Investments

1149Portfolio Exits

154Funds

16Partners & Customers

3Service Providers

1About Tiger Global Management

Tiger Global provides investment management services. It focuses on public and private companies in the global Internet, software, consumer, and financial technology industries. The company was founded n 2001 and is based in New York, New York.

Expert Collections containing Tiger Global Management

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Tiger Global Management in 4 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

E-Commerce

22 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Research containing Tiger Global Management

Get data-driven expert analysis from the CB Insights Intelligence Unit.

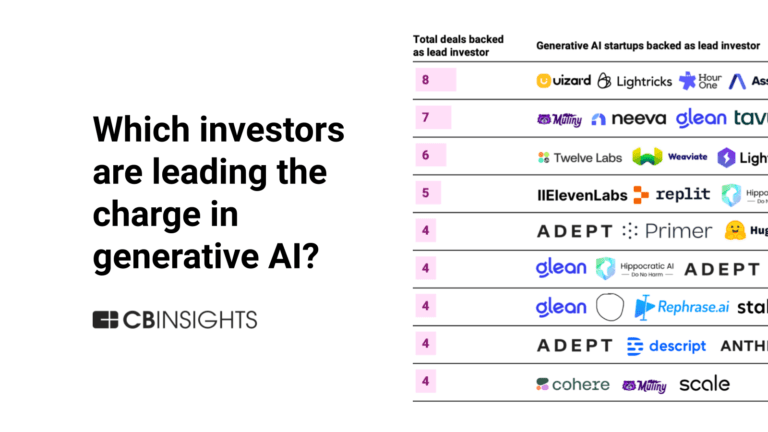

CB Insights Intelligence Analysts have mentioned Tiger Global Management in 10 CB Insights research briefs, most recently on Mar 26, 2024.

