Plug and Play Ventures

Investments

2153Portfolio Exits

228Funds

4Partners & Customers

10About Plug and Play Ventures

Plug and Play Ventures is a global technology accelerator and venture fund. Plug and Play Ventures participates in Seed, Angel and Series A funding where they often co-invest with strategic partners. Through years of experience and as part of its network, the firm has put together a world-class group of serial entrepreneurs, strategic investors, and industry leaders who actively assist the firm with successful and growing investment portfolio.

Expert Collections containing Plug and Play Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Plug and Play Ventures in 2 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Research containing Plug and Play Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

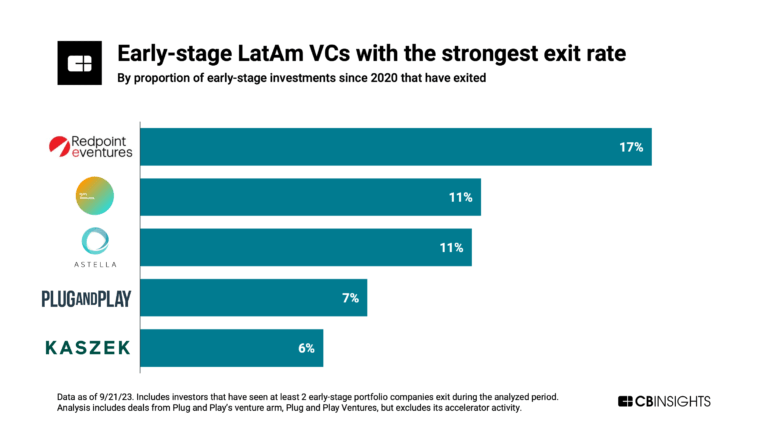

CB Insights Intelligence Analysts have mentioned Plug and Play Ventures in 4 CB Insights research briefs, most recently on Feb 1, 2024.

