Tradeshift

Founded Year

2009Stage

Series H | AliveTotal Raised

$1.173BLast Raised

$70M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+6 points in the past 30 days

About Tradeshift

Tradeshift operates as a supply chain network for e-invoicing and accounts payable automation. It provides accounts payable, e-procurement, and strategic finance. The company offers business to business marketplace platform for e-procurement, application programming interface, supplier collaboration and analytics, and more. It was founded in 2009 and is based in San Francisco, California.

Loading...

Loading...

Research containing Tradeshift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

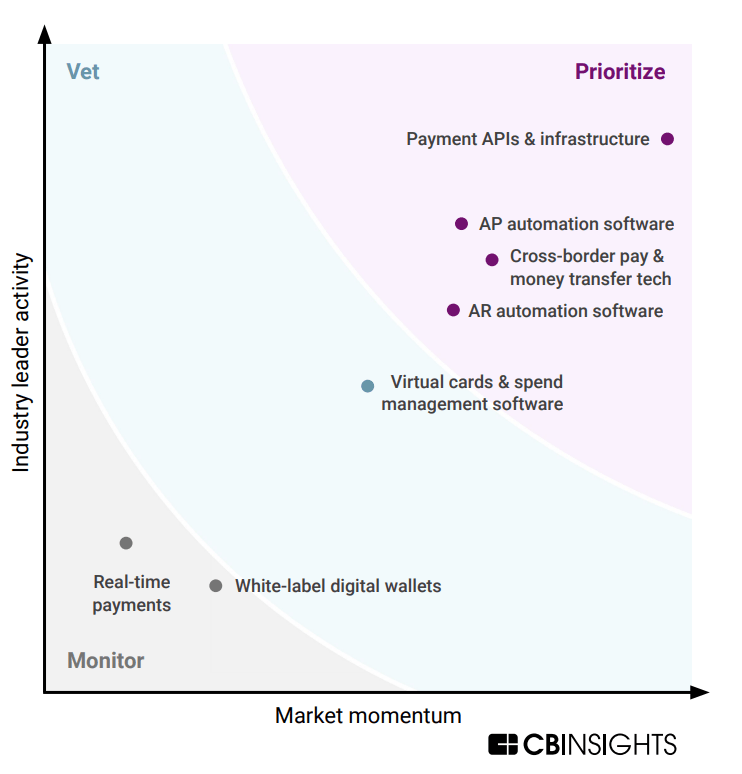

CB Insights Intelligence Analysts have mentioned Tradeshift in 5 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market mapExpert Collections containing Tradeshift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tradeshift is included in 8 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

4,040 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,244 items

Fintech 100

748 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,231 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

