TradingView

Founded Year

2011Stage

Series C | AliveTotal Raised

$339.37MValuation

$0000Last Raised

$298M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-43 points in the past 30 days

About TradingView

TradingView is a financial charting platform and social network for traders and investors. The company provides tools for real-time market data analysis, enabling users to share and discuss trading strategies within an investment community. TradingView offers a suite of market analysis tools, including access to an economic calendar, collaborative trading ideas, and a custom scripting language for advanced charting. It was founded in 2011 and is based in London, England.

Loading...

TradingView's Product Videos

ESPs containing TradingView

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital assets market data & insights market provides comprehensive data and insights into blockchain networks, crypto markets, and decentralized finance. It empowers financial institutions with historical and real-time fundamental (on chain) and market data for research, trading, risk analytics, reporting, and compliance. The market is fragmented and lacks standardization, making it complex a…

TradingView named as Leader among 14 other companies, including Coin Metrics, Nansen, and Kaiko.

TradingView's Products & Differentiators

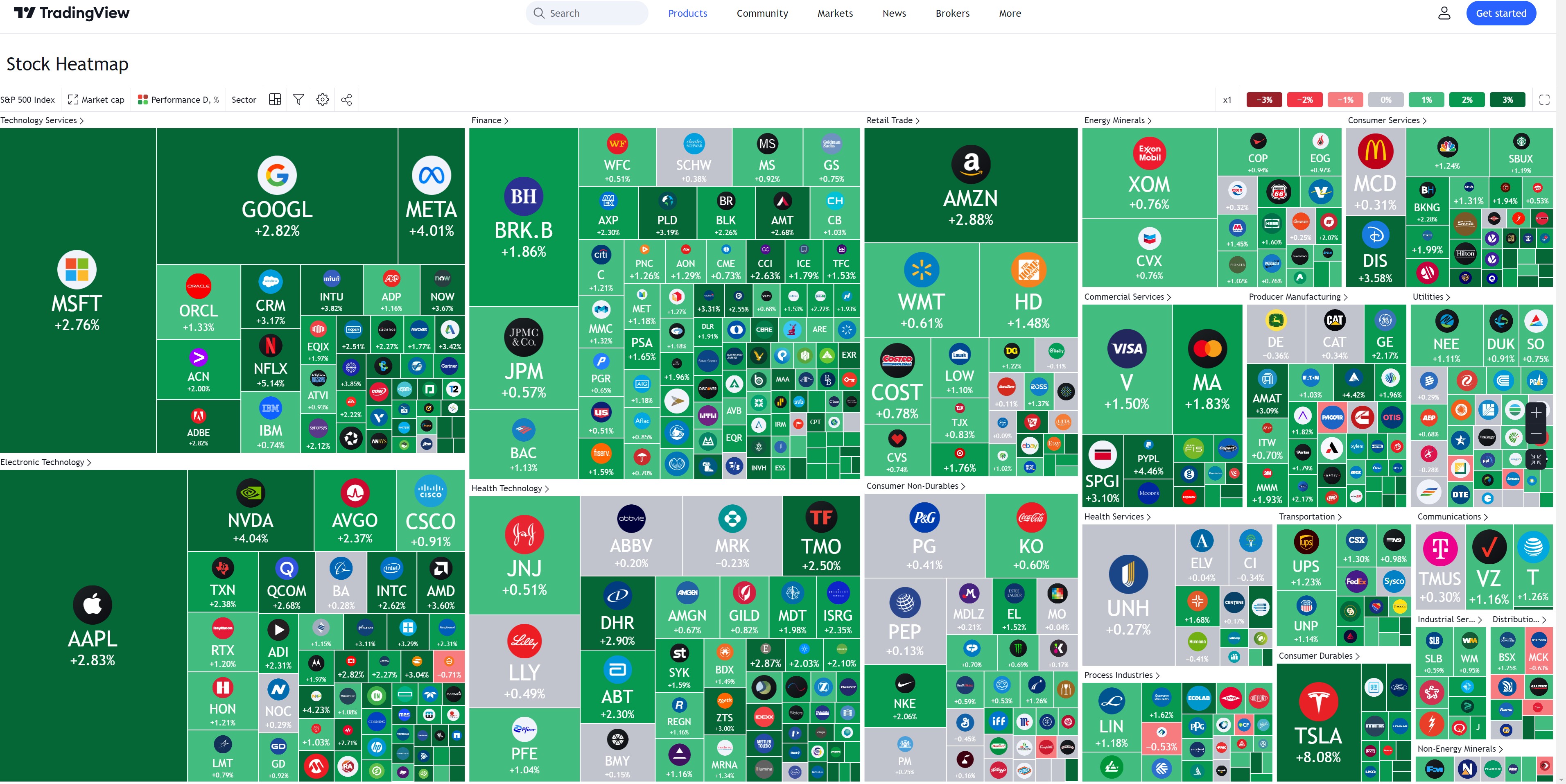

Charts

Best in class charts enabling comprehensive technical analysis of the markets

Loading...

