Prove Identity

Founded Year

2008Stage

Series I | AliveTotal Raised

$261.3MValuation

$0000Last Raised

$40M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+50 points in the past 30 days

About Prove Identity

Prove Identity operates as a digital identity authentication platform. It offers phone-centric solutions to enable businesses to verify customers while thwarting fraud and cyberattacks. Prove Identity was formerly known as Payfone. The company was founded in 2008 and is based in New York, New York.

Loading...

Prove Identity's Product Videos

ESPs containing Prove Identity

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The identity verification market focuses on providing technologies and processes to verify the identities of individuals in both online and offline interactions, as well as prevent identity fraud. These solutions cater to a wide variety of industries and include new account and also synthetic fraud prevention, which involve bad actors stealing all or part of a person’s information to open new acco…

Prove Identity named as Highflier among 15 other companies, including SAP, Onfido, and Ping Identity.

Prove Identity's Products & Differentiators

Prove Pre-Fill

Powered by Pinnacle™, Prove Pre-Fill® easily and securely expedites the digital onboarding process and improving consumer experience and reducing friction by pre-populating forms with verified identity information tied to authenticated identities. Consumers provide consent for Pre-Fill seamlessly to return verified name, address and other fields to pre-populate forms and ONLY the specified consumer will be able to autofill their info. For companies, Pre-Fill increases consumer acquisition, improves user experience, lowers costs, and mitigates fraud and the need for manual intervention/reviews.

Loading...

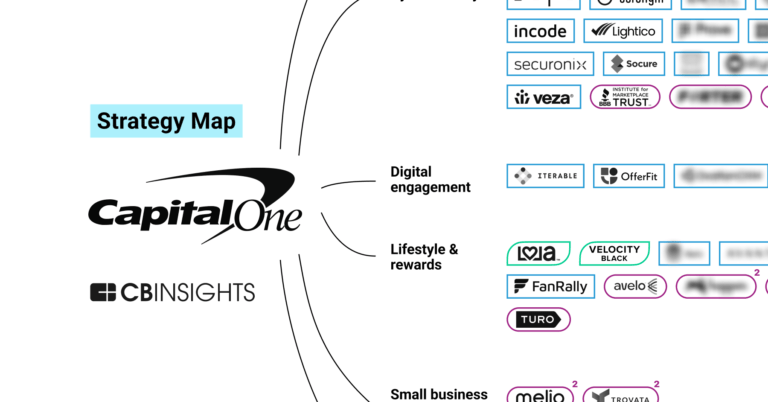

Research containing Prove Identity

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Prove Identity in 7 CB Insights research briefs, most recently on Mar 18, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Prove Identity

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Prove Identity is included in 11 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,240 items

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

SMB Fintech

2,003 items

Conference Exhibitors

5,501 items

HLTH is a healthcare event bringing together startups and large companies from pharma, health insurance, business intelligence, and more to discuss the shifting landscape of healthcare

Payments

2,971 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Cybersecurity

8,848 items

These companies protect organizations from digital threats.

Prove Identity Patents

Prove Identity has filed 31 patents.

The 3 most popular patent topics include:

- wireless networking

- computer network security

- payment systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/29/2021 | 6/11/2024 | Payment systems, Banking technology, Payment service providers, Mobile payments, Credit cards | Grant |

Application Date | 12/29/2021 |

|---|---|

Grant Date | 6/11/2024 |

Title | |

Related Topics | Payment systems, Banking technology, Payment service providers, Mobile payments, Credit cards |

