R3

Founded Year

2015Stage

Incubator/Accelerator | AliveTotal Raised

$112MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-101 points in the past 30 days

About R3

R3 is a company focused on the digitization of financial services within the enterprise technology sector. It offers a private, permissioned distributed ledger technology (DLT) platform named Corda, designed to enable secure and direct digital collaboration among regulated institutions. R3's solutions cater to various sectors including banks, central banks, corporates, exchanges, central counterparties, and fintechs, providing services such as tokenization of digital assets and currencies, streamlined inter-bank transactions, and modernization of legacy workflows. It was founded in 2015 and is based in New York, New York.

Loading...

R3's Product Videos

ESPs containing R3

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

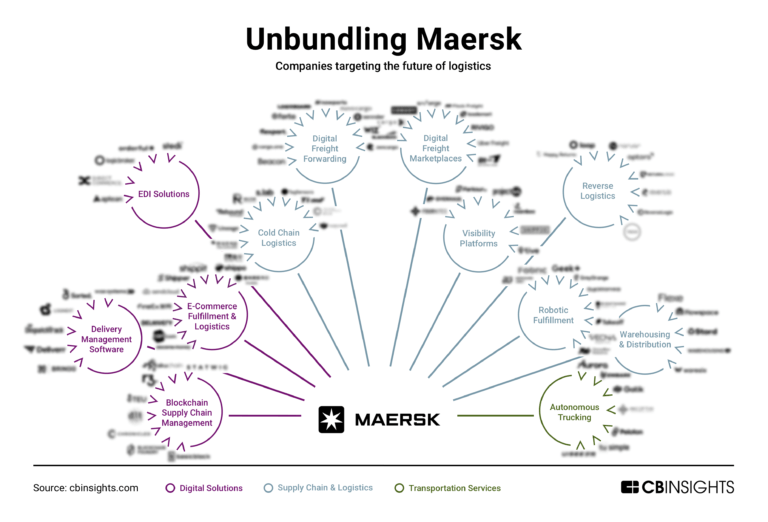

The blockchain interbank payments market refers to the use of blockchain technology to facilitate payments between financial institutions. The companies in this space are focused on boosting payment speed, efficiency, and security. The market is still in its early stages and is driven by the growing demand for solutions that enable real-time payment and settlement between banks.

R3 named as Leader among 10 other companies, including Ripple, Consensys, and Digital Asset.

R3's Products & Differentiators

Corda

The leading distributed application platform powering multi-party workflows in regulated digital finance. Corda was engineered to meet the needs of customers who are operating at scale in regulated environments.

Loading...

Research containing R3

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned R3 in 7 CB Insights research briefs, most recently on Mar 2, 2023.

