TRM

Founded Year

2018Stage

Series B - III | AliveTotal Raised

$150.05MLast Raised

$70M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-32 points in the past 30 days

About TRM

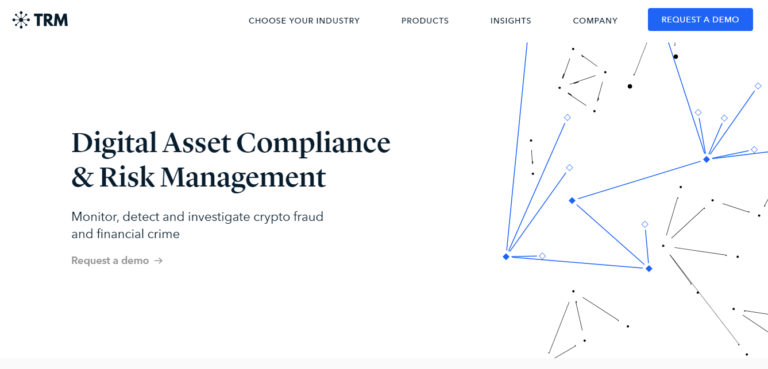

TRM is a blockchain intelligence company focused on detecting and investigating crypto-related financial crime and fraud. The company offers a suite of services including transaction monitoring, wallet screening, and know-your-entity solutions, as well as training programs for digital forensics and crypto compliance. TRM primarily serves financial institutions, crypto businesses, and the public sector. It was founded in 2018 and is based in San Francisco, California.

Loading...

TRM's Product Videos

_thumbnail.png?w=3840)

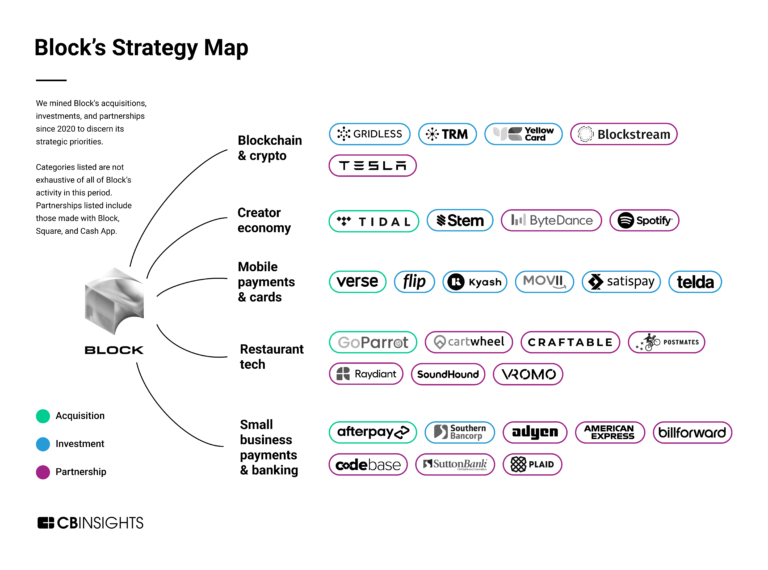

ESPs containing TRM

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

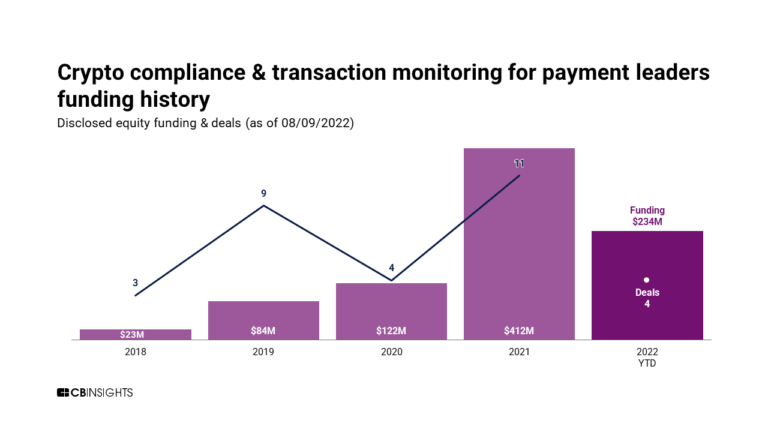

The crypto compliance & transaction monitoring market helps organizations comply with regulatory requirements in the cryptocurrency industry, including anti-money laundering (AML) and counter-terrorism financing (CTF) standards. These solutions leverage blockchain technology and proprietary risk algorithms to monitor transactions for potential illicit activity, such as money laundering, terrorism …

TRM named as Highflier among 15 other companies, including Chainalysis, CertiK, and Coinfirm.

TRM's Products & Differentiators

TRM Transaction Monitoring

Provides end-to-end transaction monitoring for AML compliance. Transactions are registered via our API and clients receive a risk score that's calculated in real-time to proactively detect suspicious transactions. Compliance professionals are then able to review activity and disposition alerts in TRM’s easy-to-use web interface, or in their own system. Registered transactions and pre-screened wallet addresses are continuously monitored daily and new alerts are generated as new risk(s) emerge.

