Sift

Founded Year

2011Stage

Secondary Market | AliveTotal Raised

$156.52MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-100 points in the past 30 days

About Sift

Sift provides real-time machine learning fraud prevention solutions for online businesses. Its machine-learning software automatically learns and detects fraudulent behavioral patterns and alerts businesses before they or their customers are defrauded. It provides its services in a wide range of industries such as financial technology, retail, payment service providers, and more. It was formerly known as Sift Science. It was founded in 2011 and is based in San Francisco, California.

Loading...

ESPs containing Sift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The device fingerprinting market, also referred to as device intelligence, offers customers a tool for identifying and authenticating devices accessing their systems or platforms. Device fingerprinting involves creating unique digital profiles based on various device attributes such as hardware, software, network configuration, and behavior patterns. This helps enhance security measures by detecti…

Sift named as Outperformer among 12 other companies, including Socure, Signifyd, and SEON Technologies.

Loading...

Research containing Sift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sift in 6 CB Insights research briefs, most recently on Mar 14, 2024.

Mar 14, 2024

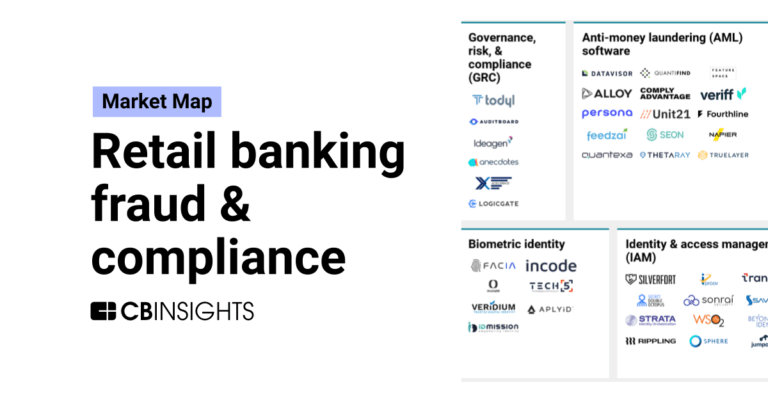

The retail banking fraud & compliance market map

Aug 14, 2023

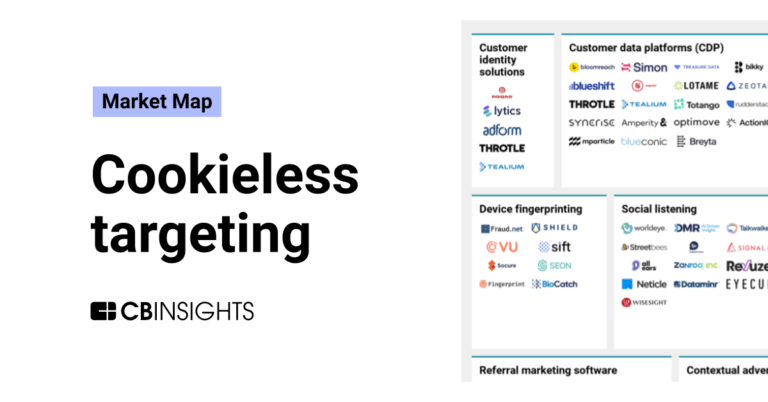

The cookieless targeting market map

Feb 27, 2023 report

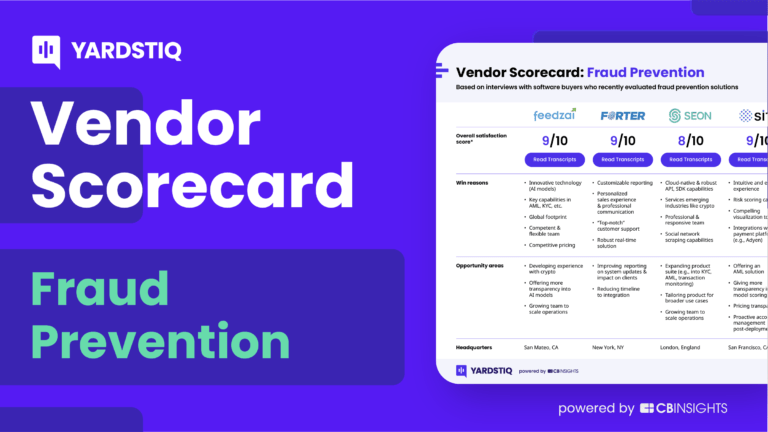

Top fraud prevention companies — and why customers chose themExpert Collections containing Sift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sift is included in 13 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Regtech

1,721 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Sift Patents

Sift has filed 45 patents.

