Stash

Founded Year

2015Stage

Convertible Note | AliveTotal Raised

$531.85MLast Raised

$40M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+88 points in the past 30 days

About Stash

Stash is a personal finance app that aids investment and financial management for individuals. The app offers automated and self-directed investing options and a debit card that rewards users with stock. Stash also provides financial education resources to help users make informed decisions. Stash was formerly known as Collective Returns. It was founded in 2015 and is based in New York, New York.

Loading...

Stash's Products & Differentiators

Invest, Retire + Custodial

With just 1¢1, customers can buy fractional shares of stocks and funds, build their own diversified portfolios, and learn how to invest confidently; access to a curated selection of +3,000 ETFs and stocks; option to open personal brokerage, Roth or traditional IRAs and/or custodial (UGMA and UTMA) accounts.

Loading...

Research containing Stash

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stash in 7 CB Insights research briefs, most recently on Mar 5, 2024.

Mar 5, 2024 report

The top 20 venture investors in North America

Nov 3, 2022

3 banking trends to watch

Oct 5, 2021 report

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021Expert Collections containing Stash

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stash is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

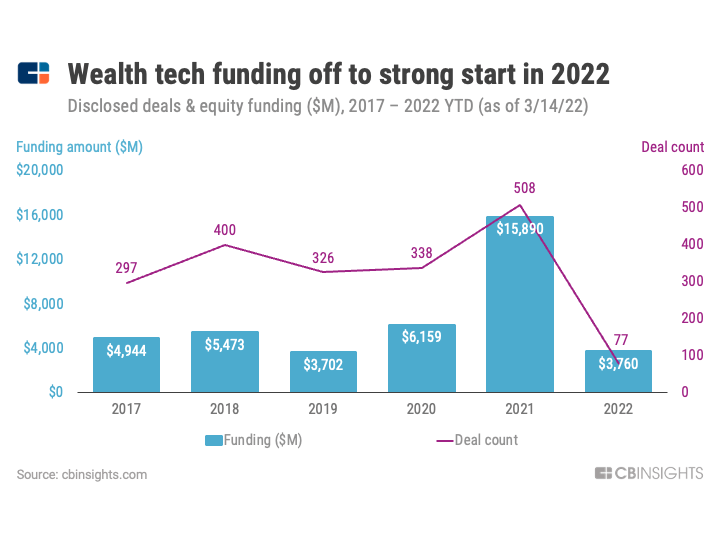

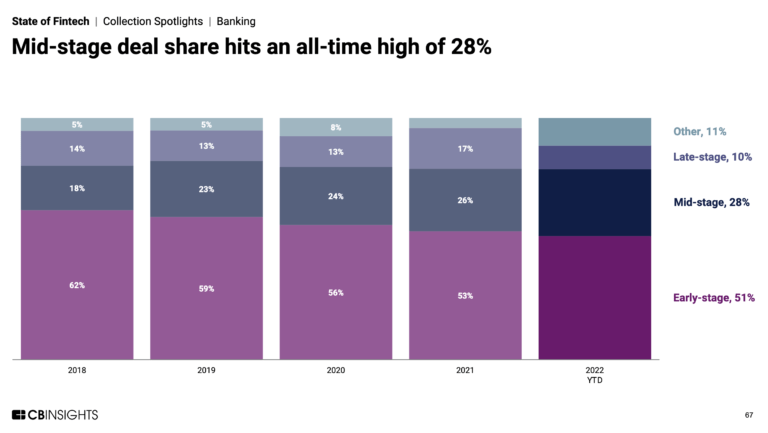

Wealth Tech

2,294 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Stash Patents

Stash has filed 7 patents.

The 3 most popular patent topics include:

- credit cards

- debit cards

- payment systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/13/2020 | 5/28/2024 | Thermodynamic cycles, Heat pumps, Energy conservation, Cooling technology, Energy conversion | Grant |

Application Date | 3/13/2020 |

|---|---|

Grant Date | 5/28/2024 |

Title | |

Related Topics | Thermodynamic cycles, Heat pumps, Energy conservation, Cooling technology, Energy conversion |