Loading...

Research containing TRM

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TRM in 5 CB Insights research briefs, most recently on Mar 14, 2024.

Expert Collections containing TRM

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TRM is included in 4 Expert Collections, including Regtech.

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

8,276 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest TRM News

Sep 20, 2024

Link copied Brazilian authorities have uncovered a $9.7 billion crypto laundering scheme, arresting suspects in multiple cities as part of a major financial crime investigation. Brazilian authorities have clamped down on a multi-billion-dollar money laundering scheme involving cryptocurrencies across multiple cities, including São Paulo, Fortaleza, and Brasília. As part of the so-called “Operation Niflheim,” the Federal Revenue and Federal Police executed 23 search and eight arrest warrants, targeting a network suspected of using crypto to launder funds from criminal activities, such as drug trafficking and smuggling, blockchain forensic firm TRM Labs revealed in a Sept. 20 blog post . The investigation centers on two companies in Caxias do Sul that allegedly moved R$ 19 billion (around $3.6 billion) and R$ 15 billion ($2.8 billion) between August 2019 and May. Brazilian crypto laundering scheme | Source: TRM Labs The scheme involved four layers, including tax evaders, shell companies, and firms facilitating foreign exchange and crypto transactions. Laundered funds were then transferred abroad to countries like the U.S., Hong Kong, and the UAE. “Authorities discovered that over half of the deposits linked to the main suspects came from individuals with criminal backgrounds, pointing to widespread use of cryptocurrencies to facilitate illicit activities.” TRM Labs A federal court froze $1.58 billion in funds held in bank accounts and cryptocurrency exchanges, though the report did not specify which platforms were involved. In total, the Federal Police reported that over $9.7 billion had been laundered since the investigation began in 2021, underscoring the significant role cryptocurrencies play in facilitating financial crimes in Brazil.

TRM Frequently Asked Questions (FAQ)

When was TRM founded?

TRM was founded in 2018.

Where is TRM's headquarters?

TRM's headquarters is located at 450 Townsend Street, San Francisco.

What is TRM's latest funding round?

TRM's latest funding round is Series B - III.

How much did TRM raise?

TRM raised a total of $150.05M.

Who are the investors of TRM?

Investors of TRM include PayPal Ventures, American Express Ventures, Citi Ventures, Goldman Sachs, Thoma Bravo and 28 more.

Who are TRM's competitors?

Competitors of TRM include Coinfirm, Chainalysis, Ospree, Elementus, Merkle Science and 7 more.

What products does TRM offer?

TRM's products include TRM Transaction Monitoring and 2 more.

Loading...

Compare TRM to Competitors

Chainalysis is a blockchain data platform that operates in the cryptocurrency sector, providing insights and analytics to support various industries. The company offers solutions for crypto investigations, regulatory compliance, and market intelligence, enabling businesses, financial institutions, and government agencies to engage with digital assets securely and effectively. Chainalysis primarily serves law enforcement agencies, financial institutions, and regulatory bodies seeking to understand and leverage blockchain technology for security and compliance purposes. It was founded in 2014 and is based in New York, New York.

Elliptic is a company specializing in blockchain analytics and crypto compliance solutions within the financial technology sector. The company offers products and services designed to prevent financial crime in cryptoassets, including real-time wallet screening, automated transaction monitoring, and cross-chain investigations. Elliptic primarily serves financial institutions, crypto businesses, regulators, and law enforcement agencies. Elliptic was formerly known as Bitxchange. It was founded in 2013 and is based in London, England.

Merkle Science offers predictive transaction monitoring and forensics advanced solutions in blockchain monitoring. The company provides the infrastructure to help blockchain companies, cryptocurrency exchanges, investment funds, banks, and regulators perform due diligence on the blockchain. It was founded in 2018 and is based in Manhattan, New York.

Notabene provides pre-transaction compliance solutions in cryptocurrency. The company's main service is its SafeTransact platform, which offers a holistic view of crypto transactions, enabling customers to automate real-time decision-making, perform counterparty sanctions screening, identify self-hosted wallets, and ensure compliance with global regulations. It primarily serves financial institutions and virtual asset service providers (VASPs). It was founded in 2020 and is based in Brooklyn, New York.

Gray Wolf operates as a blockchain intelligence company. The company offers solutions that use data mining techniques to analyze blockchain data, trace asset origins and destinations, and evaluate counterparty risk. Its services are primarily used by virtual asset service providers, governments, and law enforcement agencies. The company was founded in 2019 and is based in Fredericton, Canada.

Scorechain specializes in blockchain analytics and compliance solutions within the cryptocurrency sector. The company offers a suite of tools for crypto wallet and transaction screening, customizable alerts, risk assessments, and detailed reporting to enhance due diligence and manage digital asset risks. Scorechain primarily serves sectors such as crypto businesses, financial institutions, law enforcement agencies, and regulators. It was founded in 2015 and is based in Esch-sur-Alzette, Luxembourg.

Loading...