Treasury Prime

Founded Year

2017Stage

Series C - II | AliveTotal Raised

$103.19MLast Raised

$40M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-76 points in the past 30 days

About Treasury Prime

Treasury Prime is an embedded banking platform that specializes in connecting businesses with a network of banks and financial service providers. Their main offerings include API banking integrations that enable companies to develop and launch financial products such as FDIC insured accounts, payment processing solutions, and debit card issuance. Treasury Prime's platform is designed to support compliance program integration and multi-bank operations, facilitating the creation of investment vehicles and instant payout ecosystems for various industries. It was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Treasury Prime

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

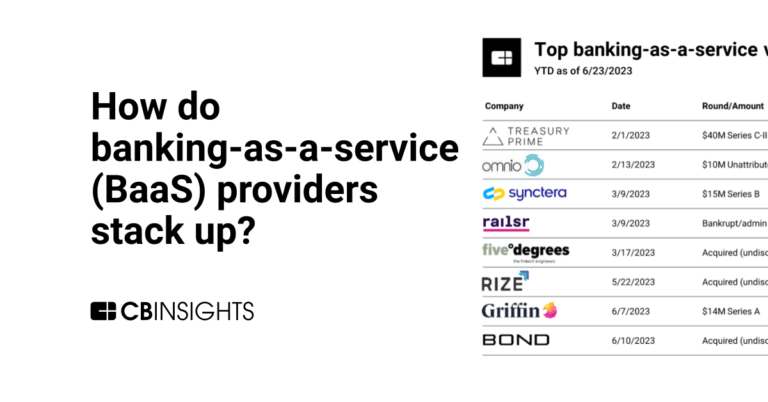

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to digitize their services and expand their customer base through embedded banking and payment options. This market also allows established non-fintech companies to add banking services to differentiate their offerings and generate new revenue streams. BaaS providers offer a single API that enables clie…

Treasury Prime named as Challenger among 15 other companies, including Stripe, Fiserv, and FIS.

Treasury Prime's Products & Differentiators

Treasury Prime API Platform

Treasury Prime API Platform enables companies to embed a full range of banking services into their product or application from cards to opening accounts to payments. Our easy-to-use API provides the scale and security required for the most sensitive and demanding applications. The Treasury Prime Platform is fully integrated into core banking systems so developers can launch new offerings in days, not months. Treasury Prime’s experience with banking requirements and its range of bank partners have helped dozens of fintechs get to market fast.

Loading...

Research containing Treasury Prime

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Treasury Prime in 5 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Treasury Prime

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Treasury Prime is included in 3 Expert Collections, including Fintech.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

979 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Treasury Prime News

Aug 21, 2024

RegTech Analyst Treasury Prime and Kobalt Labs partner to revolutionize AI compliance in banking August 21, 2024 Treasury Prime has announced its latest collaboration with Kobalt Labs, a firm specializing in AI-powered compliance solutions. Kobalt Labs, known for its robust copilot platform for risk and compliance teams, has joined the Treasury Prime Partner Marketplace, marking a significant enhancement in the embedded banking sector. The partnership has been formed to address the increasing compliance costs that banks face with embedded banking. By integrating Kobalt Labs into the Treasury Prime network, banks are now empowered to manage their third-party diligence more efficiently using advanced AI tools. This collaboration enables banks to streamline legal, compliance, and infosec diligence processes within a single platform, fostering better compliance and risk management. Treasury Prime operates within the FinTech sector, specializing in embedded banking software that facilitates seamless banking services integration for various businesses. Their software solutions help banks and FinTech companies expand their BaaS (Banking as a Service) capabilities, thus broadening their service offerings and enhancing customer experiences. Kobalt Labs, on the other hand, focuses on enhancing compliance and risk management for financial institutions. Their platform is designed to modernize the diligence processes, ensuring comprehensive checks and balances against regulatory standards and helping firms remain agile in the ever-evolving regulatory landscape. Kobalt Labs will contribute its expertise to modernize and strengthen the entire third-party diligence flow within Treasury Prime’s bank network. Their platform is synchronized with all financial regulations and security standards, capable of conducting quick, thorough checks on external documentation. This not only boosts the efficiency of compliance processes but also helps banks stay aligned with regulatory requirements during audits. The addition of Kobalt Labs to the Treasury Prime network is expected to enhance the internal diligence capacities of banks by over four times, providing extensive real-time regulatory coverage and ensuring continuous compliance with evolving regulations. “Compliance costs are a big consideration for banks as they weigh the investments associated with embedded banking. By partnering with Kobalt Labs, we’re enabling our bank clients to access new capabilities for third party risk management compliance as they scale their BaaS programs,” Treasury Prime Head of Partnerships Kyle Costello said. “Initial benchmarking shows that our platform boosts internal diligence capacity by over 4 times, increases real-time regulatory coverage and aligns with evidence required during audit periods,” Kobalt Labs co-founder Kalyani Ramadurgam said. “Kobalt accelerates my manual workflow and reduces the time to meet ever-changing regulatory obligations,” said Sarah Mirsky-Terranova, Kobalt Labs advisor and former Chief Compliance Officer at Synctera and POSaBIT. Copyright © 2024 RegTech Analyst