The 3 most popular patent topics include:

- computer security

- social networking services

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/12/2023 | 7/23/2024 | Kernel methods for machine learning, Machine learning, Artificial intelligence, Natural language processing, Classification algorithms | Grant |

Application Date | 9/12/2023 |

|---|---|

Grant Date | 7/23/2024 |

Title | |

Related Topics | Kernel methods for machine learning, Machine learning, Artificial intelligence, Natural language processing, Classification algorithms |

Status | Grant |

Latest Sift News

Sep 19, 2024

News provided by Share this article Share toX SAN FRANCISCO, Sept. 19, 2024 /PRNewswire/ -- Lucinity and Sift have announced a partnership, unifying fraud and Anti-Money Laundering (AML) into Lucinity's integrated FinCrime compliance platform for case management, agent-enabled workflow automation, and Generative AI. Sift is an AI-powered fraud platform securing digital trust for leading global businesses. Its Global Data Network analyzes more than 1 trillion events and identity signals per year to prevent fraud across the entire consumer journey. Lucinity and Sift formed this new partnership to address the challenges of fragmented fraud and AML systems, aiming to centralize and enhance financial crime investigations. Sift's AI-powered solution will now be integrated into Lucinity's platform. This collaboration enhances Lucinity's ability to provide a seamless and efficient compliance solution. It allows teams to review and manage fraud alerts more effectively through Lucinity's unified Case Management system, thanks to the native integration between the systems. Key benefits to Lucinity's users include: Real-Time Fraud Screening: Payments are screened for potential fraud in real time, utilizing Sift's fraud detection capabilities. Automatic Payment Holds: Payments suspected of fraud are temporarily held, ensuring verification before processing. Streamlined Reviews: Compliance teams can conduct thorough reviews of flagged payments within Lucinity's Case Management solution. Risk Level Adjustments: Fraud detection parameters can be customized to adjust sensitivity levels, adapting to emerging fraud trends and risk appetites. This partnership also enables users to leverage Lucinity's Generative AI capabilities through the Luci copilot to investigate fraud cases more efficiently. Udi Nessimyan, President and Chief Revenue Officer of Lucinity, comments, "One of the greatest challenges in fighting financial crime is fragmented systems and data. Our partnership with Sift helps address this challenge by providing a centralized platform for various case types, including AML, fraud, sanctions, and ad hoc cases. Our collaboration significantly enhances the productivity of investigation teams, reducing the time spent on cases from hours to minutes." Sift's Chief Marketing Officer, Armen Najarian, emphasizes the collaborative effort to enhance financial crime prevention, stating, "Cybercriminals are increasingly leveraging AI to bypass traditional anti-money laundering and fraud controls, creating sophisticated and dynamic threats. To combat these evolving risks, companies must adopt a 'fight fire with fire' approach by leveraging AI-powered solutions. Through Sift's partnership with Lucinity, businesses can stay ahead of fraudsters, ensuring robust protection against abuse and enabling fearless growth."

Sift Frequently Asked Questions (FAQ)

When was Sift founded?

Sift was founded in 2011.

Where is Sift's headquarters?

Sift's headquarters is located at 525 Market Street, San Francisco.

What is Sift's latest funding round?

Sift's latest funding round is Secondary Market.

How much did Sift raise?

Sift raised a total of $156.52M.

Who are the investors of Sift?

Investors of Sift include Fabrica Ventures, Union Square Ventures, Insight Partners, Stripes Group, Spark Capital and 18 more.

Who are Sift's competitors?

Competitors of Sift include Venminder, BioCatch, Incognia, Accertify, ComplyAdvantage and 7 more.

Loading...

Compare Sift to Competitors

Signifyd provides e-commerce fraud protection and prevention services. The company offers services, including revenue protection, abuse prevention, and payment compliance, all aimed at maximizing conversion and eliminating fraud and consumer abuse. These services primarily cater to the e-commerce industry. Signifyd was founded in 2011 and is based in San Jose, California.

Forter focuses on fraud prevention and protection in the digital commerce industry. The company offers services such as fraud management, payment optimization, chargeback recovery, identity protection, and abuse prevention, all aimed at increasing revenue, reducing losses, and enhancing the customer experience. It primarily serves the digital commerce industry. It was founded in 2013 and is based in New York, New York.

Ravelin specializes in fraud prevention and payment security within the online business sector. The company offers a suite of solutions that utilize machine learning and human insights aiming to protect against online payment fraud, account takeovers, policy abuse, marketplace fraud, and optimization of three-dimensional secure transactions. Ravelin primarily serves online merchants looking to secure their transactions and enhance customer journey. It was founded in 2014 and is based in London, United Kingdom.

BioCatch is a company specializing in behavioral biometrics for fraud prevention and digital identity verification within the financial services sector. The company offers solutions that analyze online user behavior to detect and prevent fraud, money laundering, and various cyber threats. It was founded in 2011 and is based in Tel Aviv, Israel.

Feedzai focuses on financial crime prevention, operating within the financial technology and artificial intelligence (AI) sectors. The company offers a suite of solutions that use advanced machine learning to detect and prevent financial fraud, manage financial risk, and ensure compliance with regulatory requirements. Its primary customers are large financial organizations, including retail and corporate banks, fintech companies, and payment service providers. It was founded in 2011 and is based in San Mateo, California.

Fraud.net specializes in AI-powered fraud detection and prevention for various industries, including financial services and e-commerce. The company offers a suite of services that include real-time transaction monitoring, identity verification, and anti-money laundering (AML) compliance. Fraud.net's solutions cater to sectors such as financial services, e-commerce, travel, and government. It was founded in 2015 and is based in New York, New York.

Loading...