Paystand

Founded Year

2013Stage

Series D | AliveTotal Raised

$83MValuation

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-51 points in the past 30 days

About Paystand

Paystand specializes in Business-to-business (B2B) payments, leveraging software as a service (SaaS) and blockchain technology within the financial services industry. The company offers a suite of products designed to automate and digitize the entire cash cycle, including accounts receivable and payment processing, while eliminating transaction fees. Its solutions cater to various sectors such as construction, food and beverage, insurance, manufacturing, medical suppliers, and environmental industries. It was founded in 2013 and is based in Scotts Valley, California.

Loading...

Paystand's Product Videos

ESPs containing Paystand

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The accounts receivable (AR) automation market streamlines invoicing and payment collection processes. Vendors provide APIs and software development kits that allow companies to embed accounts receivable functionalities into their enterprise resource planning software, customer relationship management systems, and other digital platforms. The tools allow automated invoicing, payment reminders and…

Paystand named as Outperformer among 15 other companies, including FIS, Sage, and Blackline.

Paystand's Products & Differentiators

B2B Payment Network

Paystand’s B2B Payment Network is a robust payment portal supporting bank transfers, checks, and card payments. Bank-to-bank payments are free, offering fast, secure transfers that cut down processing fees. For businesses handling checks, the check scanning feature digitizes processing, speeding up funds availability. ACH payments streamline recurring transactions and payroll with a secure, cost-effective method. Card payments add flexibility, allowing businesses to accept Visa, Mastercard, and other major cards with security and fraud protection, ensuring fast, reliable transactions.

Loading...

Research containing Paystand

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Paystand in 6 CB Insights research briefs, most recently on Sep 6, 2024.

Aug 23, 2024

The B2B payments tech market map

Dec 14, 2023

Cross-border payments market map

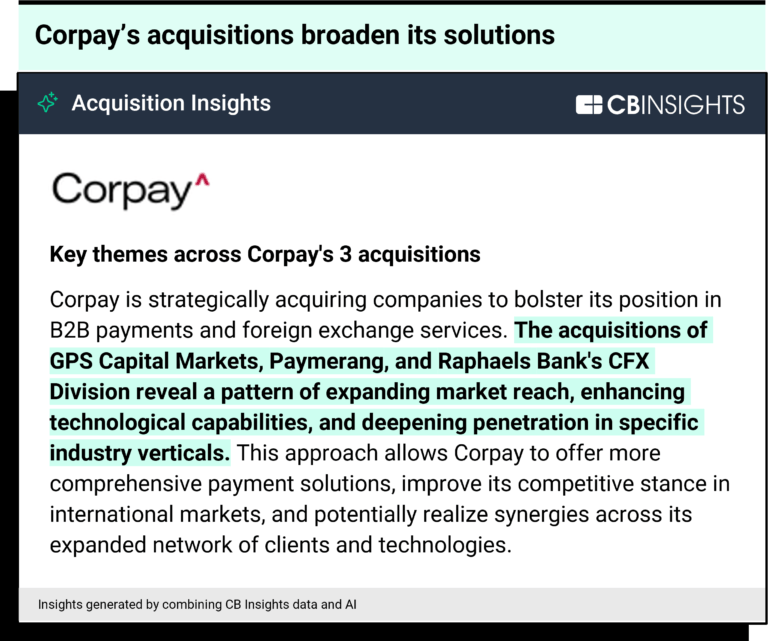

Oct 31, 2022 report

State of Blockchain Q3’22 ReportExpert Collections containing Paystand

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Paystand is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

8,904 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

SMB Fintech

2,003 items

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Paystand Patents

Paystand has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/28/2014 | Payment systems, Payment service providers, Mobile payments, Digital currencies, Online payments | Application |

Application Date | 3/28/2014 |

|---|---|

Grant Date | |

Title | |

Related Topics | Payment systems, Payment service providers, Mobile payments, Digital currencies, Online payments |

