Stori

Founded Year

2019Stage

Debt - III | AliveTotal Raised

$666.5MLast Raised

$107M | 2 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+21 points in the past 30 days

About Stori

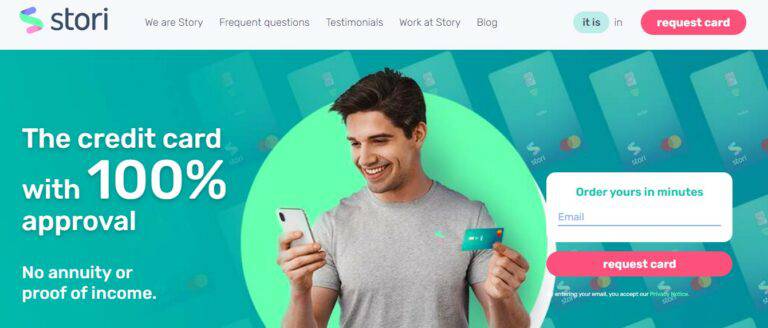

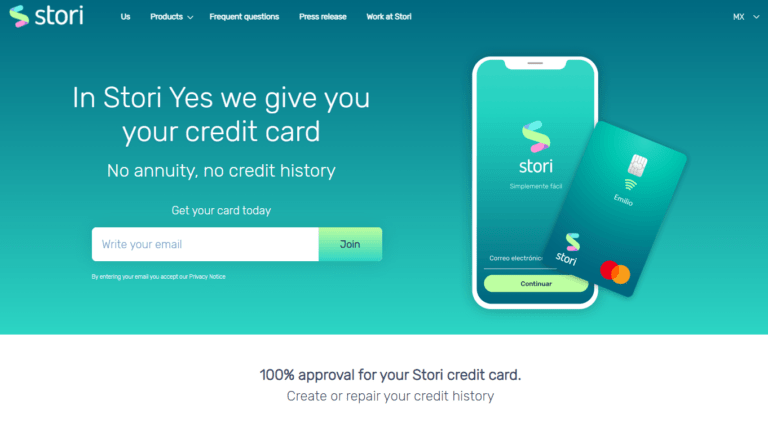

Stori is a financial technology company focused on providing credit access and financial services. The company offers credit cards with high approval rates and cashback rewards, as well as deposit accounts with competitive returns. Stori primarily serves the underbanked population in Latin America, offering financial products that aim to democratize credit access and enhance financial inclusion. It was founded in 2019 and is based in Mexico City, Mexico.

Loading...

Loading...

Research containing Stori

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stori in 3 CB Insights research briefs, most recently on Jul 22, 2022.

Expert Collections containing Stori

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stori is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Digital Banking

1,008 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Latest Stori News

Aug 30, 2024

Latin Lawyer Credit: Shutterstock/Deemerwha studio Goldman Sachs relied on three Mayer Brown offices to participate in a US$212 million debt and equity financing for fintech startup Stori, marking the largest funding round by a Mexican start-up this year. To read more

Stori Frequently Asked Questions (FAQ)

When was Stori founded?

Stori was founded in 2019.

Where is Stori's headquarters?

Stori's headquarters is located at 213 Juárez Colonia, Cuauhtemoc, Mexico City.

What is Stori's latest funding round?

Stori's latest funding round is Debt - III.

How much did Stori raise?

Stori raised a total of $666.5M.

Who are the investors of Stori?

Investors of Stori include Lightspeed Venture Partners, General Catalyst, BAI Capital, GIC, Goodwater Capital and 11 more.

Who are Stori's competitors?

Competitors of Stori include Aplazo, Uala, Klar, Credivalores-Crediservicios, Cooprogreso and 7 more.

Loading...

Compare Stori to Competitors

Fondeadora provides digital banking services. The company offers a mobile banking application and an international master-card debit card that helps users to spend, store, and move money. It primarily serves the financial services industry. The company was founded in 2011 and is based in Mexico City, Mexico.

Ualá operates in the financial technology sector, focusing on providing digital financial services. The company offers a prepaid Mastercard and an application that allows users to manage their money, make purchases, access loans, invest, and pay bills. Ualá primarily serves the financial services industry. It was founded in 2017 and is based in Buenos Aires, Argentina.

Cuenca is a financial technology company offering electronic funds payment accounts within the digital banking sector. Their services include easy account opening, SPEI bank transfers, bill payments, and 24/7 access to funds through a mobile app. Cuenca provides various account levels to meet different customer needs, from those making cash deposits to those receiving regular transfers. Cuenca was formerly known as Cuenca Health. It was founded in 2018 and is based in Mexico City, Mexico.

Parcelex is a digital platform operating in the financial services sector, with a focus on providing credit solutions. The company offers a 'Buy Now Pay Later' service, allowing customers to make purchases and pay in installments via Pix or boleto, without the need for a credit card. Parcelex primarily serves the ecommerce industry. It was founded in 2020 and is based in Rio de Janeiro, Brazil.

Prex is a company that operates in the financial services sector, with a focus on digital banking solutions. The company offers a prepaid international Mastercard, along with an app that allows users to manage their accounts, make transactions, exchange currencies, and apply for loans. The company primarily serves individuals and businesses seeking digital banking and payment solutions. It was founded in 2015 and is based in Montevideo, Uruguay.

Digio is a digital platform focused on financial services. The company offers a range of products and services including a digital account, credit card management through an application, personal loans, and a rewards club. These services are designed to simplify people's relationship with their money. It was founded in 2013 and is based in Barueri, Brazil.

Loading...