Sendbird

Founded Year

2013Stage

Series C | AliveTotal Raised

$219.64MValuation

$0000Last Raised

$100M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-61 points in the past 30 days

About Sendbird

Sendbird focuses on providing in-application communication solutions, operating within the technology and communications industry. The company offers a platform that enables businesses to integrate chat, voice, video, and livestream capabilities into their applications, enhancing customer engagement and retention. Sendbird primarily serves sectors such as financial services, digital health, marketplaces, on-demand services, retail and travel, and social communities. It was founded in 2013 and is based in San Mateo, California.

Loading...

ESPs containing Sendbird

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital adoption platforms market is a fast-growing space that offers businesses a solution to streamline the adoption and usage of digital tools and applications. These platforms provide interactive guidance and training to end-users, allowing them to quickly and effectively learn how to use new software, reducing frustration and improving productivity. They can also help businesses reduce tr…

Sendbird named as Challenger among 15 other companies, including Oracle, WalkMe, and WhatFix.

Loading...

Research containing Sendbird

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sendbird in 7 CB Insights research briefs, most recently on May 17, 2023.

Nov 28, 2022

The Transcript from Yardstiq: Feel the churn

Oct 26, 2022 report

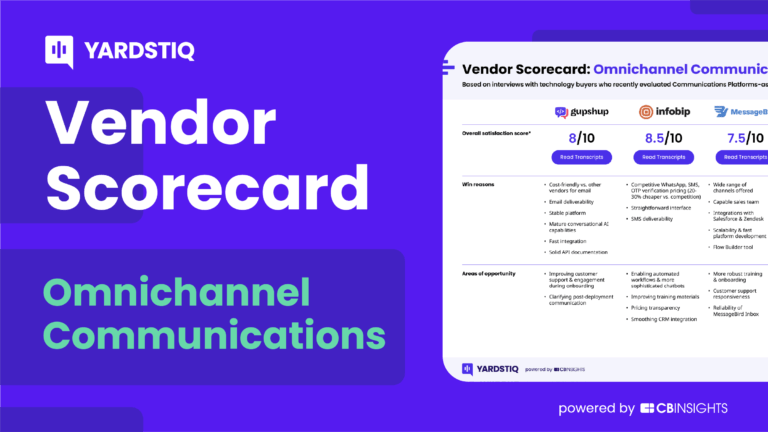

Top omnichannel communications companies — and why customers chose them

Oct 11, 2022

The Transcript from Yardstiq: Klarna vs. Afterpay

Expert Collections containing Sendbird

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

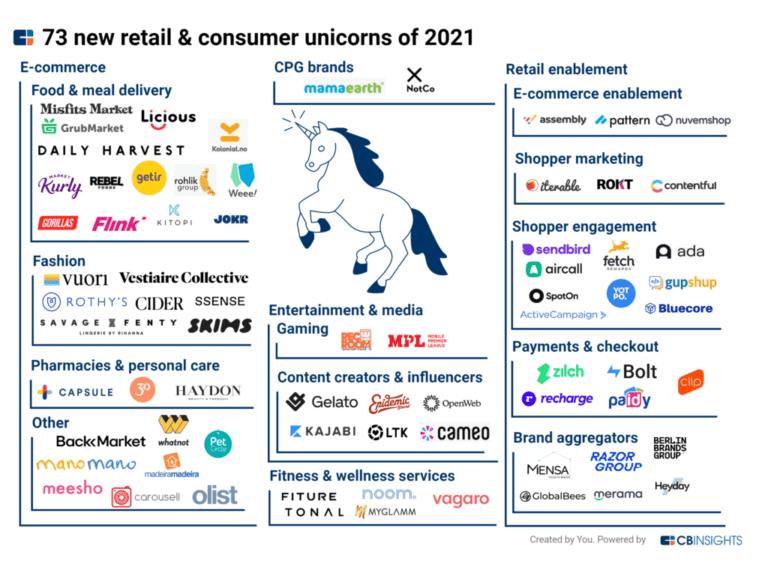

Sendbird is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Future Unicorns 2019

50 items

Sales & Customer Service Tech

1,037 items

Companies offering technology-driven solutions for brands and retailers to enable customer service before, during, and after in-store and online shopping.

