Slope

Founded Year

2021Stage

Series C | AliveTotal Raised

$127.13MLast Raised

$15M | 2 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+182 points in the past 30 days

About Slope

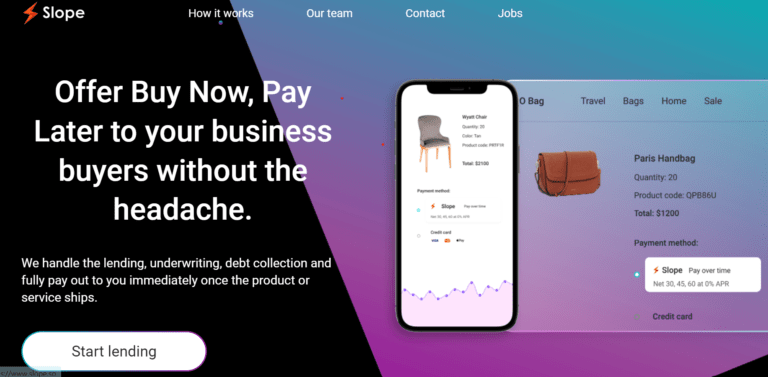

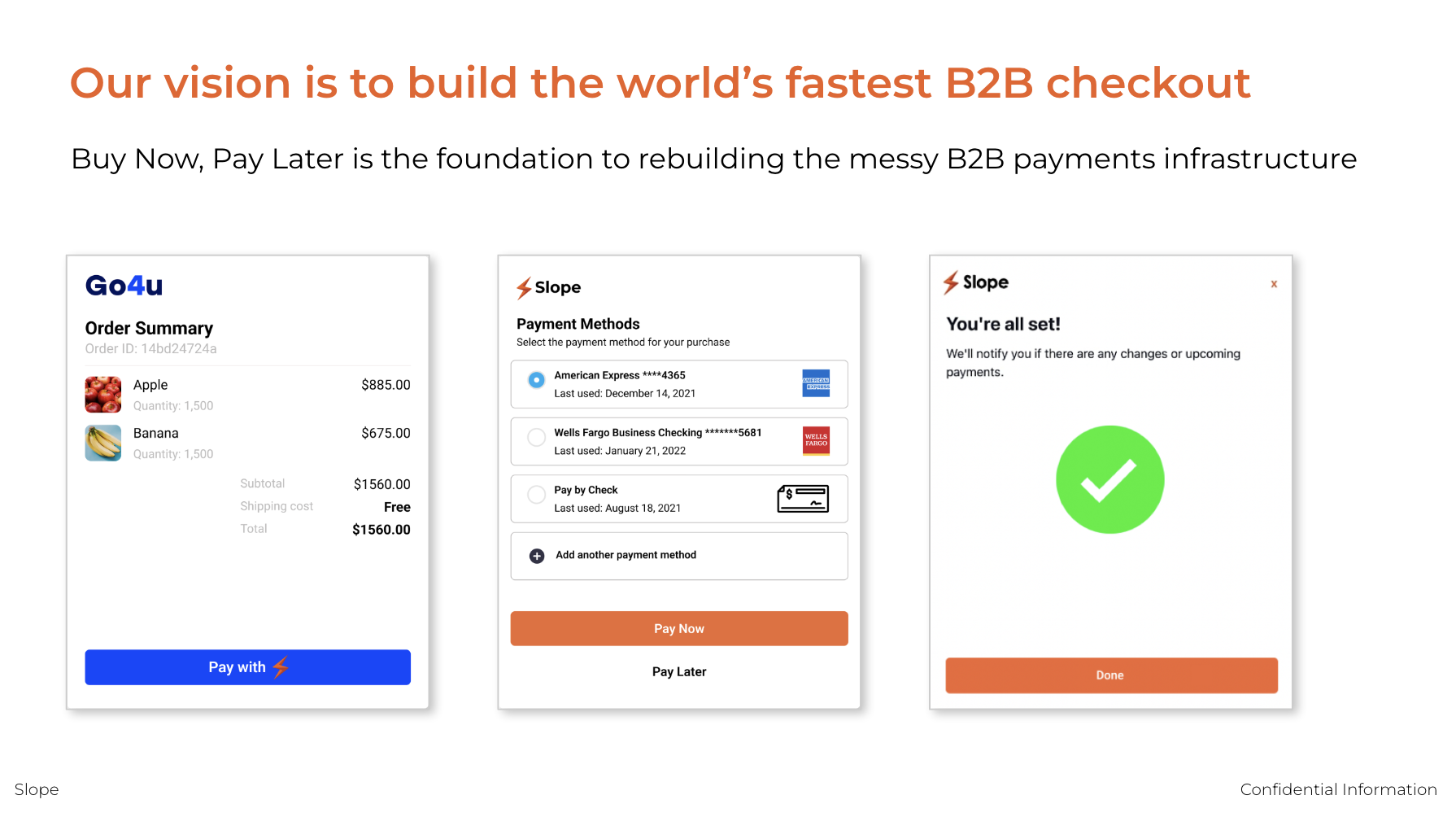

Slope specializes in B2B workflow automation within the financial technology sector. The company offers solutions for online payment processing, flexible payment terms, and automates the entire order-to-cash cycle using its software and APIs. Slope primarily caters to businesses looking to streamline their financial operations and payment systems. It was founded in 2021 and is based in San Francisco, California.

Loading...

Slope's Product Videos

ESPs containing Slope

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2B payments market offers flexible financing options for businesses to enhance their purchasing power and manage their working capital and cash flow by acquiring goods or services immediately and paying for them in installments over time. BNPL solutions in the B2B market provide streamlined application processes, quick approvals, and transparent terms for businesses…

Slope named as Highflier among 15 other companies, including PayPal, Amount, and Hokodo.

Slope's Products & Differentiators

Pay Later for B2B

Slope offers flexible payment plans for businesses

Loading...

Research containing Slope

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Slope in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Expert Collections containing Slope

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Slope is included in 4 Expert Collections, including Digital Lending.

Digital Lending

2,428 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

2,986 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,218 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Slope News