Nov 19, 2022

State of Enterprise Blockchain 2022

Oct 18, 2022

How blockchain could disrupt banking

Sep 12, 2022

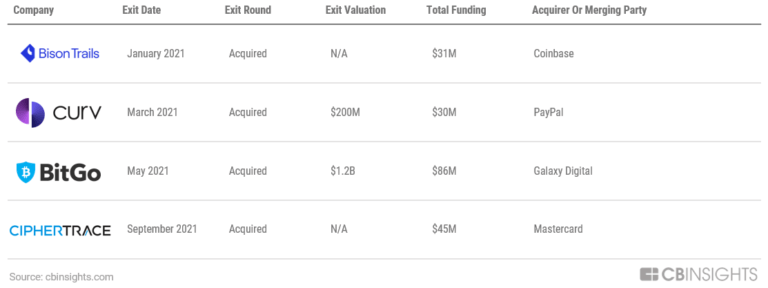

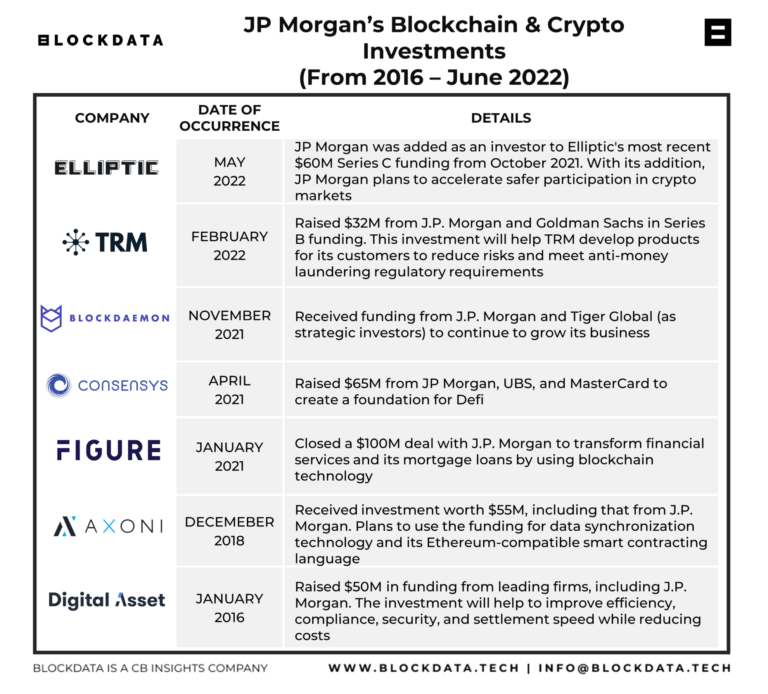

What JP Morgan is doing in blockchain and cryptoExpert Collections containing R3

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

R3 is included in 4 Expert Collections, including Blockchain.

Blockchain

9,026 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Insurtech

4,352 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

R3 Patents

R3 has filed 81 patents.

The 3 most popular patent topics include:

- cryptography

- cryptocurrencies

- alternative currencies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/20/2021 | 6/4/2024 | Cryptocurrencies, Cryptography, Key management, Block ciphers, Cryptographic protocols | Grant |

Application Date | 8/20/2021 |

|---|---|

Grant Date | 6/4/2024 |

Title | |

Related Topics | Cryptocurrencies, Cryptography, Key management, Block ciphers, Cryptographic protocols |

Status | Grant |

Latest R3 News

Sep 17, 2024

Date 17/09/2024 R3, the infrastructure platform building digital solutions for financial markets, and Quant , the digital finance pioneer, announce the publication of the results of UK Finance’s UK Regulated Liability Network. The report which follows work with UK Finance with eleven of its members [1] and partners [2] on a new experimentation phase. This is a new type of financial market infrastructure that can deliver new capabilities for payments and settlement, including tokenisation and programmability. R3 and Quant were selected by the UK RLN, alongside DXC Technology and Coadjute, as technology partners in exploring a number of use cases and in particular the technology workstream which delivered a multi- issuer DLT-based Tokenisation Platform, a comprehensive API for interaction with all forms of money, and an Orchestration Layer. Implementation of the Orchestration Layer seamlessly connected the Tokenisation Platform to different ledgers and integrated with existing systems (e.g. Open Banking, Project Rosalind, and simulated RTGS). Together with other participants, R3 and Quant reviewed and worked on various technical, legal and business case questions surrounding the development of an RLN and the main conclusions are: Such a platform, in collaboration with other important initiatives such as Open Banking, could deliver economic value and support innovation in the market. New functionality, such as programmable payments and locking/unlocking of funds, could be delivered across a range of use cases. It could provide new and innovative firms with a single, common point of access to enable them to interface with established institutions, and enhanced payment and settlement systems. The legal and regulatory framework of the UK is sufficiently flexible to support the implementation of an RLN. R3 has brought its ability to deliver complex pioneering projects for regulated markets whilst providing the critical distributed ledger capability, via Corda, its leading open permissioned DLT platform, powering the tokenisation of assets and currencies connecting global markets. Quant enabled programmability and interoperability across different forms of money by delivering the orchestration and API layer to the project with its Overledger platform. Jana Mackintosh, Managing Director of Payments, Innovation and Operational Resilience at UK Finance, said: “Every year, over £11 trillion worth of payments are processed in the UK, powering the economy. The success of the RLN experiment shows the potential of technology to transform the customer experience and deliver economic value and benefits for society. “The Experimentation Phase demonstrated the power of industry collaboration to deliver a platform for innovation in the UK. The private sector wants to invest in the future of commercial bank money but needs a partnership with regulators to do so.” Kate Karimson, R3 Chief Commercial Officer, said: “We’re proud to be a part of this pioneering effort where the UK finance industry has operated across retail, wholesale, technology and legal workstreams in a collaborative manner. R3 is committed to progressing financial markets and to enabling an open, trusted and advanced digital economy. The success of the RLN experimentation phase and the publication of a roadmap for the UK economy to harness the potential for the benefits of tokenisation demonstrates our advanced technology implementation capability,” Gilbert Verdian, Founder and CEO at Quant, said: “The RLN isn’t just about enhancing the efficiency of our current payment infrastructure; it’s about creating different forms of money that will transform the way value and assets are moved and managed. Programmability is at the heart of the transition to digital finance. As the project has proven, programmability brings new functionality across payments and settlement that are inconceivable under the current system. Implementing programmability will be key to cementing the UK’s leadership position in digital finance and futureproofing our capital markets for the decades to come. As the digital economy evolves, we’re excited to continue working with other project participants in delivering further innovation across payments.” [1] Barclays, Citi, HSBC, Lloyds Banking Group, Mastercard, NatWest, Nationwide, Santander, Standard Chartered, Virgin Money and VISA. [2] EY and Linklaters and a technology team of R3, Quant, DXC and Coadjute.

