Shield AI

Founded Year

2015Stage

Debt - III | AliveTotal Raised

$1.071BValuation

$0000Last Raised

$200M | 9 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+5 points in the past 30 days

About Shield AI

Shield AI specializes in artificial intelligence for aviation, focusing on developing autonomous artificial intelligence (AI) pilots for various aircraft within the defense technology sector. The company's flagship product, Hivemind, enables drones and aircraft to operate autonomously without the need for global positioning system (GPS), communications, or human pilots, and is designed to adapt and react to dynamic environments in both military and commercial settings. It was founded in 2015 and is based in San Diego, California.

Loading...

Shield AI's Product Videos

ESPs containing Shield AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

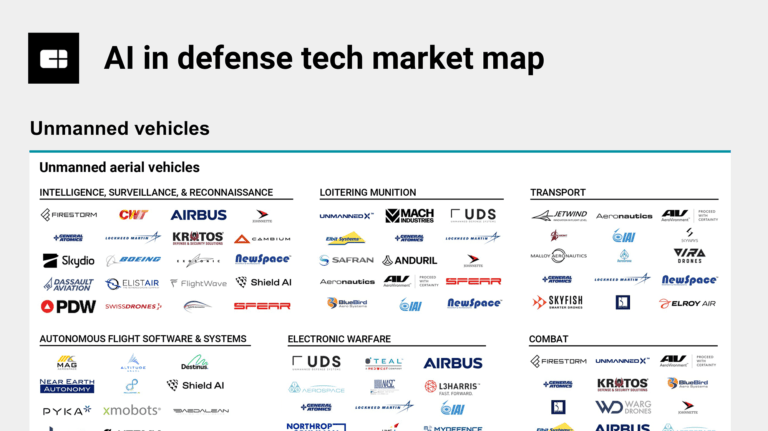

The autonomous flight software & systems market focuses on technologies and platforms that enable aircraft to operate without human intervention. This market includes solutions such as commercial drones, military unmanned aerial vehicles (UAVs), urban air mobility solutions, and autonomous cargo delivery systems. Key technologies driving this market include advanced sensors, artificial intelligenc…

Shield AI named as Leader among 10 other companies, including Altitude Angel, Merlin Labs, and Pyka.

Shield AI's Products & Differentiators

Hivemind

Shield AI’s stand-out product is Hivemind, an autonomy and artificial intelligence stack for military and commercial aircraft, designed from the ground up to be multi-role, multi-vehicle. Simply put, it is self-driving technology for aircraft. Hivemind enables swarms of aircraft to maneuver fully autonomously on the edge in high threat, GPS and communication degraded environments. It uses state-of-the-art path-planning, mapping, state-estimation, and computer vision algorithms, combined with reinforcement learning and simulations, to train unmanned systems to execute a variety of missions – from infantry clearance operations to breaching integrated air defense systems with unmanned aircraft.

Loading...

Research containing Shield AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Shield AI in 1 CB Insights research brief, most recently on Aug 14, 2024.

Aug 14, 2024

The AI in defense tech market mapExpert Collections containing Shield AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Shield AI is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

AI 100

399 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

Game Changers 2018

70 items

Artificial Intelligence

14,769 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Aerospace & Space Tech

2,889 items

These companies provide a variety of solutions, ranging from industrial drones to electrical vertical takeoff vehicles, space launch systems to satellites, and everything in between

Defense Tech

1,268 items

Defense tech is a broad field that encompasses everything from weapons systems and equipment to geospatial intelligence and robotics. Company categorization is not mutually exclusive.

Shield AI Patents

Shield AI has filed 4 patents.

The 3 most popular patent topics include:

- 3d imaging

- automation

- biometrics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/16/2019 | 4/14/2020 | Maintenance, Huawei mobile phones, Cooling technology, Automation, Mechanical engineering | Grant |

Application Date | 1/16/2019 |

|---|---|

Grant Date | 4/14/2020 |

Title | |

Related Topics | Maintenance, Huawei mobile phones, Cooling technology, Automation, Mechanical engineering |

