Sixfold

Founded Year

2023Stage

Series A | AliveTotal Raised

$21.5MLast Raised

$15M | 4 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+118 points in the past 30 days

About Sixfold

Sixfold specializes in generative artificial intelligence tools for the insurance underwriting sector. The company offers solutions that automate risk analysis, triage submissions, and summarize data, aiming to improve decision-making for insurers, managing general agents (MGA), and reinsurers. It primarily serves the insurance sector. The company was founded in 2023 and is based in New York, New York.

Loading...

Sixfold's Products & Differentiators

Sixfold Submit

Sixfold triages incoming submissions based on their alignment with the carrier's unique underwriting guidelines, allowing underwriters to identify high-priority cases that fit the carrier's risk appetite. By effectively triaging submissions, Sixfold enables underwriters to concentrate their efforts on the most promising and high-value cases. This targeted approach maximizes efficiency and increases the likelihood of successful underwriting outcomes.

Loading...

Research containing Sixfold

Get data-driven expert analysis from the CB Insights Intelligence Unit.

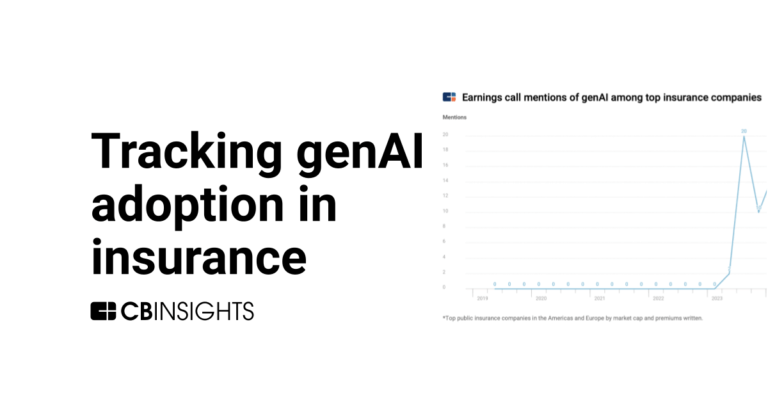

CB Insights Intelligence Analysts have mentioned Sixfold in 2 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024Expert Collections containing Sixfold

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sixfold is included in 6 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Insurtech

4,354 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,297 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Future Tech Hotshots

52 items

The 52 startups our data says are most likely to get a successful exit in the next decade

Insurtech 50

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Latest Sixfold News

Sep 14, 2024

By Christine Dobby, Bloomberg News September 13, 2024 at 3:30PM EDT Dan Rohinton, portfolio manager at iA Global Asset Management, joins BNN Bloomberg to discuss Canadian bank earnings. (Bloomberg) -- Bank of Montreal’s capital reserves will get a boost in the fourth quarter after the lender won a legal victory over its involvement in a multi-billion-dollar Minnesota Ponzi scheme. The Canadian bank will record an extra C$875 million ($644 million) after-tax in the fourth quarter, it said in a statement. The move reverses an earlier provision it took in a case related to the scheme orchestrated by disgraced businessman Tom Petters. BMO took the provision in 2022 after a jury found its subsidiary BMO Harris Bank liable for the actions of a predecessor bank. Petters, a Minnesota businessman, convinced investors he and his associates were financing the purchase of consumer electronics for resale to big-box retailers, but he never bought any and used money from new investors to pay returns to older ones. He was convicted of fraud in 2009 and sentenced to 50 years in prison. Petters originally used an account at National City Bank, which was bought by Milwaukee-based Marshall and Ilsley Bank in 2001. M&I was acquired by BMO Harris in 2011. The plaintiff in the lawsuit, the bankruptcy trustee for Petters’ former company, was barred from recovering funds in the case, according to a judgment Thursday from the US Court of Appeals for the Eighth Circuit. Capital Support The reversal should help support BMO’s regulatory capital levels, said Paul Gulberg, an analyst with Bloomberg Intelligence. Royal Bank of Canada analyst Darko Mihelic estimated it will increase BMO’s reported earnings per share by C$1.20 in the fourth quarter and bolster its common equity tier 1 capital ratio. BMO’s regulatory ratio should remain stable at 13%, versus a previously projected decline to 12.6%, he said. “We believe there is a small chance that this verdict gets appealed, but we believe that BMO reversing its provision shows confidence that this will likely not be the case,” Mihelic wrote in a report Friday. BMO faced a round of analyst downgrades last month after reporting higher-than-expected provisions for loan losses, fueling concerns that it is overexposed to US commercial lending. ©2024 Bloomberg L.P.

