Paga

Founded Year

2009Stage

Series B - III | AliveTotal Raised

$39.2MLast Raised

$5.2M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-60 points in the past 30 days

About Paga

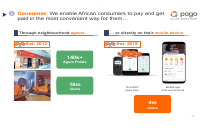

Paga is a mobile money company focused on facilitating digital financial transactions. The company offers services that allow users to send and receive money, pay bills, and top-up airtime and data. Paga primarily serves the financial technology sector by simplifying access to financial services for individuals. It was founded in 2009 and is based in Lagos, Nigeria.

Loading...

Paga's Product Videos

Paga's Products & Differentiators

Consumer Mobile App

Similar to Cash App. Mobile App that aggregates all financial accounts and gives consumer one place to view all their balances and transact from one place. Customers can send money, request money, pay bills, buy or send airtime.

Loading...

Research containing Paga

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Paga in 3 CB Insights research briefs, most recently on Apr 7, 2023.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Paga

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Paga is included in 3 Expert Collections, including Fintech 100.

Fintech 100

747 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Latest Paga News

Aug 29, 2024

To embed, copy and paste the code into your website or blog: <iframe frameborder="1" height="620" scrolling="auto" src="//www.jdsupra.com/post/contentViewerEmbed.aspx?fid=9097ce9e-ea58-4be9-9b28-912ac6d1ca38" style="border: 2px solid #ccc; overflow-x:hidden !important; overflow:hidden;" width="100%"></iframe> Key Takeaways California employers can have greater reassurance that an approved PAGA settlement is less likely to be disrupted by other plaintiffs with separate and overlapping claims. PAGA plaintiffs are not foreclosed from seeking consolidation or coordination in overlapping PAGA actions or from offering objections or comments on the fairness of proposed settlements to courts, which may be considered in the courts’ discretion. While the court expressly declined to opine on the newest PAGA reforms , it did invite the Legislature “to decide whether statutory recognition” of the right to intervene “is wise and/or necessary to achieve PAGA’s goals.” Introduction In a welcome win for employers, the California Supreme Court recently blocked a PAGA plaintiff’s attempt to intervene and object to another PAGA plaintiff’s proposed settlement as a matter of right, in Turrieta v. Lyft, Inc., No. S271721. Resolving an appellate court split, the court held in a 5-2 decision: We hold that an aggrieved employee’s status as the State’s proxy in a PAGA action does not give that employee the right to seek intervention in the PAGA action of another employee, to move to vacate a judgment entered in the other employee’s action, or to require a court to receive and consider objections to a proposed settlement of that action. PAGA Background California’s Private Attorneys General Act of 2004 (PAGA) provides a private enforcement mechanism for employees to pursue claims as allegedly “aggrieved employees” on behalf of the Labor and Workforce Development Agency against employers that allegedly violate the California Labor Code. PAGA actions are almost always brought on a representative basis. However, because representative PAGA actions have lacked the procedural safeguards typical of class actions, they are far easier to pursue. Because of this and several decisions regarding the arbitrability of PAGA claims, PAGA litigation has steadily increased year after year. Turrieta v. Lyft, Inc. As the court in Turrieta v. Lyft, Inc. recognized, the case involved “what has become a common scenario in PAGA litigation: multiple persons claiming to be an ‘aggrieved employee’ within the meaning of PAGA file separate and independent lawsuits seeking recovery of civil penalties from the same employer for the same alleged Labor Code violations.” Three drivers for Lyft, Inc. (Lyft) – Tina Turrieta, Brandon Olson and Million Seifu – each filed a separate action seeking civil penalties under PAGA for Lyft’s alleged failure to pay minimum wages, overtime premiums and business expense reimbursements. Turrieta and Lyft signed an agreement settling Turrieta’s action for $15 million. Prior to the settlement approval hearing, Olson and Seifu filed separate motions to intervene in Turrieta’s action and submitted objections to the settlement. The trial court denied the motions, approved the settlement and later denied the motions of Olson and Seifu to vacate the judgment. Olson and Seifu appealed, and the Court of Appeal affirmed, finding that the trial court had properly denied the intervention motions and that Olson and Seifu lacked standing to move in the trial court to vacate the judgment or to challenge the judgment on appeal. The California Supreme Court affirmed the Court of Appeal’s judgment. It found that the right as a state proxy to assert the state’s alleged right to intervene would be inconsistent with PAGA. The court based its reasoning on the plain text of PAGA and the legislative history and statutory scheme as a whole. The court concluded that a PAGA plaintiff has “authority to prosecute a PAGA action after commencing one,” which “necessarily implies the power to use the ordinary tools of civil litigation” such as serving the complaint, engaging in discovery and motion practice, and attending trial – but not necessarily intervention. Because the text is not dispositive on the question of intervention, the court analyzed the broader statutory scheme and found the recognition of intervention power is neither reasonably necessary to effectuate PAGA’s purpose nor consistent with the Legislature’s intent. In the act’s express provisions, the Legislature specifically looked only to the courts and to the Labor and Workforce Development Agency to effectively oversee PAGA settlements. Conclusion This decision may impact how employers and plaintiffs alike proceed in pending and forthcoming PAGA litigation. Plaintiffs may feel incentivized to be the first to reach a PAGA settlement, whereas employers may have greater confidence in the finality of approved PAGA settlements.