Latest Sendbird News

Jul 17, 2024

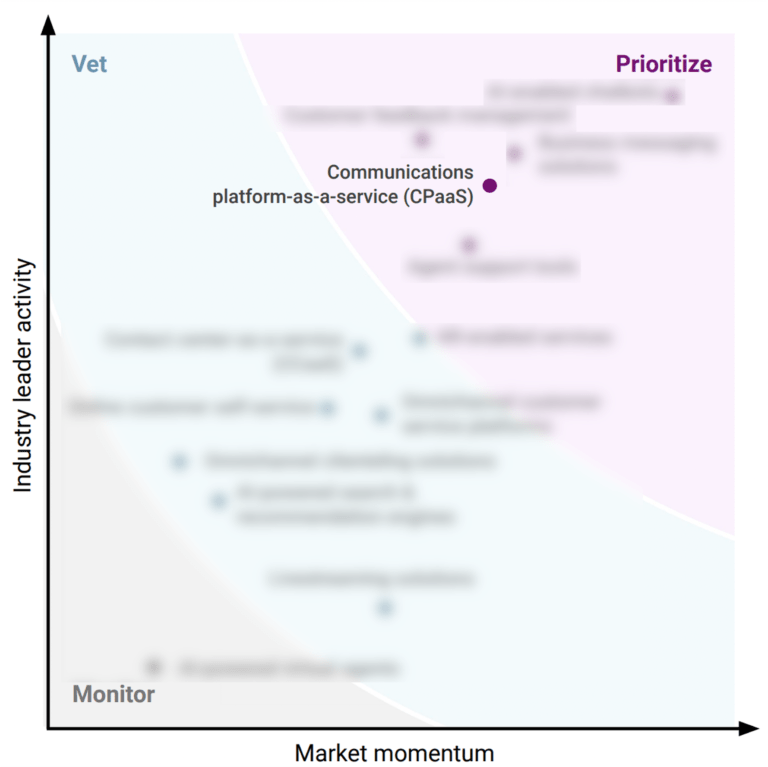

The India Communication Platform as a Service Market size is estimated at USD 0.81 billion in 2024, and is expected to reach USD 2.46 billion by 2029, growing at a CAGR of 24.83% during the forecast period (2024-2029). The Indian CPaaS market is driven primarily by increased digital customer engagement, cloud encryption, and digital transformation. A communication platform as a service (CPaaS) is a cloud-based delivery architecture that enables businesses to add real-time communication capabilities. CPaaS, a cloud communication technology, is primarily used to improve customer communication channels. Key Highlights The WhatsApp Business API and chatbots are the most visible CPaaS use cases. Text messaging, call-based help, and video-based services can all be integrated into the same application with CPaaS. The company is aware of future issues as everything is linked in the back end. The company is also aware of the buyer's previous communication history when a client contacts the firm and can even get to the heart of a problem and solve it. This, of course, increases the efficiency of transactions and can improve the customer experience. Numerous cloud-based APIs are used more frequently by CPaaS providers since they offer tremendous value. These are made available to developers as pre-packaged plugins or as a component of integration modules so they can integrate messaging, audio, video, email, and other OTT into their applications. This platform uses a pay-as-you-go system for ads, allowing companies to only pay for the services they utilize. As there is no significant expenditure needed to create an infrastructure or develop software, it makes the business asset lighter. As a result, CPaaS is becoming more and more popular among enterprises. Technological innovations carry a value that works in multiple sectors. Smart shopping assistants are expected to be better at making purchase suggestions based on the user's browsing history. The software would provide accurate, real-time translations, reducing the need for expensive multilingual customer support representatives. APIs would provide CPaaS video chat technology and AI capable of facial recognition to turn any phone or webcam into a biometric security checkpoint. Chatbots would also continue to grow in scope and capacity, allowing multiple businesses to deploy teams of automated service reps made entirely of bots. Over the past year, global communication has changed. Always-on consumers drive expectations, and businesses work harder to adapt to these rapid changes in a customer-centric manner. Flexibility, seamless connectivity, and multichannel commercial communication are becoming increasingly important. The transition to a contemporary digital platform is fueled by communications-platform-as-a-service (CPaaS) services, allowing businesses to adapt to changing client needs. Implementation challenges in the ecosystem are expected to hinder the market growth. After the COVID-19 pandemic, due to the rise in the requirement for CPaaS services, many startups entered the market to capture significant shares. In June 2022, following the widespread use of the WhatsApp chatbot during the last two years of the pandemic, WhatsApp India and the Centre planned to expand this bot's features to include dedicated medical opinion for cancer consultation online, as well as electronic history capturing of patients. Solutions, such as X-Ray Setu, an automated system that aids in interpreting chest X-rays from low-resolution photos provided over WhatsApp, are also in the works. CPAAS in India Market Trends SMEs to Witness Significant Growth The SME sector in India is recognized as the foundation of the country's economy, accounting for 45% of industrial output, 40% of exports, 60 million jobs annually, 1.3 million new jobs annually, and the production of more than 8000 high-quality goods for domestic and international markets. The Udyam registration platform registered 12,201,448 MSMEs as of November 25, 2022, according to the data from the Ministry of Micro, Small, and Medium Enterprises, replacing the previous procedure of registering for a Udyog Aadhaar Memorandum. Microbusinesses made 11,735,117 (96.17%) of all registered businesses, while small companies made 426,864 (3.49%) and midsized businesses made 39,467 (0.32%). For CPaaS providers, the enormous and rapidly expanding market for SMEs in India offers a significant chance to expand their operations across the ecosystem. A fantastic platform for SMEs is CPaaS (Communication