2,003 items

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Latest Tradeshift News

Sep 10, 2024

Saudi Arabia's Accounts Payable Market was valued at USD 4.2 million in 2023 and is expected to reach at USD 6.9 Million in 2029 and project robust growth in the forecast period with a CAGR of 8.4% through 2029. The Saudi Arabia accounts payable market is witnessing robust growth, driven by the country's rapid economic expansion and digital transformation initiatives. As businesses across Saudi Arabia increasingly seek to enhance financial management and operational efficiency, there is a rising demand for sophisticated accounts payable solutions. These solutions streamline invoice processing, automate payments, and improve accuracy in financial transactions, thereby reducing operational costs and mitigating errors. The market's expansion is further supported by the government's Vision 2030 program, which emphasizes technological advancement and digitalization in various sectors, including finance. The adoption of advanced technologies such as artificial intelligence, machine learning, and blockchain is reshaping the accounts payable landscape by enabling real-time data processing, enhancing transparency, and ensuring compliance with regulatory standards. Additionally, the increasing focus on financial compliance and risk management, coupled with the need for improved supplier relationship management, drives businesses to invest in comprehensive accounts payable systems. As Saudi Arabia continues to modernize its financial infrastructure, the accounts payable market is expected to grow, reflecting the broader trends of efficiency and digital integration in the financial sector. Digital Transformation Initiatives The Saudi Arabia accounts payable market is significantly driven by the country's broader digital transformation initiatives, especially those outlined in the Vision 2030 framework. This initiative underscores the importance of modernizing business practices and adopting advanced technologies across various sectors. For accounts payable functions, digital transformation translates to the automation of invoice processing, payment reconciliation, and financial reporting. This shift towards digital solutions enhances efficiency by reducing manual intervention, minimizing errors, and accelerating transaction processing times. The integration of technologies such as Robotic Process Automation (RPA) and Artificial Intelligence (AI) allows for the automation of repetitive tasks and the extraction of valuable insights from financial data. As businesses in Saudi Arabia seek to align with national digitalization goals, there is a growing adoption of electronic invoicing and payment systems that streamline accounts payable processes, improve accuracy, and ensure compliance with regulatory requirements. This technological advancement drives the market by making financial operations more efficient and agile, thus supporting the overall economic modernization goals of the country. Increased Focus on Financial Efficiency The growing emphasis on financial efficiency and cost reduction is a major driver of the Saudi Arabia accounts payable market. Organizations are increasingly recognizing the need to optimize their financial processes to achieve greater operational efficiency and reduce overhead costs. By implementing advanced accounts payable solutions, businesses can automate routine tasks, such as invoice matching, approval workflows, and payment processing, thereby reducing the time and resources required for these activities. Automation also helps in minimizing errors and discrepancies, leading to more accurate financial reporting and improved cash flow management. Furthermore, efficient accounts payable processes contribute to better supplier relationships by ensuring timely and accurate payments, which can enhance negotiation power and achieve cost savings. The drive towards financial efficiency is supported by the need to remain competitive in a rapidly evolving market and to meet the demands of investors and stakeholders for transparency and effective financial management. Regulatory Compliance Requirements Regulatory compliance is a critical driver for the Saudi Arabia accounts payable market, as businesses face stringent requirements related to financial reporting, tax compliance, and anti-fraud measures. The Saudi Arabian government has implemented a series of regulations and standards aimed at enhancing financial transparency and ensuring compliance with international best practices. These include mandates for electronic invoicing, tax reporting, and financial audits. Accounts payable systems play a crucial role in helping organizations meet these compliance requirements by automating the documentation and reporting processes, ensuring that transactions are accurately recorded and easily accessible for audits. Advanced accounts payable solutions also incorporate features such as real-time compliance checks, automated tax calculations, and secure document storage to mitigate the risk of non-compliance and potential penalties. As regulatory requirements evolve and become more stringent, the demand for robust accounts payable systems that ensure compliance and provide audit trails continues to drive market growth. Emergence of Advanced Analytics and AI The emergence of advanced analytics and Artificial Intelligence (AI) is transforming the Saudi Arabia accounts payable market by providing deeper insights and enhancing decision-making capabilities. Advanced analytics tools enable organizations to analyze large volumes of financial data, identify trends, and make informed decisions based on predictive insights. AI technologies further augment this by automating complex processes, such as invoice matching and fraud detection, which traditionally required manual intervention. AI-powered systems can learn from historical data to improve accuracy and efficiency over time, reducing the likelihood of errors and enhancing process reliability. Additionally, AI-driven chatbots and virtual assistants streamline vendor interactions and support inquiries, further optimizing the accounts payable function. The integration of these technologies into accounts payable systems allows businesses to achieve greater operational efficiency, enhance financial visibility, and proactively manage risks. As Saudi Arabian businesses increasingly leverage advanced analytics and AI to drive innovation and competitive advantage, these technologies are expected to play a significant role in shaping the future of the accounts payable market. Key Market Trends Adoption of Robotic Process Automation (RPA) The adoption of Robotic Process Automation (RPA) is a prominent trend in the Saudi Arabia accounts payable market, driven by the need for enhanced efficiency and accuracy in financial operations. RPA technology automates repetitive, rule-based tasks such as invoice processing, data entry, and payment reconciliations, significantly reducing manual intervention and the potential for human error. This trend is fueled by the desire for operational cost savings and faster processing times, as RPA can handle high volumes of transactions with greater speed and accuracy compared to traditional methods. Organizations are increasingly implementing RPA to streamline their accounts payable processes, which not only enhances efficiency but also provides real-time insights into financial operations. As businesses in Saudi Arabia continue to embrace digital transformation, the integration of RPA into accounts payable functions is becoming a critical component of their strategy to achieve greater operational agility and improve overall financial management. Rise of Cloud-Based Accounts Payable Solutions Cloud-based accounts payable solutions are gaining significant traction in Saudi Arabia, reflecting a broader trend towards digitalization and remote accessibility. These solutions offer several advantages, including scalability, flexibility, and cost-effectiveness, which are attractive to organizations of all sizes. Cloud-based systems facilitate real-time access to financial data, enabling remote management and collaboration across different departments and locations. This trend is particularly relevant in the context of Saudi Arabia's Vision 2030 initiative, which emphasizes technological innovation and the adoption of cloud technologies. By leveraging cloud-based accounts payable solutions, organizations can streamline their processes, reduce IT infrastructure costs, and enhance their ability to adapt to changing business needs. The shift towards cloud solutions also supports improved data security and compliance, as cloud providers offer advanced security features and regular updates to address emerging threats and regulatory requirements. Increased Integration with Artificial Intelligence (AI) The integration of Artificial Intelligence (AI) into accounts payable systems is emerging as a significant trend in Saudi Arabia, driven by the need for advanced data analysis and decision-making capabilities. AI technologies are being utilized to enhance various aspects of accounts payable, including invoice matching, fraud detection, and predictive analytics. By analyzing large volumes of financial data, AI can identify patterns, detect anomalies, and provide actionable insights that improve decision-making and risk management. This trend is aligned with the broader push towards digital innovation and smart technologies within the Saudi Arabian market. AI-driven solutions offer the potential to automate complex processes, reduce errors, and increase overall efficiency in accounts payable operations. As businesses seek to leverage data-driven insights and enhance their financial management capabilities, the adoption of AI in accounts payable is expected to continue growing, providing a competitive edge and supporting the strategic goals of digital transformation. Growing Emphasis on Regulatory Compliance A growing emphasis on regulatory compliance is shaping the Saudi Arabia accounts payable market, driven by the need to adhere to stringent financial regulations and standards. Recent regulatory updates, including requirements for electronic invoicing and enhanced anti-fraud measures, have heightened the importance of compliance in accounts payable processes. Organizations are increasingly investing in systems that ensure they meet these regulatory requirements while also maintaining operational efficiency. This trend is supported by the need for accurate tax reporting, secure data handling, and transparent financial practices. Advanced accounts payable solutions are being designed to incorporate compliance features, such as automated tax calculations, real-time reporting, and secure document storage, to help businesses navigate the complex regulatory landscape. As regulatory requirements continue to evolve, the focus on compliance will drive the demand for solutions that offer robust regulatory support and ensure that organizations can effectively manage their accounts payable functions within legal and industry standards. Enhanced Focus on Supplier Relationship Management An enhanced focus on supplier relationship management is emerging as a key trend in the Saudi Arabia accounts payable market. Organizations are recognizing the importance of maintaining strong relationships with their suppliers to ensure timely deliveries, favorable terms, and overall operational efficiency. Advanced accounts payable systems are increasingly incorporating features that facilitate better supplier management, such as automated payment scheduling, dynamic discounting, and real-time communication tools. This trend reflects a broader shift towards optimizing supply chain processes and leveraging technology to strengthen business relationships. By improving transparency and efficiency in payment processes, organizations can build trust and collaboration with their suppliers, leading to improved negotiation power and cost savings. The emphasis on supplier relationship management also aligns with the goals of enhancing overall financial performance and operational resilience, making it a critical focus area for businesses in the Saudi Arabian market as they seek to streamline their accounts payable functions and foster stronger partnerships. Key Market Players:

