NorthOne

Founded Year

2016Stage

Series B | AliveTotal Raised

$83.79MLast Raised

$67M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-71 points in the past 30 days

About NorthOne

NorthOne operates in banking. The company provides an online business account with integrated features designed to simplify business banking, including real-time money transfers, automatic budgeting tools, and connections to accounting, payment, and payroll tools, primarily serving small businesses across various sectors. NorthOne was formerly known as Ferst Digital. The company was founded in 2016 and is based in New York, New York.

Loading...

NorthOne's Product Videos

NorthOne's Products & Differentiators

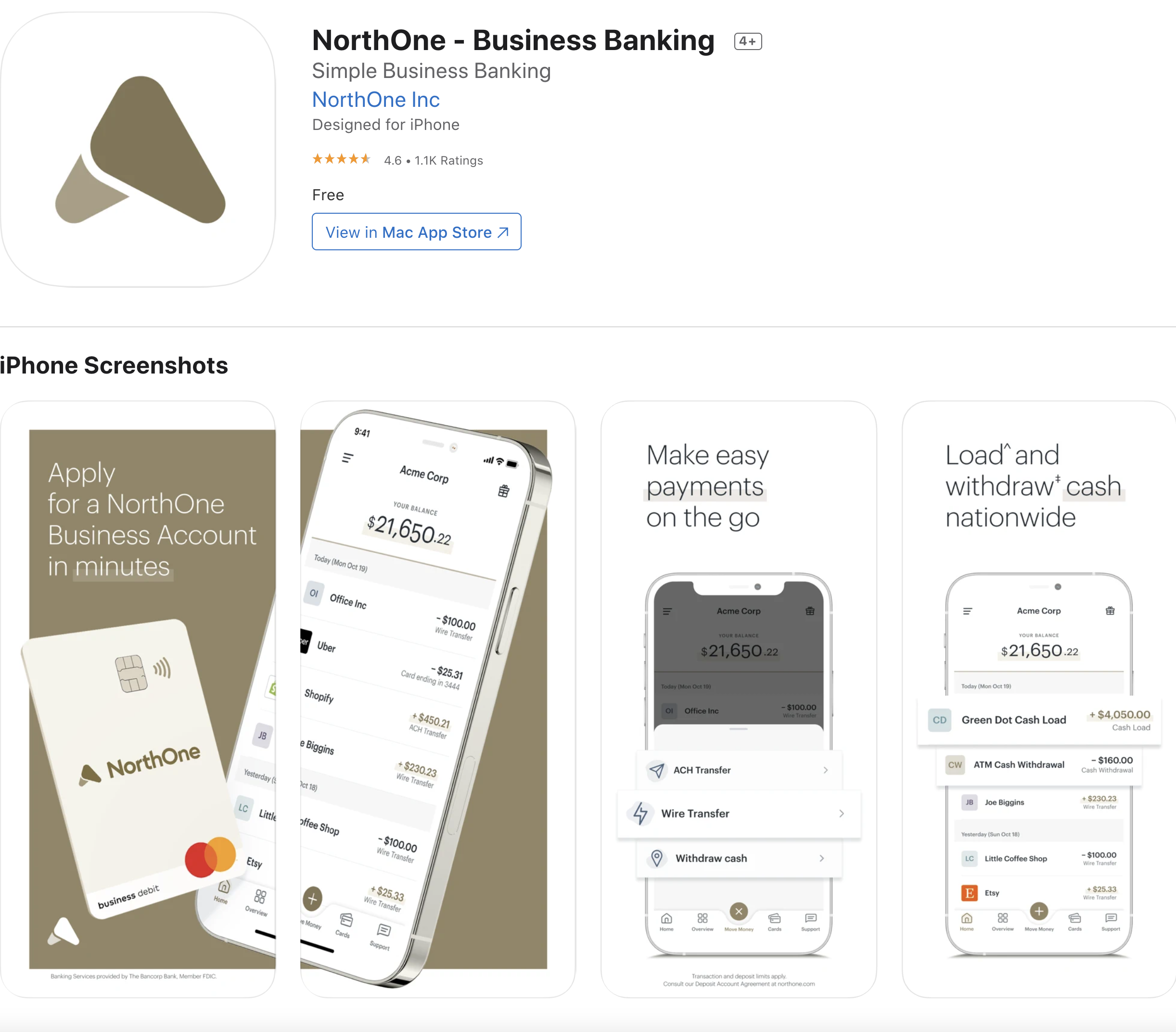

NorthOne Banking

Mobile and web based digital banking applications with linked NorthOne Master Card debit card

Loading...

Expert Collections containing NorthOne

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

NorthOne is included in 5 Expert Collections, including SMB Fintech.

