RavenPack

Founded Year

2003Stage

Debt | AliveTotal Raised

$34.97MLast Raised

$19.97M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-55 points in the past 30 days

About RavenPack

RavenPack serves as a provider of big data analytics in the financial services industry. The company offers products that analyze unstructured content to help financial professionals return, reduce risk, and increase efficiency. RavenPack primarily serves hedge funds, banks, and asset managers. It was founded in 2003 and is based in Malaga, Spain.

Loading...

ESPs containing RavenPack

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The institutional investment analytics and insights market refers to a range of software and services that provide investment managers with tools to help them make informed investment decisions and optimize their portfolios. These solutions typically include investment research, data analysis, risk management, and performance attribution capabilities. The market for institutional investment analyt…

RavenPack named as Challenger among 9 other companies, including S&P Global, SESAMm, and AlphaSense.

Loading...

Research containing RavenPack

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned RavenPack in 1 CB Insights research brief, most recently on Oct 6, 2023.

Oct 6, 2023

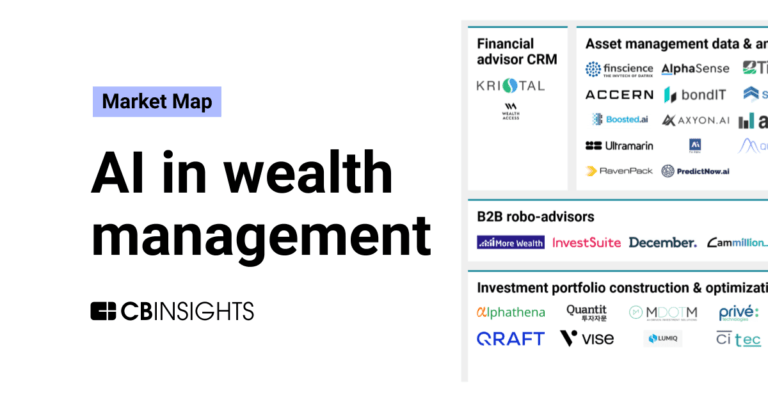

The AI in wealth management market mapExpert Collections containing RavenPack

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

RavenPack is included in 2 Expert Collections, including Capital Markets Tech.

Capital Markets Tech

1,122 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

13,396 items

Excludes US-based companies

Latest RavenPack News

Jul 12, 2024

Exit and Investment Update Share Exit and Investment Update Exit and Investment Update Step-up in realisations coming through, above holding value Molten Ventures (LSE: GROW, Euronext Dublin: GRW), a leading venture capital firm investing in and developing high-growth digital technology businesses, today provides an update on recent developments in its portfolio. Key highlights are: Acquisition of Perkbox by Great Hill Partners now closed The acquisition of Endomagnetics (‘Endomag’) by Hologic, Inc continuing through the closing processes All three exits reinforce the rigour of the Molten valuation process, underpinning Molten’s net asset value (‘NAV’) Isar Aerospace closes £220m Series C round RavenPack raises $20m to launch new AI platform Bigdata.com GRAPHCORE As announced by Graphcore earlier today, the company has been acquired by SoftBank. Molten has realised a total return of $26m, in line with its Group holding value. Molten first invested in Graphcore in 2016 as part of the company’s Series A and further supported the business in subsequent funding rounds. At a 0.9x multiple on invested capital, the majority of the cost has been returned which demonstrates the benefit of downside protection with preference shares. Graphcore is a machine intelligence semiconductor company, which develops Intelligent Processing Units (‘IPUs’) that enable world-leading levels of AI computing. Graphcore will continue to operate under the Graphcore name, as a wholly-owned subsidiary of SoftBank, with its head office remaining in Bristol and offices in Cambridge, London, Gdansk and Hsinchu. PERKBOX Further to the announcement of 18 March, the acquisition of Perkbox, a British-based employee benefits and reward platform, by Great Hill Partners, a US-based private equity firm, has closed. The award-winning platform has been a portfolio company since Molten first invested in 2016. Further capital was invested to support the growth of Perkbox from 2017 to 2019. Cash proceeds of approximately £18m, will be received in circa 60 days once released from escrow. This is above the Molten holding value of £16.3m and delivers a 1.3x multiple on invested capital. ENDOMAG Further to the announcement of 30 April in respect of the acquisition of medical technology company Endomag by global leader in women’s health Hologic, Inc, the regulatory review, working capital and other customary closing adjustments remain on track. As previously announced and subject to minor adjustments, this deal also values Molten's stake in Endomag modestly above its Group holding value of £34.7 million. At the current holding value this would deliver a 3.7x multiple on invested capital. The three realisations provide a cross section of the portfolio returns and add to the over £520m of realisations by the Company since 2016. In accordance with the capital allocation policy outlined in the Company’s final results on 12 June, a further update will be provided on the allocation of a minimum of 10% of the proceeds from the above realisations to share buybacks, once the funds have been received by the Company. ISAR AEROSPACE In June, core portfolio company ISAR Aerospace announced the closing of its Series C round raising £220m. ISAR Aerospace is a German launch service provider for small and medium-sized satellites. The funds will be used to build a bigger, fully automated factory near Munich to produce at least 40 of its Spectrum rockets a year by the end of the decade. RAVENPACK In July, Core Portfolio company RavenPack, a leading big data analytics provider for hedge funds and banks, has raised $20m from technology advisory and investment firm GP Bullhound as the company aims to accelerate the development and launch of RavenPack’s new AI platform, Bigdata.com, enhancing decision-making for leading financial professionals. Martin Davis, Chief Executive Officer, Molten Ventures, commented: “As we anticipated at the time of our recent trading update and final results, we are seeing a step-up in realisations, most recently with our exit from Graphcore and the previously announced Perkbox and Endomag transactions. These realisations and the fact that Core Portfolio companies ISAR Aerospace and Ravenpack are attracting investment, even in an environment which is still challenging for fundraising, all demonstrate the high quality of our portfolio. More importantly, the valuation of recent exits underscores the rigour of our valuation methodology and should give further confidence to investors in our net asset value.”

