Qover

Founded Year

2016Stage

Series C | AliveTotal Raised

$69.93MLast Raised

$30M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-61 points in the past 30 days

About Qover

Qover specializes in insurance orchestration within the insurance sector. The company offers a platform-as-a-service to enable businesses to integrate insurance services into their digital experiences, including claims management and customer support. Qover primarily serves sectors that require integrated insurance solutions, such as fintech, automotive, retail, and the gig economy. It was founded in 2016 and is based in Brussels, Belgium.

Loading...

ESPs containing Qover

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded insurance infrastructure market consists of tech vendors that offer products to enable insurance sales on third-party platforms via APIs (application programming interfaces). These companies sell their products to insurance providers or third-party platforms. Some embedded insurance infrastructure providers may also provide insurance (as a licensed carrier, managing general agent, or …

Qover named as Leader among 15 other companies, including Igloo, Cover Genius, and Matic.

Qover's Products & Differentiators

Bike

Bike insurance empowering bike businesses to increase value and income.

Loading...

Research containing Qover

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Qover in 2 CB Insights research briefs, most recently on Aug 7, 2023.

Expert Collections containing Qover

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Qover is included in 5 Expert Collections, including Gig Economy Value Chain.

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

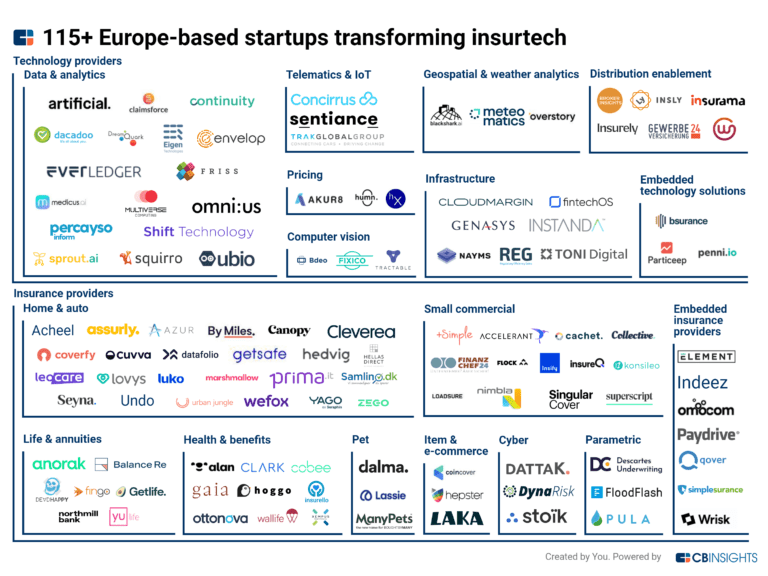

Insurtech

4,359 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,398 items

Excludes US-based companies

Insurtech 50

100 items

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Latest Qover News

Dec 19, 2023

Lydia, a mobile banking application, has partnered with insurtech Qover to introduce a seamless travel insurance experience. This offering is exclusively available “to Lydia’s premium cardholders, known as Black+ users, in Belgium, France, Portugal and Spain.” Qover’s embedded insurance orchestration platform is at the heart... Read More

Qover Frequently Asked Questions (FAQ)

When was Qover founded?

Qover was founded in 2016.

Where is Qover's headquarters?

Qover's headquarters is located at Rue du commerce 31, Brussels.

What is Qover's latest funding round?

Qover's latest funding round is Series C.

How much did Qover raise?

Qover raised a total of $69.93M.

Who are the investors of Qover?

Investors of Qover include Anthemis, Alven Capital, Kreos Capital, Zurich Global Ventures, Prime Ventures and 5 more.

Who are Qover's competitors?

Competitors of Qover include bsurance, ELEMENT, Embea, Bolttech, Hepster and 7 more.

What products does Qover offer?

Qover's products include Bike and 4 more.

Who are Qover's customers?

Customers of Qover include Deliveroo, Decathlon, Immoweb and Cowboy.

Loading...

Compare Qover to Competitors

Cover Genius is the insurtech company specializing in embedded protection for various industries. It main offerings include a global distribution platform, XCover, which provides seamless insurance and protection services, and an API that enables instant claims payments in over 90 currencies. It primarily serve sectors such as retail, fintech, logistics, mobility and auto, gig economy, travel, property, and live event ticketing. It was founded in 2014 and is based in New York, New York.

Wefox is an insurtech company that provides a platform connecting insurance companies, brokers, businesses, and customers for digital insurance solutions. The company offers a comprehensive ecosystem that facilitates the launch of new insurance products, enhances broker advisory capabilities, and integrates insurance services into business offerings. Wefox also focuses on ensuring customer safety and support through its platform. It was founded in 2015 and is based in Berlin, Germany.

Simplesurance is a company focused on providing embedded insurance solutions within various fast-changing ecosystems such as mobility, e-commerce, travel, fintech, and banking. The company offers a platform that facilitates easy and smart access to insurance services, aiming to enhance customer experiences and add value for businesses. Simplesurance primarily sells to sectors including e-commerce, mobility, travel, fintech, and banking industries. It was founded in 2012 and is based in Berlin, Germany.

KASKO is an InsurTech company providing technology solutions within the insurance sector. The company offers a modular no-/low-code platform that enables insurance providers to create and manage digital insurance programs efficiently. KASKO also provides services such as EU market access, technology consulting, and recruitment for the insurance industry. It was founded in 2015 and is based in London, England.

Clupp is a company focused on providing accessible insurance for low-risk drivers in the vehicle insurance sector. The company offers a subscription-based insurance model that includes comprehensive coverage for vehicles, protection against theft and damage, medical expenses for occupants, and liability in case of damages to third parties. Clupp's insurance model is unique in that it calculates premiums based on the kilometers driven and rewards good driving behavior. It was founded in 2016 and is based in Mexico City, Mexico.

Moonshot Insurance is a pioneer in the insurtech sector, focusing on providing Insurance-As-A-Service solutions. The company offers innovative insurance coverage with a fully digital experience, aiming to enrich the customer experience and meet new uses. Moonshot Insurance primarily serves the e-commerce industry, mobility providers, and financial services sector. It was founded in 2017 and is based in Paris, France.

Loading...