Aug 12, 2024

Share this article: Grace Howie, vice-president of trade and working capital fintech & product strategy at J.P. Morgan Payments, and Ashish Jain, CFO at Slope, a B2B payments platform, explain how J.P. Morgan’s debt facility and strategic investment support Slope on its rapid expansion and provide J.P. Morgan clients access to Slope’s embedded finance solution. Starting this July, the companies have engaged in a strategic alliance to unlock cash flow constraints for J.P. Morgan clients’ small and medium-sized enterprise (SME) business customers in a timely manner. Q: The ongoing volatility within global trade means that businesses are experiencing a prolonged period of pressure on their cash flows. Where are you focusing your efforts to support clients in these challenging times? Howie: In today’s environment, there are a number of factors impacting the cash flow of a business, from geopolitical events and nearshoring, to inflation, higher-for-longer rates and quantitative tightening. This means operating margins are being squeezed, with inventory purchases and capital expenditure often being delayed. With tighter lending standards, it is harder for SMEs to obtain access to credit, especially when there is already an estimated US$2.5tn lending gap . And given the macro environment, where pressure on cash flow is already prominent, if SMEs don’t have access to credit, they can’t purchase the inventory that they need to survive and continually grow their business, leading to supply chain disruptions – especially for the enterprise clients that trade and working capital serve. As such, we continually look for ways to support our clients and their business customers. Working with Slope means we can provide much-needed support to our clients’ customers, SMEs, which make up around 90% of all businesses and truly represent the backbone of our economy. It is critical that we provide effective tools to meet their working capital and supply chain requirements, enabling their businesses to grow, and help strengthen global trade more broadly. Q: How did the relationship with Slope originate and how does the solution respond to the challenges depicted and the growing need for enhanced digital B2B payments? Howie: At J.P. Morgan Payments, we are committed to expanding our trade and working capital solutions to meet client needs, and we constantly monitor trends and work with our clients to understand how to prioritise our investments. When looking to enhance our capabilities, we consider various options around whether to build, buy or partner, as well as how to leverage the power of J.P. Morgan firm-wide to support our clients. We strongly believe in the power of collaboration as a means of bringing best-in-class capabilities to our clients. Especially with the rise of omnichannel, direct-to-consumer sale strategies and multiple inbound client requests, it became clear there was a need to provide an integrated solution for our clients, as merchants. Merchants, in particular, want simple-to-implement solutions that enable them to provide liquidity to their customers at the point of sale via their online checkout, in-store or out in the field. As such, our focus was to find a solution that not only offered our clients the ability to receive payment at point of purchase, but also, importantly, to offer an extension of payment terms to their business customers to help procure the required inventory and gain access to credit. And in this instance, because there is a need to offer a flexible front-end origination and underwriting platform, the partnership route made sense. Slope, a digital B2B payments platform, is a rapidly growing fintech that aims to digitise the US$125tn B2B payments market by providing short-term embedded financing, order-to-cash automation, credit management and data enrichment solutions, via its innovative and AI-driven approach. It made sense for J.P. Morgan Payments to form a strategic relationship with Slope, since their order-to-cash automation solution and AI-driven underwriting capabilities will help us diversify our product offerings to address these unmet client needs. We are excited to be working with Ashish and the team at Slope to unlock ways to better serve this target market. Jain: Equally, as a company that serves some of the largest enterprises globally, J.P. Morgan is an ideal organisation for us to work with. The team understands what is going on at the heart of the US economy, especially when it comes to enterprise clients that are looking to digitise their order-to-cash workflow and provide for the needs of their end business customers. Slope’s mission is to transition the world’s B2B economy online. We look to bring simplicity and flexibility to B2B payments so businesses can seamlessly handle transactions digitally and be empowered with the resources that they need to grow. In a nutshell, what Slope does is take an embedded finance approach to create an efficient experience between a merchant and its business customers. We seek to help those customers to readily purchase goods from the merchant, while also helping that merchant to enhance its own offerings by being able to accept various forms of payment. Howie: And through our agreement, we can now refer our clients, as merchants, to Slope, with the J.P. Morgan debt facility providing the capital on the back-end to extend the payment terms, in the form of a loan. Q: Drilling down into the solution, what benefits can Slope’s offerings – and this relationship – bring for merchants and their business customers? Jain: We aim to create a streamlined, end-to-end experience between a merchant and its business customers. Key to this is addressing all the existing manual workflows that are involved in B2B transactions. In particular, Slope is transforming onboarding and underwriting processes through automation, removing the need for businesses to provide