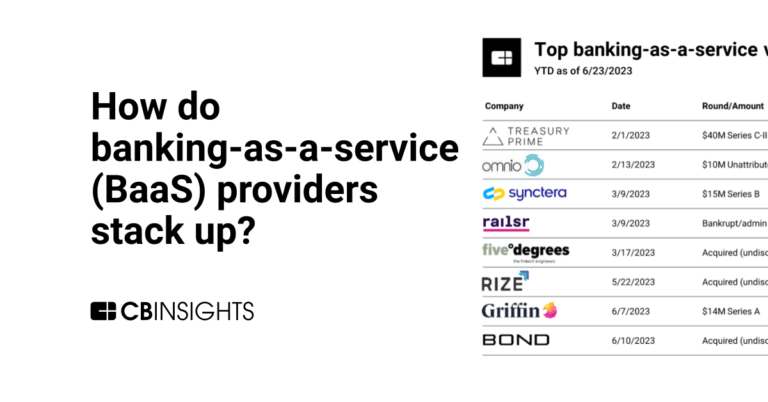

Railsr

Founded Year

2016Stage

Convertible Note | AliveTotal Raised

$188.34MLast Raised

$24M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-25 points in the past 30 days

About Railsr

Railsr operates as a banking and compliance platform. It connects together a global network of partner banks with companies offering embedded banking and wallets known as banking-as-a-service, embedded rewards known as reward-as-a-service, embedded cards known as cards-as-a-service, and embedded credit known as credit-as-a-service. Railsr was formerly known as Railsbank. The company was founded in 2016 and is based in London, United Kingdom.

Loading...

Railsr's Products & Differentiators

Banking as a Service

All the APIs, operations, and regulation needed to embed bank accounts, send money, receive money and collect money capabilities into an existing consumer experience.

Loading...

Research containing Railsr

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Railsr in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market map

Jan 23, 2023 report

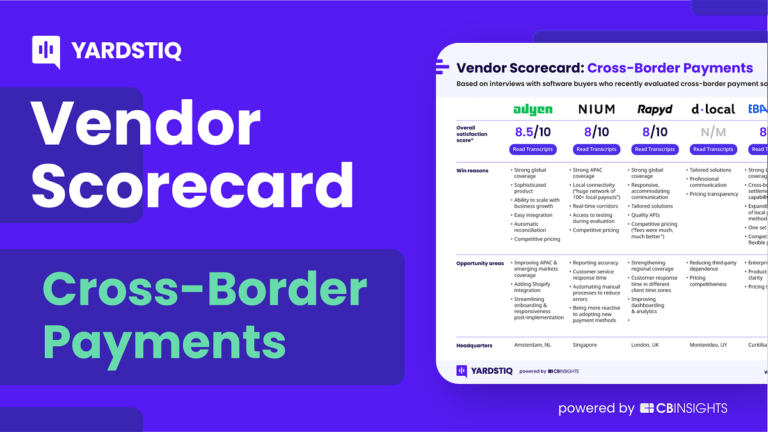

Top cross-border payments companies — and why customers chose themExpert Collections containing Railsr

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Railsr is included in 4 Expert Collections, including Regtech.

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

871 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Latest Railsr News

Sep 24, 2024

The embedded finance industry in the country is expected to grow by 30.5% annually to reach US$1.14 billion in 2024. The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 48.1% from 2024 to 2029. The country's embedded finance revenues will increase from US$1.14 billion in 2024 to reach US$8.17 billion by 2029. This report offers a comprehensive, data-centric analysis of the embedded finance industry. It covers lending, insurance, payment, wealth and asset-based finance sectors and provides a detailed breakdown of market opportunities and risks across various sectors. With over 75+ KPIs at the country level, this report ensures a thorough understanding of embedded finance market dynamics, market size, and forecast. It breaks down market opportunities by type of business model, consumer segment, and distribution model. In addition, it provides detailed information across various segments in each sector of embedded finance. KPI revenue helps in getting an in-depth understanding of end market dynamics. Reasons to buy In-depth Understanding of Embedded Finance Market Dynamics: Understand market opportunities and key trends along with forecast (2020-2029). Insights into Opportunity by end-use sectors - Get market dynamics by end-use sectors to assess emerging opportunity across various end-use sectors. Develop Market Specific Strategies: Identify growth segments and target specific opportunities to formulate embedded finance strategy; assess market specific key trends, drivers, and risks in the industry. Get Sector Insights: Drawing from proprietary survey results, this report identifies opportunities across embedded lending, embedded insurance, embedded finance, and embedded wealth sectors. Get insights at segment level, by the distribution model and by business model in key embedded finance segments Insights into the asset based finance market size and by type of assets, by end users. Key Attributes:

Railsr Frequently Asked Questions (FAQ)

When was Railsr founded?

Railsr was founded in 2016.

Where is Railsr's headquarters?

Railsr's headquarters is located at 1 Snowden Street, London.

What is Railsr's latest funding round?

Railsr's latest funding round is Convertible Note.

How much did Railsr raise?

Railsr raised a total of $188.34M.

Who are the investors of Railsr?

Investors of Railsr include Moneta VC, D Squared Capital, Embedded Finance, Anthos Capital, Outrun Ventures and 24 more.

Who are Railsr's competitors?

Competitors of Railsr include CleverCards, NIUM, Alviere, Solaris, Griffin and 7 more.

What products does Railsr offer?

Railsr's products include Banking as a Service and 2 more.

Loading...

Compare Railsr to Competitors

Seyula.io is a technology company focused on the financial services sector. The company provides a unified banking API that allows customers to securely connect their bank accounts to various applications. Seyula.io primarily serves businesses in the lending, personal finance, consumer payments, banking & brokerage, and business finances sectors. It is based in United Arab Emirates.

Teller is a company that focuses on providing API solutions for bank accounts in the financial technology sector. Their main service involves offering an easy-to-use API that allows users to connect their bank accounts to applications, enabling account verification, money transfers, payments, and transaction viewing. The company primarily serves the financial technology industry. It was founded in 2014 and is based in London, England.

Solaris is a technology company specializing in embedded finance solutions within the banking sector. The company provides a banking-as-a-Service platform that enables businesses to integrate digital banking, payment, and lending services into their products. Solaris primarily serves industries that require embedded financial services, such as the travel and mobility sectors. Solaris was formerly known as Solarisbank. It was founded in 2016 and is based in Berlin, Germany.

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

TrueLayer provides an open banking platform, specializing in the financial technology sector. The company provides solutions for instant bank payments, verified payouts, and streamlined user onboarding, leveraging real-time financial and identity data. TrueLayer primarily serves businesses in the ecommerce, iGaming, financial services, and cryptocurrency sectors. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, England.

Loading...