Pulley

Founded Year

2019Stage

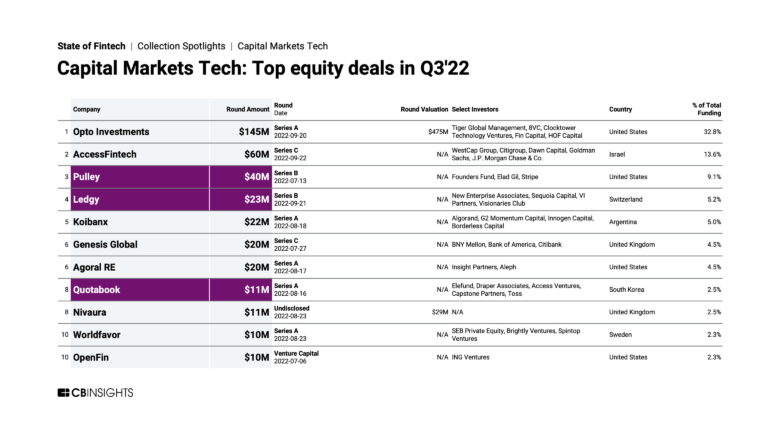

Series B | AliveTotal Raised

$54.9MValuation

$0000Last Raised

$40M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-29 points in the past 30 days

About Pulley

Pulley operates as an equity management platform for fundraising. The company offers solutions including cap table management, fundraising modeling, crypto and tokens, communications hub, and more. It primarily serves the financial service sector. The company was founded in 2019 and is based in Oakland, California.

Loading...

ESPs containing Pulley

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The equity management market enables individuals and institutions to manage, track, and optimize their ownership stakes in various assets, such as stocks and shares. Equity management tools offer a range of benefits, including portfolio diversification, risk mitigation, and performance monitoring. They empower investors to make data-driven decisions, align their equity strategies with financial go…

Pulley named as Highflier among 9 other companies, including Carta, Ledgy, and Qapita.

Loading...

Research containing Pulley

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Pulley in 3 CB Insights research briefs, most recently on Jan 3, 2024.

Jan 3, 2024

2024 prediction: Rippling acquires Pulley

Nov 11, 2022

3 capital markets trends to watchExpert Collections containing Pulley

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pulley is included in 3 Expert Collections, including Capital Markets Tech.

Capital Markets Tech

997 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

SMB Fintech

1,231 items

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Pulley News

Aug 13, 2024

News Provided By Share This Article Top Equity Management Software Managing equity offers companies the ability to maintain clear and organized records, which is essential for building trust with investors and ensuring long-term success.” — Alexandru Stan, CEO of Tekpon MIDDLETOWN, DELAWARE, UNITED STATES, August 13, 2024 / EINPresswire.com / -- Tekpon , a leading platform for discovering essential software solutions, is excited to announce its latest list of the top Equity Management Software tools. These tools are designed to help businesses manage their equity structures more effectively, saving time and reducing complexities. Equity Management Software helps companies manage ownership stakes, track investor relations, and stay compliant with regulations. This software is vital for businesses as it simplifies the process of issuing shares, tracking transactions, and maintaining accurate records. By using these tools, companies can improve transparency, streamline operations, and enhance their communication with stakeholders, which can lead to better decision-making and stronger investor confidence. Top Equity Management Software Eqvista - eqvista.com Eqvista offers a user-friendly platform for managing cap tables, valuations, and investor relations. It allows companies to issue and transfer shares easily, track equity transactions, and generate detailed reports. The platform is particularly useful for startups and growing businesses that need a reliable system to manage their equity as they scale. Eqvista’s integrated valuation services are a standout feature, providing accurate financial insights that help companies stay compliant and informed. The platform’s focus on simplicity and efficiency makes it a strong choice for businesses looking to streamline their equity management processes. Zapflow - zapflow.com Zapflow is an equity management tool designed specifically for venture capital and private equity firms. It provides a centralized platform for managing deal flow, tracking investments, and communicating with stakeholders. The software’s robust analytics and reporting features help firms make informed decisions by offering insights into portfolio performance and investment trends. Zapflow’s ability to handle complex ownership structures and its focus on improving operational efficiency make it a valuable tool for firms looking to optimize their investment processes. Its integration capabilities with other financial systems further enhance its utility for managing equity across multiple portfolios. Allocations - allocations.com Allocations is a cloud-based platform that simplifies equity management for investment funds. It offers tools for managing capital calls, distributions, and investor communications, making the process more transparent and efficient. The platform’s real-time updates and detailed financial reporting ensure that fund managers have accurate and up-to-date information at all times. Allocations is designed to reduce administrative burdens and improve communication with investors, providing a seamless experience for both fund managers and their clients. Its focus on automation and ease of use makes it an ideal choice for firms looking to streamline their equity management processes. A1 Tracker - a1enterprise.com A1 Tracker provides a comprehensive solution for managing equity and investment portfolios. The software is known for its strong risk management features, which help businesses assess and mitigate potential risks associated with their investments. A1 Tracker’s detailed reporting tools ensure that companies can maintain transparency and compliance with regulatory requirements. The platform is highly customizable, allowing businesses to tailor it to their specific needs. Its ability to integrate with other enterprise systems makes it a versatile tool for managing complex equity structures. A1 Tracker is ideal for companies of all sizes that need a reliable and flexible solution for managing their equity. TheInvestorNet - theinvestornet.com TheInvestorNet is a platform that offers a range of tools for managing equity, investor relations, and fundraising activities. It provides a centralized system for tracking investments, managing cap tables, and maintaining communication with investors. The platform’s advanced analytics and reporting features give businesses insights into their equity structures, helping them make informed decisions. TheInvestorNet’s focus on improving investor relations and streamlining equity management processes makes it a valuable tool for companies looking to enhance their operational efficiency. Its user-friendly interface and integration capabilities with other financial systems add to its appeal. Carta - carta.com Carta is a leading equity management platform used by startups, venture capital firms, and large enterprises. It offers a full suite of tools for managing cap tables, valuations, and equity plans. Carta’s compliance features ensure that companies stay up-to-date with regulatory requirements, while its advanced reporting tools provide insights into equity structures and ownership trends. The platform’s ability to integrate with other financial and HR systems makes it a comprehensive solution for managing equity across the organization. Carta’s reputation for reliability and its extensive feature set make it a top choice for businesses looking to manage their equity efficiently. Global Shares - globalshares.com Global Shares offers a robust platform for managing equity compensation plans and investor relations. The platform supports a wide range of equity plans, including stock options, RSUs, and ESPPs, providing flexibility for companies of all sizes. Global Shares’ detailed reporting and compliance features help businesses maintain transparency and meet regulatory requirements. The platform also offers tools for communicating with stakeholders, making it easier to manage investor relations and employee ownership programs. Global Shares’ focus on scalability and ease of use makes it a valuable tool for companies looking to manage their equity compensation plans more effectively. Cake Equity - cakeequity.com Cake Equity provides a simple and efficient platform for managing cap tables, equity plans, and shareholder communications. The platform is designed with startups and small businesses in mind, offering easy-to-use tools that simplify equity management. Cake Equity’s automated compliance features ensure that companies stay on top of their legal obligations, while its reporting tools provide insights into ownership structures. The platform’s focus on simplicity and affordability makes it an attractive option for businesses that need a reliable solution for managing their equity without the complexities often associated with larger platforms. Pulley - pulley.com Pulley is an equity management platform that helps startups manage their cap tables, valuations, and equity plans with ease. The platform offers a range of tools that simplify the process of issuing shares, tracking ownership, and staying compliant with regulatory requirements. Pulley’s intuitive interface makes it easy for businesses to navigate and manage their equity, while its detailed reporting features provide insights into ownership trends and financial health. The platform’s focus on simplicity and efficiency makes it a great choice for startups looking to manage their equity as they grow. Vestd - vestd.com Vestd is a platform focused on helping businesses manage employee share schemes and equity incentives. It offers tools for designing and managing various types of equity plans, including options, RSUs, and growth shares. Vestd’s emphasis on employee engagement makes it easy for companies to communicate the value of equity ownership to their teams. The platform also provides analytics and reporting tools that help businesses track the performance of their equity plans and ensure they align with company goals. Vestd’s user-friendly interface and focus on employee ownership make it a valuable tool for businesses looking to enhance their equity management processes. About Tekpon: Tekpon is an online marketplace connecting businesses with the software solutions they need to thrive in today’s digital landscape. With a focus on innovation, quality, and transparency, Tekpon offers a curated selection of software across various categories, aiding businesses in enhancing their operations and achieving their digital marketing goals. Ana-Maria Stanciuc