Status | Grant |

Latest Shield AI News

Sep 11, 2024

News provided by Share this article Operational Restructuring Now Complete, Focus Turns to Higher Revenue Growth MONTREAL, Sept. 11, 2024 /PRNewswire/ - Haivision Systems Inc. ("Haivision" or the "Company") (TSX: HAI), a leading global provider of mission critical, real-time video networking and visual collaboration solutions, today announced its results for the third quarter ended July 31, 2024. "As we get closer to the end of our Fiscal 2024, I'm proud to say that we have completed our 2-year strategic plan for major EBITDA and profitability transformation," said Mirko Wicha, Chairman and CEO of Haivision. Successfully transitioning out of low margin businesses, our focus over the next two years will be to return Haivision to organic, double-digit revenue growth." Q3 2024 Financial Results Revenue of $30.6 million, down from the prior year comparative period, partially the result of delays in the U.S. budget approval, but also reflect our transformation away from the bespoke "integrator" model and our success in the long-term rental program. Gross Margins* were 75.0%, a significant improvement from 71.9% for the same prior year period. Total expenses were $21.9 million, a decrease of $3.8 million, from the same prior year period. Operating profit was $1.1 million, a $1.8 million or 333% improvement from the same prior year period. Adjusted EBITDA* was $4.1 million, consistent with the prior year period. Adjusted EBITDA Margins* was 13.5%, compared to 12.4% for the same prior year period. Net income was $0.4 million, a $1.3 million or 298% improvement from the same prior year period. Financial Results for the nine months ended July 31, 2024 Revenue of $99.4 million, down from the prior year comparative period, partially the result of delays in approval of the U.S. federal budget, but also reflects our transformation away from the bespoke integrator model, our success in the long-term rental program and are departure from the house of worship business. Gross Margins* were 73.1%, a notable improvement from 69.1% for the same prior year period. Total expenses were $67.4 million, a decrease of $7.0 million from the same prior year period. Operating profit was $5.2 million, a $7.7 million or 317% improvement from the same prior year period. Adjusted EBITDA* was $14.4 million, a $5.3 million or 78% improvement from the same prior year period. Adjusted EBITDA Margins* was 14.5%, a signficant improvement when compared to 8.7% for the same prior year period. Net income was $2.6 million, a $6.4 million or 243% improvement from the same prior year period. Key Company Highlights Haivision joins consortium with Airbus Defense and Space to develop new technologies for rapid, secure, and reliable communications. Haivision MCS awarded US$61.2 million (CAD$82 million) production agreement by U.S. Navy for next-generation combat visualization and video distribution systems. Haivision collaborates with Shield AI to bring together full-motion video with AI object detection for defense and ISR applications. France Television provides exclusive coverage of the Paris 2024 Olympic surfing competition with Haivision's private 5G video transmission ecosystem. Celebrated its 20-years anniversary as a leader and innovator in mission critical live video. Unveiled Hub 360, a cloud-based master control solution that streamlines live production workflows. Published its fifth annual Broadcast Transformation Report, highlighting the state of technology adoption in the broadcast industry. Awarded "Single/Dual-Stream Encoding Hardware" and "Best On-Prem Encoding/ Transcoding Solution" for the Makito X4 by Streaming Media Readers' Choice Awards. Joined the Panasonic Partner Alliance for live video production workflows with Kairos; joined the Sony Cloud Production Platform for low latency live video in the cloud; and partnered with Grabyo, a London-based live cloud production platform, enabling integrated solution for live multi-camera productions. Announced strategic partnerships with CP Communications, Flypack, RF Wireless Systems, and Vidovation to extend mobile video transmitters rental services into North America. "Haivision MCS's recent award of a C$82M production agreement by the U.S. Navy, the Airbus Defense development partnership, and our investment in AI development demonstrate our ability to deliver advanced technology solutions for our key markets. Said Dan Rabinowitz, Chief Financial Officer and EVP, Operations. These are but a few example of growth opportunities for the Company. It has clearly been a busy year for Haivision." Financial Results Revenue for the three months and nine months ended July 31, 2024 was $30.6 million and $99.4 million, respectively modest decrease when compared to the prior year comparative period. In this last quarter revenues were impacted by delays in the approval of a U.Ss Federal spending bill which, in turn, delayed certain procurement process; our transition away from the integrator model in the control room space, which offered lower-margined, third-party components; our long-term rental program which will offer a recurring revenue model and enhanced margins in our transmitter business; and our departure from the house of worship market in fiscal 2023. Gross Margin* for the three months and nine months ended July 31, 2024 was 75.0% and 71.9%, respectively compared to 72.0% and 69.1% for the prior year comparable periods. Gross Margin* were positively impacted by our decision to exit the managed services business; transitioning away from the integrator model in the control room market, decreases in the incremental costs of components procured during the worldwide component shortage, and supply chain improvements. Total expenses for the three months and nine months ended July 31, 2024 were $21.9 million and $67.4 million, respectively representing decrease of $3.8 million and $7.0 million when compared to from the prior year comparative periods, largely the result of recently completed restructuring efforts. The result of these Gross Margin* improvements and lower total expenses was operating profits for the three months and nine months ended July 31,, 2024 of $1.1 million and $5.3 million, respectively representing improvements of $1.6 million and $7.7 million when compared to the prior year comparable periods. Adjusted EBITDA* for the three months ended July 31, 2024 was $4.1 million a modest decrease of $0.2 million from the prior year period. However, Adjusted EBITDA* for the nine-month period ended July 31, 2024 was $14.4 million representing a significant increase of $5.3 million (or 58%) from the prior year comparative period. Adjusted EBITDA Margins* for