Status | Grant |

Latest Stash News

Sep 20, 2024

2024-09-20T12:04:10.234+02:00 Disclaimer Building wealth might seem daunting, but micro-investing has made it more accessible by allowing individuals to invest small amounts consistently, gradually creating a substantial financial cushion. Micro-investing involves putting aside small sums, sometimes just a few cents or dollars, into diversified portfolios or other assets, turning everyday spending into long-term savings. Just like a ‘ black ops 6 boost ’ gives gamers an edge, micro-investing offers a real boost to anyone’s financial game plan. With platforms like Acorns, Robinhood, and Stash, micro-investing is now within reach for everyone, from students to professionals, helping them steadily build wealth without the stress of large initial investments. Understanding Micro-Investing and Its Appeal Micro-investing is based on the concept of making investing simple and accessible by allowing individuals to invest small sums regularly. The idea is to lower the barrier to entry, traditionally set high by minimum deposit requirements and hefty transaction fees. With micro-investing, you can start with as little as $5, making it possible for nearly anyone to begin their investing journey. A significant appeal of micro-investing is that it integrates investing into daily routines. For example, many micro-investing platforms use the round-up method, where they round up the spare change from everyday purchases and invest it automatically. According to a survey conducted by Stash, more than 75% of its users found micro-investing to be a stress-free way to start investing. This hands-off approach allows people to build wealth over time without feeling the financial strain. The Power of Compound Interest One of the most critical aspects of micro-investing is the power of compound interest. When you invest even a small amount consistently, your investments begin to generate returns, which are then reinvested to produce more earnings over time. This cycle of reinvesting the returns accelerates the growth of your wealth. Albert Einstein famously referred to compound interest as the "eighth wonder of the world." Even small, consistent investments can grow significantly over time. For example, if you invest $5 a day with an average annual return of 7%, you could accumulate over $76,000 in 20 years. A study by Fidelity found that individuals who began investing small amounts early in their careers accumulated substantially more wealth than those who started investing large sums later in life. Micro-investing harnesses this principle, showing that the key to building wealth is not necessarily how much you invest, but how consistently and early you start. Micro-Investing Platforms: Making Investing Accessible Several micro-investing platforms have emerged in recent years, making investing accessible to everyone. Platforms like Acorns, Robinhood, and Stash are popular choices for those new to investing. These platforms often allow users to invest in diversified portfolios made up of stocks, bonds, and other assets, with the flexibility to choose portfolios based on their risk tolerance and financial goals. Acorns, for instance, uses the round-up method, investing the spare change from users’ everyday purchases. A study conducted by Acorns revealed that the average user invests about $30-$50 per month through round-ups alone. Robinhood, on the other hand, offers commission-free trades, making it easier for users to buy fractional shares of high-priced stocks with as little as $1. Stash provides educational resources along with its investment options, helping users make informed decisions as they grow their portfolios. How to Get Started with Micro-Investing Starting with micro-investing is simple and requires minimal effort. First, choose a micro-investing platform that aligns with your financial goals and preferences. Platforms like Acorns are ideal for those looking for an automated approach, while Robinhood is more suited for those who want to be more hands-on with their investments. Once you've selected a platform, set up your account and link it to your bank account. Decide how much you want to invest and whether you want to use the round-up feature for automatic investments. The key to successful micro-investing is consistency. By setting up recurring deposits, even if it's just a few dollars per week, you can build a habit of investing without feeling a significant impact on your daily finances. Micro-Investing for Different Financial Goals Micro-investing is versatile and can be used to meet various financial goals. Whether you're saving for an emergency fund, a vacation, a down payment on a house, or retirement, micro-investing provides a flexible way to grow your money over time. For short-term goals, micro-investing into a low-risk portfolio can help accumulate funds with less exposure to market volatility. For long-term goals like retirement, a more aggressive portfolio with higher risk but potentially higher returns might be appropriate. A report by Betterment found that individuals who used micro-investing platforms were 60% more likely to have emergency savings and 45% more likely to invest for retirement. This adaptability makes micro-investing a valuable tool for different stages of life, helping individuals gradually work toward their financial objectives. The Risks of Micro-Investing While micro-investing offers many benefits, it is not without risks. Like all investments, the assets purchased through micro-investing platforms are subject to market volatility. The value of your investments can go up or down depending on market conditions. Additionally, some micro-investing platforms charge fees, which can add up over time and eat into your investment returns, especially if you are investing very small amounts. It is crucial to research and understand the fee structures of various platforms before starting. For example, while some platforms charge a flat monthly fee, others may take a percentage of your investments. A study by NerdWallet revealed that even a seemingly small monthly fee of $1 can equate to a significant portion of your returns if you are investing minimal amounts. Therefore, weigh the potential costs and choose a platform that aligns with your financial strategy. How Micro-Investing Fits into a Broader Investment Strategy Micro-investing is an excellent starting point for beginners, but it should be part of a broader investment strategy. While micro-investing helps build good financial habits and grow wealth over time, it may not be sufficient for achieving all your financial goals, especially larger ones like retirement or buying a house. As your financial knowledge and resources grow, consider diversifying your investments by