Pulley Frequently Asked Questions (FAQ)

When was Pulley founded?

Pulley was founded in 2019.

Where is Pulley's headquarters?

Pulley's headquarters is located at 6114 La Salle Avenue, Oakland.

What is Pulley's latest funding round?

Pulley's latest funding round is Series B.

How much did Pulley raise?

Pulley raised a total of $54.9M.

Who are the investors of Pulley?

Investors of Pulley include Elad Gil, Stripe, Founders Fund, South Park Commons, BoxGroup and 16 more.

Who are Pulley's competitors?

Competitors of Pulley include Shoobx, Cake Equity, Upstock, Sprout, trica and 7 more.

Loading...

Compare Pulley to Competitors

Carta focuses on ownership and equity management solutions. The company offers a range of services including equity management, compensation management, and venture capital solutions, which help businesses manage their equity, build their businesses, and invest in future companies. It primarily serves sectors such as investment funds, law firms, and companies in various stages of growth. It was formerly known as eShares. It was founded in 2012 and is based in San Francisco, California.

Upstock is a company specializing in equity management solutions within the financial technology sector. They offer RSU-based equity plans and a platform for real-time tracking and management of worker equity, designed to empower founders and team members to align and achieve collective success. Upstock primarily serves startups, legal experts, contractors, and companies looking to integrate equity into their compensation and culture. It was founded in 2019 and is based in Wilmington, Delaware.

Cake Equity specializes in equity management software for startups and scaleups. The company provides a platform for managing cap tables, employee stock options, equity modeling, and capital raising activities. Cake Equity's software is designed to streamline the administration of equity-related tasks, making it easier for companies to attract and retain talent through equity compensation plans. It was founded in 2018 and is based in Palm Beach, Queensland.

Shareworks is a company that focuses on providing workplace financial solutions, operating within the financial services industry. The company offers a range of services including equity plan administration, retirement readiness programs, deferred compensation plan services, and executive services, all designed to help employees achieve their financial goals and companies to grow. The company primarily serves sectors such as private companies, public companies, and strategic partners. It was founded in 1999 and is based in New York, New York.

Ledgy is an equity management platform that specializes in streamlining equity-related processes for businesses. The company offers solutions for cap table management, equity plan automation, and financial reporting, designed to simplify workflows, ensure compliance, and enhance employee engagement through intuitive dashboards. Ledgy's platform is tailored to serve various sectors, including HR and compensation, finance and accounting, and legal and operations. It was founded in 2017 and is based in Zurich, Switzerland.

Trica is a technology platform focused on equity management and private market investments. The company offers services that enable startups to manage their equity and raise funds, and allows investors to invest in growth-stage startups using their proprietary digital platform. Trica primarily serves the investment and startup sectors. It is based in Mumbai, India. trica operates as a subsidiary of LetsVenture.

Loading...