Resilience

Founded Year

2016Stage

Series D | AliveTotal Raised

$217MLast Raised

$100M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-43 points in the past 30 days

About Resilience

Resilience specializes in cyber risk management and insurance solutions within the cybersecurity industry. The company offers cyber insurance, risk management services, and technology errors and omissions (E&O) insurance to help organizations mitigate and manage cyber threats. Resilience's solutions are designed to enhance cyber resilience by integrating risk mitigation, risk acceptance, and risk transfer strategies. It was founded in 2016 and is based in San Francisco, California.

Loading...

Resilience's Product Videos

Resilience's Products & Differentiators

Essential

Comprehensive cyber insurance connected with advanced cybersecurity

Loading...

Research containing Resilience

Get data-driven expert analysis from the CB Insights Intelligence Unit.

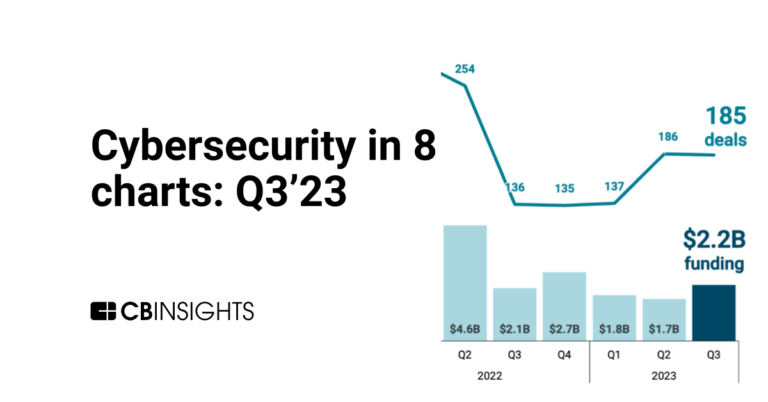

CB Insights Intelligence Analysts have mentioned Resilience in 2 CB Insights research briefs, most recently on Feb 23, 2024.

Feb 23, 2024

The B2C US insurtech market mapExpert Collections containing Resilience

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Resilience is included in 5 Expert Collections, including Regtech.

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Insurtech

4,354 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Cybersecurity

9,332 items

These companies protect organizations from digital threats.

Fintech

9,297 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Resilience Patents

Resilience has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/31/2018 | 10/8/2019 | Computer security, Cyberwarfare, Cybercrime, Computer network security, Cyberattacks | Grant |

Application Date | 12/31/2018 |

|---|---|

Grant Date | 10/8/2019 |

Title | |

Related Topics | Computer security, Cyberwarfare, Cybercrime, Computer network security, Cyberattacks |

Status | Grant |

Latest Resilience News

May 13, 2024

The hacking group accused of disrupting casinos and hotels at MGM Resorts International last year is engaged in a new campaign targeting banks and insurance companies, according to cybersecurity researchers. The group, known as Scattered Spider, has targeted 29 companies since April 20 and successfully compromised the systems of at least two insurance companies, according to Resilience Cyber Insurance Solutions, a cybersecurity risk company whose researchers have been tracking the group’s activities online. In the recent campaign, Scattered Spider targeted Visa Inc., PNC Financial Services Group Inc., Transamerica, New York Life Insurance Co. and Synchrony Financial, according to a senior threat researcher at Resilience, who didn’t want to be named due to security concerns. It wasn’t clear if the group successfully gained access to any of those companies, the researcher said. Representatives at Transamerica and Synchrony declined to comment, while spokespeople for Visa, PNC and New York Life didn’t respond to requests for comment. The researcher declined to name the two companies in the insurance sector that were successfully breached. Resilience researchers said the attackers purchased lookalike domains that match the names of these target companies. They then used them to host fake log-in pages intended to misdirect them, sending phishing links via emails and text messages to employees in the sector directing them to the bogus pages, according to research from Resilience. Those pages are branded as Okta Inc., or as content management services, that enable the hackers to steal the user’s credentials. For people who visit the fake pages, a link for those who “need help signing in” misdirects them to a domain labeled with racist epithets run by Scattered Spider, according to the research. Kyrk Storer, a spokesperson for Okta, said the company has been tracking ongoing threat activity from Scattered Spider and “proactively notifying customers when we identify fake log-in pages like these.” The company recently introduced new security features to mitigate the group’s tactics, including phishing-resistant authentication and safeguarding sensitive log-ins with additional security checks, Storer said. The group is working at incredible speed, targeting multiple companies with social engineering techniques seen most recently on May 6, according to the senior threat researcher at Resilience. Scattered Spider, an amorphous group that cybersecurity researchers say emerged in May 2022, has been accused of orchestrating a spate of high-profile hacks in the second half of last year, including those against MGM and Caesars Entertainment Inc., as well as cryptocurrency trading platform Coinbase Global Inc. and manufacturer Clorox Co., which led to a shortage of cleaning supplies on shelves across the US. The hackers often trick call center employees and IT help desk staffers into giving up passwords and sensitive information, according to researchers. The attackers impersonate other company employees on phone calls, sometimes by threatening to have targets fired. The group’s criminal activities fell off between December and February, according to Resilience researchers, who didn’t know whether that might be related to the holidays, attempting to lie low as the spotlight has increasingly fallen on them or seeking to develop a set of targets for a new campaign. The group calls itself Star Fraud and is comprised of teenage and young adult hackers in the US and UK drawn from a larger criminal underground known as The Com, according to Resilience’s research. While the group originally focused on telecommunications companies, they have in 2024 broadened their focus to many more sectors, including food, retail and video games, as well as banking and insurance, the Resilience researchers say. The cybersecurity firm CrowdStrike Holdings Inc., which named the group Scattered Spider, said it has tracked 52 breaches by the group through October 2023. The FBI and the Cybersecurity and Infrastructure Security Agency, known as CISA, have repeatedly appealed for information about the activities, identities and whereabouts of members of Scattered Spider. The FBI and CISA didn’t immediately respond to requests for comment. Photo: A lion statue at the MGM Grand Hotel and Casino in Las Vegas. Photographer: Roger Kisby/Bloomberg Copyright 2024 Bloomberg.