Tradeshift Frequently Asked Questions (FAQ)

When was Tradeshift founded?

Tradeshift was founded in 2009.

Where is Tradeshift's headquarters?

Tradeshift's headquarters is located at 447 Sutter Street, San Francisco.

What is Tradeshift's latest funding round?

Tradeshift's latest funding round is Series H.

How much did Tradeshift raise?

Tradeshift raised a total of $1.173B.

Who are the investors of Tradeshift?

Investors of Tradeshift include Notion Capital, Fuel Venture Capital, IDC Ventures, LUN Partners Capital, The Private Shares Fund and 31 more.

Who are Tradeshift's competitors?

Competitors of Tradeshift include JAGGAER, Coupa, Basware, Scanmarket, BirchStreet Systems and 7 more.

Loading...

Compare Tradeshift to Competitors

Varisource provides a technology buying and management platform. The company offers a platform for businesses for technology purchases, compare vendor options, and manage technology-spent data. It serves various sectors including information technology (IT), procurement, finance, and private equity. The company was founded in 2021 and is based in Orlando, Florida.

Coupa operates as a business spend management (BSM) company, within the cloud-based software industry. The company offers an artificial intelligence (AI) driven platform that provides solutions for procurement, supply chain management, finance, and more. Coupa's platform is designed to automate and optimize business spending processes, including procurement, invoicing, expense management, and supply chain planning. It was founded in 2006 and is based in San Mateo, California.

GEP provides procurement and supply chain solutions. The company provides artificial intelligence (AI) enabled software, strategy consulting, and managed services. Its main offerings include procurement software, supply chain management solutions, and strategic consulting services, all designed to help businesses streamline their operations and increase efficiency. It was founded in 1999 and is based in Clark, New Jersey.

Ivalua focuses on providing cloud-based spend management software. It includes a unified platform for managing all categories of spend and suppliers, which aids in increasing profitability, improving environmental, social, and governance (ESG) performance, lowering risk, and enhancing employee productivity. The company primarily serves various industries such as aerospace and defense, automotive, construction and engineering, financial services, healthcare, manufacturing, oil, gas and energy, public sector, retail, and telecommunications. The company was founded in 2000 and is based in Redwood City, California.

Vroozi is a company that focuses on business spend management, operating within the procurement and accounts payable automation industry. The company offers a platform that digitizes the procurement and vendor invoice management processes, leveraging AI and machine learning capabilities to streamline business operations. This platform is designed to reduce transaction costs, maximize efficiency, and improve business margins, providing financial insights to stakeholders. It is based in Sherman Oaks, California.

Zycus is a company that focuses on cognitive procurement, operating in the software as a service (SaaS) industry. The company offers a suite of AI-powered software solutions that streamline procurement processes, including source-to-pay, e-invoicing, accounts payable automation, and contract lifecycle management. These solutions primarily cater to large global enterprises across various sectors. It was founded in 1998 and is based in Princeton, New Jersey.

Loading...