Payhawk

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$236.5MValuation

$0000Last Raised

$100M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-63 points in the past 30 days

About Payhawk

Payhawk is a spend management platform that operates in the financial technology sector. The company offers a suite of tools for managing corporate expenses, including issuance of corporate cards, automation of expense management, and comprehensive accounts payable software. Payhawk's solutions are designed to provide real-time visibility and control over business spending, streamline financial operations, and integrate with existing ERP and accounting systems. It was founded in 2018 and is based in London, England.

Loading...

Payhawk's Product Videos

ESPs containing Payhawk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

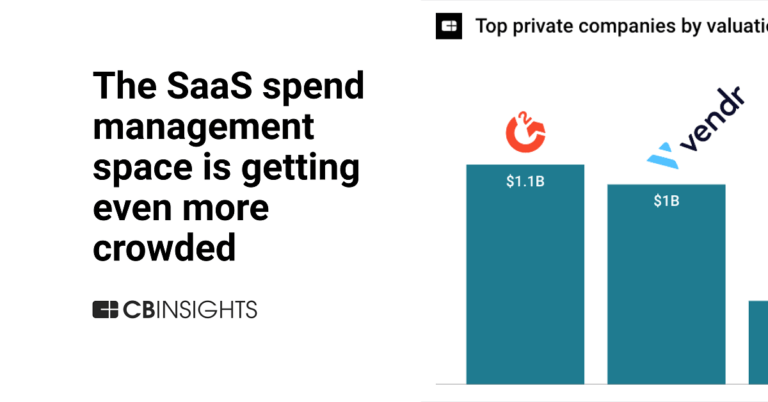

The spend management market enable businesses to efficiently manage and control their expenditures through a suite of integrated software solutions, including virtual corporate cards, expense management systems, procurement software, budget tracking tools, and supplier management platforms. Vendors use APIs and cloud-based platforms to integrate these solutions into existing financial and operatio…

Payhawk named as Outperformer among 15 other companies, including Coupa, Brex, and Ramp.

Payhawk's Products & Differentiators

Payhawk

• Integrated global solution for managing company spending • Corporate bank accounts in multiple currencies with dedicated IBANs • Global company cards • Mobile app for employees • Powerful and flexible software for the finance accounting team • Best-in-class direct integrations with ERP mean no manual data transfer (especially Xero and Oracle NetSuite)

Loading...

Research containing Payhawk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Payhawk in 13 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Oct 11, 2022

The Transcript from Yardstiq: Klarna vs. Afterpay

Oct 4, 2022

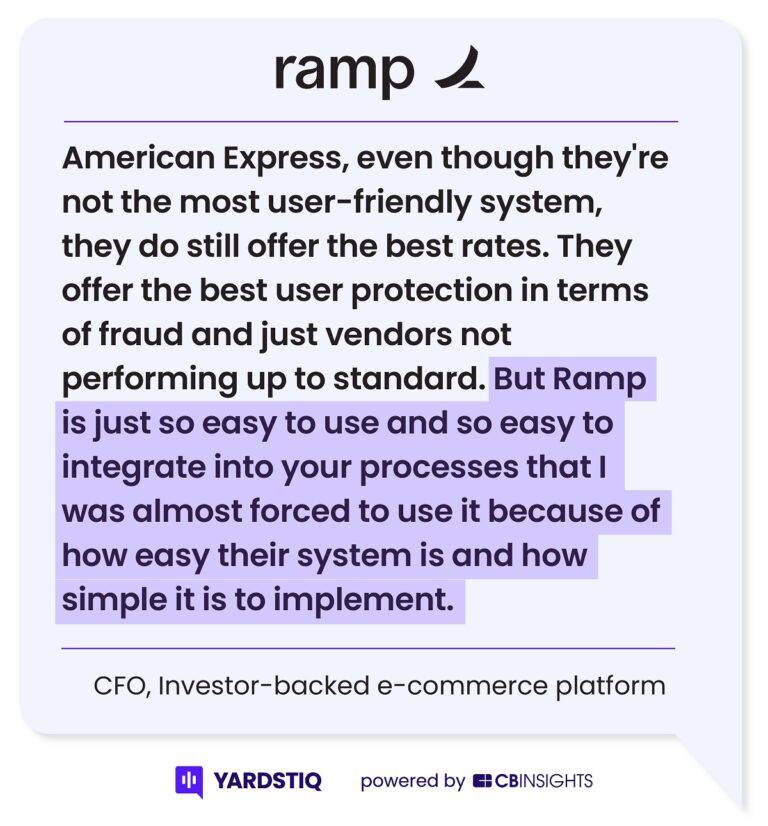

The Transcript from Yardstiq: Ramp vs. BrexExpert Collections containing Payhawk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Payhawk is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