the three months ended July 31, 2024, was 13.5% compared to 12.4% in the prior year comparative period. Adjusted EBITDA Margins* for the nine months ended July 31, 2024, was 14.5% compared to 8.7% in the prior year comparative period. Net income for the three months ended July 31, 2024, was $0.4 million representing an increase of $1.3 million from the prior year net loss of $0.9 million, and net income for the nine months ended July 31, 2024 was $2.6 million and increase of $6.4 million from the prior year loss of $3.8 million. *Measures followed by the suffix "*" in this press release are non-IFRS measures. For the relevant definition, see "Non-IFRS Measures" below. As applicable, a reconciliation of this non-IFRS measure to the most directly comparable IFRS financial measure is included in the tables at the end of this press release and in the Company's management's discussion and analysis for the three months and nine months ended July 31, 2024. Conference Call Notification Haivision will hold a conference call to discuss its second quarter financial results on Thursday, September 12, 2024 at 8:30 am (ET). To register for the call, please use this link https://registrations.events/direct/Q4I3341499 . After registering, a confirmation will be sent through email, including dial in details and unique conference call codes for entry. Financial Statements, Management's Discussion and Analysis and Additional Information Haivision's unaudited interim consolidated financial statements for the third quarter ended July 31, 2024 (the "Q3 Financial Statements"), the management's discussion and analysis thereon and additional information relating to Haivision and its business can be found under Haivision's profile on SEDAR+ at www.sedarplus.ca . The financial information presented in this release was derived from the Q3 Financial Statements. Forward-Looking Statements This release includes "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable securities laws, including, without limitation, statements regarding the Company's growth opportunities and its ability to execute on its growth strategy. In some cases, but not necessarily in all cases, forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "targets", "expects" or "does not expect", "is expected", "an opportunity exists", "is positioned", "estimates", "intends", "assumes", "anticipates" or "does not anticipate" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "will" or "will be taken", "occur" or "be achieved". In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. Forward-looking statements are not historical facts, nor guarantees or assurances of future performance but instead represent management's current beliefs, expectations, estimates and projections regarding future events and operating performance. Forward-looking statements are necessarily based on opinions, assumptions and estimates that, while considered reasonable by Haivision as of the date of this release, are subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ, possibly materially, from those indicated by the forward-looking statements include, but are not limited to, the risk factors identified under "Risk Factors" in the Company's latest annual information form, and in other periodic filings that the Company has made and may make in the future with the securities commissions or similar regulatory authorities in Canada, all of which are available under the Company's SEDAR+ profile at www.sedarplus.ca . These factors are not intended to represent a complete list of the factors that could affect Haivision. However, such risk factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. You should not place undue reliance on forward-looking statements, which speak only as of the date of this release. Haivision undertakes no obligation to publicly update any forward-looking statement, except as required by applicable securities laws. Non-IFRS Measures Haivision's consolidated financial statements for the third quarter ended July 31, 2024 are prepared in accordance with International Financial Reporting Standards ("IFRS"). As a compliment to results provided in accordance with IFRS, this press release makes reference to certain (i) non-IFRS financial measures, including "EBITDA", and "Adjusted EBITDA", (ii) non-IFRS ratios including "Adjusted EBITDA Margin", and (iii) supplementary financial measures including "Gross Margins" (collectively "non-IFRS measures"). These non-IFRS measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our financial information reported under IFRS. Rather, these non-IFRS measures are used to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. We also believe that securities analysts, investors, and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Our management also uses non-IFRS measures to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation. For information on the most directly comparable financial measure disclosed in the primary financial statements of Haivision, composition of the non-IFRS measures, a description of how Haivision uses these measures and an explanation of how these measures provide useful information to investors, refer to the "Non-IFRS Measures" section of the Company's management's discussion and analysis for the three months and nine months ended July 31, 2024, dated September 11, 2024, available on the Company's SEDAR+ profile at www.sedarplus.ca , which is incorporated by reference into this press release. As applicable, the reconciliations for each non-IFRS measure are outlined below. Non-IFRS measures should not be considered as alternatives to net income or comparable metrics determined in accordance with IFRS as indicators of the Company's performance, liquidity, cash flow and profitability. About Haivision Haivision is a leading global provider of mission-critical, real-time video streaming and visual collaboration solutions. Our connected cloud and intelligent edge technologies enable organizations globally to engage audiences, enhance collaboration, and support decision making. We provide high quality, low latency, secure, and reliable live video at a global scale. Haivision open sourced its award-winning SRT low latency video streaming protocol and founded the SRT Alliance to support its adoption. Awarded four Emmys® for Technology and Engineering from the National Academy of Television Arts and Sciences, Haivision continues to fuel the future of IP video transformation. Founded in 2004, Haivision is headquartered in Montreal and Chicago with offices, sales, and support located throughout the Americas, Europe, and Asia. Learn more at haivision.com. Thousands of Canadian dollars (except per share amounts) Three months ended

