Stashfin

Founded Year

2016Stage

Debt - IV | AliveTotal Raised

$449.32MValuation

$0000Last Raised

$100M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-88 points in the past 30 days

About Stashfin

Stashfin is a financial services platform. It provides instant personal loans to borrowers in India. Stashfin offers a variety of repayment options, including equated monthly installments (EMIs), lump sum payments, and flexible repayments. Stashfin was founded in 2016 and is based in New Delhi, India.

Loading...

Stashfin's Product Videos

Stashfin's Products & Differentiators

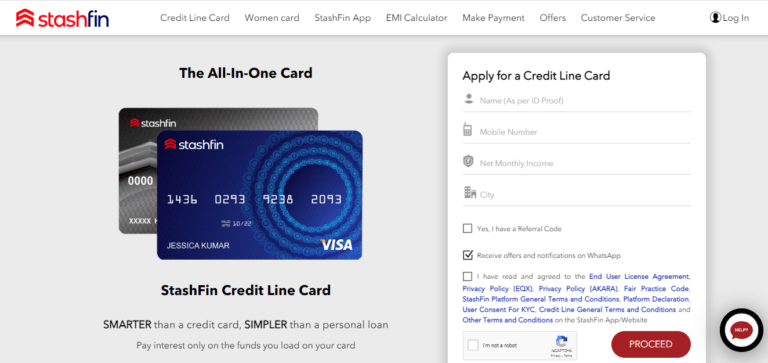

Credit Line

1) Instant credit line is provided to consumers over mobile & web , 2) Flexible credit limit of up to 5 lacs, 3) Automated KYC process in just 90 seconds, 4) flexible monthly repayment schedule, 5) Dynamic pricing to reflect real time creditworthiness

Loading...

Research containing Stashfin

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stashfin in 1 CB Insights research brief, most recently on Jun 23, 2022.

Expert Collections containing Stashfin

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stashfin is included in 1 Expert Collection, including Fintech.

Fintech

13,396 items

Excludes US-based companies

Latest Stashfin News

Sep 11, 2024

AKARA Capital Advisors aims to raise Rs 100 crore over the next quarter through this bond issue. 11 Sep 2024, 08:03 PM IST 11 Sep 2024, 08:03 PM IST WhatsApp Fintech. For representative purposes only (Source: Envato) Financial services platform Stashfin on Wednesday said its parent company AKARA Capital Advisors has become the first fintech NBFC to offer Non-Convertible Debentures at a face value of Rs 10,000 on BSE, as it aims to raise Rs 100 crore through the bond issuance. This offering follows a recent regulatory amendment by market regulator SEBI in July, which lowered the minimum face value of debt securities from Rs 1,00,000 to Rs 10,000, enhancing financial inclusion and accessibility for retail investors across the country, it said. "Through this bond issue, the company aims to raise Rs 100 crore over the next quarter. This milestone reflects Stashfin's role as the first fintech company to democratise investment opportunities for retail investors," Stashfin said in a release. The first tranche, valued at Rs 6.5 crore and launched on the retail platform, was fully subscribed. Commenting on the announcement, Tushar Agarwal, founder and CEO of Stashfin, said the move by SEBI is a game-changer for the financial markets, significantly lowering the entry barriers for retail investors and broadening the scope of participation in debt securities. "As the first fintech NBFC to seize this opportunity, we view this as a pivotal moment in India's financial evolution, where access to secure and diversified investment options is becoming democratised," Agarwal said. The regulatory development by SEBI aims to transform bond investments, thereby enhancing the accessibility and captivity for retail investors, Stashfin said. Additionally, the market regulator has mandated a standardised record date of 15 days before any interest payment or redemption, ensuring transparency and consistency in the market. ALSO READ

Stashfin Frequently Asked Questions (FAQ)

When was Stashfin founded?

Stashfin was founded in 2016.

Where is Stashfin's headquarters?

Stashfin's headquarters is located at 337, Mehrauli-Gurgaon Road,, New Delhi.

What is Stashfin's latest funding round?

Stashfin's latest funding round is Debt - IV.

How much did Stashfin raise?

Stashfin raised a total of $449.32M.

Who are the investors of Stashfin?

Investors of Stashfin include InnoVen Capital, Trifecta Capital, Snow Leopard Global, Kravis Investment Partners, Altara Ventures and 12 more.

Who are Stashfin's competitors?

Competitors of Stashfin include Slice, KB NBFC, OneCard, Upwards, Uni and 7 more.

What products does Stashfin offer?

Stashfin's products include Credit Line .

Loading...

Compare Stashfin to Competitors

Slice operates as a financial technology company focusing on providing consumer payment solutions. The company offers a digital prepaid account for everyday payments, a fast and simple way to make payments via credit or UPI. The company primarily serves the financial services industry. Slice was formerly known as Slice Pay. It was founded in 2016 and is based in Bengaluru, India.

OneCard specializes in offering a metal credit card with a focus on simplicity and transparency in the financial services sector. The company provides a co-branded credit card that allows users to manage various aspects through a mobile app, including transaction limits and payment types, and offers a digital on-boarding process. OneCard's products are designed to cater to individual and family financial management needs, with features like shared credit limits and rewards on spending. It was founded in 2019 and is based in Pune, India.

Uni is a fintech company focused on redefining the credit card experience within the financial services industry. The company offers next-generation credit cards with features such as cashback rewards, zero foreign exchange markup, and a user-friendly mobile application for managing finances. Uni primarily serves the consumer finance sector with its innovative credit card solutions. It was founded in 2020 and is based in Bengaluru, India.

KB NBFC serves as a financial services provider focused on credit solutions for students in India. The company offers a range of products including financing for online purchases, loans for two-wheelers and college tuition, as well as cash loans, all tailored to the needs of college students with flexible repayment options. It was founded in 2016 and is based in Bangalore, India.

Red Fort Capital provides an investment platform for institutional investors. Its financing vehicles include private equity funds, Red Fort Principal Investing Group, and a Non-Bank Finance Company (NBFC) in India. NBFC provides Business Credit with a quick turnaround time. The company was founded in 2005 and is based in Mumbai, India.

SMC Finance, a subsidiary of SMC Global Securities Ltd., specializes in financial services and operates as a non-banking financial company (NBFC). The company offers a variety of loan products, including loans against property and securities, business loans, and financing for IPOs and medical equipment. SMC Finance serves a diverse clientele, including corporate entities, small and medium-sized enterprises (SMEs), professionals, and salaried individuals. It was founded in 2008 and is based in New Delhi, India.

Loading...