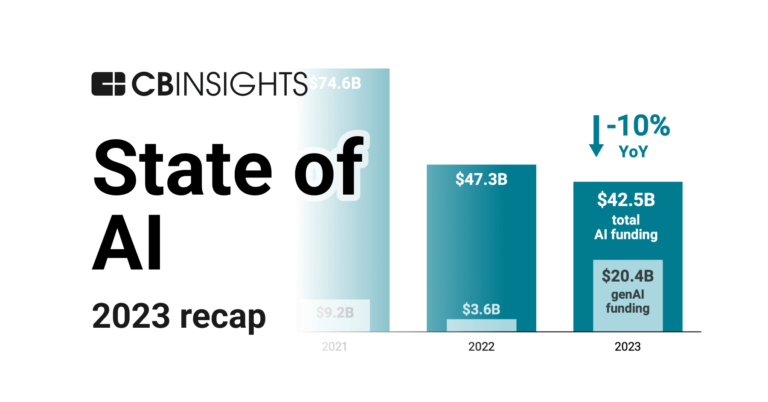

Feb 1, 2024 report

State of AI 2023 Report

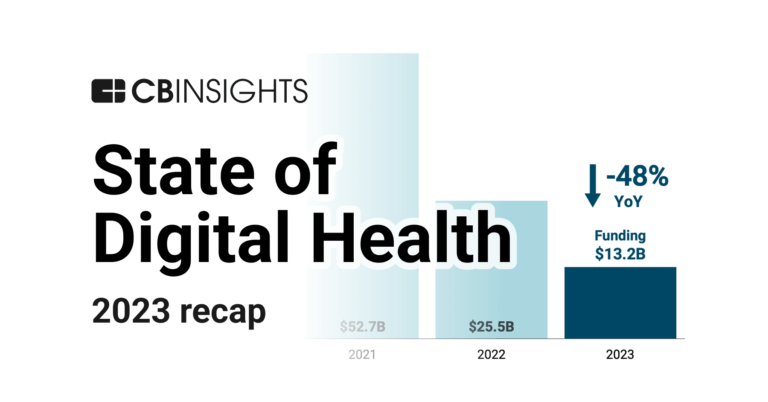

Jan 25, 2024 report

State of Digital Health 2023 Report

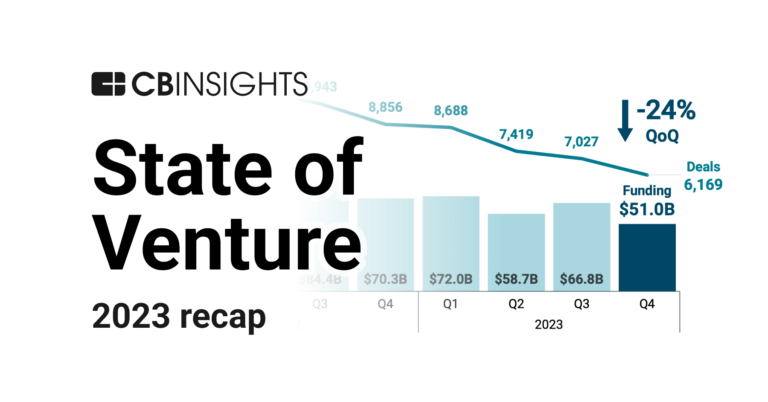

Jan 4, 2024 report

State of Venture 2023 ReportLatest Plug and Play Ventures News

Aug 28, 2024

Fleet, a modern commuter benefits management platform, announced the closing of its $2.5 million seed round led by Congruent Ventures with the participation of Great Oaks Venture Capital, Plug and Play Ventures, Rally Cap, and Virta Ventures. And Fleet also brought on a talented group of angels and advisors, including former execs at Robinhood and Brex, such as ex-COO Michael Tannenbaum. The seed funding round brings Fleet’s total venture capital to $5 million. And the seed funding round will support Fleet’s exclusive focus on enhancing and deploying its signature commuter benefits management platform, a low-cost, scalable solution for employers to attract and retain talent, comply with commute mandates, and promote sustainable transportation. The rise of hybrid schedules and return-to-office (RTO) programs brought new complexities and employee expectations to commuting. And employers are also scrambling to find solutions to comply with new mandates, requiring companies of a certain size to offer pre-tax commuter benefits programs to employees. These mandates, combined with less predictable work schedules, have made it a challenge for HR managers to implement and manage tax-advantaged commuter benefits programs using legacy solutions and for employees to take full advantage of the benefits available. Plus, commuter benefits are integral to talent attraction and employee retention, as they help employers stand out by offering comprehensive benefits packages that include health, dental, vision, and commuter benefits. Fleet’s platform makes it easier for employers to deploy, scale, and manage a commuter benefits program across an entire enterprise, seamlessly integrating into HR, accounting, and finance systems. And employees are able to view and manage their benefits without additional back-office overhead, cumbersome reimbursement, or accounts payable processes. They can also easily take advantage of incentives offered by their employers and make commutes less carbon-intensive and more rewarding. Fleet’s solutions see a 3x faster adoption rate from employees, with a 70% reduction in customer support inquiries and 50% cost savings compared to legacy systems. KEY QUOTES: “When implemented the right way, commuter benefits programs reduce costs while supporting public transportation and its many positive social impacts. Benefits administration services that are complicated for employers to adopt and frustrating for employees to navigate have prevented these programs from reaching their full potential for too long. We’ve shown that the Fleet platform can change that, and with support from our seed investors, we’re ready to bring better commuter benefits management and great results to locations around the U.S. As we do, we’ll save companies and their employees money while reducing GHG emissions from transportation–the biggest contributor to climate change in the country today–and boost corporate sustainability.” Shaurya Saluja, Co-Founder & CEO of Fleet “As commuters have returned to the office and cities across the country are mandating employers offer employees pre-tax deductions for commuting spend, there is an enormous need for Fleet, an easy-to-use platform with advanced reporting and analytics that makes it easier for both employers and employees to take advantage of low carbon commuter benefits. The value proposition resonated with us so clearly that not only did we invest, we are also a Fleet user!” Jackie Kossmann, Partner at Congruent Ventures Pulse 2.0 focuses on business news, profiles, and deal flow coverage.

Plug and Play Ventures Investments

2,153 Investments

Plug and Play Ventures has made 2,153 investments. Their latest investment was in Userguest as part of their Seed VC on September 12, 2024.