know your customer (KYC) and know your business (KYB) documents, and also the need for merchants to carry out a range of time-consuming credit checks and ongoing monitoring. This enables business customers to get through the funnel faster, making approval far more streamlined and efficient, and thereby allowing customers to access all-important credit quickly and easily – to the degree that underwriting decisions can be made within seconds. In turn, this drives traffic to the merchant’s website, and, if a customer has a great experience, this leads to increased business retention. What we effectively do is drive conversion, volumes and repeat purchases. Another feature that really sets this offering apart is the payment flexibility. It is important for business customers to have different payment options available to them; they might prefer to pay via their bank, Automated Clearing House or a credit card. And together, we are able to do all that, with J.P. Morgan Payments powering money movement from end to end. Howie: It has been found that nine out of 10 CFOs want more accounts receivables automation in order to solve payment delays and discrepancies in invoicing . And this speaks to the problem that Slope is solving: if you integrate a suite of payment solutions at checkout, inclusive of a financing solution for business customers, it enables the merchant to receive payment – in the mode of the customer’s choice – at the point of purchase. This, therefore, helps to mitigate non-payment risk for J.P. Morgan clients as merchants while simultaneously keeping business customers happy with access to credit, purchasing larger amounts of inventory without draining cash, improving supply chain health and supporting growth. Moreover, business customers are able to automate their accounts payables process, further enhancing efficiency and cash flow, and ultimately leading to increased savings and reduced payment delays. It is a win-win. Q: How is Slope applying technology to deliver these enhancements? Jain: Among everything we do, we believe our application of AI to data enrichment and risk management has led to the greatest business impact. Our team is deeply technical; many of our employees come from backgrounds across autonomous driving, AI research and robotics. We chose to build our entire stack on top of real-time data (open banking) and an underwriting system with instant onboarding, continuous monitoring and active learning built in. These design choices were second nature to us, but an anomaly in finance, where loan applications take days, processes are manual, and data is not real-time. Achieving such a level of automation is only possible by deeply integrating AI at every step. For instance, bank transactions are messy, complex and context-dependent. To solve this we built Slope TransFormer , a proprietary large language model (LLM) trained to understand, enrich and categorise bank transactions with human-level precision. Another example is KYB: traditional solutions are surface-level and lagging – often requiring a human to manually check for web presence, legitimacy and bankruptcies. To solve this we built DeepKYB, an AI agent with web access trained to carry out the entire due diligence process and generate a report that’s fed directly into our database. Importantly, all these systems are built to continuously improve with more and more data. These advancements ultimately lead to concrete benefits for our customers, such as instant, automated approvals, and impact our bottom line with approval rates, loss rates and operating costs. Howie: The AI capabilities that Slope has are true market differentiators in this space. The fact that they not only use AI for initial underwriting but also for the ongoing risk monitoring of the portfolio is what really attracted us to Slope. The continuous reviewing of a business customer means Slope’s team can be alerted to circumstances that allow a higher credit limit to be provided to them, bringing huge value to those businesses. That isn’t something we’ve seen anywhere else in the market. Get listed in GTR Directory now! Become a part of the most comprehensive contact listing of service providers in the global trade, commodity and export finance markets. Subscribe Privacy Policy Our privacy commitments This Privacy Policy outlines the information we may collect about you in relation to your use of our websites, events, related publications and services (“personal data”) and how we may use that personal data. It also outlines the methods by which we and our service providers may (subject to necessary consents) monitor your online behaviour to deliver customised advertisements, marketing materials and other tailored services. This Privacy Policy also tells you how you can verify the accuracy of your personal data and how you can request that we delete or update it. This Privacy Policy applies to all websites operated by Exporta Publishing & Events Ltd (as indicated on the relevant website). This privacy statement does not cover the activities of third parties, and you should consult those third-party sites’ privacy policies for information on how your data is used by them. Any questions regarding this Policy and our privacy practices should be sent by e-mail to privacy@gtreview.com or by writing to Data Protection Officer at, Exporta Publishing & Events Ltd, 4 Hillgate Place, London, SW12 9ER, United Kingdom. Alternatively, you can telephone our London headquarters at +44 (0) 20 8673 9666. Who are we? Established in 2002 and with offices in London and Singapore, Exporta Publishing & Events Ltd is the world’s leading trade and trade finance media company, offering information, news, events and services for companies and individuals involved in global trade. Our principal business activities are: Business-to-Business financial publishing. We provide a range of products and services focused on