Nuvemshop

Founded Year

2011Stage

Series E | AliveTotal Raised

$628.3MValuation

$0000Last Raised

$500M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-52 points in the past 30 days

About Nuvemshop

Nuvemshop is a leading e-commerce platform that specializes in providing online store creation and management solutions. The company offers a suite of tools for payment processing, logistics integration, store customization, and sales channel integration, designed to empower entrepreneurs to build and grow their online businesses. Nuvemshop also provides educational resources in digital marketing and supports dropshipping business models. It was founded in 2011 and is based in Sao Paulo, Brazil.

Loading...

ESPs containing Nuvemshop

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

End-to-end e-commerce solutions providers provide all of the tools to create an e-commerce website, from the back end (data, site architecture, content management, order management) to the front end (search, display pages, payments and checkout). These companies offer varying options for infrastructure (e.g., headless) and design. Some also integrate with physical store operations to create omnich…

Nuvemshop named as Challenger among 15 other companies, including Shopify, BigCommerce, and Wix.

Nuvemshop's Products & Differentiators

SaaS Online store

An online store ready to be used, easy to set-up and start selling. Contains different and important integrations, as payments, logistics, ERP, marketing automation, among others

Loading...

Research containing Nuvemshop

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Nuvemshop in 1 CB Insights research brief, most recently on Jan 24, 2022.

Expert Collections containing Nuvemshop

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Nuvemshop is included in 3 Expert Collections, including E-Commerce.

