Investments

2298Portfolio Exits

60Funds

8Partners & Customers

7About SOSV

SOSV operates as a venture capital firm with a focus on deep technology aimed at improving human and planetary health. The company provides multi-stage investments and operates startup development programs, such as HAX and IndieBio, to accelerate product development and scale innovative technologies. SOSV's programs support startups in sectors like hard tech and life sciences, offering expertise, lab facilities, and supply chain access. It was founded in 1995 and is based in Princeton, New Jersey.

Expert Collections containing SOSV

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find SOSV in 4 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Synthetic Biology

382 items

Food & Beverage

123 items

Game Changers 2018

20 items

Research containing SOSV

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SOSV in 7 CB Insights research briefs, most recently on Jul 3, 2024.

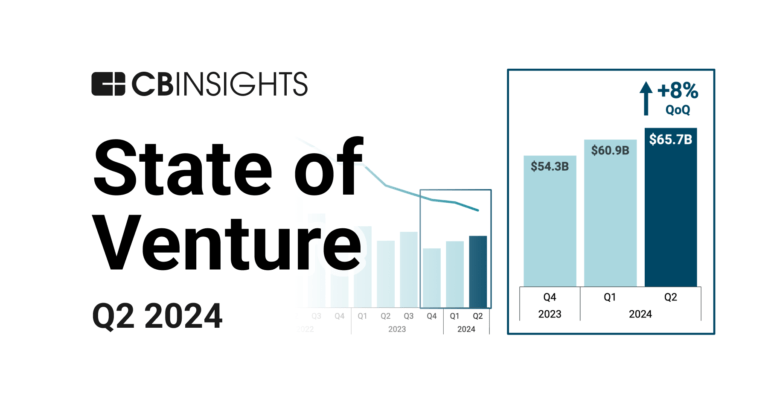

Jul 3, 2024 report

State of Venture Q2’24 Report

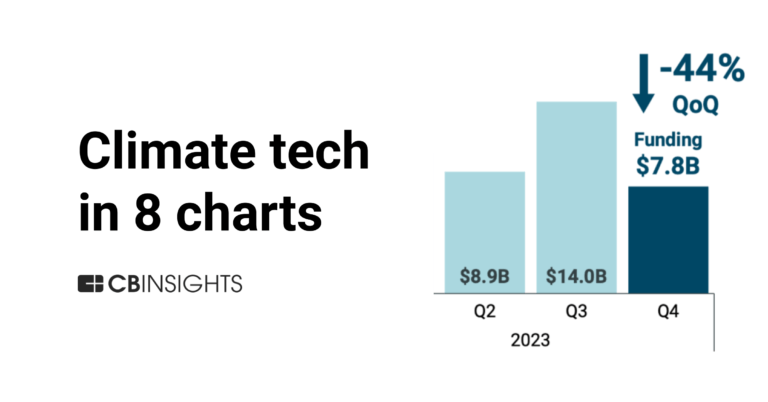

Mar 12, 2024

Climate tech in 8 charts: 2023

Dec 8, 2023 report

The top 25 most successful startup accelerators

Oct 10, 2023 report

The most active startup accelerators and where they’re investing

Jul 26, 2023 report

State of Digital Health Q2’23 Report

Oct 11, 2022 report

State of Venture Q3’22 ReportLatest SOSV News

Sep 5, 2024

News Provided By Share This Article NKT Cell Therapy Firm Joins IndieBio Program VALHALLA, NY, UNITED STATES, September 5, 2024 / EINPresswire.com / -- Tinkeso Therapeutics , Inc., an early-stage biotechnology company focused on the development of allogeneic, off-the-shelf, natural killer T (NKT) cell therapies and modulators to treat autoimmune diseases and cancers, announced today they have been accepted into the 2024 Fall Startup Program of IndieBio New York City (NYC). IndieBio is part of SOSV, a global venture capital firm with more than $1.5B in assets under management. They offer multi-stage investment starting in their deeply resourced, deep tech startup programs, IndieBio and HAX, with locations in New York City, Newark and San Francisco. 100+ new startups per year are chosen by SOSV out of the over 8,000 that apply to their programs. “We are very excited being part of SOSV portfolio companies. I believe IndieBio’s unique program will bring us not only the immediate funding opportunity but also the access to the investor ecosystem where SOSV is a key player. This comprehensive program will provide Tinkeso Therapeutics the critical resources and guidance to advance our R&D efforts”, said Ms. Emmie Fan, CEO and co-founder. “With the funding from IndieBio, we now can start conducting preclinical work on autoimmune diseases with CAR-NKT approach. This will help expand the horizon of our NKT platform beyond cancers”, said Dr. Jerry Zhou, founder and CSO. About Tinkeso Therapeutics Tinkeso Therapeutics is a privately owned, preclinical stage biotechnology company located in Valhalla, NY. The company is focused on the development of novel off-the shelf, allogeneic chimeric antigen receptor (CAR) engineered NKT cell therapies and modulators for the treatment of autoimmune diseases and cancers. For more information, please visit the Tinkeso’s website at https://www.tinkeso.com . Investor/Media Contact

SOSV Investments

2,298 Investments

SOSV has made 2,298 investments. Their latest investment was in InBolt as part of their Series A on September 19, 2024.