Mar 26, 2024

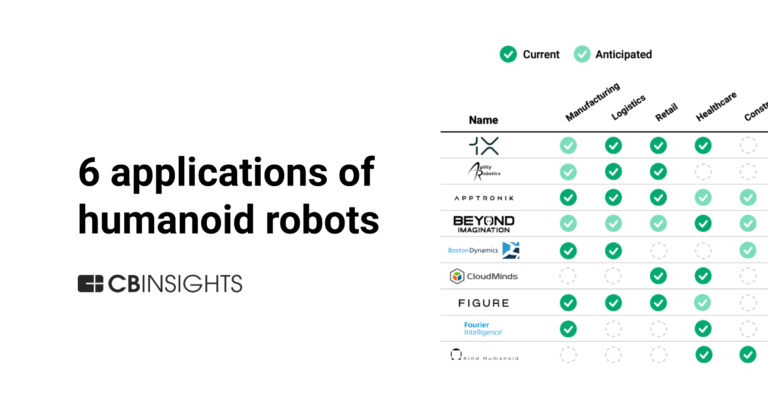

6 applications of humanoid robots across industries

Jan 4, 2024 report

State of Venture 2023 Report

Nov 20, 2023 report

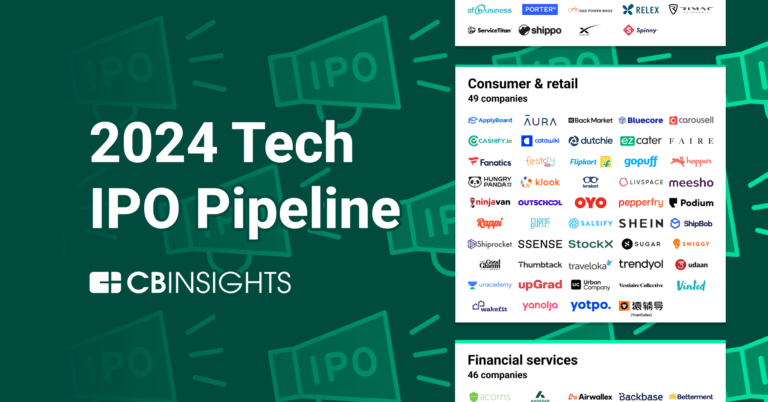

The 2024 Tech IPO Pipeline

Jul 14, 2023

The state of LLM developers in 6 charts

Latest Tiger Global Management News

Sep 24, 2024

The Weekly Notable Startup Funding Report: 9/23/24 Published: The Weekly Notable Startup Funding Report takes us on a trip across various ecosystems in the US, highlighting some of the notable funding activity in the various markets that we track. The notable startup funding rounds for the week ending 9/21/24 featuring funding details for Clasp, Arzeda, Aerwave, and twenty-four other deals representing $940M+ in new funding that you need to know about. Hotel Engine – $140.0M Denver-based Denver-based Hotel Engine simplifies business travel with software connecting businesses to hotels and transportation. Founded by Elia Wallen in 2015, Hotel Engine has now raised a total of $221.0M in total equity funding and is backed by Permira. Aerwave – $20.0M Dallas-based Dallas-based Aerwave is a reimagined WiFi connectivity experience for both residents and property managers in the multifamily industry. Founded by Alex Wey, Daniel Jensen, and Daniel Jensen in 2019, Aerwave has now raised a total of $40.0M in total equity funding and is backed by Dominicus Wireless, Moderne Ventures, and S&P 500 REIT. Pairwise Plants – $40.0M Durham-based Durham-based Pairwise is a purpose-driven food+tech company dedicated to building a healthier world through better fruits and vegetables. Founded by David R. Liu, Haven Baker, J. Keith Joung, and Tom Adams in 2017, Pairwise Plants has now raised a total of $155.0M in total equity funding and is backed by Aliment Capital, Corteva Agriscience, Deerfield Management, and Leaps by Bayer. AtoB – $130.0M San Francisco-based San Francisco-based AtoB is a technology company building payments infrastructure for the transportation industry. Founded by Harshita Arora, Tushar Misra, and Vignan Velivela in 2019, AtoB has now raised a total of $232.0M in total equity funding and is backed by Bloomberg Beta, General Catalyst, and Mastercard. Arzeda – $38.0M Seattle-based Seattle-based Arzeda is a protein design company that creates and manufactures proteins and enzymes for pharmaceuticals and industrial chemicals. Founded by Alexandre Zanghellini, Daniela Grabs, David Baker, Eric Althoff, and Walter G. Rakitsky in 2009, Arzeda has now raised a total of $86.2M in total equity funding and is backed by Bunge Ventures, Conti Ventures, Fall Line Capital, Lewis & Clark AgriFood, Silver Blue, Sofinnova Partners, Sucden Ventures, and W.L. Gore & Associates. Cherre – $30.0M New York-based New York-based Cherre is a real estate data platform that connects decision-makers to property investment, management, and market information. Founded by Ben Hizak, L.D. Salmanson, and Riju Pahwa in 2016, Cherre has now raised a total of $105.0M in total equity funding and is backed by Carthona Capital, Glilot Capital Partners, HighSage Ventures, Intel Capital, Nuveen, a TIAA company, RXR Realty, and Trustbridge Partners. AlleyWatch broke the news in an exclusive covering the round and much more – Cherre Raises $30M to Power the Real Estate Industry’s Data Revolution The AlleyWatch audience is driving progress and innovation on a global scale. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement, lead generation, and thought leadership in front of an audience that comprises the vast majority of key decision-makers in the NYC business community and beyond. Learn more about advertising to NYC Tech, at scale . DeltaStream – $15.0M San Mateo-based San Mateo-based DeltaStream is a real-time stream processing platform that includes streaming analytics and database features. Founded by Hojjat Jafarpour in 2020, DeltaStream has now raised a total of $25.0M in total equity funding and is backed by Galaxy Interactive, New Enterprise Associates, and Sanabil. EasyDMARC – $20.0M Dover-based Dover-based EasyDMARC is an email security firm that simplifies the email security and authentication process for businesses of all sizes. Founded by Avag Arakelyan and Gerasim Hovhannisyan in 2018, EasyDMARC has now raised a total of $22.3M in total equity funding and is backed by Radian Capital. Fathom – $17.0M San Francisco-based San Francisco-based Fathom records, transcribes, and summarizes meetings for enhanced productivity. Founded by Richard White in 2020, Fathom has now raised a total of $23.8M in total equity funding and is backed by Active Capital, Character, Maven Ventures, Rackhouse Venture Capital, and Telescope Partners. Ferrum Health – $16.0M San Francisco-based San Francisco-based Ferrum Health is a developer of an enterprise IT and AI patient safety platform for health systems. Founded by Ken Ko and Pelu Tran in 2017, Ferrum Health has now raised a total of $31.0M in total equity funding and is backed by Blumberg Capital, Catalyst by Wellstar, Cercano Management, Foundry Group, GSR Ventures, Headwater Ventures, Singtel Innov8, UnitedHealthcare Accelerator, and Urban Innovation Fund. GreenLite Technologies – $28.5M New York-based New York-based GreenLite is a construction technology company that operates a prop-tech platform designed to streamline the permitting process. Founded by Benjamin Allen and James Gallagher in 2022, GreenLite Technologies has now raised a total of $36.5M in total equity funding and is backed by 53 Stations, Craft Ventures, LiveOak Ventures, and Trust Ventures. Intezer – $33.0M New York-based New York-based Intezer is a cybersecurity platform that automates alert triage, incident response, and threat hunting. Founded by Alon N. Cohen, Itai Tevet, and Roy Halevi in 2015, Intezer has now raised a total of $58.0M in total equity funding and is backed by Alon N. Cohen, Intel Capital, Magma Venture Partners, Norwest Venture Partners, and OpenView. LiquidStack – $35.0M Marlborough-based Marlborough-based LiquidStack isa liquid cooling that provides hyperscale, edge, and computing. Founded by Joe Capes and Kar-Wing Lau in 2012, LiquidStack has now raised a total of $45.0M in total equity funding and is backed by Tiger Global Management and Trane Technologies. You are seconds away from signing up for the hottest list in NYC Tech! point.me – $15.0M New York-based New York-based Point.me is a travel engagement platform that connects consumers to loyalty programs with the reward flights for their points. Founded by Adam Morvitz and Tiffany Funk in 2021, point.me has now raised a total of $27.0M in total equity funding and is backed by Brian Kelly, Citi Ventures, Four Cities Capital, Jason Kay, Jason Rubin, MoreThan Capital, Nyca Partners, PAR Capital Management, RiverPark Ventures, Samsung NEXT, and Thayer Ventures. Roots Automation – $22.2M New York-based New York-based Roots Automation is a cognitive process automation platform supporting daily operations and reducing time spent on low-value tasks. Founded by Chaz Perera and John Cottongim in 2018, Roots Automation has now raised a total of $44.0M in total equity funding and is backed by Harbert Growth Partners, Liberty Mutual Strategic Ventures, MissionOG, and Vestigo Ventures. AlleyWatch broke the news in an exclusive covering the round and much more – Roots Automation Raises $22.2M to Tackle Unstructured Data in Insurance with Digital Coworkers RunSafe Security – $12.0M Mclean-based Mclean-based RunSafe Security immunizes software without developer friction to enable continous delivery. Founded by Doug Britton, Joe Saunders, and Simon Hartley in 2015, RunSafe Security has now raised a total of $24.2M in total equity funding and is backed by Alsop