international commodities, export, supply chain and trade finance markets including magazines, newsletters, electronic information and data Organisers of seminars, conferences, training courses and exhibitions for the finance industry Exporta Publishing & Events Ltd is a company registered in the United Kingdom with company number 4407327 | VAT Registration: 799 1585 59 Data Protection Policy This Data Protection Policy explains when and why we collect personal information about people who visit our website, how we use it, the conditions under which we may disclose it to others and how we keep it secure. Why do we collect information from you? Our primary goal in collecting personal data from you is to give you an enjoyable customised experience whilst allowing us to provide services and features that will meet your needs. We collect certain personal data from you, which you give to us when using our Site and/or registering or subscribing for our products and services. However, we also give you the option to access our Sites’ home pages without subscribing or registering or disclosing your personal data. We also collect certain personal data from other group companies to whom you have given information through their websites (including, by way of example, Exporta Publishing & Events Ltd and subsidiaries, in accordance with the purposes listed below). Should we discover that any such personal data has been delivered to any of the Sites, we will remove that information as soon as possible. Why this policy exists Complies with data protection law and follow good practice Protects the rights of staff, customers and partners Is open about how it stores and processes individuals’ data pretexts itself from the risk of a data breach We may change this Policy from time to time so please check this page occasionally to ensure that you’re happy with any changes. By using our website, you’re agreeing to be bound by this Policy. Data protection law The Data Protection Act 1998 described how organisations – including Exporta Publishing & Events Ltd – must collect, handle and store personal information. These rules apply regardless of whether data is stored electronically, on paper or on other materials. To comply with the law, personal information collected must be stored safely, not disclosed unlawfully and used fairly. The Data Protection Act is underpinned by eight important principles. These say that personal data must: Be processed fairly and lawfully Be obtained only for specific, lawful purposes Be adequate, relevant and not excessive Be accurate and kept up to date Not be held for any longer than necessary Processed in accordance with the rights of data subjects Be protected in appropriate ways Not be transferred outside the European Economic Area (EEA), unless that country of territory also ensures an adequate level of protection How do we collect information from you? We obtain information about you when you use our website, for example, when you contact us about products and services, when you register for an event, register to receive eNewsletters, subscribe or register for a trial to our GTR magazine/website. Types of Personal Data Held and its Use 1. Customer Services and Administration On some Sites, Exporta Publishing & Events Ltd collects personal data such as your name, job title, department, company, e-mail, phone, work and/or home address, in order to register you for access to certain content, subscriptions and events. In addition, we may also store information including IP address and page analytics, including information regarding what pages are accessed, by whom and when. This information is used to administer and deliver to you the products and/or services you have requested, to operate our Sites efficiently and improve our service to you, and to retain records of our business transactions and communications. By using the Sites and submitting personal information through the registration process you are agreeing that we may collect, hold, process and use your information (including personal information) for the purpose of providing you with the Site services and developing our business, which shall include (without limitation) the purposes described in the below paragraphs. 2. Monitoring use of our Sites Where, as part of our Site services, we enable you to post information or materials on our Site, we may access and monitor any information which you upload or input, including in any password-protected sections. Subject to any necessary consents, we also monitor and/or record the different Sites you visit and actions taken on those Sites, e.g. content viewed or searched for. If you are a registered user (e.g. a subscriber or taking a trial), when you log on, this places a cookie on your machine. This enables your access to content and services that are not publicly available. Once you are logged on, the actions you take – for example, viewing an article – will be recorded (subject to any necessary consents). We may use technology or a service provider to do this for us. This information may be used for one or more of the following purposes: to fulfil our obligations to you; to improve the efficiency, quality and design of our Sites and services; to see which articles, features and services are most read and used to track compliance with our terms and conditions of use, e.g. to ensure that you are acting within the scope of your user licence; for marketing purposes (subject to your rights to opt-in and opt-out of receiving certain marketing communications) – see paragraph 3 below; for advertising purposes, although the information used for these purposes does not identify you personally. Please see paragraph 5 below for more details; to protect or comply with our legal rights and obligations; and to enable our journalists to contact and interact with you online in connection with any content you may post to our Sites. Please see paragraph 5 below for more information on cookies and similar technologies and a link to a page where you can turn them on or off. 3. Marketing Some of your personal data collected under paragraphs 1 and 2 above may be used by us to contact you by e-mail, telephone and/or post for sending information or promotional material on our products and/or services and/or those of our other group companies.We give you the opportunity to opt-out of receiving marketing communications. Further detail can be found on the applicable Site and in the footer of each marketing communication sent by us, our group companies or service providers. See also “Consents and opt-outs” section below.We will not share your information with third parties for marketing purposes. 