Research containing TradingView

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TradingView in 3 CB Insights research briefs, most recently on Nov 11, 2022.

Nov 11, 2022

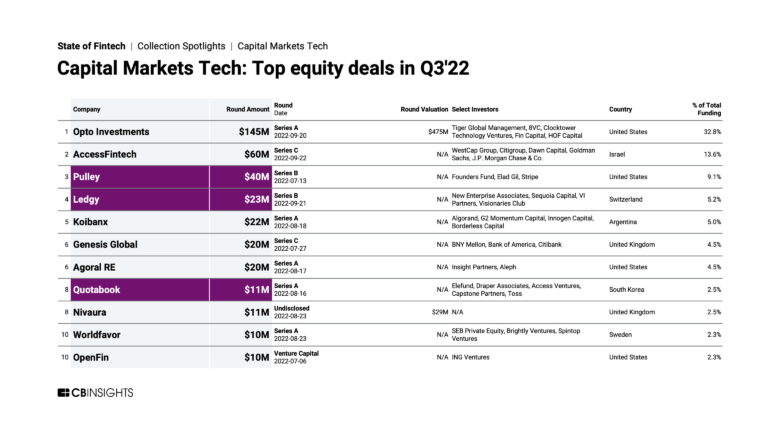

3 capital markets trends to watchExpert Collections containing TradingView

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TradingView is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

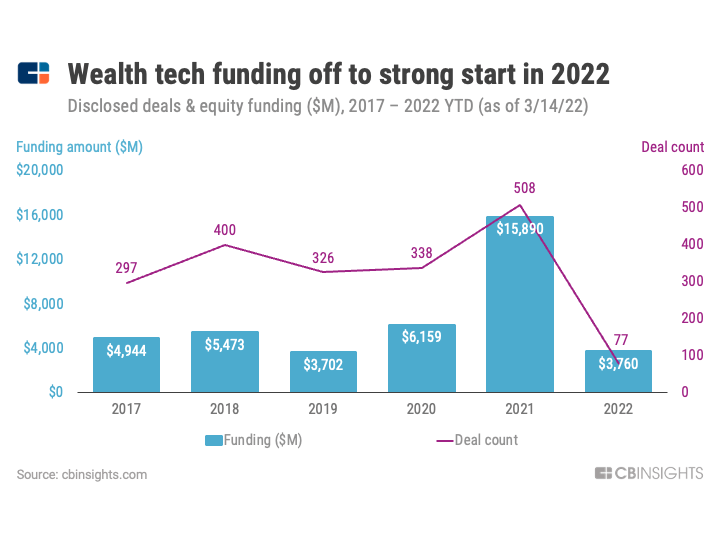

Wealth Tech

2,294 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

997 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Financial Wellness

245 items

Track startups and capture company information and workflow.