E-Commerce

11,032 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

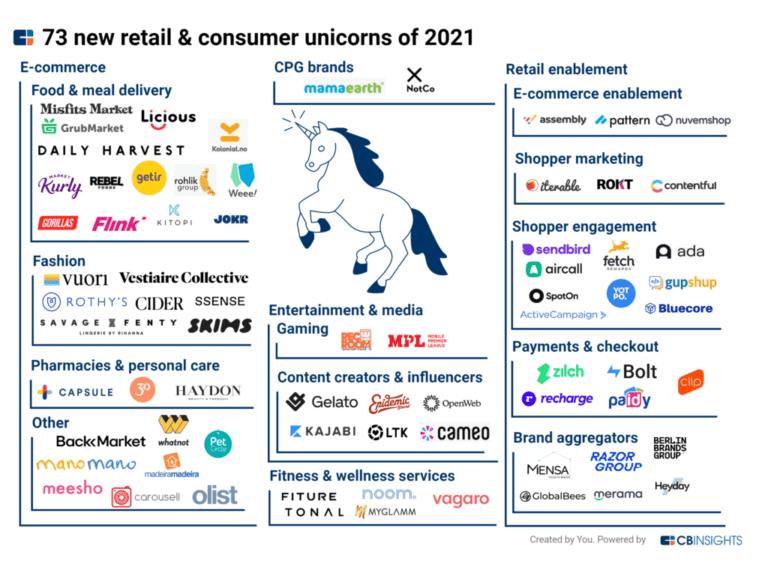

Unicorns- Billion Dollar Startups

1,244 items

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Latest Nuvemshop News

Jun 19, 2024

Ecommerce market in Latin America is expected to grow by 6.55% on annual basis to reach US$194.7 billion in 2024. Medium to long term growth story of Ecommerce industry in Latin America promises to be attractive. The Ecommerce is expected to grow steadily over the forecast period, recording a CAGR of 8.50% during 2024-2028. The Ecommerce gross merchandise value in this region will increase from US$182.7 billion in 2023 to reach US$269.8 billion by 2028. The e-commerce sector is experiencing strong growth in the Latin American market and the trend is projected to continue further over the medium term. The enhancement in digital infrastructure and supply chain networks are among the factors driving the uptake of online shopping in Latin America. To tap into the growing market, global firms are also increasing their investment in the regional markets. Shein, for instance, is planning to develop and build more warehouses in Mexico over the medium term. Temu and TikTok are other Chinese e-commerce firms that are eyeing market share in Latin America. Consequently, the publisher expects a further increase in investment in the regional e-commerce market in 2024. Overall, the publisher maintains a positive growth outlook for the Latin American B2C e-commerce industry over the next three to four years. Latin American e-commerce marketplaces continue to diversify to accelerate revenue growth MercadoLibre, one of the leading e-commerce platforms having a yearly revenue of US$10 billion, experienced notable growth in its cryptocurrency segment. In their latest quarterly earnings report, the firm revealed they held US$21 million in crypto assets for their customers, as of September 2023. This is a significant increase from the US$15 million reported in December 2022. Despite the impressive growth in the crypto sector, it remains a small part of MercadoLibre's overall business, which includes credit cards and loans. However, the firm exceeded expectations by announcing US$3.8 billion in revenue and US$685 million in profits for Q3, with the growth attributed to its expanding presence in Brazil and Mexico. MercadoLibre introduced Mercado Coin last year, a cryptocurrency tradable on their own wallet called Mercado Pago, with an initial price of just 10 cents. In December 2021, they also began offering Bitcoin and Ethereum to their customers. Firms are entering into acquisition deals to grow their presence in the Brazilian e-commerce market The e-commerce industry is poised for strong growth over the next three to four years in Brazil. Consequently, firms are entering into acquisition deals to grow their presence in the market. Nuvemshop, in December 2023, acquired Perfit to enhance its sales and efficiency in marketing campaigns. Perfit is a standout choice for those seeking marketing automation solutions. Their tools make it easy to efficiently manage, segment, and send personalized communications to contact lists or email databases. Furthermore, Perfit also makes use of artificial intelligence to optimize marketing campaigns. The addition of Perfit is, therefore, expected to help Nuvemshop further strengthen its position in the Brazilian market over the next three to four years. Shopee, the e-commerce arm operated by Singapore-based firm Sea, also entered into an acquisition deal with Brazilian fintech firm Blu in December 2023. The deal is part of the firm's strategy to accelerate growth in Brazil. The acquisition will enable Shopee to end its partnership with a local firm through which it currently offers credit to consumers. In Brazil, Shopee has more than 3 million merchants and the firm also gained approval from the central bank to operate as a payment institution in 2022. With a low-cost marketplace strategy, Shopee has been gaining strong popularity among online shoppers in Brazil. These collaborations are expected to further strengthen the position of Nuvemshop and Shopee in the Brazilian market over the medium term. As the competitive landscape continues to grow, the publisher expects more such acquisition deals to take place in the Brazilian e-commerce industry. Chinese e-commerce marketplaces continue to expand their footprint in the Latin American market Consumer consumption continues to remain sluggish amid the real estate crisis and sinking exports in China. Consequently, Chinese e-commerce firms are looking for growth in foreign markets, where inflation is driving consumers towards low-cost products. Temu, which is owned by China-based Pinduoduo Holdings, announced the launch in Chile in 2023. The e-commerce marketplace, which offers discounted products, has been gaining strong popularity among shoppers globally. Alongside Chile, Temu also has operations in Mexico. Shein, another Chinese e-commerce marketplace, has been seeking to expand in the Latin American market. As part of its strategy to gain a bigger foothold in the Latin American e-commerce industry, Shein has been planning to add more warehouse capacity in Mexico. These firms, over the medium term, are expected to increase their investment in the Latin American region. This will drive the competitive landscape, while also supporting the regional market growth over the next three to four years. This report provides a detailed data-centric analysis of Ecommerce market dynamics, covering over 50+ KPIs in Latin America. It details market opportunities across key Ecommerce verticals - Retail Shopping, Travel & Hospitality, Online Food Service, Media and Entertainment, Healthcare and Wellness, and Technology Products and Services. It provides market share by key players across key verticals along with sales channels (Platform to Consumer, Direct to Consumer, Consumer to Consumer). The report also covers niche trends such as market size by live streaming engagement model and cross-border purchases. It also covers ecommerce spend share by operating systems, devices (mobile vs. desktop) and cities. In addition to detailed data-centric analysis, this report provides analyst commentary on key trends, drivers, strategies, and innovations in the B2C ecommerce industry in Latin America. Scope of the Report Gross Merchandise Value Trend Analysis Average Value Per Transaction Trend Analysis Gross Merchandise Volume Trend Analysis Ecommerce Market Share by Key Players Retail Shopping Ecommerce Market Share by Key Players (20+ Players) Travel Ecommerce Market Share by Key Players (20+ Players) Food Service Ecommerce Market Share by Key Players (20+ Players) Ecommerce Market Size and Forecast by Ecommerce Segments (Gross Merchandise Value Trend Analysis, 2019-2028) Retail Shopping (breakdown by clothing, footwear & accessories, health, beauty and personal care, food & beverage, appliances and electronics, home improvement, books, music & video, toys & hobby, auto) Travel and Hospitality (breakdown by air travel, train & bus, taxi service, hotels & resorts) Online Food Service (breakdown by aggregators, direct to consumer) Media and Entertainment (breakdown by streaming services, movies & events, theme parks & gaming) Healthcare and Wellness Platform to Consumer