1,648 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

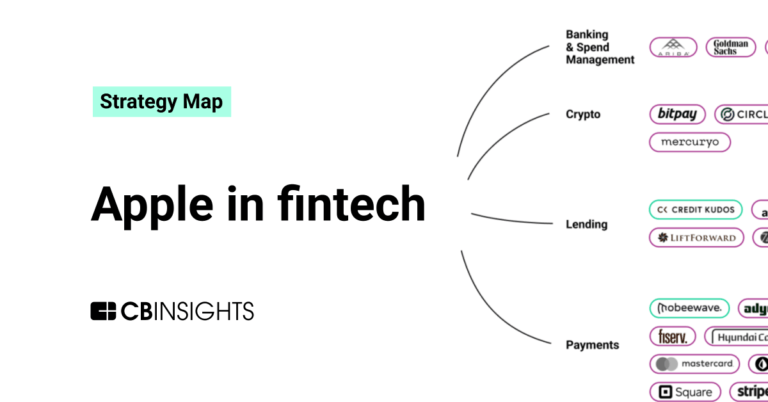

Fintech

13,396 items

Excludes US-based companies

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Payhawk News

Sep 23, 2024

London-based fintech Payhawk posted heavy losses for 2023 despite more than doubling revenue. Based in Chancery Lane, Payhawk is a tool for managing corporate expenses, invoices, and company cards. The company works with clients including Microsoft, QuickBooks and Oracle NetSuite. The group reported a loss of €32m (£26.8m) for the year ended December 2023, 80% more than the year prior. The loss was driven by increased administrative and operating expenses as well as depreciation and amortisation expenses. Payhawk said the increased expenses were largely down to a higher headcount and “heavy investment in marketing campaigns”. Despite the loss, the company reported revenue of €12.6m, up from €5.8m in 2022. Gross profit for the year reached €9.7m. No dividends were paid during 2023. The director’s report described 2023 as a year “marked by unparalleled achievements” and “nothing short of extraordinary”. Payhawk, which has locations in London, Sofia, Berlin and Barcelona, raised a $112m (£84.5m) Series B round in 2021 led by Silicon Valley-based investor Greenoaks – a backer of Gorillas, Robinhood, Stripe and Checkout.com. This round was extended with an additional $100m investment in February 2022 that included Lightspeed Venture Partners. Payhawk’s Series B came just seven months after its $20m Series A round . Topics

Payhawk Frequently Asked Questions (FAQ)

When was Payhawk founded?

Payhawk was founded in 2018.

Where is Payhawk's headquarters?

Payhawk's headquarters is located at WeWork, 1 Waterhouse Square, London.

What is Payhawk's latest funding round?

Payhawk's latest funding round is Series B - II.

How much did Payhawk raise?

Payhawk raised a total of $236.5M.

Who are the investors of Payhawk?

Investors of Payhawk include Earlybird Venture Capital, QED Investors, Greenoaks Capital Management, Lightspeed Venture Partners, HubSpot Ventures and 12 more.

Who are Payhawk's competitors?

Competitors of Payhawk include Airbase, Moss, Jeeves, Pleo, Ramp and 7 more.

What products does Payhawk offer?

Payhawk's products include Payhawk and 4 more.

Who are Payhawk's customers?

Customers of Payhawk include ATU, Luxair, Heroes, Payflow and Gtmhub.

Loading...

Compare Payhawk to Competitors

Pleo operates as a business spend management platform. It provides virtual cards, expenses, automated expense reports for employees, invoices, and more. It serves industries such as retail, healthcare, technology, and more. It was founded in 2015 and is based in Kobenhavn N, Denmark.

Moss is a spend management platform that operates in the financial technology sector. The company provides solutions for corporate credit card issuance, expense management, and accounts payable automation, designed to streamline financial processes and enhance control over company spending. Moss's platform is tailored to the needs of modern SMB finance teams, offering features such as real-time budget tracking, receipt capture, and seamless integrations with accounting software. Moss was formerly known as Vanta. It was founded in 2019 and is based in Berlin, Germany.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Spendesk is a spend management platform that offers a comprehensive solution for modern finance teams in various business sectors. The company provides corporate cards, invoice payments, expense reimbursements, budgets, approvals, reporting, compliance, and pre-accounting in one integrated system. Spendesk's platform is designed to give businesses complete visibility and control over their spending, with features such as built-in automation and an easily adopted approval process. It was founded in 2016 and is based in Paris, France.

Soldo operates as a financial services and software company in the financial technology industry. The company offers a spend management platform that automates business and employee spending, along with prepaid company cards that provide real-time tracking and control over expenses. It primarily serves businesses across various sectors, with a focus on reducing financial administrative burdens. It was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Fyle focuses on intelligent expense management. Its main services include tracking receipts, reporting expenses, managing credit card reconciliation, and providing analytics on company spending. The company primarily sells to sectors such as construction, non-profit, technology, and legal services. It was founded in 2016 and is based in Bengaluru, India.

Loading...