exploring other options, such as retirement accounts, mutual funds, or real estate. A study by Vanguard highlighted that diversification across different asset classes is one of the most effective ways to reduce risk and enhance returns. Micro-investing can serve as the foundation of your investment portfolio, providing a steady growth avenue while you explore other investment opportunities. The Role of Automation in Micro-Investing Automation is a key feature that sets micro-investing apart from traditional investing methods. Micro-investing platforms leverage automation to make investing seamless and effortless. By linking to your bank account and rounding up your everyday purchases, these platforms automatically invest your spare change, helping you build wealth passively. According to a survey by Charles Schwab, 61% of investors believe that automation helps them stay on track with their financial goals. This hands-off approach eliminates the need for constant market monitoring, making micro-investing particularly appealing for those who may not have the time or expertise to actively manage their investments. Conclusion Micro-investing has revolutionised the way individuals approach wealth-building, making it accessible and manageable for people from all walks of life. By breaking down barriers and leveraging the power of small, consistent investments, micro-investing offers a pathway to financial security and growth. The success of micro-investing lies in its simplicity and the power of compounding. By starting early, being consistent, and understanding the risks involved, micro-investing can be a powerful tool to help you achieve your financial goals over time. Building wealth might seem daunting, but micro-investing has made it more accessible by allowing individuals to invest small amounts consistently, gradually creating a substantial financial cushion. Micro-investing involves putting aside small sums, sometimes just a few cents or dollars, into diversified portfolios or other assets, turning everyday spending into long-term savings. Just like a ‘ black ops 6 boost ’ gives gamers an edge, micro-investing offers a real boost to anyone’s financial game plan. With platforms like Acorns, Robinhood, and Stash, micro-investing is now within reach for everyone, from students to professionals, helping them steadily build wealth without the stress of large initial investments. Understanding Micro-Investing and Its Appeal Micro-investing is based on the concept of making investing simple and accessible by allowing individuals to invest small sums regularly. The idea is to lower the barrier to entry, traditionally set high by minimum deposit requirements and hefty transaction fees. With micro-investing, you can start with as little as $5, making it possible for nearly anyone to begin their investing journey. A significant appeal of micro-investing is that it integrates investing into daily routines. For example, many micro-investing platforms use the round-up method, where they round up the spare change from everyday purchases and invest it automatically. According to a survey conducted by Stash, more than 75% of its users found micro-investing to be a stress-free way to start investing. This hands-off approach allows people to build wealth over time without feeling the financial strain. The Power of Compound Interest One of the most critical aspects of micro-investing is the power of compound interest. When you invest even a small amount consistently, your investments begin to generate returns, which are then reinvested to produce more earnings over time. This cycle of reinvesting the returns accelerates the growth of your wealth. Albert Einstein famously referred to compound interest as the "eighth wonder of the world." Even small, consistent investments can grow significantly over time. For example, if you invest $5 a day with an average annual return of 7%, you could accumulate over $76,000 in 20 years. A study by Fidelity found that individuals who began investing small amounts early in their careers accumulated substantially more wealth than those who started investing large sums later in life. Micro-investing harnesses this principle, showing that the key to building wealth is not necessarily how much you invest, but how consistently and early you start. Micro-Investing Platforms: Making Investing Accessible Several micro-investing platforms have emerged in recent years, making investing accessible to everyone. Platforms like Acorns, Robinhood, and Stash are popular choices for those new to investing. These platforms often allow users to invest in diversified portfolios made up of stocks, bonds, and other assets, with the flexibility to choose portfolios based on their risk tolerance and financial goals. Acorns, for instance, uses the round-up method, investing the spare change from users’ everyday purchases. A study conducted by Acorns revealed that the average user invests about $30-$50 per month through round-ups alone. Robinhood, on the other hand, offers commission-free trades, making it easier for users to buy fractional shares of high-priced stocks with as little as $1. Stash provides educational resources along with its investment options, helping users make informed decisions as they grow their portfolios. How to Get Started with Micro-Investing Starting with micro-investing is simple and requires minimal effort. First, choose a micro-investing platform that aligns with your financial goals and preferences. Platforms like Acorns are ideal for those looking for an automated approach, while Robinhood is more suited for those who want to be more hands-on with their investments. Once you've selected a platform, set up your account and link it to your bank account. Decide how much you want to invest and whether you want to use the round-up feature for automatic investments. The key to successful micro-investing is consistency. By setting up recurring deposits, even if it's just a few dollars per week, you can build a habit of investing without feeling a significant impact on your daily finances. Micro-Investing for Different Financial Goals Micro-investing is versatile and can be used to meet various financial goals. Whether you're saving for an emergency fund, a vacation, a down payment on a house, or retirement, micro-investing provides a flexible way to grow your money over time. For short-term goals, micro-investing into a low-risk portfolio can help accumulate funds with less exposure to market volatility. For long-term goals like retirement, a more aggressive portfolio with higher risk but potentially higher returns might be appropriate. A report by Betterment found that individuals who used micro-investing platforms were 60% more likely to have emergency savings and 45% more likely