Thought Machine

Founded Year

2014Stage

Series D - II | AliveTotal Raised

$508.05MValuation

$0000Last Raised

$106M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-43 points in the past 30 days

About Thought Machine

Thought Machine specializes in core banking software and operates within the financial technology sector. The company offers a cloud-native core banking platform, Vault Core, and a payment processing platform, Vault Payments, which enable banks to create and manage a wide range of financial products and payment schemes. Thought Machine's products are designed to provide banks with flexibility, control, and the ability to deploy on any cloud infrastructure. It was founded in 2014 and is based in London, England.

Loading...

Thought Machine's Product Videos

ESPs containing Thought Machine

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

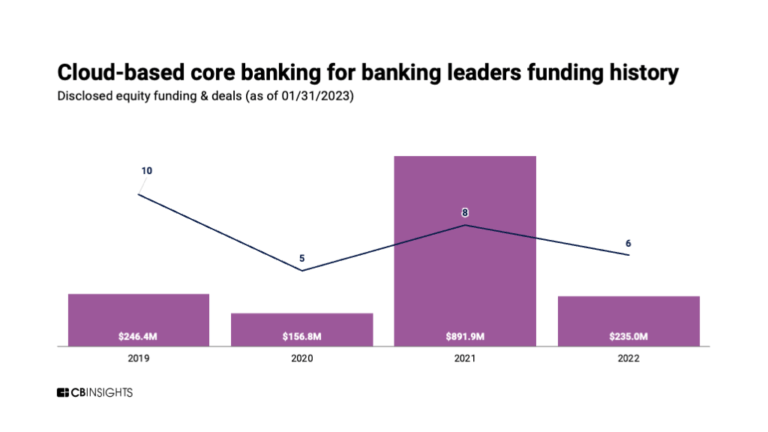

The cloud-based core banking solutions market offers financial institutions the opportunity to modernize outdated legacy systems and provide customers with personalized products and services. The market is competitive, with vendors offering cloud-native solutions that are scalable, secure, and cost-effective. The use of APIs and microservices architecture allows for quick integration with other sy…

Thought Machine named as Challenger among 15 other companies, including Temenos, Oracle, and Fiserv.

Thought Machine's Products & Differentiators

Vault Core

https://www.thoughtmachine.net/vault-core

Loading...

Research containing Thought Machine

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Thought Machine in 5 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Thought Machine

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Thought Machine is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Future Unicorns 2019

50 items

Fintech

13,398 items

Excludes US-based companies

Fintech 100

599 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

979 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Thought Machine News

Sep 13, 2024

Tech.eu Tech.eu Insights creates insight and guides strategies with its comprehensive content and reports. Browse popular Insights content. Capital gains tax hike in UK a “hammer blow” to startup staff, warns top tech leader Founders say a possible rise in capial gains tax in the UK could lead to investment drying up and startups leaving the UK. A rise in UK capital gains tax would be a ‘hammer blow” to startup staff, according to one of the top UK tech leaders. Entrepreneurs and investors have voiced concerns over a possible hike in capital gains tax in the UK October budget to a top rate of 45 per cent, saying it could drive investment and startups overseas. The Labour Party is looking to fill a £22 billion fiscal hole left by the previous Conservative government, leading to speculation that capital gains will be targeted by the Treasury. Paul Taylor, CEO and founder of cloud-based banking tech platform Thought Machine , said: “There is real dismay in the startup community, people cannot believe this.” Startups often offer shares to staff instead of high salaries as an incentive to join. The tax hike could see startup staff hit with 45 per cent capital gains tax when they sell shares, compared to the current rate of 20 which can be as low as 10 per cent with further tax relief. Taylor said: "My main concern is with staff because under the EMI [Enterprise Management Incentive) scheme, staff stock options are valued as capital gains. “That was put in by the last Labour government in about 2001. That is a really, really important thing to give them a fair reward. It would be a real hammer blow on them. “And the really hard thing is it's retrospective. They have been working for years under the basis that they pay 20 per cent for it to ramp up to 45 per cent is pretty bad." Speaking more broadly about a possible rise in capital gains tax, Taylor said: “It’s bad on the investor community. We have investors from the UK, we have got investors from abroad. You get decent tax breaks, why would anybody do it if the rate was going to go way up?” The unicorn, last valued at £2.2 billion in its last funding round in 2022, provides cloud-based banking services for the likes of Lloyds, Standard Chartered and JP Morgan. Taylor said its services were popular in Europe, saying the UK was a key market, and had also sold into the Nordics, Italy and Eastern Europe. He said: “I think by banks signed, the UK is our number one.” Last year, Thought Machine made job cuts of between 50 and 70 staff in a cost cutting exercise. Taylor said there had been no job cuts since and no plans for job cuts this year. The founder also touched upon the use of GenAI and how if at all it was being used at Thought Machine. He said that GenAI would not lead to a reduction in headcount at Thought Machine, given that unlike Klarna Thought Machine did not have a large customer support team. Asked how Thought Machine staff were using GenAI tools, Taylor said “barely at all”. He added: “We tried it in a few places, we tried it here, we tried it there. It just doesn’t really fit. “When you aren’t a programmer, getting AI to write a website is a huge boost. It is very, very productive. But when you are an expert programmer, it’s rare that it does it better. “It’s not good at bleeding edge stuff. And what we’re doing here is bleeding edge platform technology."