Plug and Play Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/12/2024 | Seed VC | Userguest | $2.42M | Yes | 1 | |

9/3/2024 | Seed VC | Involve | $2.76M | Yes | 2 | |

9/2/2024 | Series A | Foundersuite | $13M | Yes | 1 | |

8/27/2024 | Seed VC | |||||

8/19/2024 | Seed VC - II |

Date | 9/12/2024 | 9/3/2024 | 9/2/2024 | 8/27/2024 | 8/19/2024 |

|---|---|---|---|---|---|

Round | Seed VC | Seed VC | Series A | Seed VC | Seed VC - II |

Company | Userguest | Involve | Foundersuite | ||

Amount | $2.42M | $2.76M | $13M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | |||||

Sources | 1 | 2 | 1 |

Plug and Play Ventures Portfolio Exits

228 Portfolio Exits

Plug and Play Ventures has 228 portfolio exits. Their latest portfolio exit was SwipeGuide on September 04, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/4/2024 | Acquired | 4 | |||

8/29/2024 | Acquired | 2 | |||

8/28/2024 | Corporate Majority | 3 | |||

Date | 9/4/2024 | 8/29/2024 | 8/28/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Corporate Majority | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 4 | 2 | 3 |

Plug and Play Ventures Fund History

4 Fund Histories

Plug and Play Ventures has 4 funds, including Plug and Play Supply Chain Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/19/2022 | Plug and Play Supply Chain Fund I | $25.5M | 1 | ||

Plug & Play Umbrella Fund | |||||

Plug & Play Future Commerce Fund I | |||||

Plug & Play Growth Fund |

Closing Date | 4/19/2022 | |||

|---|---|---|---|---|

Fund | Plug and Play Supply Chain Fund I | Plug & Play Umbrella Fund | Plug & Play Future Commerce Fund I | Plug & Play Growth Fund |

Fund Type | ||||

Status | ||||

Amount | $25.5M | |||

Sources | 1 |

Plug and Play Ventures Partners & Customers

10 Partners and customers

Plug and Play Ventures has 10 strategic partners and customers. Plug and Play Ventures recently partnered with The Rawlings Group on June 6, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

6/17/2024 | Partner | United States | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | 1 | |

6/1/2023 | Partner | Netherlands | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | 1 | |

11/15/2022 | Partner | United States, Netherlands, and Gibraltar | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | 1 | |

8/23/2022 | Partner | ||||

6/15/2022 | Partner |

Date | 6/17/2024 | 6/1/2023 | 11/15/2022 | 8/23/2022 | 6/15/2022 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | Netherlands | United States, Netherlands, and Gibraltar | ||

News Snippet | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | ||

Sources | 1 | 1 | 1 |

Plug and Play Ventures Team

1 Team Member

Plug and Play Ventures has 1 team member, including former President, Alex Popa.

Name | Work History | Title | Status |

|---|---|---|---|

Alex Popa | President | Former |

Name | Alex Popa |

|---|---|

Work History | |

Title | President |

Status | Former |

Compare Plug and Play Ventures to Competitors

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, internet of things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

SOSV operates as a venture capital firm with a focus on deep technology aimed at improving human and planetary health. The company provides multi-stage investments and operates startup development programs, such as HAX and IndieBio, to accelerate product development and scale innovative technologies. SOSV's programs support startups in sectors like hard tech and life sciences, offering expertise, lab facilities, and supply chain access. It was founded in 1995 and is based in Princeton, New Jersey.

Runway is a technology hub bringing together entrepreneurs, startups, VCs, mentors, Fortune 500 corporations, and industry experts. It provides coworking space to entrepreneurs, accelerator programs for high-growth startups, corporate services to global companies, and event programming.

Sequoia Capital serves as a venture capital firm that focuses on supporting startups from inception to IPO within various sectors. It provides investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Greycroft is a venture capital firm focused on investments in internet and mobile markets. The firm leverages a network of media and technology industry connections to help entrepreneurs gain visibility, build strategic relationships, bring their products to market, and build successful businesses. It was formerly known as Greycroft Partners. It was founded in 2006 and is based in New York, New York.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Loading...