to invest for retirement. This adaptability makes micro-investing a valuable tool for different stages of life, helping individuals gradually work toward their financial objectives. The Risks of Micro-Investing While micro-investing offers many benefits, it is not without risks. Like all investments, the assets purchased through micro-investing platforms are subject to market volatility. The value of your investments can go up or down depending on market conditions. Additionally, some micro-investing platforms charge fees, which can add up over time and eat into your investment returns, especially if you are investing very small amounts. It is crucial to research and understand the fee structures of various platforms before starting. For example, while some platforms charge a flat monthly fee, others may take a percentage of your investments. A study by NerdWallet revealed that even a seemingly small monthly fee of $1 can equate to a significant portion of your returns if you are investing minimal amounts. Therefore, weigh the potential costs and choose a platform that aligns with your financial strategy. How Micro-Investing Fits into a Broader Investment Strategy Micro-investing is an excellent starting point for beginners, but it should be part of a broader investment strategy. While micro-investing helps build good financial habits and grow wealth over time, it may not be sufficient for achieving all your financial goals, especially larger ones like retirement or buying a house. As your financial knowledge and resources grow, consider diversifying your investments by exploring other options, such as retirement accounts, mutual funds, or real estate. A study by Vanguard highlighted that diversification across different asset classes is one of the most effective ways to reduce risk and enhance returns. Micro-investing can serve as the foundation of your investment portfolio, providing a steady growth avenue while you explore other investment opportunities. The Role of Automation in Micro-Investing Automation is a key feature that sets micro-investing apart from traditional investing methods. Micro-investing platforms leverage automation to make investing seamless and effortless. By linking to your bank account and rounding up your everyday purchases, these platforms automatically invest your spare change, helping you build wealth passively. According to a survey by Charles Schwab, 61% of investors believe that automation helps them stay on track with their financial goals. This hands-off approach eliminates the need for constant market monitoring, making micro-investing particularly appealing for those who may not have the time or expertise to actively manage their investments. Conclusion Micro-investing has revolutionised the way individuals approach wealth-building, making it accessible and manageable for people from all walks of life. By breaking down barriers and leveraging the power of small, consistent investments, micro-investing offers a pathway to financial security and growth. The success of micro-investing lies in its simplicity and the power of compounding. By starting early, being consistent, and understanding the risks involved, micro-investing can be a powerful tool to help you achieve your financial goals over time. Topics Email By subscribing, you agree to our Terms of Use and Privacy Policy . You may unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. SIGN UP Keep Reading Friday, 20/09/2024 | 08:17 GMT Thursday, 19/09/2024 | 15:30 GMT Thursday, 19/09/2024 | 15:08 GMT Thursday, 19/09/2024 | 14:05 GMT Thursday, 19/09/2024 | 09:13 GMT Thursday, 19/09/2024 | 08:24 GMT Friday, 20/09/2024 | 08:17 GMT Thursday, 19/09/2024 | 15:30 GMT Thursday, 19/09/2024 | 15:08 GMT Thursday, 19/09/2024 | 14:05 GMT Finance Magnates Pacific Summit 2024 | FMPS:24 Highlights Finance Magnates Pacific Summit 2024 | FMPS:24 Highlights Finance Magnates Pacific Summit 2024 | FMPS:24 Highlights Relive the best moments from the Finance Magnates Pacific Summit 2024 with our highlights video! ✨From action-packed moments, insightful speaker sessions, the exclusive Opening Blitz, and immersive workshops, this video captures the energy and excitement of FMPS:24. Whether you attended or missed out, here’s your chance to experience the top moments that made FMPS:24 unforgettable.🎬 Watch, share, and join the conversation!Don’t forget to use the hashtags #fmps #fmps24 #FMevents when sharing.Stay tuned for more events. See you next time!📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Relive the best moments from the Finance Magnates Pacific Summit 2024 with our highlights video! ✨From action-packed moments, insightful speaker sessions, the exclusive Opening Blitz, and immersive workshops, this video captures the energy and excitement of FMPS:24. Whether you attended or missed out, here’s your chance to experience the top moments that made FMPS:24 unforgettable.🎬 Watch, share, and join the conversation!Don’t forget to use the hashtags #fmps #fmps24 #FMevents when sharing.Stay tuned for more events. See you next time!📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Relive the best moments from the Finance Magnates Pacific Summit 2024 with our highlights video! ✨From action-packed moments, insightful speaker sessions, the exclusive Opening Blitz, and immersive workshops, this video captures the energy and excitement of FMPS:24. Whether you attended or missed out, here’s your chance to experience the top moments that made FMPS:24 unforgettable.🎬 Watch, share, and join the conversation!Don’t forget to use the hashtags #fmps #fmps24 #FMevents when sharing.Stay tuned for more events. See you next time!📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Relive the best moments from the Finance Magnates Pacific Summit 2024 with our highlights video! ✨From action-packed moments, insightful speaker sessions, the exclusive Opening Blitz, and immersive workshops, this video captures the energy and excitement of FMPS:24. Whether you attended or missed out, here’s your chance to experience the top moments that made FMPS:24 unforgettable.🎬 Watch, share, and join the conversation!Don’t forget to use the hashtags #fmps #fmps24 #FMevents when sharing.Stay tuned for more events. See you next time!📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Transformation in the APAC Trading Landscape and Beyond | FMPS:24 Transformation in the APAC Trading Landscape and Beyond | FMPS:24 Transformation in the APAC Trading Landscape and Beyond | FMPS:24 Transformation in the APAC Trading Landscape and Beyond | FMPS:24 Transformation in the APAC Trading Landscape and Beyond | FMPS:24 As the financial services industry experiences rapid and transformative changes, leading fintech experts and policymakers come together to discuss the present and future of retail trading and the evolving regulatory landscape. Join this insightful session for a forward-looking perspective on the trends, innovations, and trader needs that are shaping the future of offerings on a global scale.Speakers:Eric Blewitt, CEO, Investment TrendsRhys Bollen, Senior Executive Leader, Digital Assets, Australian Securities and Investments Commission (ASIC)Michael Bogoevski, Head of Institutional Sales, CMC ConnectKarin Setchell, General Manager, Product & Investing Solutions, CommSec#fmps #fmps24 #fmevents #RetailTrading #FintechInnovation #FinancialRegulation #DigitalAssets #GlobalFinance📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! As the financial services industry experiences rapid and transformative changes, leading fintech experts and policymakers come together to discuss the present and future of retail trading and the evolving regulatory landscape. Join this insightful session for a forward-looking perspective on the trends, innovations, and trader needs that are shaping the future of offerings on a global scale.Speakers:Eric Blewitt, CEO, Investment TrendsRhys Bollen, Senior Executive Leader, Digital Assets, Australian Securities and Investments Commission (ASIC)Michael Bogoevski, Head of Institutional Sales, CMC ConnectKarin Setchell, General Manager, Product & Investing Solutions, CommSec#fmps #fmps24 #fmevents #RetailTrading #FintechInnovation #FinancialRegulation #DigitalAssets #GlobalFinance📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! As the financial services industry experiences rapid and transformative changes, leading fintech experts and policymakers come together to discuss the present and future of retail trading and the evolving regulatory landscape. Join this insightful session for a forward-looking perspective on the trends, innovations, and trader needs that are shaping the future of offerings on a global scale.Speakers:Eric Blewitt, CEO, Investment TrendsRhys Bollen, Senior Executive Leader, Digital Assets, Australian Securities and Investments Commission (ASIC)Michael Bogoevski, Head of Institutional Sales, CMC ConnectKarin Setchell, General Manager, Product & Investing Solutions, CommSec#fmps #fmps24 #fmevents #RetailTrading #FintechInnovation #FinancialRegulation #DigitalAssets #GlobalFinance📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! As the financial services industry experiences rapid and transformative changes, leading fintech experts and policymakers come together to discuss the present and future of retail trading and the evolving regulatory landscape. Join this insightful session for a forward-looking perspective on the trends, innovations, and trader needs that are shaping the future of offerings on a global scale.Speakers:Eric Blewitt, CEO, Investment TrendsRhys Bollen, Senior Executive Leader, Digital Assets, Australian Securities and Investments Commission (ASIC)Michael Bogoevski, Head of Institutional Sales, CMC ConnectKarin Setchell, General Manager, Product & Investing Solutions, CommSec#fmps #fmps24 #fmevents #RetailTrading #FintechInnovation #FinancialRegulation #DigitalAssets #GlobalFinance📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! As the financial services industry experiences rapid and transformative changes, leading fintech experts and policymakers come together to discuss the present and future of retail trading and the evolving regulatory landscape. Join this insightful session for a forward-looking perspective on the trends, innovations, and trader needs that are shaping the future of offerings on a global scale.Speakers:Eric Blewitt, CEO, Investment TrendsRhys Bollen, Senior Executive Leader, Digital Assets, Australian Securities and Investments Commission (ASIC)Michael Bogoevski, Head of Institutional Sales, CMC ConnectKarin Setchell, General Manager, Product & Investing Solutions, CommSec#fmps #fmps24 #fmevents #RetailTrading #FintechInnovation #FinancialRegulation #DigitalAssets #GlobalFinance📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! As the financial services industry experiences rapid and transformative changes, leading fintech experts and policymakers come together to discuss the present and future of retail trading and the evolving regulatory landscape. Join this insightful session for a forward-looking perspective on the trends, innovations, and trader needs that are shaping the future of offerings on a global scale.Speakers:Eric Blewitt, CEO, Investment TrendsRhys Bollen, Senior Executive Leader, Digital Assets, Australian Securities and Investments Commission (ASIC)Michael Bogoevski, Head of Institutional Sales, CMC ConnectKarin Setchell, General Manager, Product & Investing Solutions, CommSec#fmps #fmps24 #fmevents #RetailTrading #FintechInnovation #FinancialRegulation #DigitalAssets #GlobalFinance📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Executive Interviews with Joe Li & Simon Naish | ATFX | FMPS:24 Executive Interviews with Joe Li & Simon Naish | ATFX | FMPS:24 Executive Interviews with Joe Li & Simon Naish | ATFX | FMPS:24 Executive Interviews with Joe Li & Simon Naish | ATFX | FMPS:24 Executive Interviews with Joe Li & Simon Naish | ATFX | FMPS:24 Executive Interviews with Joe Li & Simon Naish | ATFX | FMPS:24 In this Finance Magnates Executive Interview, Joe Li, Chairman at ATFX and Simon Naish, Country Head of Australia at ATFX Connect, discuss ATFX’s strategic growth in the APAC region, particularly focusing on their institutional arm, ATFX Connect. They highlight the importance of Australia as a strategic hub, the challenges of operating in a highly competitive and regulated market, and their plans for regional expansion across APAC. The conversation touches on the integration of advanced technology and multi-asset offerings, the significance of optimal execution tools, and the importance of tailoring solutions to meet the sophisticated demands of institutional clients. They also emphasize their strong regulatory compliance and their commitment to enhancing client experience through innovative tools and infrastructure.#fmps #fmps24 #fmevents #ATFXConnect #APACFinance #InstitutionalTrading #FinancialTechnology #MarketExpansion📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In this Finance Magnates Executive Interview, Joe Li, Chairman at ATFX and Simon Naish, Country Head of Australia at ATFX Connect, discuss ATFX’s strategic growth in the APAC region, particularly focusing on their institutional arm, ATFX Connect. They highlight the importance of Australia as a strategic hub, the challenges of operating in a highly competitive and regulated market, and their plans for regional expansion across APAC. The conversation touches on the integration of advanced technology and multi-asset offerings, the significance of optimal execution tools, and the importance of tailoring solutions to meet the sophisticated demands of institutional clients. They also emphasize their strong regulatory compliance and their commitment to enhancing client experience through innovative tools and infrastructure.