Latest TradingView News

Sep 21, 2024

Bitcoin has surged 11% since Tuesday following the Federal Reserve’s announcement of a 50 bps interest rate cut. This significant price movement pushed BTC past the $62,000 mark, a psychological level that shifted investor sentiment toward optimism. However, despite the recent rally, critical data from Glassnode reveals that both Bitcoin capital inflows and outflows remain relatively small, indicating reduced market activity. The current state of the Bitcoin market reflects a sense of equilibrium, where the price is stable, but trading volumes are lower than expected. While some investors see this balance as an attractive entry point, anticipating a continued upward trend, others are more cautious. The lack of strong demand could potentially lead to a slowdown or reversal in price momentum if new buyers fail to enter the market. As Bitcoin hovers around this crucial price level, the next few days will be essential in determining whether the market will continue to surge or face a pullback due to limited liquidity. Investors are closely monitoring the situation to gauge whether this equilibrium will break in favor of further growth or stagnation. Bitcoin Minimal Profit And Loss-Taking: What Does It Mean? After days of positive price action and excitement about a potential bull run, Bitcoin still faces risks. Key data from Glassnode highlights the market’s current state of equilibrium, prompting cautious optimism among investors. The Sell-Side Risk Ratio has dropped below the low-value band, indicating minimal profit-taking or loss-cutting in the current range. This suggests that equilibrium has been reached, with investors hesitant to make moves until there is a broader price expansion. Recent macro events, including the Federal Reserve’s interest rate cut, may provide the catalyst Bitcoin needs. The 50 bps cut has been viewed as a signal for more liquidity entering the market, which could fuel the anticipated surge in volatility. Investors are hopeful that this event will break the current price stagnation, setting the stage for Bitcoin’s next significant move. Though the market is in equilibrium now, many believe a major shift is just around the corner. BTC Breaks Past $62,000 –The Start Of A New Rally? Bitcoin is trading at $63,493 after an impressive 22% surge from its local lows set on September 6. The price has broken past the daily 200 exponential moving average (EMA) at $59,396 and is now testing the daily 200 moving average (MA) as resistance. BTC is trading above the 1D 200 EMA and testing the 200 MA from below. | Source: BTCUSDT chart on TradingView These indicators are historically crucial for Bitcoin, as they often serve as key support and turning points during rallies. Reclaiming the daily 200 MA would signal long-term strength and could confirm the start of a sustained uptrend. For bulls aiming to push BTC to new highs, breaking past the daily 200 MA and the $65,000 level is essential. Holding these levels as support would solidify a change in market structure, which has been dominated by downward trends over the past six months. However, if BTC fails to reclaim the 200 MA, a retracement toward lower demand levels around $60,000 is likely. This price level may act as a magnet for testing demand before continuing the upward trend, but losing $60,000 could result in a deeper correction. Investors are watching these levels closely as they will determine the direction of Bitcoin’s next major move. Featured image from Dall-E, chart from TradingView

TradingView Frequently Asked Questions (FAQ)

When was TradingView founded?

TradingView was founded in 2011.

Where is TradingView's headquarters?

TradingView's headquarters is located at 32 London Bridge Street, London.

What is TradingView's latest funding round?

TradingView's latest funding round is Series C.

How much did TradingView raise?

TradingView raised a total of $339.37M.

Who are the investors of TradingView?

Investors of TradingView include Tiger Global Management, Jump Capital, Insight Partners, DRW Venture Capital, OkCupid and 8 more.

Who are TradingView's competitors?

Competitors of TradingView include TipRanks, MacroMicro, Atom Finance, TakeProfit, StockViva and 7 more.

What products does TradingView offer?

TradingView's products include Charts and 4 more.

Loading...

Compare TradingView to Competitors

Seeking Alpha is a company focused on investment and financial services. It provides a platform for investors to connect, share investing ideas, discuss news, and make informed investment decisions. The company offers a range of services including breaking news, analysis, newsletters, and subscription plans that cater to different investing styles and user needs. It was founded in 2004 and is based in New York, New York.

MetaTrader 5 is a software development company with a focus on the financial trading sector. The company offers a trading platform that allows users to perform technical analysis and execute trading operations in the Forex and exchange markets. The platform is primarily used by traders in the financial sector. It is based in Limassol, Cyprus.

Koyfin is a financial data and analytics platform focused on equipping investors with comprehensive market insights and analysis tools across various asset classes. The company offers live market data, advanced graphing, customizable dashboards, and a suite of features to support investment decisions for a range of financial instruments including stocks, mutual funds, and more. Koyfin primarily serves independent investors, financial advisors, traders, research analysts, students, and enterprise clients with its data-driven solutions. It was founded in 2016 and is based in Miami, Florida.

MarketSeer provides fundamental market research solutions for investments using its integrated platform. It provides benefits such as real-time market data and analysis, breaking news and expert commentary, in-depth research reports, investment ideas, interactive tools, and financial calculators. The company was founded in 2019 and is based in Johannesburg, South Africa.

Simply Wall St is a company focused on democratizing investing in the financial services industry. The company provides a platform that offers comprehensive visual analysis on stocks, including past performance, risks and rewards, valuation and comparison, growth forecast, financial health, and more. This service is primarily targeted towards individual investors. It is based in Sydney, New South Wales.

Stock Target Advisor specializes in financial analysis and investment decision-making tools within the financial services sector. The company offers automated calculations, analyst ratings, and market insights to assist investors in building robust investment portfolios. Stock Target Advisor primarily serves individual investors and investment professionals seeking to make informed decisions without the need for deep financial expertise. It was founded in 2018 and is based in Waterloo, Ontario.

Loading...