Thought Machine Frequently Asked Questions (FAQ)

When was Thought Machine founded?

Thought Machine was founded in 2014.

Where is Thought Machine's headquarters?

Thought Machine's headquarters is located at 5 New Street Square, London.

What is Thought Machine's latest funding round?

Thought Machine's latest funding round is Series D - II.

How much did Thought Machine raise?

Thought Machine raised a total of $508.05M.

Who are the investors of Thought Machine?

Investors of Thought Machine include Lloyds Banking Group, Eurazeo, J.P. Morgan Chase, Intesa Sanpaolo, Morgan Stanley and 16 more.

Who are Thought Machine's competitors?

Competitors of Thought Machine include FintechOS, Fimple, Tuum, 10x Banking, Pismo and 7 more.

What products does Thought Machine offer?

Thought Machine's products include Vault Core and 1 more.

Who are Thought Machine's customers?

Customers of Thought Machine include Standard Chartered, JP Morgan, Intesa Sanpaolo and Atom Bank.

Loading...

Compare Thought Machine to Competitors

Tuum specializes in core banking solutions within the financial technology sector. They provide a modular core banking platform that allows banks to replace legacy systems and launch new financial products, including accounts, lending, payments, and cards. Tuum's platform serves the financial industry by enabling the creation of unique banking models and the integration of partner solutions. It was formerly known as Modularbank. It was founded in 2019 and is based in Tallinn, Estonia.

10x Banking focuses on providing a cloud-native core banking platform, operating within the financial technology sector. The company offers a digital banking solution that enables banks to modernize their core banking systems, launch digital banks, and reduce operating costs. It was founded in 2016 and is based in London, United Kingdom.

Finastra provides a range of financial services, treasury, lending, and banking software solutions. The company offers a wide range of services including lending and corporate banking, payments, treasury and capital markets, universal banking, and investment management. It primarily serves the financial technology industry. It was founded in 2017 and is based in London, United Kingdom.

Ohpen is a Netherlands-based company that has built cloud-based core banking software, targeting any large financial services provider that administrates retail investment and savings accounts.

Nymbus operates in the financial services industry, providing alternatives to traditional banking business models. The company offers products and solutions designed to enable financial institutions of all sizes to grow and serve their customers without the need for core conversion. Nymbus primarily caters to banks and credit unions looking to launch digital banking services, create niche financial brands, or deploy innovative core banking platforms. It was founded in 2015 and is based in Jacksonville, Florida.

Fimple operates as a product-focused company specializing in financial technology solutions within the banking and finance sector. The company offers a cloud-based system designed to simplify the creation and management of banking products for financial institutions. Fimple's Transaction Composer enables banks and financial institutions to develop and offer products and services to their customers and fintech partners. It was founded in 2022 and is based in London, England.

Loading...