Resilience Frequently Asked Questions (FAQ)

When was Resilience founded?

Resilience was founded in 2016.

Where is Resilience's headquarters?

Resilience's headquarters is located at 55 2nd Street, San Francisco.

What is Resilience's latest funding round?

Resilience's latest funding round is Series D.

How much did Resilience raise?

Resilience raised a total of $217M.

Who are the investors of Resilience?

Investors of Resilience include Lightspeed Venture Partners, Founders Fund, General Catalyst, Intact Ventures, CRV and 7 more.

Who are Resilience's competitors?

Competitors of Resilience include Cowbell Cyber, KYND, Axio, Corvus Insurance, CyberCube and 7 more.

What products does Resilience offer?

Resilience's products include Essential and 2 more.

Loading...

Compare Resilience to Competitors

Cyberwrite specializes in cyber insurance analytics and risk assessment within the insurance industry. The company offers AI-driven risk analysis and reporting tools to help insurers, reinsurers, agents, and brokers understand and manage cyber risk. Cyberwrite primarily serves the insurance industry, providing actionable insights for underwriting, risk management, and sales efficiency in cyber insurance. It was founded in 2016 and is based in New York, New York.

CyberCube specializes in cyber risk analytics for the insurance sector, leveraging a cloud-based technology platform to facilitate data-driven decision-making. The company offers a suite of products and services that enable insurance organizations to quantify cyber risk, optimize portfolio management, and manage cyber risk aggregation. CyberCube's solutions cater to various stakeholders within the insurance industry, including brokers, insurers, reinsurance brokers, and reinsurers. It was founded in 2015 and is based in San Francisco, California.

Coalition operates in the cyber insurance and cybersecurity sectors. The company offers comprehensive insurance coverage and cybersecurity tools designed to help businesses manage and mitigate digital risks. Coalition primarily serves businesses worldwide that are seeking resilience against cyber attacks. It was founded in 2017 and is based in San Francisco, California.

Cowbell Cyber specializes in providing cyber insurance solutions within the insurance industry. The company offers cyber coverage tailored to small and medium-sized enterprises (SMEs), utilizing artificial intelligence for continuous risk assessment and underwriting. Cowbell Cyber's products are designed to assist businesses in managing cyber risks through a closed-loop approach, including risk prevention, mitigation, and incident response services. It was founded in 2019 and is based in Pleasanton, California.

RiskQ specializes in cyber risk management, offering software solutions in the cybersecurity industry. Their main offerings include cyber risk quantification, prioritization, and management, as well as tools for cyber insurance assessment and vendor risk management. RiskQ's services cater to a variety of sectors including financial services, healthcare insurance, technology, manufacturing, and retail. It was founded in 2018 and is based in Miami, Florida.

Kovrr specializes in cyber risk quantification in cybersecurity. The company offers services that enable businesses to financially quantify their cyber risk exposure, manage cyber insurance coverage, and make informed decisions about managing cyber risk. Its solutions include cyber materiality reporting, cyber insurance analysis, cyber insurance coverage, and more. It primarily sells to sectors that require cyber risk management, such as the insurance industry. It was founded in 2017 and is based in Tel Aviv, Israel.

Loading...