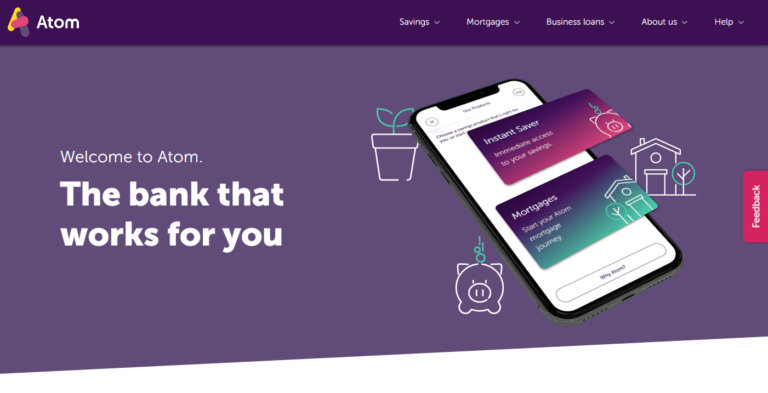

Atom Bank is a financial institution that provides an online banking platform focusing on personal and business banking services. The company offers savings accounts, residential and commercial mortgages, and business loans. It primarily serves individuals looking for savings options and businesses seeking financing solutions. Atom Bank was founded in 2014 and is based in Durham, United Kingdom.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Shawbrook Bank is a specialist bank focusing on savings and lending in the financial services industry. The company offers a broad range of products including personal loans, residential and commercial mortgages, business finance, and savings products. Shawbrook primarily serves real estate professionals, small and medium-sized enterprises (SMEs), and individual consumers. Shawbrook Bank was formerly known as Whiteaway Laidlaw Bank. It was founded in 2011 and is based in Brentwood, England.

Loading...