Status | Grant |

Latest Prove Identity News

May 15, 2024

By PYMNTS | May 15, 2024 | As the company that laid claim to the concept of “digital identity” more than 10 years ago, Prove Identity takes verification seriously, even when it’s not. Case in point: As CEO Rodger Desai told Karen Webster in an interview, at Prove, there’s a running joke inside the firm in which he keeps score on how many times a would-be scammer (Desai) has texted employees that he’s in a jam and they need to purchase gift cards for him. It’s a joke with a serious side, of course, because criminals are stepping up their brazen attempts to pose as corporate executives, owners, vendors and even employees. For businesses across all types of verticals, the problem is ever-present and boils down to the urgent challenge of trusting interactions in the digital economy, especially when you’re not directly in front of someone. Even Desai, who helms the identity verification and authentication platform, has been targeted by bad actors who have taken artificial intelligence and twisted it in the service of identity fraud. “Someone sent me a website where I put in a two-second clip of my voice … and it had me singing songs,” Desai said. “The technology’s becoming democratized quickly, and it’s pretty cheap.” Deepfakes represent a growing threat to businesses, he said, adding the phone needs to be the foundation of identity verification because it is often the device used to commit fraud. A spike in business identity fraud demands a new approach to authenticating the person sending invoices, phoning in and even texting. “The digital front doors of most businesses are not very secure,” he said. What Change Has Wrought The lack of security has pushed business fraud to a level so lucrative that sending out false invoices brings in billions of dollars a year in Europe — proving to be a more lucrative trade than drugs and money laundering with higher margins to boot. Imposter scams remained the top fraud category in 2023, with reported losses in the United States of $2.7 billion, according to the Federal Trade Commission . “These scams include people pretending to be your bank’s fraud department, the government, a relative in distress, a well-known business or a technical support expert,” the FTC said. Major breaches such as a hack into Change Healthcare have provided huge swathes of transactional data. This then becomes fodder for fraudsters looking for “replayable” relationships that can give them grist for business impersonation schemes, fake invoices and even employee details to appropriate to create synthetic identities, Desai said. Part of the reason those scams have been so lucrative and successful, said Desai, lies with the fact that business transactions tend to be highly “repeatable” interactions. An unwitting employee at a firm that does business with, say, ABC Carpet several times a month, may not have their suspicions roused when yet another invoice comes in (but with bank details subtly changed) or they’re prompted by a phone message to send payment for a bit of fictitious business. Before the ruse is detected, the scammers have had several payments redirected to their own accounts, and then disappear into the ether. Signature Solutions Desai said the solution, no matter if the contact with a company comes through a tweet, bot or invoice, is that “these things have to be signed — because by signing it, you can authenticate the vendor or counterparty and make sure it’s someone you trust.” Automated authentication eliminates the time spent — upon getting an email from someone claiming to be your boss, for instance — calling the counterparty and finding out if the contact was indeed legitimate, he said. To be specific, the signatures are cryptographic ones tied to mobile devices, he said. Across platforms, such as what is on offer via Prove, which through its Identity Manager has a real-time registry of phone identity tokens tied to phone numbers, the onboarding process is similar to what would be seen across vendor management systems. Using the ABC Carpet example again, the carpet firm representative, and invoices sent, can be identified via the phone that was enrolled at the start of the relationship, Desai said. As he told Webster, just as financial institutions onboard individuals who open bank accounts and make sure that one-time passwords can authenticate them, “vendor relationships have to be onboarded in the same fashion. There has to be something that you can reach out and ‘touch’ … that subsequently, you can ‘redo’ for authentication … so you have a lineage of trust.” As he noted, “if you can enroll all of the phone numbers — and the phones — of the people you trust to interact with, you can authenticate them” automatically every time. That level of automation builds a strong digital front door that Desai said “keeps the bad folks out while the good folks have an easy way to get in.” Recommended

Prove Identity Frequently Asked Questions (FAQ)

When was Prove Identity founded?

Prove Identity was founded in 2008.

Where is Prove Identity's headquarters?

Prove Identity's headquarters is located at 245 Fifth Avenue, New York.

What is Prove Identity's latest funding round?

Prove Identity's latest funding round is Series I.

How much did Prove Identity raise?

Prove Identity raised a total of $261.3M.

Who are the investors of Prove Identity?

Investors of Prove Identity include MassMutual Ventures, Capital One Ventures, Stack Capital, Plug and Play Fintech Accelerator, Opus Capital and 25 more.

Who are Prove Identity's competitors?

Competitors of Prove Identity include Fourthline, ThetaRay, Socure, Veriff, Persona and 7 more.

What products does Prove Identity offer?

Prove Identity's products include Prove Pre-Fill and 3 more.

Who are Prove Identity's customers?

Customers of Prove Identity include Synchrony, Tabula Rasa, Binance, Varo and Bilt Rewards.

Loading...

Compare Prove Identity to Competitors

Socure focuses on digital identity verification and fraud prediction, operating within the technology and financial services sectors. The company offers a platform that uses artificial intelligence (AI) and machine learning (ML) to verify identities in real-time, analyzing various elements such as email, phone, address, and device risk. This service is primarily used by industries such as financial services, government, gaming, healthcare, telecom, and e-commerce. It was founded in 2012 and is based in Incline Village, Nevada.

Veriff develops an artificial intelligence (AI) driven visionary verification platform. It provides AI-powered identity verification solutions for identity fraud prevention, know-your-customer compliance, and fast conversions of valuable customers. It was founded in 2015 and is based in Tallinn, Estonia.

Sumsub is a company that focuses on online identity verification and orchestration services, operating in the technology and security sectors. The company offers a platform that allows businesses to verify users, businesses, and transactions, manage cases, and deter fraud, all from a single dashboard. Sumsub primarily serves sectors such as fintech, online gaming, and trading. It was founded in 2015 and is based in London, England.

Trulioo focuses on global online identity verification, operating within the technology and security sectors. The company offers services such as individual and business identity verification, watchlist screening, and identity document verification, all aimed at ensuring know-your-customer (KYC) and know-your-business (KYB) compliance. Trulioo primarily serves sectors such as banking, cryptocurrency, online trading, and wealth management. It was founded in 2011 and is based in Vancouver, British Columbia.

Persona specializes in identity management solutions. It focuses on the automation of Know Your Customer (KYC) and Know Your Business (KYB) programs and fraud prevention. It offers services that automate identity-related use cases, including the secure collection and verification of personal information, government identity documents (IDs), and user selfies, as well as providing tools for case review and orchestration to streamline identity operations. It serves businesses that need to comply with strict identity verification regulations, such as those in the online education and financial sectors. It was founded in 2018 and is based in San Francisco, California.

Mitek Systems is a company that specializes in mobile capture and digital identity verification solutions, operating within the technology and financial sectors. The company offers services such as identity verification during digital transactions, which helps businesses mitigate financial risk and meet regulatory requirements, as well as mobile check deposit and automation of the onboarding process. Mitek primarily sells to financial institutions, payments companies, and other businesses operating in highly regulated markets. Mitek Systems was formerly known as Mitek Systems of Delaware, Inc.. It was founded in 1986 and is based in San Diego, California.

Loading...