#fmps #fmps24 #fmevents #ATFXConnect #APACFinance #InstitutionalTrading #FinancialTechnology #MarketExpansion📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In this Finance Magnates Executive Interview, Joe Li, Chairman at ATFX and Simon Naish, Country Head of Australia at ATFX Connect, discuss ATFX’s strategic growth in the APAC region, particularly focusing on their institutional arm, ATFX Connect. They highlight the importance of Australia as a strategic hub, the challenges of operating in a highly competitive and regulated market, and their plans for regional expansion across APAC. The conversation touches on the integration of advanced technology and multi-asset offerings, the significance of optimal execution tools, and the importance of tailoring solutions to meet the sophisticated demands of institutional clients. They also emphasize their strong regulatory compliance and their commitment to enhancing client experience through innovative tools and infrastructure.#fmps #fmps24 #fmevents #ATFXConnect #APACFinance #InstitutionalTrading #FinancialTechnology #MarketExpansion📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In this Finance Magnates Executive Interview, Joe Li, Chairman at ATFX and Simon Naish, Country Head of Australia at ATFX Connect, discuss ATFX’s strategic growth in the APAC region, particularly focusing on their institutional arm, ATFX Connect. They highlight the importance of Australia as a strategic hub, the challenges of operating in a highly competitive and regulated market, and their plans for regional expansion across APAC. The conversation touches on the integration of advanced technology and multi-asset offerings, the significance of optimal execution tools, and the importance of tailoring solutions to meet the sophisticated demands of institutional clients. They also emphasize their strong regulatory compliance and their commitment to enhancing client experience through innovative tools and infrastructure.#fmps #fmps24 #fmevents #ATFXConnect #APACFinance #InstitutionalTrading #FinancialTechnology #MarketExpansion📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In this Finance Magnates Executive Interview, Joe Li, Chairman at ATFX and Simon Naish, Country Head of Australia at ATFX Connect, discuss ATFX’s strategic growth in the APAC region, particularly focusing on their institutional arm, ATFX Connect. They highlight the importance of Australia as a strategic hub, the challenges of operating in a highly competitive and regulated market, and their plans for regional expansion across APAC. The conversation touches on the integration of advanced technology and multi-asset offerings, the significance of optimal execution tools, and the importance of tailoring solutions to meet the sophisticated demands of institutional clients. They also emphasize their strong regulatory compliance and their commitment to enhancing client experience through innovative tools and infrastructure.#fmps #fmps24 #fmevents #ATFXConnect #APACFinance #InstitutionalTrading #FinancialTechnology #MarketExpansion📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In this Finance Magnates Executive Interview, Joe Li, Chairman at ATFX and Simon Naish, Country Head of Australia at ATFX Connect, discuss ATFX’s strategic growth in the APAC region, particularly focusing on their institutional arm, ATFX Connect. They highlight the importance of Australia as a strategic hub, the challenges of operating in a highly competitive and regulated market, and their plans for regional expansion across APAC. The conversation touches on the integration of advanced technology and multi-asset offerings, the significance of optimal execution tools, and the importance of tailoring solutions to meet the sophisticated demands of institutional clients. They also emphasize their strong regulatory compliance and their commitment to enhancing client experience through innovative tools and infrastructure.#fmps #fmps24 #fmevents #ATFXConnect #APACFinance #InstitutionalTrading #FinancialTechnology #MarketExpansion📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Ready to Scale? Regtech in Australia, A Global View | FMPS:24 Ready to Scale? Regtech in Australia, A Global View | FMPS:24 Ready to Scale? Regtech in Australia, A Global View | FMPS:24 Ready to Scale? Regtech in Australia, A Global View | FMPS:24 Ready to Scale? Regtech in Australia, A Global View | FMPS:24 Ready to Scale? Regtech in Australia, A Global View | FMPS:24 In the effort to elevate Australian fintech on the global stage, RegTech presents a unique and compelling case. Despite the increasing demand for robust compliance solutions, Australia's RegTech sector—ranked third-largest globally—remains underfunded. Join this insightful fireside chat to explore the future of Australia’s RegTech hub and its global potential.Key discussion points include uncovering the hidden opportunities in RegTech that VCs are overlooking, the necessary steps for increased governmental support, the readiness of the local ecosystem to collaborate across global regulatory regimes, and lessons learned from other leading fintech hubs around the world.Speakers:Dickie Currer, National Lead, Tech Australia AdvocatesDeborah Young, CEO, The RegTech Association#fmps #fmps24 #fmevents #RegTech #Fintech #AustralianFintech #GlobalCompliance #TechInnovation📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In the effort to elevate Australian fintech on the global stage, RegTech presents a unique and compelling case. Despite the increasing demand for robust compliance solutions, Australia's RegTech sector—ranked third-largest globally—remains underfunded. Join this insightful fireside chat to explore the future of Australia’s RegTech hub and its global potential.Key discussion points include uncovering the hidden opportunities in RegTech that VCs are overlooking, the necessary steps for increased governmental support, the readiness of the local ecosystem to collaborate across global regulatory regimes, and lessons learned from other leading fintech hubs around the world.Speakers:Dickie Currer, National Lead, Tech Australia AdvocatesDeborah Young, CEO, The RegTech Association#fmps #fmps24 #fmevents #RegTech #Fintech #AustralianFintech #GlobalCompliance #TechInnovation📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In the effort to elevate Australian fintech on the global stage, RegTech presents a unique and compelling case. Despite the increasing demand for robust compliance solutions, Australia's