Status | Application |

Latest Paystand News

Sep 17, 2024

News provided by Share this article Share toX WALL STREET VETERAN SHÁKA RASHEED JOINS MARCELO CLAURE AND PAUL JUDGE AS PART OF FIRM'S NEXT STAGE OF GROWTH ATLANTA, Sept. 17, 2024 /PRNewswire/ -- Open Opportunity Fund, a venture capital firm focused on investing in software companies founded by diverse entrepreneurs, today announced that Sháka Rasheed, financial services and technology executive, has joined the firm as General Partner, leading capital development and portfolio value creation. Rasheed brings senior leadership experience in building and leading capital formation teams at some of the world's most premier alternative asset management firms including Bridgewater, Lazard, Citadel and J.P. Morgan, as well as scaling growth at global technology companies including Salesforce and Microsoft. Sháka Rasheed, Open Opportunity Fund, General Partner Throughout his career, Sháka has successfully raised billions in capital across various investor segments, including family offices, pension funds, endowments, foundations, sovereign governments, central banks, insurance companies and bank platforms, among others. Rasheed's deep financial services experience has spanned prominent leadership roles at some of the world's most premier asset management firms, including Head of Sales & Marketing at Bridgewater Associates; Managing Director and Head of Alternatives, Americas at Lazard Asset Management; Director, Global Distribution at Citadel Asset Management; and over 15 years at J.P. Morgan Chase, culminating as Managing Director within the Institutional Investment Management Division. His proven ability to drive organizational growth through innovative go-to-market strategies has established him as a visionary leader across financial services and technology. Most recently, Rasheed served as Senior Vice President at Salesforce, where he managed the company's billion-dollar Strategic Banking & Wealth Management business. Prior to Salesforce, Rasheed was Managing Director and General Manager of the U.S. Capital Markets business at Microsoft, where he played a crucial role in scaling it into the fastest growing sub-vertical within the Financial Services division. While at Microsoft, Sháka also served as an Expert Network Member and Advisor for M12 (Microsoft's Corporate venture capital business), where he guided portfolio companies, founders, and senior management teams on their strategic goals and go-to-market approach for market expansion and growth. Shaka is currently an Independent Director on the Board of DigitalBridge Group, Inc. (NYSE: DBRG ), a global firm that owns, operates, and invests in businesses such as data centers, cell towers, fiber networks, small cells, and edge infrastructure, managing more than $80 billion on behalf of its limited partners and shareholders. Rasheed holds a bachelor's degree from Morehouse College and earned an MBA from Harvard University. Opportunity Fund 1 has invested $100 million into 75 Black- and Latino-led tech companies. Its diverse portfolio includes companies such as Atomic, Brex, Career Karma, Cityblock Health, Eight Sleep, Esusu, Lumu, Paystand, QuickNode, Squire, and Subject. The fund has successfully achieved seven exits, demonstrating its commitment to fostering innovation and driving impactful growth in underrepresented communities. As the firm looks to the future, it is now raising Fund 2 to continue executing this strategy. In 2022, Black and Latino founders received less than 3% of venture capital funding, despite comprising over 30% of the United States population. Research has consistently shown that diverse companies yield greater results, producing higher profits and exit multiples. "I am excited to join Open Opportunity Fund, a firm that stands at the forefront of innovation in the venture capital space," said Sháka Rasheed. "With a strong foundation and a clear focus on making impactful investments, the potential to scale the firm into a major player in the industry is immense. I am eager to bring my experience in capital formation and value creation to the team, and to help drive the continued success and growth of our firm." "Sháka's appointment is a key move in our strategy to strengthen our leadership team," said Paul Judge, Managing Partner of Open Opportunity Fund. "His deep expertise in financial services and proven track record in driving growth will be instrumental as we continue to scale our organization and expand our investment capabilities." "We are thrilled to welcome Sháka to our team," said Marcelo Claure, Vice Chairman and General Partner, Open Opportunity Fund. "His capital development expertise, honed at some of the world's most respected alternative asset managers and technology companies, aligns perfectly with our mission. Sháka will be instrumental as we continue to scale the firm." For more information, visit http://TheOpportunityFund.com and follow @OpportunityFund on X and Instagram. For media and interview requests, please contact About Open Opportunity Fund Open Opportunity Fund is a technology venture capital firm focused on investing in software companies founded by outstanding diverse founders. Open Opportunity Fund's portfolio spans enterprise IT, artificial intelligence, fintech, and digital health sectors. Opportunity Fund 1 is a $100 million fund with SoftBank as an anchor LP. The firm has invested in 75 Black- and Latino-led tech companies including Atomic, Brex, Career Karma, Cityblock Health, Eight Sleep, Esusu, Lumu, Paystand, QuickNode, Squire, and Subject. The fund has achieved seven portfolio company exits. In 2023, the team led by Paul Judge and Marcelo Claure acquired the Fund from SoftBank and announced Fund 2 to continue to execute the thesis. SOURCE Open Opportunity Fund

Paystand Frequently Asked Questions (FAQ)

When was Paystand founded?

Paystand was founded in 2013.

Where is Paystand's headquarters?

Paystand's headquarters is located at 1800 Green Hills Road, Scotts Valley.

What is Paystand's latest funding round?

Paystand's latest funding round is Series D.

How much did Paystand raise?

Paystand raised a total of $83M.

Who are the investors of Paystand?

Investors of Paystand include Commerce Ventures, NewView Capital, Industrious Ventures, Streamlined Ventures, King River Capital and 20 more.

Who are Paystand's competitors?

Competitors of Paystand include Stripe, CoreChain, Balance, MerchantE, Chargezoom and 7 more.

What products does Paystand offer?

Paystand's products include B2B Payment Network and 2 more.

Who are Paystand's customers?

Customers of Paystand include Covetous, Motorola Solutions, Thumbtack, Choozle and Allterra Solar.

Loading...

Compare Paystand to Competitors

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Billtrust focuses on automating accounts receivable and order-to-cash processes for businesses. Its main offerings include artificial intelligence (AI)-powered invoicing, payment processing, cash application, and collections, designed to streamline financial operations and enhance cash flow. Billtrust's solutions cater to a variety of industries, providing tailored automation to meet specific sector needs. It was founded in 2001 and is based in Hamilton, New Jersey.

Worldpay provides electronic payment processing services to merchants and financial institutions. It offers merchant acquiring and payment processing services, such as authorization and settlement, customer service, chargeback and retrieval processing, and interchange management for national merchants, and regional and small-to-medium-sized businesses. The company was founded in 1993 and is based in London, United Kingdom.

Melio develops accounts payable solutions. The company offers services that allow businesses to pay their bills, send invoices, and receive payments online, as well as make international payments and automate their bill pay process. Its accountant dashboard enables integrations, team management, easy bill capture, and more. It primarily serves the business-to-business (B2B) payments in logistics, healthcare, construction, non-profit, and retail industries. It was founded in 2018 and is based in New York, New York.

Exact Payments is a company that specializes in payment solutions, operating within the financial technology sector. The company provides a range of services including the integration of payment systems into software platforms, online and mobile payment acceptance, and the setup and management of subscription services. Their primary market is the Software as a Service (SaaS) industry. It was founded in 1999 and is based in Scottsdale, Arizona.

Pagos specializes in optimizing global payments operations within the financial technology sector. The company offers a suite of products that provide holistic analytics, real-time data monitoring, and tools for payments performance optimization. Pagos primarily serves businesses looking to enhance their transaction processing capabilities and reduce costs through data-driven insights. It was founded in 2021 and is based in Hermosa Beach, California.

Loading...