SMB Fintech

1,231 items

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

871 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Latest NorthOne News

Jun 19, 2024

19 Jun 2024 Speakers representing FDX, FDATA North America, League Data, NorthOne and National Bank of Canada discussed the necessity and implications of aligning Canada’s Open Banking standards with those of the US at Open Banking Expo Canada on June 11. Mauricio Deutsch, senior vice president, banking and capital markets Canada at GFT, moderated the panel session, which he opened by emphasizing the potential benefits of interoperability between Canada and the US. GFT’s Mauricio Deutsch He pointed out that such a path could enhance consumer convenience and foster financial inclusion. Carrie Forbes, chief executive officer of League Data, highlighted the importance of collaboration and observed that Canada, due to its smaller scale, often faces challenges in accessing technology and solutions that could be readily available through collaboration with US counterparts. Forbes noted that, without interoperability, Canadian institutions might remain isolated, unable to fully leverage shared goals and technologies with their US counterparts. Jason Chomik, Canadian director at FDX, talked about the technical feasibility of creating interoperable standards, noting that FDX already includes data elements for both Canada and the US. He acknowledged the larger challenges of regulatory alignment but remained optimistic about the technical aspects being manageable. Steve Boms, executive director at FDATA North America, detailed the significant regulatory differences between the two countries, highlighting the distinct approaches to data privacy and consumer protection. Boms told delegates that achieving regulatory harmony would require substantial coordination and alignment, both within each country and across the border. During the panel debate, Natacha Boudrias, lead Open Banking at National Bank of Canada, focused on the evolving landscape of data privacy and security. She stressed the need for ethical practices and consumer consent, emphasizing that any framework must ensure the secure handling of data to gain consumer trust. Eytan Bensoussan, NorthOne’s chief executive officer, highlighted the potential for Canadian businesses to expand into the US market, leveraging interoperable standards to simplify cross-border operations. He also pointed out that many small businesses already expect interoperable systems due to their experiences with other sectors, like ecommerce. The discussion also touched on the role of various stakeholders in fostering industry collaboration. The panelists called for increased involvement from financial institutions, fintechs, government bodies, and educational institutions. They emphasized the importance of aligning these stakeholders to create a cohesive and efficient framework for Open Banking. The panel concluded with a consensus on the need for an interoperable path between Canada and the US, despite the numerous challenges, calling for a consumer-centric approach, emphasizing that the ultimate goal of Open Banking should be to meet the needs of consumers and businesses. Share

NorthOne Frequently Asked Questions (FAQ)

When was NorthOne founded?

NorthOne was founded in 2016.

Where is NorthOne's headquarters?

NorthOne's headquarters is located at 18 West 18th Street, New York.

What is NorthOne's latest funding round?

NorthOne's latest funding round is Series B.

How much did NorthOne raise?

NorthOne raised a total of $83.79M.

Who are the investors of NorthOne?

Investors of NorthOne include Tom Williams, Ferst Capital Partners, Battery Ventures, Redpoint Ventures, Tencent and 11 more.

Who are NorthOne's competitors?

Competitors of NorthOne include Tide, Shine, Allica Bank, Relay, Railsr and 7 more.

What products does NorthOne offer?

NorthOne's products include NorthOne Banking.

Loading...

Compare NorthOne to Competitors

Lili focuses on providing business finance solutions. The company offers a range of services including business banking, smart bookkeeping, invoice and payment management, and tax planning tools. It primarily serves the fintech industry. The company was founded in 2018 and is based in New York, New York.

Novo develops a financial platform. It offers neo-banking facilities without traditional physical branch networks. It provides zero-balance accounts, business checking and debit card access, lending services, and more. The platform caters to small and medium enterprises (SMEs). Novo was formerly known as CLEAR Bank. The company was founded in 2016 and is based in Miami, Florida.

Oxygen is a financial technology company focused on providing mobile banking solutions for personal and business finances. It offers services such as cashback rewards, virtual cards, early payroll access, and tools for business incorporation and invoicing. Oxygen primarily serves consumers, freelancers, solopreneurs, and small to medium-sized businesses with its financial products. It was founded in 2017 and is based in Princeton, New Jersey.

Qonto is a business finance solution specializing in banking, financing, bookkeeping, and spend management for small and medium enterprises (SMEs) and freelancers. The company offers an online platform that includes business accounts with Mastercard debit cards, invoice management, and tools for expense and cash flow management. Qonto primarily serves the needs of small and medium-sized enterprises, freelancers, and various associations seeking efficient financial management solutions. It was founded in 2016 and is based in Paris, France.

Found operates as a financial technology company specializing in business banking and smart financial tools for self-employed individuals and small business owners. The company offers a suite of services including business banking, automated bookkeeping, tax estimation, and professional invoicing, all integrated into one easy-to-use app. Found's platform is designed to simplify financial management for entrepreneurs by providing real-time insights into cash flow, expenses, and tax obligations without hidden fees. It was founded in 2019 and is based in San Francisco, California.

Leveris has developed an end-to-end platform to allow financial institutions and fintech startups such as digital-only banks or challenger banks to run their services.

Loading...