4. Profiling We may analyse your personal information to create a profile of your interests and preferences so that we can contact you with information relevant to you. 5. Cookies and similar technologies All our Sites use cookies and similar technical tools to collect information about your access to the Site and the services we provide. What is a cookie? When you enter some sites, your computer will be issued with a cookie. Cookies are text files that identify your computer to servers. Cookies in themselves do not identify the individual user, just the computer used. Many sites do this whenever a user visits their site in order to track traffic flows, recording those areas of the site that have been visited by the computer in question, and for how long. Users have the opportunity to set their computers to accept all cookies, to notify them when a cookie is issued, or not to receive cookies at any time. Selecting not to receive means that certain personalised services Exporta Publishing & Events Ltd offers cannot then be provided to that user. Why do we use cookies? Log In – Where we provide log in mechanisms for site users a cookie is created at login and for the duration of the session. Each cookie contains a unique reference number only (no personal information) which is used to confirm you are authorised. Analytics – To allow us to keep track of traffic to our website we use cookies. The cookies simply tell us if you have previously visited our website so we can get more accurate figures for New vs Returning visitors. Find and control your cookies All of the major browser providers offer advice on setting up and using the privacy and security functions for their products. If you require technical advice or support for a specific browser/version please contact the provider or visit their website for further details:www.microsoft.com / www.mozilla.com / www.apple.com / www.opera.com / www.aol.com / www.netscape.com / www.flock.com / www.google.com. We may use cookies to: remember that you have used the Site before; this means we can identify the number of unique visitors we receive to different parts of the Site. This allows us to make sure we have enough capacity for the number of users that we get and make sure that the Site runs fast enough remember your login session so you can move from one page to another within the Site; store your preferences or your user name and password so that you do not need to input these details every time you visit the Site; customise elements of the layout and/or content of the pages of Site for you; record activity on our Sites so that we understand how you use our Sites enabling us to better tailor our content, services and marketing to your needs; collect statistical information about how you use the Site so that we can improve the Site; and gather information about the pages on the Site that you visit, and other information about other websites that you visit, so as to place you in a “market segment”. This information is only collected by reference to the IP address that you are using, but does include information about the county and city you are in, together with the name of your internet service provider. Most web browsers automatically accept cookies but, if you prefer, you can change your browser to prevent that, or to notify you each time a cookie is set. You can also learn more about cookies in general by visiting www.allaboutcookies.org which includes additional useful information on cookies and how to block cookies using different types of browser. Please note however, that by blocking, deleting or turning off cookies used on the Site you may not be able to take full advantage of the Site. 6. E-mail tracking E-mail tracking is a method for monitoring the e-mail delivery to those subscribers who have opted-in to receive marketing e-mails from GTR, including GTR Africa, GTR Asia, GTR Americas, GTR Europe, GTR Mena, GTR eNews, Third party e-mails and GTR Ventures. Why do we track e-mails? So that we can better understand our users’ needs, we track responses, subscription behaviour and engagement to our e-mails – for example, to see which links are the most popular in newsletters. They enable us to understand the consumers journey through metrics including open rate, click-through rate, bounces and unsubscribes. Any other purposes for which Exporta Publishing & Events Ltd wishes to use your personal data will be notified to you and your personal data will not be used for any such purpose without obtaining your prior consent. How do you track GTR eNewsletters? To do this, we use pixel GIFs, also known as “pixel tags” – these are small image files that are placed within the body of our e-mail messages. When that image is downloaded from our web servers, the e-mail is recorded as being opened. By using some form of digitally time-stamped record to reveal the exact time and date that an e-mail was received or opened, as well the IP address of the recipient. 