Louie Partners, BMW i Ventures, Critical Ventures, Hyperlink Ventures, Iron Gate Capital, Lockheed Martin Ventures, NextGen Venture Partners, SineWave Ventures, and Working Lab Capital. Clasp – $10.0M Boston-based Boston-based Clasp is a financial technology company that offers an alternative to traditional student loans through income share agreements. Founded by Tess Michaels in 2018, Clasp has now raised a total of $35.8M in total equity funding and is backed by Crosslink Capital, Marc Weill, and SHRM. Virtuous Software – $100.0M Phoenix-based Phoenix-based Virtuous Software provides nonprofit CRM and donor management tools to enhance fundraising efforts. Founded by Gabe Cooper and Rob Peabody in 2014, Virtuous Software has now raised a total of $155.8M in total equity funding and is backed by Susquehanna Growth Equity. Vana – $5.0M San Francisco-based San Francisco-based Vana focuses on user-owned data and provides tools to create, govern, and earn from AI models. Founded by Anna Kazlauskas and Arthur Abal in 2021, Vana has now raised a total of $25.0M in total equity funding and is backed by Coinbase Ventures. TeamBridge – $28.0M San Francisco-based San Francisco-based TeamBridge is a workforce operating system that helps teams automate their processes and improve efficiency, especially for hourly workers. Founded by Arjun Vora and Tito Goldstein in 2019, TeamBridge has now raised a total of $31.1M in total equity funding and is backed by Abstract Ventures, General Catalyst, and Mayfield Fund. Founded by Arjun Vora and Tito Goldstein in 2019, TeamBridge has now raised a total of $31.1M in total equity funding and is backed by Abstract Ventures, General Catalyst, and Mayfield Fund. Wealth.com – $30.0M Phoenix-based Phoenix-based Wealth.com is a digital estate planning platform for wealth management firms, utilizing advanced technology and advisory services. Founded by Danny Lohrfink, Rafael Loureiro, Rei Carvalho, and Tim White in 2021, Wealth.com has now raised a total of $46.0M in total equity funding and is backed by 53 Stations, Citi Ventures, Firebolt Ventures, Google Ventures, and Outpost Ventures. The AlleyWatch audience is driving progress and innovation on a global scale. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement, lead generation, and thought leadership in front of an audience that comprises the vast majority of key decision-makers in the NYC business community and beyond. Learn more about advertising to NYC Tech, at scale . e6data – $10.0M College Station-based College Station-based e6data develops Lakehouse compute engines designed for enterprise-level data analytics. Founded by Adishesh Kishore, Srinath Prabhu, and Vishnu Vasanth in 2020, e6data has now raised a total of $10.0M in total equity funding and is backed by Accel, Atrium Angels, and BEENEXT. PictorLabs – $30.0M Vahan.ai – $10.0M Locust Grove-based Vahan uses artificial intelligence to match job seekers with employers inside messaging apps. Founded by Madhav Krishna and Rajat Shahi in 2016, Vahan.ai has now raised a total of $18.0M in total equity funding and is backed by Gaingels, Khosla Ventures, Vijay Shekhar Sharma, and Y Combinator. Mindtrip – $12.0M San Francisco-based Mindtrip operates as an AI assistant that provide travel data that includes maps with suggested places to visit. Canopie – $3.7M Washington-based Canopie offers a digital platform that addresses symptoms of maternal depression and anxiety. Founded by Ann Don Bosco and Anne Wanlund in 2020, Canopie has now raised a total of $3.7M in total equity funding and is backed by Aeroflow, Beta Boom, Symphonic Capital, and Techstars. Vero Networks – $80.0M Boulder-based Vero Networks provides fiber optic services, focusing on building and operating fiber networks for internet and data connectivity. You are seconds away from signing up for the hottest list in NYC Tech!