R3 Frequently Asked Questions (FAQ)

When was R3 founded?

R3 was founded in 2015.

Where is R3's headquarters?

R3's headquarters is located at 1155 Avenue of the Americas, New York.

What is R3's latest funding round?

R3's latest funding round is Incubator/Accelerator.

How much did R3 raise?

R3 raised a total of $112M.

Who are the investors of R3?

Investors of R3 include Plug and Play Crypto & Digital Assets, Temasek, OUE, TIS INTEC Group, CLS Group and 58 more.

Who are R3's competitors?

Competitors of R3 include Symbiont, Fluency, Digital Asset, Consensys, Polymesh and 7 more.

What products does R3 offer?

R3's products include Corda.

Who are R3's customers?

Customers of R3 include DTCC, HSBC, SDX and Spunta.

Loading...

Compare R3 to Competitors

Consensys operates as a blockchain and web3 software company to specializes in decentralized web technologies. The company offers a suite of products including a self-custodial wallet, development tools for Ethereum, smart contract auditing, and Ethereum scaling solutions. It primarily serves developers and organizations within the blockchain and cryptocurrency sectors. Consensys was formerly known as Capital Platinum Systems. It was founded in 2014 and is based in Brooklyn, New York.

Hyperledger is a company that focuses on advancing blockchain technology across various industries. The company offers enterprise-grade blockchain technologies that are used to transform the way business transactions are conducted. These technologies are primarily used in the financial sector, among others. It was founded in 2015 and is based in San Francisco, California.

Digital Asset specializes in blockchain and tokenization solutions within the financial and capital markets sector. The company provides software and services that enable the synchronization of data and transactions across organizational boundaries, facilitating the creation of regulatory-grade digital assets and solutions that streamline reconciliation processes, reduce settlement risks, and support real-time operations. Digital Asset's offerings primarily cater to financial institutions, market infrastructure providers, and technology companies seeking to leverage blockchain technology for capital market applications. It was founded in 2014 and is based in New York, New York.

Avalanche is a smart contracts platform known for its scalability and rapid transaction finality in the blockchain industry. The company offers a suite of tools and services that enable Web3 developers to build and deploy highly-scalable decentralized applications with ease. Avalanche's novel Subnets architecture and compatibility with Ethereum Virtual Machine (EVM) allow for the creation of custom virtual machines and eco-friendly blockchain solutions. It was founded in 2018 and is based in Tortola, Virgin Islands (British).

Algorand provides a secure and decentralized digital currency and transactions platform. It offers an open-source protocol that enables even the smallest transactions, regardless of transaction volume or the number of users. It primarily serves the financial technology industry. The company was founded in 2017 and is based in Singapore.

Hedera operates as a decentralized, enterprise-grade public network designed for the decentralized economy, operating in the blockchain and cryptocurrency domain. The company offers a variety of network services including tokenization, consensus, and smart contracts, enabling users to mint, configure, and manage tokens, verify timestamps, order events, and execute smart contracts. Its native cryptocurrency, HBAR, is used for transactions within its network. Hedera was formerly known as Hashgraph Consortium. It was founded in 2018 and is based in Las Vegas, Nevada.

Loading...