RegTech sector—ranked third-largest globally—remains underfunded. Join this insightful fireside chat to explore the future of Australia’s RegTech hub and its global potential.Key discussion points include uncovering the hidden opportunities in RegTech that VCs are overlooking, the necessary steps for increased governmental support, the readiness of the local ecosystem to collaborate across global regulatory regimes, and lessons learned from other leading fintech hubs around the world.Speakers:Dickie Currer, National Lead, Tech Australia AdvocatesDeborah Young, CEO, The RegTech Association#fmps #fmps24 #fmevents #RegTech #Fintech #AustralianFintech #GlobalCompliance #TechInnovation📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In the effort to elevate Australian fintech on the global stage, RegTech presents a unique and compelling case. Despite the increasing demand for robust compliance solutions, Australia's RegTech sector—ranked third-largest globally—remains underfunded. Join this insightful fireside chat to explore the future of Australia’s RegTech hub and its global potential.Key discussion points include uncovering the hidden opportunities in RegTech that VCs are overlooking, the necessary steps for increased governmental support, the readiness of the local ecosystem to collaborate across global regulatory regimes, and lessons learned from other leading fintech hubs around the world.Speakers:Dickie Currer, National Lead, Tech Australia AdvocatesDeborah Young, CEO, The RegTech Association#fmps #fmps24 #fmevents #RegTech #Fintech #AustralianFintech #GlobalCompliance #TechInnovation📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In the effort to elevate Australian fintech on the global stage, RegTech presents a unique and compelling case. Despite the increasing demand for robust compliance solutions, Australia's RegTech sector—ranked third-largest globally—remains underfunded. Join this insightful fireside chat to explore the future of Australia’s RegTech hub and its global potential.Key discussion points include uncovering the hidden opportunities in RegTech that VCs are overlooking, the necessary steps for increased governmental support, the readiness of the local ecosystem to collaborate across global regulatory regimes, and lessons learned from other leading fintech hubs around the world.Speakers:Dickie Currer, National Lead, Tech Australia AdvocatesDeborah Young, CEO, The RegTech Association#fmps #fmps24 #fmevents #RegTech #Fintech #AustralianFintech #GlobalCompliance #TechInnovation📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! In the effort to elevate Australian fintech on the global stage, RegTech presents a unique and compelling case. Despite the increasing demand for robust compliance solutions, Australia's RegTech sector—ranked third-largest globally—remains underfunded. Join this insightful fireside chat to explore the future of Australia’s RegTech hub and its global potential.Key discussion points include uncovering the hidden opportunities in RegTech that VCs are overlooking, the necessary steps for increased governmental support, the readiness of the local ecosystem to collaborate across global regulatory regimes, and lessons learned from other leading fintech hubs around the world.Speakers:Dickie Currer, National Lead, Tech Australia AdvocatesDeborah Young, CEO, The RegTech Association#fmps #fmps24 #fmevents #RegTech #Fintech #AustralianFintech #GlobalCompliance #TechInnovation📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Resilience in Trading: From Third Class To World Class | FMPS:24 Resilience in Trading: From Third Class To World Class | FMPS:24 Resilience in Trading: From Third Class To World Class | FMPS:24 Resilience in Trading: From Third Class To World Class | FMPS:24 Resilience in Trading: From Third Class To World Class | FMPS:24 Resilience in Trading: From Third Class To World Class | FMPS:24 Join Mario Singh, Founder and Chairman of Fullerton Markets, as he shares his life story, highlighting the traits that were required starting without financial knowledge to become a financial and trading expert recognised by world-renowned media like CNBC & Bloomberg.#fmps #fmps24 #fmevents #trading #onlinetrading #tradingexpert #tradingjourney📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Join Mario Singh, Founder and Chairman of Fullerton Markets, as he shares his life story, highlighting the traits that were required starting without financial knowledge to become a financial and trading expert recognised by world-renowned media like CNBC & Bloomberg.#fmps #fmps24 #fmevents #trading #onlinetrading #tradingexpert #tradingjourney📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Join Mario Singh, Founder and Chairman of Fullerton Markets, as he shares his life story, highlighting the traits that were required starting without financial knowledge to become a financial and trading expert recognised by world-renowned media like CNBC & Bloomberg.#fmps #fmps24 #fmevents #trading #onlinetrading #tradingexpert #tradingjourney📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Join Mario Singh, Founder and Chairman of Fullerton Markets, as he shares his life story, highlighting the traits that were required starting without financial knowledge to become a financial and trading expert recognised by world-renowned media like CNBC & Bloomberg.#fmps #fmps24 #fmevents #trading #onlinetrading #tradingexpert #tradingjourney📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Join Mario Singh, Founder and Chairman of Fullerton Markets, as he shares his life story, highlighting the traits that were required starting without financial knowledge to become a financial and trading expert recognised by world-renowned media like CNBC & Bloomberg.#fmps #fmps24 #fmevents #trading #onlinetrading #tradingexpert #tradingjourney📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more! Join Mario Singh, Founder and Chairman of Fullerton Markets, as he shares his life story, highlighting the traits that were required starting without financial knowledge to become a financial and trading expert recognised by world-renowned media like CNBC & Bloomberg.#fmps #fmps24 #fmevents #trading #onlinetrading #tradingexpert #tradingjourney📣 Stay updated with the latest in finance and trading!Follow FMevents across our social media platforms for news, insights, and event updates.Connect with us today:🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents📸 Instagram: https://www.instagram.com/fmevents_official🐦 Twitter: https://twitter.com/F_M_events🎥 TikTok: https://www.tiktok.com/@fmevents_official▶️ YouTube: https://www.youtube.com/@FinanceMagnates_officialDon't miss out on our latest videos, interviews, and event coverage.Subscribe to our YouTube channel for more!