Tiger Global Management Investments

1,149 Investments

Tiger Global Management has made 1,149 investments. Their latest investment was in LiquidStack as part of their Series B - II on September 19, 2024.

Tiger Global Management Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/19/2024 | Series B - II | LiquidStack | $20M | Yes | 2 | |

9/2/2024 | Series A | Foundersuite | $13M | Yes | 1 | |

8/16/2024 | Secondary Market | Revolut | No | 6 | ||

8/8/2024 | Series B | |||||

6/25/2024 | Series A - II |

Date | 9/19/2024 | 9/2/2024 | 8/16/2024 | 8/8/2024 | 6/25/2024 |

|---|---|---|---|---|---|

Round | Series B - II | Series A | Secondary Market | Series B | Series A - II |

Company | LiquidStack | Foundersuite | Revolut | ||

Amount | $20M | $13M | |||

New? | Yes | Yes | No | ||

Co-Investors | |||||

Sources | 2 | 1 | 6 |

Tiger Global Management Portfolio Exits

154 Portfolio Exits

Tiger Global Management has 154 portfolio exits. Their latest portfolio exit was Own Company on September 05, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/5/2024 | Acquired | 5 | |||

8/28/2024 | Acquired | 4 | |||

8/16/2024 | Asset Sale | 2 | |||

Date | 9/5/2024 | 8/28/2024 | 8/16/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Asset Sale | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 5 | 4 | 2 |

Tiger Global Management Acquisitions

2 Acquisitions

Tiger Global Management acquired 2 companies. Their latest acquisition was Cobone on March 11, 2013.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

3/11/2013 | Acq - Fin | 1 | ||||

6/30/2007 | Other |

Date | 3/11/2013 | 6/30/2007 |

|---|---|---|

Investment Stage | Other | |

Companies | ||

Valuation | ||

Total Funding | ||

Note | Acq - Fin | |

Sources | 1 |

Tiger Global Management Fund History

16 Fund Histories

Tiger Global Management has 16 funds, including Tiger Private Investment Partners Fund XVI.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/2/2024 | Tiger Private Investment Partners Fund XVI | $2,200M | 2 | ||

6/16/2023 | Tiger Global Private Investment Partners XVI | $622.65M | 2 | ||

2/3/2022 | Tiger Private Investment Partners XV | $11,000M | 1 | ||

5/4/2021 | Tiger Global Tech Venture Fund | ||||

3/31/2021 | Tiger Global Private Investment Partners XIV |

Closing Date | 4/2/2024 | 6/16/2023 | 2/3/2022 | 5/4/2021 | 3/31/2021 |

|---|---|---|---|---|---|

Fund | Tiger Private Investment Partners Fund XVI | Tiger Global Private Investment Partners XVI | Tiger Private Investment Partners XV | Tiger Global Tech Venture Fund | Tiger Global Private Investment Partners XIV |

Fund Type | |||||

Status | |||||

Amount | $2,200M | $622.65M | $11,000M | ||

Sources | 2 | 2 | 1 |

Tiger Global Management Partners & Customers

3 Partners and customers

Tiger Global Management has 3 strategic partners and customers. Tiger Global Management recently partnered with Evercore on May 5, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

5/19/2023 | Vendor | United States | 1 | ||

2/22/2022 | Partner | ||||

Vendor |

Date | 5/19/2023 | 2/22/2022 | |

|---|---|---|---|

Type | Vendor | Partner | Vendor |

Business Partner | |||

Country | United States | ||

News Snippet | |||

Sources | 1 |

Tiger Global Management Service Providers

1 Service Provider

Tiger Global Management has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

Tiger Global Management Team

12 Team Members

Tiger Global Management has 12 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Chase Coleman | Founder | Current | |

Name | Chase Coleman | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder | ||||