SOSV Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/19/2024 | Series A | InBolt | $16.4M | No | 4 | |

9/5/2024 | Seed VC - III | Mesa Quantum | $3.7M | No | 2 | |

8/6/2024 | Pre-Seed | MIXRIFT | $1.6M | Yes | Outsized Ventures, Underline Ventures, and Undisclosed Angel Investors | 3 |

7/29/2024 | Series B | |||||

7/20/2024 | Seed VC - IV |

Date | 9/19/2024 | 9/5/2024 | 8/6/2024 | 7/29/2024 | 7/20/2024 |

|---|---|---|---|---|---|

Round | Series A | Seed VC - III | Pre-Seed | Series B | Seed VC - IV |

Company | InBolt | Mesa Quantum | MIXRIFT | ||

Amount | $16.4M | $3.7M | $1.6M | ||

New? | No | No | Yes | ||

Co-Investors | Outsized Ventures, Underline Ventures, and Undisclosed Angel Investors | ||||

Sources | 4 | 2 | 3 |

SOSV Portfolio Exits

60 Portfolio Exits

SOSV has 60 portfolio exits. Their latest portfolio exit was Halla on March 11, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/11/2024 | Acquired | 2 | |||

1/24/2024 | Asset Sale | 2 | |||

1/16/2024 | Acquired | 2 | |||

Date | 3/11/2024 | 1/24/2024 | 1/16/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Asset Sale | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 2 | 2 |

SOSV Fund History

8 Fund Histories

SOSV has 8 funds, including SOSV V Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/16/2024 | SOSV V Fund | $306M | 2 | ||

6/11/2021 | SOSV Select Fund | ||||

12/12/2019 | SOSV IV | ||||

10/15/2019 | SOSV IV-A | ||||

1/3/2017 | SOSV III |

Closing Date | 4/16/2024 | 6/11/2021 | 12/12/2019 | 10/15/2019 | 1/3/2017 |

|---|---|---|---|---|---|

Fund | SOSV V Fund | SOSV Select Fund | SOSV IV | SOSV IV-A | SOSV III |

Fund Type | |||||

Status | |||||

Amount | $306M | ||||

Sources | 2 |

SOSV Partners & Customers

7 Partners and customers

SOSV has 7 strategic partners and customers. SOSV recently partnered with Bioeutectics on December 12, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

12/18/2023 | Partner | Argentina | |||

2/2/2023 | Partner | ||||

10/2/2020 | Partner | ||||

11/7/2019 | Partner | ||||

2/25/2019 | Partner |

Date | 12/18/2023 | 2/2/2023 | 10/2/2020 | 11/7/2019 | 2/25/2019 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | Argentina | ||||

News Snippet | |||||

Sources |

SOSV Team

16 Team Members

SOSV has 16 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Sean O'Sullivan | Founder | Current | |

Name | Sean O'Sullivan | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder | ||||

Status | Current |

Compare SOSV to Competitors

Y Combinator operates as a seed-stage venture firm. It specializes in funding early-stage startups, primarily in software and web services. It works intensively with the companies for three months to refine their pitch to investors. It was founded in 2005 and is based in Mountain View, California.

Techstars works as a global network focused on helping early-stage startups succeed in various industries, including technology and finance. The company offers accelerator programs, investment opportunities, and mentorship to support startups in areas such as capital access, customer acquisition, and talent recruitment. Techstars serves a diverse range of sectors, providing resources and guidance to entrepreneurs worldwide. It was founded in 2006 and is based in New York, New York.

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, internet of things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

Entrepreneur First operates as a startup incubator operating in the business services sector. The company primarily focuses on bringing together and funding exceptional individuals to help them meet co-founders, develop ideas, and raise money from leading investors. Its services are mainly utilized by the startup industry. It was founded in 2011 and is based in London, England.

Founders Factory is a venture studio and startup accelerator that operates in the fintech, climate, health, and deep tech sectors. The company provides capital investment and dedicated operational support to startups, leveraging a network of industry-leading corporate partners. Founders Factory primarily serves sectors such as fintech, climate solutions, healthcare innovation, and deep technology. It was founded in 2015 and is based in London, England.

Seedcamp provides venture capital funds to support startups in the pre-seed and seed stages. The firm invests in companies and encourages them across the product market fit, traction, growth, and scale stages from seed funding to initial public offerings (IPO). The company was founded in 2007 and is based in London, United Kingdom.

Loading...