Paga Frequently Asked Questions (FAQ)

When was Paga founded?

Paga was founded in 2009.

Where is Paga's headquarters?

Paga's headquarters is located at 176 Herbert Macaulay Road, Yaba, Lagos.

What is Paga's latest funding round?

Paga's latest funding round is Series B - III.

How much did Paga raise?

Paga raised a total of $39.2M.

Who are the investors of Paga?

Investors of Paga include Flourish Ventures, Gaingels, Ping An Cloud Accelerator, Global Innovation Fund, Acumen and 9 more.

Who are Paga's competitors?

Competitors of Paga include BitGo, Airwallex, MobiKwik, Lianlian Pay, Ledger and 7 more.

What products does Paga offer?

Paga's products include Consumer Mobile App and 2 more.

Loading...

Compare Paga to Competitors

Airwallex develops a global financial platform focusing on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Coins.ph provides a blockchain-based platform. It offers consumers access to basic financial services, such as remittances, bill payments, and mobile airtime. The company was founded in 2014 and is based in Pasig City, Philippines. In April 2022, Coins.ph was acquired by Wei Zhou.

ZEPZ focuses on providing digital payment solutions. The company offers services enabling users to send money securely with options for bank deposit, cash collection, mobile airtime top-up, and mobile money. ZEPZ primarily serves the global payments industry. Zepz was formerly known as WorldRemit. It was founded in 2010 and is based in London, United Kingdom.

MobiKwik serves as a financial platform operating in the financial services industry. It offers a wide range of financial products for consumers and merchants, including payment services, digital credit, and investment opportunities. It primarily serves the e-commerce industry, with services designed to facilitate payments for everyday needs such as utility bills, food delivery, and shopping. It was founded in 2009 and is based in Gurugram, India.

AZA Finance specializes in cross-border payment solutions and foreign exchange services for the B2B sector. The company offers a robust online payment platform that facilitates multi-currency transactions, treasury management, and payment collections, designed to support businesses operating in Africa. AZA Finance primarily serves enterprises requiring financial services across multiple African and global markets. AZA Finance was formerly known as BitPesa. It was founded in 2013 and is based in Grand Duchy of Luxembourg, Luxembourg.

MoMo is a financial technology company specializing in digital payment solutions and super application development. The company offers a comprehensive ecosystem that allows users to perform various daily activities through their platform, as well as leveraging data analytics and AI to enhance user experience and merchant services. MoMo's products cater to various sectors including financial services, e-commerce, and more. It was founded in 2007 and is based in Ho Chi Minh City, Vietnam.

Loading...