RavenPack Frequently Asked Questions (FAQ)

When was RavenPack founded?

RavenPack was founded in 2003.

Where is RavenPack's headquarters?

RavenPack's headquarters is located at Centro Negocios Oasis, Urbanizacion Villaparra, Malaga.

What is RavenPack's latest funding round?

RavenPack's latest funding round is Debt.

How much did RavenPack raise?

RavenPack raised a total of $34.97M.

Who are the investors of RavenPack?

Investors of RavenPack include GP BullHound Sidecar, European Investment Bank, Plug and Play Insurtech and Molten Ventures.

Who are RavenPack's competitors?

Competitors of RavenPack include Mirador, aisot, SESAMm, Amenity Analytics, Owlin and 7 more.

Loading...

Compare RavenPack to Competitors

SESAMm is a leading artificial intelligence company that specializes in the analysis of over 20 billion documents to generate insights for investment firms and corporations. The company's main offerings include real-time monitoring of ESG controversies, risk assessment, and the provision of ESG and positive impact scores. SESAMm's solutions are primarily utilized by the private equity, asset management, and corporate sectors. It was founded in 2014 and is based in Metz, France.

AlphaSense develops a market intelligence platform. Its Artificial Intelligence (AI) technology aims to help professionals make business decisions by offering insights from private content, such as company filings, event transcripts, expert call transcripts, news, trade journals, and equity research. It serves consulting, energy, financial services, life science, and other sectors. It was founded in 2011 and is based in New York, New York.

Axyon AI focuses on the application of artificial intelligence in the investment management sector. It offers AI-powered asset rankings and optimized indices on equities and providing asset managers with predictive value and the ability to uncover alpha opportunities. Axyon AI primarily serves the financial industry, particularly asset managers, hedge funds, and trading desks. The company was founded in 2016 and is based in Modena, Italy.

Alexandria Technology is a company that focuses on Artificial Intelligence and Natural Language Processing within the investment industry. The company offers services that transform large volumes of text into actionable data, providing sentiment analysis and text classification for investment professionals. It primarily serves the investment industry, offering solutions that help analysts and portfolio managers capture more information quickly. It was founded in 2012 and is based in New York, New York.

Accern is a company specializing in no-code natural language processing (NLP) for various industries, including financial services and government. The company offers a platform that enables enterprises to classify content and automate research workflows without the need for coding. Accern's solutions are designed to enhance operational efficiency and accelerate the deployment of NLP solutions across a range of sectors. It was founded in 2014 and is based in New York, New York.

Exabel is a financial technology company that operates in the data analytics and investment sectors. The company provides a sophisticated analytical platform for investment professionals, integrating alternative data with foundational data to enhance key performance indicator analysis and fundamental research. Exabel primarily serves the financial investment industry. It was founded in 2016 and is based in Oslo, Norway.

Loading...