Scalapay

Founded Year

2019Stage

Series B - II | AliveTotal Raised

$727MLast Raised

$27M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-23 points in the past 30 days

About Scalapay

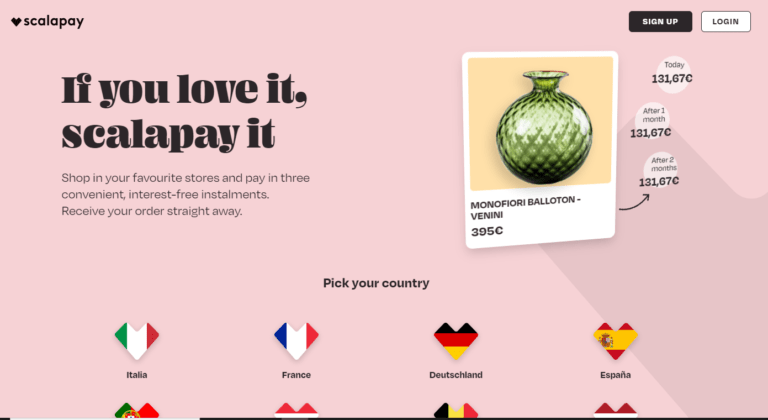

Scalapay is a financial technology company offering a buy-now-pay-later service that enables customers to make purchases and defer payments through interest-free installments. The company's main service allows consumers to receive their orders immediately while splitting the payment into three monthly installments without interest, which is facilitated through both online and in-store transactions. Scalapay primarily serves the ecommerce industry, as well as brick-and-mortar retailers, by providing a payment solution that aims to increase basket size and conversion rates for merchants. It was founded in 2019 and is based in Milan, Italy.

Loading...

ESPs containing Scalapay

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Scalapay named as Challenger among 15 other companies, including PayPal, Affirm, and Klarna.

Loading...

Research containing Scalapay

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Scalapay in 3 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market mapExpert Collections containing Scalapay

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Scalapay is included in 2 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Lending

2,470 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Latest Scalapay News

Aug 21, 2024

BNPL payments are expected to grow by 15.2% on an annual basis to reach US$167.0 billion in 2024. The medium to long-term growth story of the BNPL industry in the region remains strong. BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 10.1% during 2024-2029. The BNPL gross merchandise value in the region will increase from US$145.0 billion in 2023 to reach US$269.7 billion by 2029. This report provides a detailed data-centric analysis of the Buy Now Pay Later (BNPL) industry, covering market opportunities and risks across a range of retail categories. With over 75 KPIs at the country level, this report provides a comprehensive understanding of BNPL market dynamics, market size and forecast, and market share statistics. The buy now pay later sector is poised for accelerated growth in the European market over the medium term. The rising adoption among consumers, across age groups, will drive the growth of the industry in Europe. Not just young generation shoppers, but even older cohort is turning to the payment solution to fund their everyday purchases, as inflation continues to bite their household income. The margin pinch, caused by higher interest rates and an inflationary environment, resulted in a few global providers shutting down their operations in Europe. However, this resulted in growth opportunities for other firms, who are expected to expand aggressively across the European market, to accelerate growth rate. Overall, the publisher maintains a positive growth outlook for the BNPL industry in Europe over the next three to four years. Firms are expanding in the European market to boost usage and drive growth in the region With the market projected to grow over the next three to four years in Europe, businesses are expanding in the region to tap into untapped markets. The expansion strategy is also driving the trend of strategic collaborations in the sector. Marqeta, in October 2023, entered into a strategic partnership with Scalapay to drive the buy now pay later usage in Europe. As part of the collaboration, the two firms will issue virtual cards for online and in-store transactions to Scalapay's BNPL users. The scalable platform offered by Marqeta will support Scalapay to drive better shopping experiences for its users. Klarna, on the other hand, is also planning to expand its presence across the European region. The firm is seeking in-store partnerships to benefit from the growing usage of BNPL products among consumers across age groups. The move to expand aggressively in the European region comes at a time when a few firms have taken measures to cut down costs. Zip, for instance, abandoned 10 of the 14 markets it operated in, including the United Kingdom in 2023. Clearpay, in 2023, also ceased operations in many European nations, including Italy, France, and Spain. This is offering growth opportunities for firms like Klarna, who are well-positioned to accelerate growth rate in Europe on the back of rising demand. An increasing number of Brits are turning to buy now pay later schemes in the United Kingdom The inflationary environment has put a strain on consumer spending power, with a vast majority of the Brits struggling to even pay their bills. As a result, millions of shoppers have turned to payment solutions like buy now pay later schemes to fund their purchases and daily lifestyle. According to a report from Citizens Advice, 11% of consumers have used the payment method for grocery shopping. This percentage increases to 35% among frequent BNPL users. In another report, published by the Financial Conduct Authority, nearly 14 million Brits were using the BNPL schemes to make purchases in six months, leading to January 2023. In 2024, the publisher expects the trend to further continue in the United Kingdom market. The higher uptake of the BNPL schemes is aiding the gross merchandise value and volume growth for providers. However, this is also resulting in higher delinquencies, with many users not able to make timely repayments. BNPL startups are raising funding rounds to offer innovative payment solutions in Italy Amid the rising demand for installment payment solutions across the region, several startups have entered into the sector to tap into the growth market. These startups are also raising funding to reach more customers in the region. Qomodo, the Italy-based payment aggregator, announced that the firm had raised €34.5 million in its pre-seed funding round in November 2023. The BNPL service offered by the firm is specifically directed towards in-store retailers, which is expected to drive the next growth phase of the BNPL industry across Europe over the medium term. Going forward, the publisher expects more such startups to raise funding rounds, driving the competitive landscape in the sector. Furthermore, the publisher expects firms to enter into strategic partnerships, as they seek to widen the distribution of their BNPL product in the in-store segment. Key Topics Covered: Austria Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Belgium Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Denmark Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Finland Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook France Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Germany Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Greece Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Italy Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Netherlands Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Norway Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Poland Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Spain Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Sweden Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Switzerland Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook United Kingdom Buy Now Pay Later Business and Investment Opportunities (2020-2029) Databook Key Attributes:

Scalapay Frequently Asked Questions (FAQ)

When was Scalapay founded?

Scalapay was founded in 2019.

Where is Scalapay's headquarters?

Scalapay's headquarters is located at VIA GIUSEPPE MAZZINI, 9, Milan.

What is Scalapay's latest funding round?

Scalapay's latest funding round is Series B - II.

How much did Scalapay raise?

Scalapay raised a total of $727M.

Who are the investors of Scalapay?

Investors of Scalapay include Poste Italiane, Fasanara Capital, Tiger Global Management, Tencent, Moore Capital Management and 8 more.

Who are Scalapay's competitors?

Competitors of Scalapay include Pledg, Sunbit, SplitIt, Twisto, Younited and 7 more.

Loading...

Compare Scalapay to Competitors

Klarna specializes in providing payment solutions and services within the e-commerce sector. The company offers a platform for online shopping that includes price comparisons, deals, and various payment options to facilitate purchases for consumers. Klarna primarily serves the e-commerce industry by enabling a seamless shopping experience through its payment and financing services. It was founded in 2005 and is based in Stockholm, Sweden.

Alma is a financial technology company specializing in installment payment and deferred payment solutions within the Buy Now Pay Later (BNPL) industry. The company offers services that allow consumers to pay for purchases over time or at a later date, while ensuring merchants receive immediate payment. Alma primarily serves the ecommerce and retail sectors, providing financial products that aim to increase sales, customer loyalty, and satisfaction without increasing merchant risk. It was founded in 2018 and is based in Paris, France.

Butter is a company that focuses on financial services in the ecommerce sector. It offers a service that allows customers to make online purchases and pay for them over time, including for items such as travel, fashion, tech, and home goods. The company primarily serves the ecommerce industry. Butter was formerly known as Awaymo. It was founded in 2017 and is based in London, England.

Billie is a leading provider of Buy Now, Pay Later (BNPL) payment methods for the B2B sector, offering innovative digital payment services. The company's main offerings include modern checkout solutions that enable businesses to pay and get paid on their terms, with features such as upfront payment for sellers and flexible payment terms for buyers. Billie's services cater to a variety of sectors, including e-commerce, telesales, and in-person sales channels. It was founded in 2016 and is based in Berlin, Germany.

Jifiti is a fintech company that operates in the financial services industry. The company provides white-labeled embedded lending solutions for banks, lenders, and merchants, enabling them to deploy and scale consumer and business financing programs at any point of sale. These services primarily cater to the retail finance and consumer finance sectors. It was founded in 2011 and is based in Columbus, Ohio.

SplitIt operates as a buy now pay later (BNPL) payments company. It provides a merchant-branded, installments-as-a-service platform that allows merchants to offer their customers the option to pay for purchases over a fixed number of installments, with no interest or fees. It serves industries such as automotive, education, travel, and more. The company was formerly known as PayItSimple. It was founded in 2009 and is based in Atlanta, Georgia.

Loading...