Stampli

Founded Year

2014Stage

Series D | AliveTotal Raised

$142.7MLast Raised

$61M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+70 points in the past 30 days

About Stampli

Stampli focuses on accounts payable automation and invoice management. The company offers a range of products to provide efficiency, visibility, and control for payments, employee expenses, corporate credit card spending, and vendor management. Stampli's services are primarily utilized by sectors such as healthcare, hospitality, professional services, construction, retail, and manufacturing. It was founded in 2014 and is based in Mountain View, California.

Loading...

Stampli's Product Videos

ESPs containing Stampli

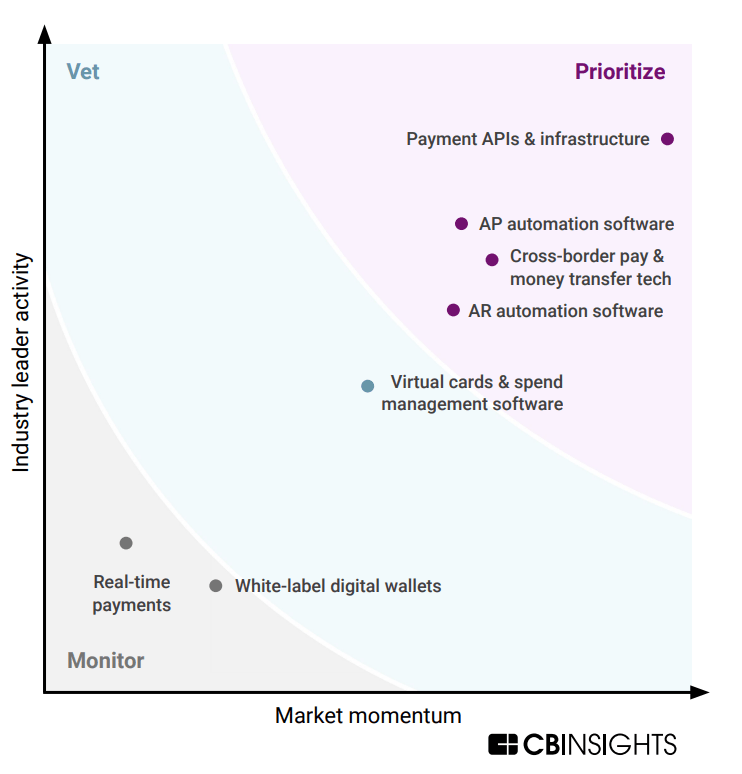

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The accounts payable automation market allows businesses to streamline and automate invoice processing and payment activities. Vendors provide platforms that integrate with existing enterprise resource planning systems and accounting software through APIs and software development kits. These platforms automate invoice capture and matching, data extraction, approval workflows, and payment processin…

Stampli named as Challenger among 15 other companies, including AvidXchange, BILL, and Bottomline.

Stampli's Products & Differentiators

AP Automation

AP Automation that is collaboration-centric give the average AP staff person must interact with ~90 other people across internal departments and external vendors, which is further powered by Artificial Intelligence and Machine Learning.

Loading...

Research containing Stampli

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stampli in 5 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Oct 26, 2023

The CFO tech stack market map

Oct 12, 2023

The procurement tech market mapExpert Collections containing Stampli

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stampli is included in 4 Expert Collections, including SMB Fintech.

SMB Fintech

2,003 items

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,254 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Stampli Patents

Stampli has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/3/2016 | Web service specifications, Information technology management, Executed revolutionaries, Rao administration, Cryptographic protocols | Application |

Application Date | 1/3/2016 |

|---|---|

Grant Date | |

Title | |

Related Topics | Web service specifications, Information technology management, Executed revolutionaries, Rao administration, Cryptographic protocols |

