Simplesurance

Founded Year

2012Stage

Acq - Fin | AliveTotal Raised

$87.51MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-72 points in the past 30 days

About Simplesurance

Simplesurance is a company focused on providing embedded insurance solutions within various fast-changing ecosystems such as mobility, e-commerce, travel, fintech, and banking. The company offers a platform that facilitates easy and smart access to insurance services, aiming to enhance customer experiences and add value for businesses. Simplesurance primarily sells to sectors including e-commerce, mobility, travel, fintech, and banking industries. It was founded in 2012 and is based in Berlin, Germany.

Loading...

Loading...

Research containing Simplesurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Simplesurance in 3 CB Insights research briefs, most recently on May 10, 2024.

Expert Collections containing Simplesurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Simplesurance is included in 3 Expert Collections, including Fintech 100.

Fintech 100

248 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

4,359 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,398 items

Excludes US-based companies

Simplesurance Patents

Simplesurance has filed 4 patents.

The 3 most popular patent topics include:

- computer network security

- data management

- internet terminology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/23/2020 | 1/24/2023 | Computer network security, Risk analysis, Network file systems, Systems engineering, Natural language processing | Grant |

Application Date | 1/23/2020 |

|---|---|

Grant Date | 1/24/2023 |

Title | |

Related Topics | Computer network security, Risk analysis, Network file systems, Systems engineering, Natural language processing |

Status | Grant |

Latest Simplesurance News

Oct 21, 2022

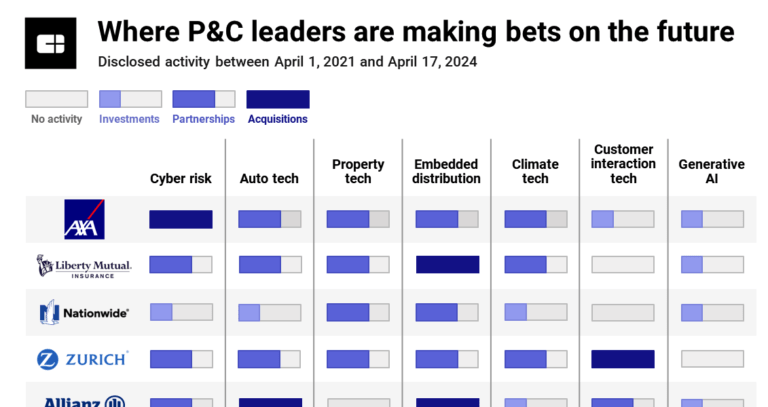

simplesurance offers a market-leading technology for embedded insurance, integrating insurance solutions into digital distribution partners in fast growing eco systems Dynamic growth thanks to presence in 31 European countries and Japan — investments in growth pay off Full acquisition by Allianz X builds on successful partnership between simplesurance and Allianz Partners Munich/Berlin, 29 September 2022 — Allianz X, the digital investments arm of Allianz Group, will acquire 100 percent of the shares in simplesurance. Allianz X has been a strategic investor in the Berlin-based insurtech pioneer since 2016 and most recently expanded its involvement in 2019. The acquisition will allow a further deepening in the partnership between Allianz Partners and simplesurance to leverage business synergies in the use of technology and in customer service. Simplesurance is one of the leading providers of embedded insurance, a field expected to be worth USD 700 billion by 2030–9 times more than it is today. Simplesurance focuses on “fast moving ecosystems” such as mobility, e-commerce, travel, fintech, and banking. Companies like N26, heycar, and OnePlus embed insurance into their customer journeys via simplesurance, thereby streamlining and improving the customer experience. “Embedded insurance is a core element when it comes to offering customers not just policies, but comfort and convenience too. With simplesurance, we bet on one of the pioneers of this market at an early stage and, together with its strong management team, built a technology leader in this segment,” said Carsten Middendorf, CIO of Allianz X. The collaboration between Allianz Partners and simplesurance strengthened over the last several years and has culminated in a new, scalable integration technology, not only for digital sales, but also traditionally strong offline distribution channels, such as automotive. The first successes in leveraging these synergies have already been achieved, such as an embedded motor insurance solution for the quality used car platform heycar. “With our innovative technology, we have been able to win over numerous large partners and their end customers in recent years and have grown strongly. Now it is time for the next developmental step. With the full backing of a global market leader in the insurance industry, we can play to the strengths of our technology even better and drive global expansion more effectively,” explained Robin von Hein, CEO and co-founder of simplesurance. “The strategic cooperation with simplesurance has been excellent,” said Tomas Kunzmann, CEO of Allianz Partners. “Simplesurance’s capabilities bring us the digital know-how and platform expertise to shape the different digital eco-systems and seize opportunities.” He continued, “So with a closer collaboration, we will leverage simplesurance’s digital capabilities even more effectively and achieve a really competitive speed to market. Combined with the strong relationship with our own B2B2C partners, this sets the foundations for a digitally powered customer experience that truly creates peace of mind for our customers.” “We are incredibly proud of what our team has achieved over the past 10 years. We look forward to further develop our platform as part of the Allianz Group with the same spirit and passion,” added Joachim von Bonin, CFO and co-founder of simplesurance. For more information, please contact: Allianz X About simplesurance As an innovative market pioneer in the Insurtech industry, the Berlin start-up company simplesurance develops and distributes software solutions for different market segments, such as e-commerce, OEM, travel, mobility, banking, and fintechs, at the interface between the traditional insurance industry and the digital world. simplesurance has been active in 32 countries for more than 10 years now. Many well-known companies like OnePlus, heycar, and N26 appreciate the innovative power and flexibility of the company. Founded in 2012 by Robin von Hein and Joachim von Bonin, simplesurance now employs over 120 people from 30 nations, with offices in Berlin and Tokyo, as well a techhub in Lisbon. Further information is available at http://www.simplesurance.com/ . About Allianz Partners Allianz Partners is a world leader in B2B2C insurance and assistance, offering global solutions that span international health and life, travel insurance, mobility and assistance. Customer driven, our innovative experts are redefining insurance services by delivering future-ready, high-tech high-touch products and solutions that go beyond traditional insurance. Our products are embedded seamlessly into our partners’ businesses or sold directly to customers, and are available through four commercial brands: Allianz Assistance, Allianz Automotive, Allianz Travel and Allianz Care. Present in over 75 countries, our 19,400 employees speak 70 languages, handle over 58 million cases each year, and are motivated to go the extra mile to offer peace of mind to our customers around the world. About Allianz X Allianz X invests in digital frontrunners in ecosystems relevant to insurance and asset management. In just a few years, it has grown to a portfolio of more than 25 companies and AuM of over 2 billion euros. Allianz X has counted 11 unicorns among its portfolio so far. The heart and brains behind it all is a talented team of around 40 people. As one of the pillars of the Allianz Group’s digital transformation strategy, Allianz X provides an interface between Allianz Operating Entities and the broader digital ecosystem, enabling collaborative partnerships in insurtech, fintech, and beyond. As an investor, Allianz X supports mature digital growth companies to take the next bold leap and reach their full potential. This media release and its assessments are subject to this disclaimer .