Sixfold Frequently Asked Questions (FAQ)

When was Sixfold founded?

Sixfold was founded in 2023.

Where is Sixfold's headquarters?

Sixfold's headquarters is located at 134 East 93rd Street 5A, New York.

What is Sixfold's latest funding round?

Sixfold's latest funding round is Series A.

How much did Sixfold raise?

Sixfold raised a total of $21.5M.

Who are the investors of Sixfold?

Investors of Sixfold include Crystal Ventures Fund, Bessemer Venture Partners, Scale Venture Partners, Salesforce Ventures, Zurich Innovation Championship and 3 more.

Who are Sixfold's competitors?

Competitors of Sixfold include Planck and 3 more.

What products does Sixfold offer?

Sixfold's products include Sixfold Submit and 1 more.

Loading...

Compare Sixfold to Competitors

UnderwriteMe offers a distribution platform to intermediaries and insurers in the United Kingdom as well underwriting automation products to insurers around the world. The firm's main products include a Protection Platform and a Decision Platform. The Protection Platform provides insurance agents, financial advisers, mortgage brokers, and price comparison websites with a seamless buying experience for Protection (life insurance) products. The Decision Platform allows insurers to optimize their underwriting process and drive high levels of automation through intuitive rules-based design (Underwriting Engine), third-party data integration (Decision Studio), and natural language processing for unstructured health data (Text Mining). It is based in London, United Kingdom.

Federato specializes in AI underwriting solutions for the insurance sector, focusing on portfolio management and risk assessment. The company offers a RiskOps platform that integrates real-time risk selection and portfolio insights to support underwriters in making informed decisions. Federato's platform is designed to streamline the underwriting process, enhance data utilization, and align underwriting actions with portfolio strategy. It was founded in 2020 and is based in Palo Alto, California.

Skopenow operates as a technology company providing comprehensive threat intelligence and open-source intelligence (OSINT) solutions. The company offers products that enable organizations to gather and analyze open-source information, identify trends and patterns in the data, and detect emerging threats and fraud. It primarily serves sectors such as insurance, legal, global security, law enforcement, government, and media. It was founded in 2016 and is based in New York, New York.

Wenalyze specializes in open data analytics for the commercial insurance and bancassurance sectors. The company offers solutions that classify SME activities, improve data accuracy, and provide actionable insights for better decision-making. Wenalyze's technology aids financial institutions in understanding their clients' insurance needs through enriched data on merchant activities. It was founded in 2018 and is based in London, United Kingdom.

Urbanico focuses on urban intelligence, providing services in the insurance technology sector. The company offers real-time, hyper-local urban data analysis to enhance property and casualty insurers' ability to price, select, and underwrite risks. Urbanico's platform serves insurance carriers by delivering contextual urban risk factors to improve their underwriting and pricing practices. It was founded in 2019 and is based in Jerusalem, Israel.

NeuralMetrics specializes in providing generative AI data solutions for the insurance underwriting sector. The company offers a suite of services that includes industry classification, risk intelligence, and market data engines to support property and casualty insurers with accurate risk assessment, policy pricing, and lead management. NeuralMetrics' AI-driven platform delivers data for underwriting, lessor's risk assessment, book roll analytics, exposure monitoring, premium audit, and renewal support, aiming to enhance productivity and compliance in the insurance industry. It was founded in 2018 and is based in Denver, Colorado.

Loading...