Perfios

Founded Year

2008Stage

Series D - II | AliveTotal Raised

$443.18MValuation

$0000Last Raised

$80M | 6 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-31 points in the past 30 days

About Perfios

Perfios specializes in financial data analysis software and lending solutions within the fintech sector. The company offers a suite of products that facilitate real-time data extraction, risk analytics, and decisioning automation for financial institutions to make informed lending decisions. Perfios' solutions cater to various financial services including consumer lending, small and medium enterprises lending, wealth management, and insurance, by providing tools for bank statement analysis, fraud checks, and credit underwriting automation. It was founded in 2008 and is based in Mumbai, India.

Loading...

Perfios's Product Videos

ESPs containing Perfios

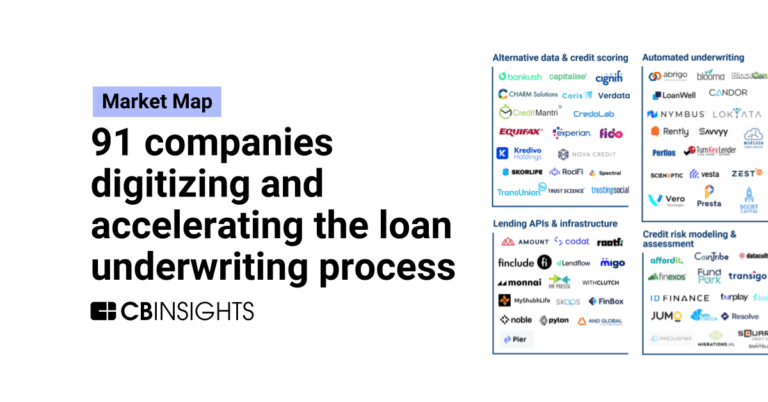

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The loan underwriting market involves the process of evaluating and analyzing a borrower's creditworthiness to determine their eligibility for a loan. Technology vendors in this business-to-business market offer solutions that automate manual processes, reduce fraud rates, and provide data-driven insights for risk mitigation and decision-making. These solutions leverage technologies AI and Machine…

Perfios named as Highflier among 14 other companies, including Blend, Scienaptic, and Tavant.

Perfios's Products & Differentiators

Bank Statement Analyzer (Insights)

Analyze Bank Statements procured in any manner to derive detailed analysis on customer’s assets, liabilities, income & expenditure and check for both transactional and behavioral fraudulences at a 100% accuracy. Covers over 800 financial institutions and over 2000 different formats.

Loading...

Research containing Perfios

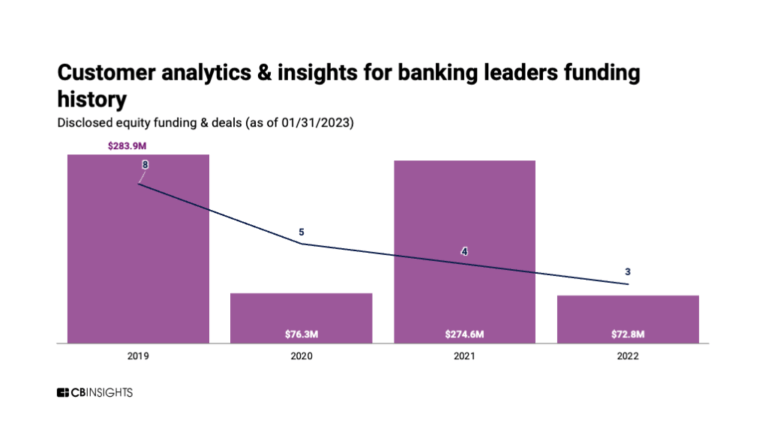

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Perfios in 5 CB Insights research briefs, most recently on Aug 23, 2024.

Oct 18, 2023 report

State of Fintech Q3’23 ReportExpert Collections containing Perfios

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

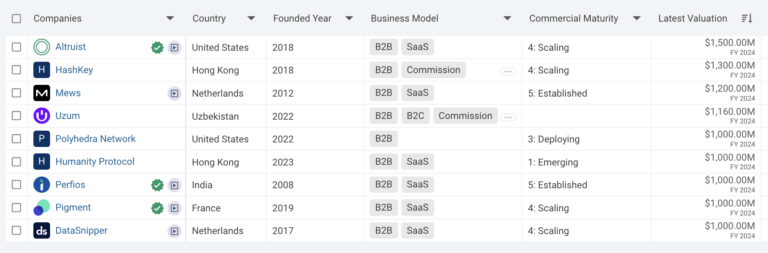

Perfios is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Wealth Tech

2,294 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,468 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,396 items