Status | Application |

Latest Stampli News

Sep 12, 2024

Screenshot courtesy of Superior Masonry Unlimited September 12, 2024 When Matt Andersen ended 20 years in public accounting and joined then-client Superior Masonry Unlimited as CFO in 2022, his first order of business was to modernize the specialty contractor’s accounting systems. That effort would bring both to use cloud-based Sage Intacct combined with Stampli, an artificial intelligence accounts payable processor, “We had an accounting system that was hosted on premises, on a server,” Andersen says. Like many specialty contractors, the Fort Mill, S.C., firm’s on-premise software had no application program interface (API) connection and field management software was out of the question. Andersen considered a software corruption issue in 2022 as a perfect opportunity to upgrade that system. “Let’s look at technology out there, and let’s build something that will help us become the company that we want to be,” he says. Andersen wanted accounting software with an open API that would allow Superior to unite its estimating and preconstruction departments with project management so bids and estimates could flow between both. Also common to specialty firms, paper invoices were piling up at Superior. “A big pain point with this company, and I know with others, is processing of accounts payable,” he says. “It was a heavy paper burden.” Accounts payable automation plugged into an API that was connected to Superior’s accounting and construction management platform was “easy fruit to pick,” says Andersen. Rethinking the Process Procore was Superior’s construction management platform that its accounting team used, along with cloud-based Sage Intacct, to provide field employees access to purchase orders, plans and communication tools. But they still needed a tool to enable accounts payable to automate many paper invoices, Andersen explains. “We started evaluating the AP automation platforms and, after probably about three months of research, we stumbled onto Stampli,” he says, noting discussions with that firm’s experts “about how they’re leveraging AI to help speed up the process.” Andersen says Stampli was on the verge of using AI to run Superior’s entire accounts payable process, matching invoices to purchase orders. “It was a no brainer for us,” he says, noting that a task that used to be “about a 40-hour week’s worth of effort” now is reduced to about four hours using the Stampli AI. Stampli software digitally captures invoice data by using optical character recognition and a large language model that enable customers like Superior to include project data such as invoice and purchase order numbers—allowing AI to automatically match them. Andersen says Superior no longer looks at its accounts payable system as separate from its construction management or accounting systems. Connecting more systems is the firm’s future, he explains. “We are building the company, not as we are today, but as the one that we will be in the future,” he says. “We’re probably ahead of where we need to be, but that’s the mindset that we have—let’s fix problems before they are problems.” Using cloud-based Sage Intacct gives Superior flexibility so its project managers can call up information and see corresponding submittals and change orders in Procore’s platform. The specialty contractor has all the tools it needs in the field to be able to function from smartphones. The next step is tieing in a customer relationship management system, Andersen says. “The last step that we are starting to take on now is looking at our preconstruction processes,” he explains. “How are we going to do our takeoffs and estimates, and how do we get that to integrate into Procore, because [it] is the hub for us that feeds all the information back to Intacct?” Andersen says the goal is having “one source of truth within that system that will give us the data that we need.”

Stampli Frequently Asked Questions (FAQ)

When was Stampli founded?

Stampli was founded in 2014.

Where is Stampli's headquarters?

Stampli's headquarters is located at 800 California Street, Mountain View.

What is Stampli's latest funding round?

Stampli's latest funding round is Series D.

How much did Stampli raise?

Stampli raised a total of $142.7M.

Who are the investors of Stampli?

Investors of Stampli include SignalFire, Next World Capital, Bloomberg Beta, Insight Partners, Blackstone and 4 more.

Who are Stampli's competitors?

Competitors of Stampli include Airbase, Settle, Tipalti, Accrualify, AvidXchange and 7 more.

What products does Stampli offer?

Stampli's products include AP Automation.

Who are Stampli's customers?

Customers of Stampli include Atlantic Coast Brands, CTI Clinical Trials, Renova Energy, Nationwide Security Service and Spanish Fork City.

Loading...

Compare Stampli to Competitors

Routable is a financial technology company specializing in accounts payable automation for businesses. The company offers a platform that streamlines invoice processing, vendor payments, and compliance management, while also providing tools for customizable approval workflows, payment reconciliation, and vendor onboarding. Routable's solutions cater to various sectors, including marketplaces, gig economy, insurance, real estate, logistics, manufacturing, and nonprofit organizations. It was founded in 2017 and is based in San Francisco, California.

Rho focuses on providing financial services, operating within the finance and technology sectors. The company offers a financial platform that includes services such as commercial banking, corporate cards, expense management, and accounts payable automation. Rho primarily serves organizations looking to manage their finances. Rho was formerly known as Rho Business Banking. It was founded in 2018 and is based in New York, New York.

Kyriba is a company that focuses on enterprise liquidity management in the financial services sector. The company offers a range of services including treasury management, risk management, payments processing, and working capital management, all aimed at enabling real-time, intelligent enterprise liquidity decisions. Kyriba primarily serves sectors such as retail, financial services, higher education, healthcare, and manufacturing. It was founded in 2000 and is based in San Diego, California.

Billtrust focuses on automating accounts receivable and order-to-cash processes for businesses. Its main offerings include artificial intelligence (AI)-powered invoicing, payment processing, cash application, and collections, designed to streamline financial operations and enhance cash flow. Billtrust's solutions cater to a variety of industries, providing tailored automation to meet specific sector needs. It was founded in 2001 and is based in Hamilton, New Jersey.

Fidesic is a company that specializes in accounts payable automation and integrates with Microsoft Dynamics GP and Business Central. The company offers solutions for invoice processing, workflow automation, and vendor payments, designed to streamline financial operations and enhance efficiency. Fidesic's platform is tailored to serve various industries such as healthcare, nonprofit, and hospitality, among others. It was founded in 2000 and is based in East Lansing, Michigan.

Tipalti is a global payables automation company that specializes in streamlining all phases of the accounts payable and payment management workflow. The company offers a cloud-based platform that simplifies the management of supplier payments, encompassing supplier onboarding, tax and regulatory compliance, invoice processing, and payments to suppliers worldwide in various methods and currencies. Tipalti's solutions are designed to reduce the workload for accounts payable departments and enhance financial and compliance controls. It was founded in 2010 and is based in San Mateo, California.

Loading...