Starling Bank

Founded Year

2014Stage

Shareholder Liquidity | AliveTotal Raised

$905.62MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-55 points in the past 30 days

About Starling Bank

Starling Bank is a digital bank focused on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, England.

Loading...

ESPs containing Starling Bank

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to digitize their services and expand their customer base through embedded banking and payment options. This market also allows established non-fintech companies to add banking services to differentiate their offerings and generate new revenue streams. BaaS providers offer a single API that enables clie…

Starling Bank named as Challenger among 15 other companies, including Stripe, Fiserv, and FIS.

Loading...

Research containing Starling Bank

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Starling Bank in 7 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

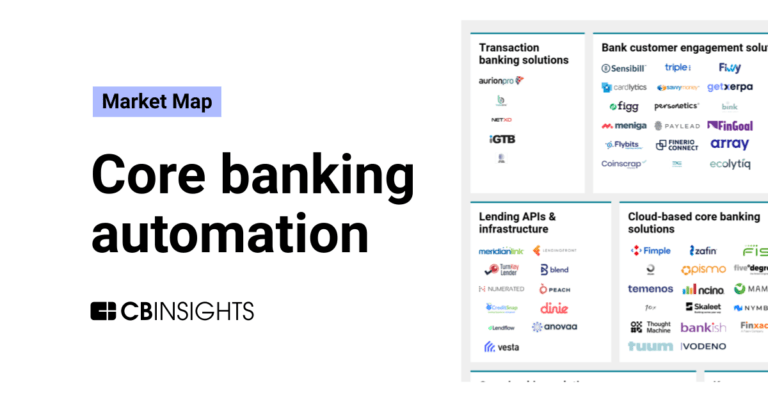

The core banking automation market map

Expert Collections containing Starling Bank

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Starling Bank is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

1,231 items

Fintech

13,396 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,008 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Starling Bank News

Sep 21, 2024

Anna CoobanCNN “Millions” of people could fall victim to scams using artificial intelligence to clone their voices, a UK bank has warned. Starling Bank, an online-only lender, said fraudsters are capable of using AI to replicate a person’s voice from just three seconds of audio found in, for example, a video the person has posted online. Scammers can then identify the person’s friends and family members and use the AI-cloned voice to stage a phone call to ask for money. These types of scams have the potential to “catch millions out,” Starling Bank said on Wednesday. They have already affected hundreds of people. According to a survey of more than 3,000 adults, which the bank conducted with Mortar Research last month, more than a quarter of respondents said they have been targeted by an AI voice-cloning scam in the past 12 months. The survey also showed 46 per cent of respondents were not aware that such scams existed, and 8 per cent would send as much money as requested by a friend or family member even if they thought the call seemed strange. “People regularly post content online which has recordings of their voice without ever imagining it’s making them more vulnerable to fraudsters,” Starling Bank chief information security officer Lisa Grahame said. The bank is encouraging people to set a “safe phrase” with their loved ones — a simple, random phrase that’s easy to remember and different from their other passwords — which can be used to verify their identity over the phone. The lender advises against sharing the safe phrase over text, which could make it easier for scammers to find. If it is shared in this way, the message should be deleted once the other person has seen it. As AI becomes increasingly adept at mimicking human voices, concerns are mounting about its potential to harm people by, for example, helping criminals access their bank accounts and spread misinformation. Earlier this year, OpenAI, the maker of generative AI chatbot ChatGPT, unveiled its voice replication tool, Voice Engine, but didn’t make it available to the public at that stage, citing the “potential for synthetic voice misuse”.

Starling Bank Frequently Asked Questions (FAQ)

When was Starling Bank founded?

Starling Bank was founded in 2014.

Where is Starling Bank's headquarters?

Starling Bank's headquarters is located at 1 Duval Square, London.

What is Starling Bank's latest funding round?

Starling Bank's latest funding round is Shareholder Liquidity.

How much did Starling Bank raise?

Starling Bank raised a total of $905.62M.

Who are the investors of Starling Bank?

Investors of Starling Bank include Jupiter Asset Management, Chrysalis Investments, Fidelity Investments, Qatar Investment Authority, Railway Pension Trustee Co. Ltd. and 11 more.

Who are Starling Bank's competitors?

Competitors of Starling Bank include Tide, Fintech Farm, Monzo, Allica Bank, Kroo and 7 more.

Loading...

Compare Starling Bank to Competitors

Monzo operates a digital banking platform focused on personal finance management. The company offers personal and joint accounts, allowing users to track income, manage spending, and save money through an integrated mobile app. Monzo primarily serves individuals looking for an easy-to-use banking solution. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Atom Bank is a financial institution that provides an online banking platform focusing on personal and business banking services. The company offers savings accounts, residential and commercial mortgages, and business loans. It primarily serves individuals looking for savings options and businesses seeking financing solutions. Atom Bank was founded in 2014 and is based in Durham, United Kingdom.

N26 provides a mobile banking platform. It gives customers a solution to control finances. The company allows users to open an N26 account directly from their phone or computer. It also offers insights into spending habits. The company was founded in 2013 and is based in Berlin, Germany.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Revolut is a financial technology company offering a suite of money management tools. It provides services such as international money transfers, currency exchange, stock trading, and savings accounts. Revolut caters to both personal and business financial needs, with a focus on providing more control and visibility over users' finances. It was founded in 2015 and is based in London, United Kingdom.

Shawbrook Bank is a specialist bank focusing on savings and lending in the financial services industry. The company offers a broad range of products including personal loans, residential and commercial mortgages, business finance, and savings products. Shawbrook primarily serves real estate professionals, small and medium-sized enterprises (SMEs), and individual consumers. Shawbrook Bank was formerly known as Whiteaway Laidlaw Bank. It was founded in 2011 and is based in Brentwood, England.

Loading...