Excludes US-based companies

Latest Perfios News

Sep 18, 2024

Perfios Success Story In a world where the internet connects people, places, and devices, data is the pulse of modern life. In this age of automation, where speed and accuracy are paramount, the ability to handle massive data flows efficiently is no longer a luxury—it’s a necessity. The demand for real-time analysis, risk management, and pricing solutions has skyrocketed, pushing tech companies to develop smarter, more agile platforms. That’s where Perfios comes into play, offering a suite of solutions simplifying this complexity for global financial institutions. With fresh investment, Perfios has become the second unicorn of 2024, crossing the $1 billion valuation mark. Perfios - Company Highlights Perfios - About Founded in 2008, Perfios is a platform that excels in extracting, categorizing, and analyzing thousands of data types in real time. This platform is built to adapt, learn, and grow the businesses they support. Whether it's decoding encrypted traffic or handling data from various entities across geographies, Perfios brings clarity to complexity. Perfios is proud to say that they’ve been a trusted partner to over a million users, offering them secure, agile, and scalable solutions that transform their digital journeys. A track record of zero security incidents speaks volumes about Perfios’ commitment to privacy and data security. Perfios - Industry The fintech industry is booming, and India is leading the charge as one of the fastest-growing markets globally. Valued at $584 billion in 2022, the Indian fintech market is expected to soar to $1.5 trillion by 2025. Within that, the digital lending sector alone was worth $270 billion in 2022 and is projected to hit INR 4.5-5 trillion by 2028. Meanwhile, the SaaS market has seen explosive growth over the past decade, with no signs of slowing down. Globally, it’s expected to reach $307.3 billion by 2026 and an astounding $908.21 billion by 2030. The surge is fueled by the need for remote work solutions, the rise of cloud-based technologies , and the demand for scalable, cost-efficient software. What's more, SaaS has now evolved to offer a strong line of defense against security threats like data breaches, thanks to its enterprise-level security measures and built-in disaster recovery protocols. Coming a long way since their early days in the financial sector, Perfios now proudly serves over 1000 lenders in India—including all of the top 10 banks, along with a majority of NBFCs and Fintechs. Their success in India has set the stage for global expansion, where their customizable ML algorithms seamlessly adapt to any country's statement formats, making data decisions a breeze. They’ve tailored their processes to fit the specific needs of each region and client, ensuring accuracy and efficiency. As India’s digital landscape continues to boom, with projections of the digital signature market growing at an impressive CAGR of 27.5% by 2026, they’re excited about the future and ready to ride this wave of growth. Perfios - Founders and Team Sabyasachi Goswami - Founder and CEO of Perfios A seasoned strategist with over 20 years of experience in financial services, fintech, and product technology, Mr. Sabyasachi Goswami brings a wealth of expertise in P&L management, business development, strategic account management, business strategy, marketing, and product development. Beginning his academic journey from Symbiosis Institute of Management Studies in Pune, Mr. Goswami, later completed the LEAD program at Stanford Graduate School of Business. Throughout his career, Sabyasachi has held senior roles across Retail and SME Banking, including leading strategic functions for a major multinational bank. He has been instrumental in business acquisitions and managing two significant private equity investments. His strengths lie in enterprise sales, consultative selling, and building strong relationships with key decision-makers. Sabyasachi is highly skilled at managing large-scale business operations, formulating and executing business strategies, identifying new markets, expanding distribution channels, and optimizing sales and profitability. His proven ability to break into new avenues, drive revenue growth, and stay ahead of market trends has consistently helped achieve market share targets. He has a strong track record of launching new products, assessing risk, and implementing marketing activities to ensure success. Passionate about leadership development, Sabyasachi focuses on nurturing future leaders, fostering an entrepreneurial mindset in teams, and driving positive impact across the value chain. His communication, collaboration, and team-building skills have earned him numerous awards for outstanding performance. V.R. Govindarajan (GOVI) is the co-founder and Executive Chairman of Perfios. V.R. Govindarajan - Co-founder and Executive Chairman of Perfios Govi, Perfios’ co-founder and Executive Chairman, is the driving force behind the vision of making them the most trusted name in personal finance software in India. With over 32 years of experience in the IT industry across the US and India, he’s no stranger to innovation. Before Perfios, Govi co-founded Aztecsoft, a pioneer in Offshore Product Development, and has had stints at tech giants like Digital Equipment Corporation (DEC) and IBM , specializing in database technology. Armed with an M.S. in Computer Science from Massachusetts University and a B.E. in Electrical and Electronics from IISc Bangalore, Govi stays actively involved in the tech community, frequently speaking at both Indian and international conferences. Rajesh Kini is the Chief Financial Officer (CFO) of Perfios. Rajesh Kini - CFO of Perfios Perfios has appointed Rajesh Kini as its new Chief Financial Officer! He served as CFO of Infosys' product subsidiary and led their Corporate Accounting Group. With over 25 years of financial leadership experience, Rajesh is well-equipped to align with