7. Consents and opt-outs You can give your consent to opt-out of all or any particular uses of your data as indicated above by: Indicating at the point on the relevant Site where personal data is collected Informing us by e-mail, post or phone Updating your preferences on the applicable Site or eNewsletter (unsubscribe and preference options are available in the footer of each eNewsletter) To turn cookies and similar technologies on and off, see the information in paragraph 5 above.Any questions regarding consents and opt-outs should be sent by e-mail to privacy@gtreview.com or by writing to Data Protection Officer at, Exporta Publishing & Events Ltd, 4 Hillgate Place, London, SW12 9ER, United Kingdom. Alternatively, you can telephone our London headquarters at +44 (0) 20 8673 9666. 8. Disclosures Information collected at one Site may be shared between Exporta Publishing & Events Ltd and other group companies for the purposes listed above. We may transfer, sell or assign any of the information described in this policy to third parties as a result of a sale, merger, consolidation, change of control, transfer of assets or reorganisation of our business. 9. Public forums, message boards and blogs Some of our Sites may have a message board, blogs or other facilities for user generated content available and users can participate in these facilities. Any information that is disclosed in these areas becomes public information and you should always be careful when deciding to disclose your personal information. 10. Data outside the EEA Services on the Internet are accessible globally so collection and transmission of personal data is not always limited to one country. Exporta Publishing & Events Ltd may transfer your personal data, for the above-listed purposes to other third parties, which may be located outside the European Economic Area and/or with a different level of personal data protection. However, when conducting transfers, we take all necessary steps to ensure that your data is treated reasonably, securely and in accordance with this Privacy Statement. Who has access to your information? Confidentiality and Security of Your Personal Data We are committed to keeping the data you provide us secure and will take reasonable precautions to protect your personal data from loss, misuse or alteration. However, the transmission of information via the internet is not completely secure. Although we will do our best to protect your personal data, we cannot guarantee the security of your data transmitted to our Site; any transmission is at your own risk. Once we have received your information, we will use strict procedures and security features described above to try to prevent unauthorised access. We have implemented information security policies, rules and technical measures to protect the personal data that we have under our control from: unauthorised access unlawful destruction or accidental loss All our employees, contractors and data processors (i.e. those who process your personal data on our behalf, for the purposes listed above), who have access to, and are associated with the processing of your personal data, are obliged to keep the information confidential and not use it for any other purpose than to carry out the services they are performing for us. Responsibilities Everyone who works for or with Exporta Publishing & Events Ltd has some responsibility for ensuring data is collected, stored and handled appropriately. Each team handling personal data must ensure that it is handled and processed in line with this policy and data protection principles. However, the following people have key areas of responsibility.The board of directors is ultimately responsible for ensuring that Exporta Publishing & Events Ltd meets its legal obligations. Name of Data Controller The Data Controller is Exporta Publishing & Events Ltd. Exporta Publishing & Events Ltd is subject to the UK Data Protection Act 1998 and is registered in the UK with the Information Commissioner`s Office. How to access, update and erase your personal information If you wish to know whether we are keeping personal data about you, or if you have an enquiry about our privacy policy or your personal data held by us, in relation to any of the Sites, you can contact the Data Protection Officer via: By writing to this address: Data Protection Officer, Exporta Publishing & Events Ltd, 4 Hillgate Place, London, SW12 9ER, UK Telephone: +44 (0) 20 8673 9666 E-mail: privacy@gtreview.com Upon request, we will provide you with a readable copy of the personal data which we keep about you. We may require proof of your identity and may charge a small fee (not exceeding the statutory maximum fee that can be charged) to cover administration and postage. Exporta Publishing & Events Ltd allows you to challenge the data that we hold about you and, where appropriate in accordance with applicable laws, you may have your personal information: erased Disclosing data for other reasons In certain circumstances, the Data Protection Act allows personal data to be disclosed to law enforcement agencies without the consent of the data subject. Under these circumstances, Exporta Publishing & Events Ltd, will disclose requested data. However, the Data Controller will ensure the request is legitimate, seeking assistance from the board and from the company’s legal advisors where necessary. Changes to this Privacy Statement We will occasionally update this Privacy Statement to reflect new legislation or industry practice, group company changes and customer feedback. We encourage you to review this Privacy Statement periodically to be informed of how we are protecting your personal data. Providing information Exporta Publishing & Events Ltd aims to ensure that individuals are aware that their data is being processed, and that they understand. How the data is being used How to exercise their rights To this end, the company has a privacy statement, setting out how data relating to individuals is used by the company. This is available on request and available on the company’s website. Review of this policy