Shield AI Frequently Asked Questions (FAQ)

When was Shield AI founded?

Shield AI was founded in 2015.

Where is Shield AI's headquarters?

Shield AI's headquarters is located at 600 West Broadway, San Diego.

What is Shield AI's latest funding round?

Shield AI's latest funding round is Debt - III.

How much did Shield AI raise?

Shield AI raised a total of $1.071B.

Who are the investors of Shield AI?

Investors of Shield AI include Hercules Capital, Andreessen Horowitz, Point72 Ventures, SnowPoint Ventures, Disruptive and 11 more.

Who are Shield AI's competitors?

Competitors of Shield AI include Anduril and 7 more.

What products does Shield AI offer?

Shield AI's products include Hivemind and 2 more.

Loading...

Compare Shield AI to Competitors

Anduril builds defense products to aid in the protection of borders, infrastructure, and national security assets. It develops border control technology including towers with cameras, infrared sensors to track movement, air, and underwater systems for various defense and commercial missions, and more. The company was founded in 2017 and is based in Orange County, California.

Second Front Systems (2F) fast-tracks government access to software-as-a-service (SaaS) applications for national security missions. The platform provides features such as visualization of all apps and their statuses, details of security and release pipelines, and the ability to view applications' vulnerabilities. The company was founded in 2014 and is based in Wilmington, United States.

Aretec specializes in data science and technology solutions. The company offers a range of products and services including data analytics, artificial intelligence (AI) enabled tools, application development, cybersecurity, and cloud solutions, all designed to help businesses unlock the potential of their data and make informed decisions. It primarily serves sectors such as the public sector, fintech, and the private sector. It was founded in 2005 and is based in Fairfax, Virginia.

Certus Core focuses on data management and artificial intelligence in the technology sector. The company offers a range of products that enable organizations to make AI-powered decisions using its concepts and manage data based on entities, all through the use of semantic knowledge graphs and data ontology frameworks. Certus Core primarily serves sectors that require data management and decision-making capabilities, such as the military and financial intelligence sectors. Certus Core was formerly known as Certus Group. It was founded in 2021 and is based in Tampa, Florida.

In-Q-Tel is a strategic investor focused on accelerating the development and delivery of cutting-edge technologies in the national security domain. The company partners with innovative startups and provides investment to enhance the national security of the United States, offering services such as technology analysis and venture-backed startup partnerships. In-Q-Tel primarily serves U.S. government agencies with a need for advanced security technologies. In-Q-Tel was formerly known as Peleus and In-Q-It. It was founded in 1999 and is based in Arlington, Virginia. In-Q-Tel operates as a subsidiary of Central Intelligence Agency.

Vannevar Labs focuses on defense technology and strategic competition within the national security and defense sectors. The company develops software and hardware to support non-kinetic and intelligence missions, including new intelligence collection methods, maritime domain awareness, and tools to counter foreign disinformation campaigns. Vannevar Labs primarily serves sectors related to national security and defense. It was founded in 2019 and is based in Palo Alto, California.

Loading...