Perfios' vision of sustainable growth. He has a strong track record in optimizing financial performance, improving margins, and enhancing operational efficiency. A Chartered Accountant, Rajesh holds a bachelor's degree in commerce from St. Joseph College of Commerce, Bangalore. His expertise will be key in guiding Perfios through its global expansion. Perfios - Startup Story Before co-founding Perfios, Mr. Govindarajan had already achieved entrepreneurial success as the co-founder and CTO of Aztecsoft, a trailblazer in Offshore Product Development. Aztecsoft eventually became a public company and was later acquired by Mindtree in 2008. After his exit from Mindtree, he began exploring the idea of developing a platform that could offer users a comprehensive view of their finances. This led to the creation of Perfios in 2008, initially launched as a Personal Finance Management (PFM) app. Over time, Perfios transitioned into a B2B analytics platform, empowering lenders to automate credit decisions and revolutionizing financial data management. Mr. Sabyasachi Goswami joined Perfios Software Solutions in 2016 as one of its early team members, playing a key role in shaping the company from a pioneering startup into a major player in the BFSI (Banking, Financial Services, and Insurance) sector. His extensive background in financial services, beginning with his early career at Citi as a Territory Sales Manager, equipped him with the skills to drive sales, business development, and growth strategies. With a clear vision and deep domain expertise, he quickly introduced innovative solutions that helped establish Perfios as a trusted partner for financial institutions. Throughout his time at Perfios, Sabyasachi’s leadership was marked by his strong emphasis on customer-centricity. He recognized early on that the key to succeeding in the competitive BFSI space was to place customers at the core of everything Perfios did. This customer-first approach helped build long-lasting relationships with banks and financial institutions, which in turn fueled the company's rapid growth. In August 2022, Sabyasachi’s promotion to CEO was a natural next step, given his substantial contributions to Perfios' success. As CEO, he maintained a balanced approach, focusing on both innovation and profitability. His leadership prioritized sustainable growth, ensuring that the company's financial health remained strong while expanding its reach. Under his direction, Perfios grew its global presence, expanding to 18 countries across Southeast Asia, the Middle East, and Africa, and began exploring opportunities in the U.S. market. A strong advocate for collaboration, Sabyasachi fostered a culture of teamwork at Perfios, where employees were encouraged to share ideas and work together to overcome challenges. This collaborative environment not only drove innovation but also helped create a cohesive team aligned with the company’s vision. Looking ahead, Sabyasachi remains focused on guiding Perfios through its next phase of expansion. His leadership philosophy—centered on customer satisfaction, sustainable growth, and continuous innovation—continues to shape the company’s success as it solidifies its position as a global leader in the SaaS-based BFSI sector. Perfios - Mission and Vision At Perfios Software Solutions, their mission is to create an ecosystem where every financial decision is powered by real-time data. They are dedicated to building an exceptional suite of products tailored to their expertise and geographic focus. From improving security and legal compliance to reducing errors and promoting sustainability, they ensure seamless integration of financial services into their customers' everyday lives. Perfios is not just reshaping how money is managed; they’re simplifying it—making transactions easier, more secure, and incredibly convenient. Understanding and meeting customer preferences is at the heart of everything Perfios does, helping them thrive in the highly competitive financial landscape. Perfios - Name, Tagline and Logo Perfios Tagline - Lead/Leap Perfios' logo, under the “Lead/Leap” positioning, symbolizes its evolution into a global tech platform, supporting the entire customer lifecycle from onboarding to underwriting. The flame arrow reflects progress, innovation, and focused energy, highlighting Perfios' mission to drive financial inclusion for billions. This identity underscores their commitment to building institutions and spreading expertise and impact. Perfios - Business Model Perfios kicked off its journey by launching the first cloud-hosted, fully automated Personal Finance Management solutions. They then went on to build the Perfios data platform, which remains unmatched in its scope and capability. Additionally, their platform leverages cutting-edge machine learning techniques to provide deep data analysis tailored to each customer’s needs, delivering reports that are uniquely customized. Privacy and security are core to their design philosophy; where they ensure that no Personally Identifiable Information or account details are stored, keeping their customers' data safe and secure. Perfios' lead generation taps into data from around 4 crore MCA and non-MCA registered entities, allowing for large-scale lead generation and effective lead qualification for B2B businesses . How? Relying only on inbound leads and existing connections can slow down how well your new products catch on in the market. Whereas, outbound lead generation means reaching out to potential customers who may not know about your product yet. It involves making calls or sending messages to spark interest and build a strong sales pipeline. Here, you might end up pitching to people who aren't that interested, no matter how long you spend on it. That's where focused outbound lead generation with Perfios comes in handy. It’s a great way to get higher conversions faster. Perfios - Revenue Model Consumer Lending Solutions: Customizable, plug-and-play solutions for income and