Stash Frequently Asked Questions (FAQ)

When was Stash founded?

Stash was founded in 2015.

Where is Stash's headquarters?

Stash's headquarters is located at 500 7th Avenue, New York.

What is Stash's latest funding round?

Stash's latest funding round is Convertible Note.

How much did Stash raise?

Stash raised a total of $531.85M.

Who are the investors of Stash?

Investors of Stash include Goodwater Capital, Union Square Ventures, T. Rowe Price, Entree Capital, Owl Ventures and 12 more.

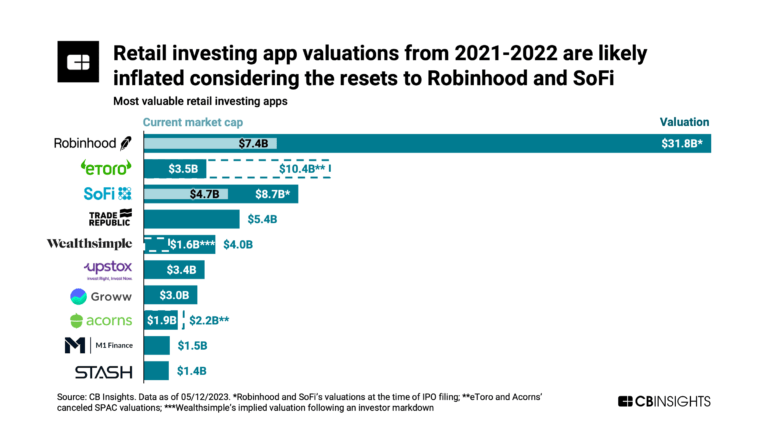

Who are Stash's competitors?

Competitors of Stash include Changed, Bundil, Bits of Stock, Moneybox, Acorns and 7 more.

What products does Stash offer?

Stash's products include Invest, Retire + Custodial and 4 more.

Loading...

Compare Stash to Competitors

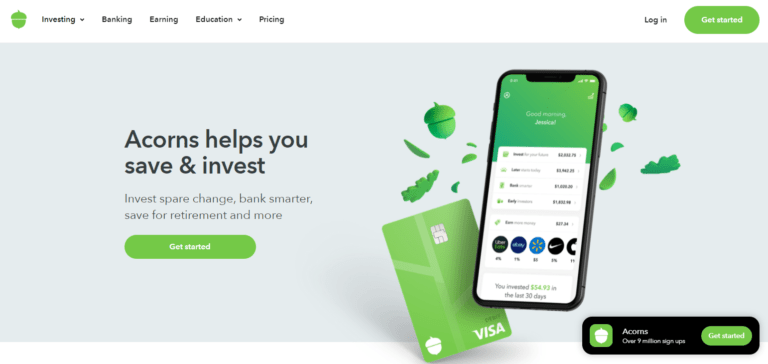

Acorns focuses on micro-investing in the financial services industry. It offers services that allow customers to invest spare change from everyday purchases into a diversified portfolio of index funds. It primarily sells to individuals looking to start investing in small amounts. The company was founded in 2012 and is based in Irvine, California.

Changed is a financial technology company focusing on helping individuals accelerate their debt repayment and achieve financial freedom. The company offers an application-based platform that rounds up users' spare change from everyday transactions and applies it toward their debt, in addition to providing tools for automated payments, tracking loan balances, and setting financial goals. Changed primarily serves individuals looking to pay off personal loans, student loans, auto loans, credit cards, and mortgages more efficiently. It was founded in 2017 and is based in Chicago, Illinois.

Bundil operates as a crypto investment mobile platform. It allows users to automatically invest spare change from everyday credit or debit card purchases into Bitcoin and other cryptocurrencies. It was founded in 2017 and is based in Dallas, Texas.

Wealthfront is a financial services company that focuses on automated investing and wealth building for individuals. The company offers a range of services including high-yield savings accounts, investment in US Treasury bonds, and diversified portfolio management using automated technology. Wealthfront's products are designed to cater to both seasoned and novice investors, aiming to simplify the investment process and maximize returns over the long term. Wealthfront was formerly known as kaChing. It was founded in 2011 and is based in Palo Alto, California.

Moneybox is a mobile savings and investment application. It provides an application to enable users to round up the digital spare change from everyday card transactions and invest that change into three tracker funds within stocks and shares. It was founded in 2015 and the company is based in London, United Kingdom.

Cred provides a personalized investment portfolio tool that matches a client's existing worldview and long-term investing need.

Loading...