Simplesurance Frequently Asked Questions (FAQ)

When was Simplesurance founded?

Simplesurance was founded in 2012.

Where is Simplesurance's headquarters?

Simplesurance's headquarters is located at Am Karlsbad 16, Berlin.

What is Simplesurance's latest funding round?

Simplesurance's latest funding round is Acq - Fin.

How much did Simplesurance raise?

Simplesurance raised a total of $87.51M.

Who are the investors of Simplesurance?

Investors of Simplesurance include Allianz X, ODDO BHF, Tokio Marine, Rheingau Founders, Rakuten Capital and 11 more.

Who are Simplesurance's competitors?

Competitors of Simplesurance include Cover Genius and 6 more.

Loading...

Compare Simplesurance to Competitors

Qover specializes in insurance orchestration within the insurance sector. The company offers a platform-as-a-service to enable businesses to integrate insurance services into their digital experiences, including claims management and customer support. Qover primarily serves sectors that require integrated insurance solutions, such as fintech, automotive, retail, and the gig economy. It was founded in 2016 and is based in Brussels, Belgium.

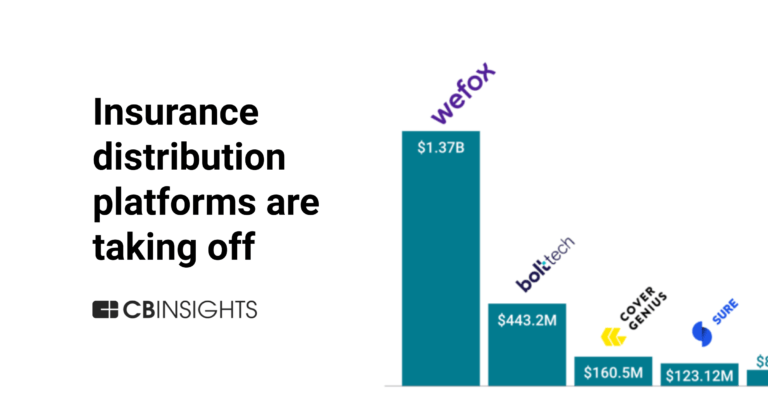

Cover Genius is the insurtech company specializing in embedded protection for various industries. It main offerings include a global distribution platform, XCover, which provides seamless insurance and protection services, and an API that enables instant claims payments in over 90 currencies. It primarily serve sectors such as retail, fintech, logistics, mobility and auto, gig economy, travel, property, and live event ticketing. It was founded in 2014 and is based in New York, New York.

Bolttech is an international insurtech company focused on creating a technology-enabled ecosystem for protection and insurance within the financial sector. The company's main offerings include a global insurance exchange platform that connects insurers, distributors, and customers, facilitating the purchase and sale of insurance and protection products. Bolttech primarily serves businesses across various sectors looking to integrate insurance solutions into their customer journeys, such as telecommunications, retail, e-commerce, real estate, and financial services. Bolttech was formerly known as EdirectInsure Group. It was founded in 2015 and is based in Singapore.

TONI Digital is a company that focuses on innovating in the insurance industry. The company offers a white-label solution that allows insurers, brokers, and distribution partners to create and offer tailored insurance products to their customers. These products cover a range of areas including car, building, travel, life, and household insurance. It was founded in 2017 and is based in Zurich, Switzerland.

Weecover specializes in embedded insurance solutions within the insurance technology sector. The company offers a plug-and-play insurance integration for online purchasing processes. It primarily serves sectors that include retail, mobility, financial technology, payments, energy, life, cyber, tickets and events, pets, travel, and health industries. The company was founded in 2019 and is based in Barcelona, Spain.

Hepstar specializes in the aggregation and personalized recommendation of travel ancillary products within the travel industry. The company's offerings include a recommendation engine that profiles customers using historical and behavioral data to provide relevant travel insurance and value-added services. Hepstar primarily serves the online travel provider sector, optimizing ancillary revenue and enhancing customer experiences. It was founded in 2013 and is based in Cape Town, South Africa.

Loading...