Treasury Prime Frequently Asked Questions (FAQ)

When was Treasury Prime founded?

Treasury Prime was founded in 2017.

Where is Treasury Prime's headquarters?

Treasury Prime's headquarters is located at 2261 Market Street , San Francisco.

What is Treasury Prime's latest funding round?

Treasury Prime's latest funding round is Series C - II.

How much did Treasury Prime raise?

Treasury Prime raised a total of $103.19M.

Who are the investors of Treasury Prime?

Investors of Treasury Prime include QED Investors, Deciens Capital, SaaStr Fund, BAM Elevate, Invicta Growth and 9 more.

Who are Treasury Prime's competitors?

Competitors of Treasury Prime include Moov, Synctera, Rize, Infinant, Sandbox Banking and 7 more.

What products does Treasury Prime offer?

Treasury Prime's products include Treasury Prime API Platform.

Who are Treasury Prime's customers?

Customers of Treasury Prime include MaxMyInterest, Brex, Bench, Alto IRA and Challenger Finance.

Loading...

Compare Treasury Prime to Competitors

Unit develops financial infrastructure for banking and lending solutions. The company offers a platform that enables technology companies to build banking and lending products, including features such as bank accounts, physical and virtual cards, payments, and lending services. Its dashboard and suite of application programming interface (API), software development kit (SDK), and white-labeled user interface (UI) enable developers to build financial features into their products. It was founded in 2019 and is based in New York, New York.

Synctera provides partnerships between community banks and fintech companies through a two-sided marketplace. It offers business-to-business (B2B) transactions, business-to-consumer (B2C) transactions, wealth management, and investing, services for nonprofits, cannabis banking, and more. It serves individuals, enterprises, and banks. It was founded in 2020 and is based in Palo Alto, California.

Productfy is a platform specializing in the embedding of financial products within various business sectors. The company offers a suite of services including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

NovoPayment specializes in providing Banking as a Service (BaaS) platforms, focusing on digital financial and transactional services. The company offers a suite of bank-grade solutions including digital banking, payment processing, card issuing, and risk management services, all designed to integrate with existing systems to enhance financial operations and customer experiences. NovoPayment primarily serves banks, financial institutions, merchants, and other financial service providers looking to digitize and modernize their services. It was founded in 2007 and is based in Miami, Florida.

Alviere is an enterprise embedded finance platform operating in the financial services industry. The company offers a suite of financial products including accounts, payments, branded cards, and global money transfers, all designed to be integrated into clients' existing business models. Alviere primarily serves sectors such as travel and hospitality, retail, marketplaces, financial services, and telecommunications. Alviere was formerly known as Mezu. It was founded in 2020 and is based in Denver, Colorado.

Nymbus operates in the financial services industry, providing alternatives to traditional banking business models. The company offers products and solutions designed to enable financial institutions of all sizes to grow and serve their customers without the need for core conversion. Nymbus primarily caters to banks and credit unions looking to launch digital banking services, create niche financial brands, or deploy innovative core banking platforms. It was founded in 2015 and is based in Jacksonville, Florida.

Loading...