employment verification. Automates credit assessment and decision-making for financial institutions and lenders. SME Lending: Tools to evaluate the financial health of SMEs and corporates seeking credit. Assesses creditworthiness, and payment capacity and identifies potential lending risks. Wealth Management: A leading personal finance management app that consolidates financial information into a single dashboard. Enables financial institutions to offer targeted advice and cross/upsell products, and helps customers achieve their financial goals. Account Aggregator: Solutions that aggregate and analyze both structured and unstructured data, providing deep analytics and insights. Specified Solutions: Specialized tools for digital transformation in lending processes. Includes InDigize, an intelligent solution that speeds up the processing of unstructured data and eliminates slow, error-prone manual tasks. Additionally, Perfios generates revenue through multiple streams, including software coding and maintenance services, as well as license and subscription fees. Perfios Financials Profit of INR 7.8 crore Perfios Financials 2023 Perfios' operating revenue grew by 199% from INR 136 crore in FY22 to INR 407 crore in FY23. Total expenses increased by 147%, rising from INR 156 crore to INR 386 crore. The company moved from a loss of INR 16.8 crore in FY22 to a profit of INR 7.8 crore in FY23, marking a significant financial turnaround. Perfios - Challenges Faced At Perfios, a few big challenges have to be dealt with as they work to stay ahead in the financial tech game. One of their main hurdles is figuring out whether to team up with just one lender or go for multiple partnerships. Sticking with a single lender might limit their growth because it narrows their potential borrower pool. But if they partner with several lenders, they get more chances for business, although it comes with its own set of problems. The integration process with multiple lenders can be tricky. They tackle tech issues like security, data management, and making sure their systems work well together. Ensuring data safety is a big deal, so they have to use strong encryption and set up solid network security. Plus, the whole integration process takes a lot of time and requires them to handle regulatory requirements and manage resources carefully. Perfios - Funding and Investors Perfios Software Solutions has raised a total of $441.2 million in funding over 7 rounds. Their latest funding was raised on Mar 13, 2024, from a Series D round. Perfios has caught the attention of five key investors: Warburg Pincus is Perfios' largest shareholder with a 41% stake, while Bessemer holds 32.1%, showing strong investor confidence. Teachers’ Venture Growth (Darius Vakil, Deepak Dara, and Kelvin Yu) and Kedaara Capital are the latest to back them. Their latest funding boost of $229 million came from a Series D round in March 2024, which is keeping them well-equipped to keep growing! Announced Date Perfios - Mergers and Acquisitions Perfios acquired Chennai-based Fego.ai, bringing in their 30-member team. Co-founders S. Kumar Srivatsan and S. Kumar Srikanthan joined Perfios to lead product and strategy, respectively. They also snapped up Karza Technologies , a banking and financial intelligence solution provider. Perfios - Growth Perfios is on a serious growth journey! Today, Perfios has grown to become the largest SaaS-based B2B fintech software company in India, serving over 800 financial institutions with a product suite of more than 75 solutions across 18 countries, including Southeast Asia, the Middle East, APAC, and MENA regions. In FY22, the company reported $17.5 million in revenue and has maintained profitability for the past five years. According to Goswami, Perfios is actively exploring inorganic growth opportunities to expand into new verticals and geographies and is open to raising future VC funding to support acquisitions. To date, it has secured $452 million in funding from top investors like Warburg Pincus and Bessemer Venture Partners. With plans to supercharge their tech stack, they’re ready to transform the entire customer experience across banking, insurance, and embedded commerce. Backed by TVG’s investment, Perfios is gearing up for even bigger things ahead, taking their international growth to the next level. Powers 90% of India’s financial institutions, handling 8.2 billion data points and 1.7 billion transactions yearly. Strong data capabilities helped major Indian banks offer same-day loans and instant approvals. Expanding into insurance (fraud detection) and HR tech (background verification) sectors with AI-powered solutions. Perfios ranks 3rd among its 300 competitors. Perfios - Future Plans Perfios is constantly upgrading its smart Document Processing platform with fresh machine learning models to handle all kinds of financial documents and spot fraud. As a B2B SaaS company in the BFSI sector, their cutting-edge decision-making solutions help make real-time decisions for everything from small transactions to major financial moves. They’ve been growing steadily and plan to use this investment to boost digital transformation for their partners. Focused on financial inclusion, Perfios aims to provide access to financial services for billions globally. Perfios processes 1.7 billion transactions annually and handles $36 billion in assets under management, delivering 8.2 billion data points to banks and financial institutions every year! FAQs What is Perfios? Perfios is a platform that excels in extracting, categorizing, and analyzing thousands of data types in real-time. This platform is built to adapt, learn, and grow the businesses they support. Who is the founder of Perfios? Perfios was founded by Sabyasachi Goswami and V.R. Govindarajan in 2008. Is Perfios a Unicorn company? Yes, Perfios is the second unicorn of 2024 with a $1 billion valuation. Must have tools for startups - Recommended by StartupTalky Convert Visitors into Leads- SeizeLead