Status | Current |

Compare Tiger Global Management to Competitors

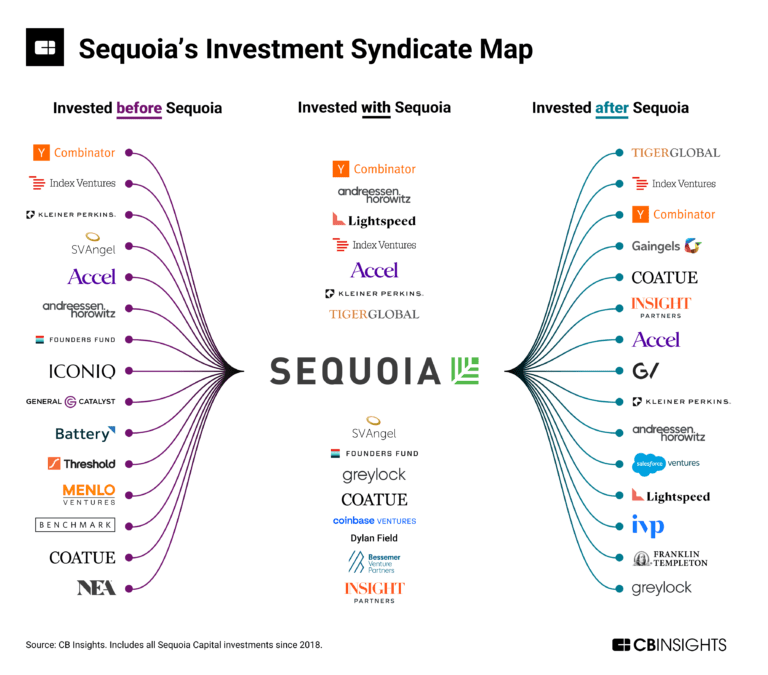

Sequoia Capital serves as a venture capital firm that focuses on supporting startups from inception to IPO within various sectors. It provides investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Coatue works as a lifecycle investment platform specializing in technology sector investments. The company offers venture, growth, thematic, and structured capital strategies to support technology companies. Coatue primarily serves the technology industry, with a focus on supporting innovative tech startups and growth-stage companies. It was founded in 1999 and is based in New York, New York.

Warburg Pincus serves as a global private equity firm focused on growth investing. The company offers private equity, real estate, and capital solutions strategies, partnering with management teams to build sustainable businesses. It primarily serves sectors such as consumer, energy transition and sustainability, financial services, healthcare, industrial and business services, real estate, and technology. It was founded in 1966 and is based in New York, New York.

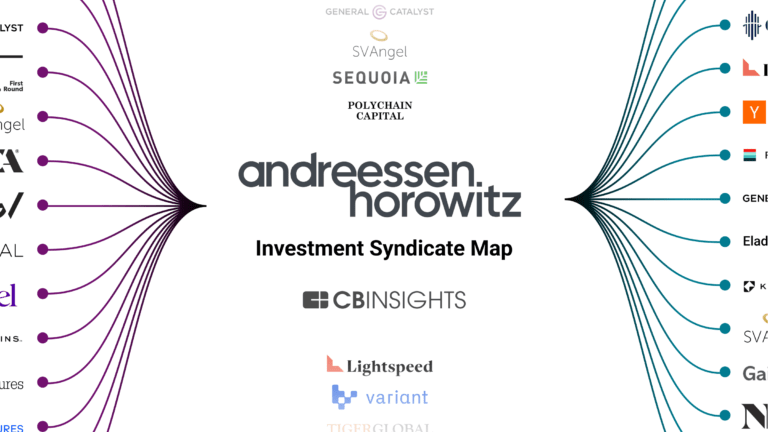

Andreessen Horowitz (a16z) is a venture capital firm with $4.2 billion under management. The firm invests in entrepreneurs building companies at every stage, from seed to growth. It seeks to invest in sectors such as bio and healthcare, consumer, cryptocurrency, enterprise, fintech, and games. It was founded in 2009 and is based in Menlo Park, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Battery Ventures is a technology and software-focused investment firm operating in the application software, information technology (IT) infrastructure technologies, consumer-internet and mobile services, and industrial technologies sectors. It invests in businesses at various stages, from startups to established market leaders, providing support in areas such as talent recruitment, business development, marketing and communications, and growth leadership. It primarily serves the application software, infrastructure software, consumer, and industrial tech and life science tools sectors. It was founded in 1983 and is based in Boston, Massachusetts.

Loading...