Slope Frequently Asked Questions (FAQ)

When was Slope founded?

Slope was founded in 2021.

Where is Slope's headquarters?

Slope's headquarters is located at 7 Freelon Street, San Francisco.

What is Slope's latest funding round?

Slope's latest funding round is Series C.

How much did Slope raise?

Slope raised a total of $127.13M.

Who are the investors of Slope?

Investors of Slope include Y Combinator, Jack Altman, J.P. Morgan Payments, Union Square Ventures, Monashees+ and 13 more.

Who are Slope's competitors?

Competitors of Slope include Tranch, Hokodo, Pledg, Aria, Treyd and 7 more.

What products does Slope offer?

Slope's products include Pay Later for B2B and 2 more.

Who are Slope's customers?

Customers of Slope include Plastiq, Frubana and Go4u.

Loading...

Compare Slope to Competitors

Tino offers a business-to-business (B2B) buy now, pay later services. It allows sellers such as industries and commercial vendors to grant credit while minimizing default risk. It also allows buyers or merchants to access credit to buy inventory from their suppliers. The company was formerly known as TruePay. It was founded in 2020 and is based in Sao Paulo, Brazil.

Mondu's solution enables merchants and marketplaces to offer their business customers the most popular B2B payment methods and flexible payment terms in a multi-channel setting, both online and offline. It empowers business customers to purchase and pay when they want, which translates to a higher conversion rate and average order value, and drives growth for merchants and marketplaces. Mondu was founded in 2021 and is based in Berlin, Germany.

Two specializes in B2B Buy Now Pay Later (BNPL) payment solutions within the e-commerce sector. The company offers services that enable merchants to provide high net term credit limits, manage credit and fraud risks, and streamline the checkout process for business customers. Two's solutions cater to various sectors including construction, wholesale, B2B marketplaces, and SaaS. Two was formerly known as Tillit. It was founded in 2020 and is based in Oslo, Norway.

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Klarna specializes in providing payment solutions and services within the e-commerce sector. The company offers a platform for online shopping that includes price comparisons, deals, and various payment options to facilitate purchases for consumers. Klarna primarily serves the e-commerce industry by enabling a seamless shopping experience through its payment and financing services. It was founded in 2005 and is based in Stockholm, Sweden.

Fluid provides checkout solutions for B2B businesses. The company offers a range of flexible payment options, allowing buyers to either pay immediately or select credit terms that fit their specific needs. Fluid primarily serves the B2B sector in Asia. It was founded in 2023 and is based in Singapore.

Loading...