Perfios Frequently Asked Questions (FAQ)

When was Perfios founded?

Perfios was founded in 2008.

Where is Perfios's headquarters?

Perfios's headquarters is located at 111, Chandivali Road, Mumbai.

What is Perfios's latest funding round?

Perfios's latest funding round is Series D - II.

How much did Perfios raise?

Perfios raised a total of $443.18M.

Who are the investors of Perfios?

Investors of Perfios include Teachers' Venture Growth, Kedaara Capital, Stride Ventures, Visa Accelerator Program, Bessemer Venture Partners and 7 more.

Who are Perfios's competitors?

Competitors of Perfios include Scienaptic, Fego, Bureau, Ocrolus, FinBox and 7 more.

What products does Perfios offer?

Perfios's products include Bank Statement Analyzer (Insights) and 4 more.

Who are Perfios's customers?

Customers of Perfios include HDFC Bank Ltd, ICICI Bank Ltd, Zest Money, PNB Housing and Canara Bank.

Loading...

Compare Perfios to Competitors

MX offers a range of data-driven financial solutions. The company offers services such as secure verification and enhancement of financial data, account aggregation, balance checks, customer analytics, and mobile banking. It primarily serves financial institutions and fintech companies. It was formerly known as MoneyDesktop. It was founded in 2010 and is based in Lehi, Utah.

MoneyThumb specializes in financial document conversion and analysis for the lending and accounting sectors. The company offers solutions that convert PDF bank statements into actionable financial data and assess creditworthiness using advanced analysis tools. MoneyThumb's products are designed to facilitate fraud detection, integrate with accounting systems, and support personal finance management by converting financial transaction data into various formats. It was founded in 2014 and is based in Encinitas, California.

Able specializes in AI-driven document management and process automation for the commercial lending sector. The company offers a platform that automates the collection and organization of borrower information, creates instant document checklists, and provides a collaborative workspace for all parties involved in a loan transaction. Able primarily serves the financial services industry, enhancing the efficiency of loan processing and document management. It was founded in 2020 and is based in San Francisco, California.

Salt Edge is a company that specializes in open banking and operates within the financial technology sector. The company offers a range of services including access to global banks through a unified API, payment initiation, data enrichment, and PSD2 compliance solutions. These services primarily cater to businesses in the financial industry, such as banks, lending companies, and fintechs. It was founded in 2013 and is based in Toronto, Ontario.

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Akoya operates as a financial data management platform. It offers financial planning and budgeting tools, investment management, payment enablement, account opening, lending, credit enhancement, and more. It was founded in 2018 and is based in Boston, Massachusetts.

Loading...