Platform as a Service), which enables businesses to create, manage, and use applications without dealing with the hassle of setting up and maintaining communication infrastructure. It includes a modern customer management platform, redundancy, and multi-layer data security, allowing users complete control over the platform. Due to the concentration of Indian MSMEs in smaller towns and cities, there is an increased requirement for multilingual communication with their clients. With the help of CPaaS, small business owners can communicate with their clients in various languages without the expense or requirement for specialized translators or translation tools. In addition to assisting MSMEs in maintaining relationships with their current clients in their local areas, CPaaS also enables them to connect with potential clients in India. Cloud and AI-enabled communication solutions allow MSMEs to connect with potential clients in multiple markets with personalized messaging, utilizing numerous channels since digital is rapidly becoming a significant component of business operations for enterprises of all sizes in India. MSMEs may scale their communications strategies up or down as necessary with CPaaS, allowing them to develop and expand at their rate. The investment money that would have been spent on growth and lead-generating services is reduced. The investment cost is crucial for SMEs when deploying any technology solution. They can profit from a customized, AI-enabled contextual communications platform with CPaaSwithout investing capital in new infrastructure. If they have any apps, they can easily incorporate them into those and other systems via APIs. CPaaScan increases marketing initiatives' return on investment (ROI) by up to 25% while lowering the cost of engagement for MSMEs by 30%. Retail and E-commerce is Expected to Hold Significant Market Share India is now a mobile-first economy, and rapid mobile and digital adoption have altered consumer engagement and brand interactions. They demand better end-to-end tailored experiences along with more options to pick from. Customers expect all offers to be individualized, according to ~52% of them. Organizations have been utilizing conversational commerce and other technologies to keep up with these shifting consumer demands, particularly when integrated with cutting-edge artificial intelligence (AI) algorithms. The requirement for conversational commerce may also be measured by looking at how willing customers are to use chatbots in their purchasing trips. The research found that 81% of the 15% of customers who used a retail chatbot to make purchases stated they would do it again. However, creating CPaaS capabilities that are simple to combine with SaaS solutions may help conversational commerce succeed. The Indian e-commerce sector is expected to grow by 21.5% and reach USD 74.8 billion in 2022. The recent increase in digital literacy has resulted in a surge of investment in e-commerce businesses, leveling the playing field for new companies to establish their bases and generating novel patterns to challenge established behavior. The CPaaS market in India is further fueled by increased investment in retail and e-commerce. Moreover, the pandemic altered the retail sector, resulting in regrettable store closures and anxiety regarding the future of the in-store experience. Retailers struggled initially but eventually changed course to serve clients through cutting-edge methods efficiently. For all players, big or small, digital-first and omnichannel experiences have become a need. The industry turned to CPaaS for welcome email-based programs, more intelligent voice-based IVR and customer service solutions, and conventional SMS initiatives. According to Global Agriculture Information Network, in 2022, there were around 13 million retail grocery stores in India. Within the category, this encompassed traditional and new retailers. While there has been a constant growth in numbers since 2013, it primarily comprises traditional stores. The rise in the retail stores would increase the demand for the studied market, and the retailers may send the product discount rate and any seasonal sales through messages. CPAAS in India Industry Overview The India Communications Platform-as-a-Service (CPaaS) Market is moderately fragmented, with major players like Twilio Inc., Tanla, Route Mobile, AMD Telecom (Routee), and Netcore Cloud, among others. Players in the market are adopting strategies such as partnerships, mergers, innovations, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage. Key Topics Covered:

Sendbird Frequently Asked Questions (FAQ)

When was Sendbird founded?

Sendbird was founded in 2013.

Where is Sendbird's headquarters?

Sendbird's headquarters is located at 400 1st Avenue, San Mateo.

What is Sendbird's latest funding round?

Sendbird's latest funding round is Series C.

How much did Sendbird raise?

Sendbird raised a total of $219.64M.

Who are the investors of Sendbird?

Investors of Sendbird include Tiger Global Management, Emergence Capital, SoftBank, Meritech Capital Partners, Steadfast Capital and 13 more.

Who are Sendbird's competitors?

Competitors of Sendbird include Amity, FreeD Group, CometChat, SignalWire, Flowroute and 7 more.

Loading...

Compare Sendbird to Competitors

SignalWire focuses on providing software-defined telecom network solutions. The company offers various services including communication platforms, messaging, voice, and video conferencing application programming interfaces (APIs), artificial intelligence (AI) agents, and trunking. It serves in sectors such as healthcare and telecommunications. It was founded in 2017 and is based in Palo Alto, California.

Plivo is a cloud communication platform operating in the technology sector. The company offers services that allow businesses to integrate voice and SMS capabilities into their applications, including the ability to send and receive text messages, integrate voice calling, and provide cloud SIP trunking for VoIP infrastructure. Plivo primarily serves sectors such as healthcare, finance, hospitality, retail, and government. It was founded in 2011 and is based in Austin, Texas.

Telnyx specializes in providing global solutions for communications, internet-of-things (IoT), artificial intelligence (AI), and networking. They offer a suite of communication application programming interfaces (APIs), IoT device connectivity, and AI-powered applications, all underpinned by a global private network. Telnyx primarily serves sectors that require scalable and reliable cloud communication services, such as contact centers, patient monitoring systems, and marketing messaging platforms. It was founded in 2009 and is based in Chicago, Illinois.

Stream specializes in providing scalable APIs and SDKs for real-time chat messaging, video and audio communications, and activity feeds across various applications. The company offers a suite of tools that enable developers to build and integrate rich conversational and community engagement features into their apps. Stream's products are designed to cater to sectors such as social media, gaming, healthcare, education, and more. It was founded in 2015 and is based in Boulder, Colorado.

Unifonic provides a customer engagement platform and operates in the communication and technology industry. The company offers a platform to integrate various communication channels, messaging apps, and chatbots to businesses for customer interactions and build relationships. It primarily serves sectors such as banking and finance, government, healthcare, retail and electronic commerce, and transport and logistics. Unifonic was formerly known as Optimal Technology Solutions. It was founded in 2006 and is based in Riyadh, Saudi Arabia.

VoxImplant specializes in intelligent cloud communications within the cloud communications industry. The company offers a platform that integrates voice, video, messaging, and natural language processing to enhance business communications. VoxImplant primarily serves sectors that require advanced communication solutions, such as the contact center industry and businesses seeking to improve customer experience through innovative communication tools. VoxImplant was formerly known as Zingaya. It was founded in 2008 and is based in New York, New York.

Loading...