Nuvemshop Frequently Asked Questions (FAQ)

When was Nuvemshop founded?

Nuvemshop was founded in 2011.

Where is Nuvemshop's headquarters?

Nuvemshop's headquarters is located at Alameda Vicente Pinzon 173, Sao Paulo.

What is Nuvemshop's latest funding round?

Nuvemshop's latest funding round is Series E.

How much did Nuvemshop raise?

Nuvemshop raised a total of $628.3M.

Who are the investors of Nuvemshop?

Investors of Nuvemshop include Kaszek Ventures, Qualcomm Ventures, ThornTree Capital Partners, NXTP Ventures, Kevin Efrusy and 21 more.

Who are Nuvemshop's competitors?

Competitors of Nuvemshop include Prepi, TiendaDa, PrestaShop, VTEX, Avec Brasil and 7 more.

What products does Nuvemshop offer?

Nuvemshop's products include SaaS Online store and 3 more.

Loading...

Compare Nuvemshop to Competitors

Highwire operates as a public relations and digital marketing agency focusing on technology companies. The company offers services such as strategic communications, brand journalism, content marketing, search engine optimization (SEO), and reputation management. Highwire primarily serves sectors like technology, healthcare, financial services, cybersecurity, and energy and sustainability. It was founded in 2008 and is based in San Francisco, California.

Shoplazza is a technology company specializing in eCommerce solutions for businesses of all sizes. The company offers a platform that enables users to create, manage, and scale their online stores with a suite of tools for website building, product management, and marketing. Shoplazza provides a range of services including customizable website templates, shopping cart integration, checkout optimization, and marketing tools to help businesses reach and engage customers across various channels. It was founded in 2017 and is based in Shenzhen, Guangdong.

Mirakl operates as a global software-as-a-service (SaaS) technology company focused on enabling businesses to achieve eCommerce growth. The company offers a suite of solutions including marketplace and dropship platforms, supplier catalog management, pay-out solutions, and retail media solutions, all designed to revolutionize the way businesses sell online. It primarily sells to the retail and business-to-business (B2B) industries. It was founded in 2011 and is based in Paris, France.

Volusion is a company that focuses on providing ecommerce solutions, operating within the technology and ecommerce industries. The company offers a platform that allows businesses to build online stores, manage inventory, collect payments, and expand their customer reach. Its primary customers are entrepreneurs and businesses looking to establish or grow their online presence in the ecommerce industry. It was founded in 1999 and is based in Austin, Texas.

OpenCart provides online store management solutions in the e-commerce industry. It offers an open-source platform that enables users to manage multiple online stores from a single back-end, providing tools for product management, customer management, order processing, tax rules, and coupon codes. The company primarily serves e-commerce entrepreneurs and web developers. OpenCart was founded in 2005 and is based in Hong Kong.

commercetools is a global leader in composable commerce, providing enterprise-grade commerce solutions. The company offers a cloud-native platform that enables businesses to create scalable and customizable digital commerce experiences. commercetools primarily serves sectors such as retail, fashion, food and grocery, telecom, automotive, and healthcare. It was founded in 2006 and is based in Munich, Germany. commercetools operates as a subsidiary of REWE Group.

Loading...