TrueLayer

Founded Year

2016Stage

Series E | AliveTotal Raised

$271.8MValuation

$0000Last Raised

$130M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-36 points in the past 30 days

About TrueLayer

TrueLayer provides an open banking platform, specializing in the financial technology sector. The company provides solutions for instant bank payments, verified payouts, and streamlined user onboarding, leveraging real-time financial and identity data. TrueLayer primarily serves businesses in the ecommerce, iGaming, financial services, and cryptocurrency sectors. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, England.

Loading...

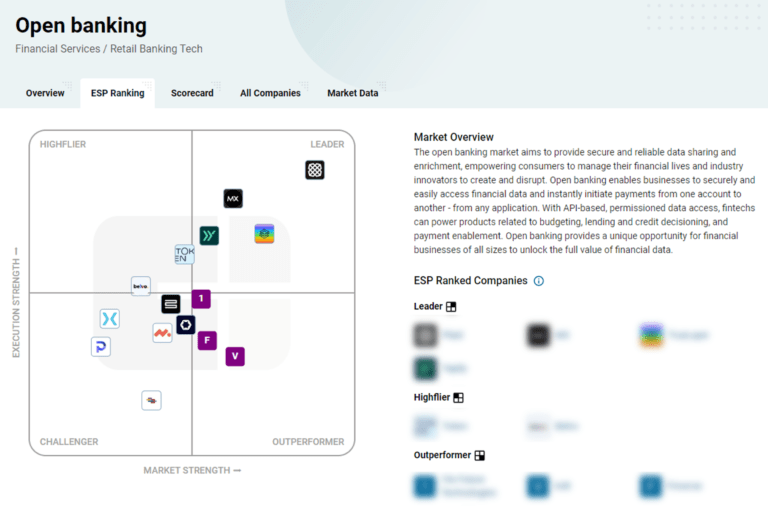

ESPs containing TrueLayer

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded payments infrastructure solutions market allows companies to integrate payment processing into non-banking digital platforms, such as online stores, without having to build the payment infrastructure from scratch. Vendors use APIs and software development kits to embed payment functionalities into software applications, websites, IoT devices, and other digital ecosystems. This integra…

TrueLayer named as Challenger among 15 other companies, including Stripe, Fiserv, and Adyen.

TrueLayer's Products & Differentiators

Data API

Connect an app to any bank account: delivering real-time access to account, balance, transaction, and identity data using open banking AIS.

Loading...

Research containing TrueLayer

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TrueLayer in 6 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Mar 14, 2024

The retail banking fraud & compliance market map

Jan 4, 2024

The core banking automation market map

Expert Collections containing TrueLayer

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TrueLayer is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

8,779 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,396 items

Excludes US-based companies

Latest TrueLayer News

Sep 14, 2024

TrueLayer & Stripe in UK Open Banking Partnership Leading fintech firms partner to enhance Pay by Bank offerings, promising reduced costs and improved user experience for British businesses TrueLayer, a Top 10 Open Banking Company and Europe's foremost Open Banking payments network, has announced an expansion of its partnership with global payment giant Stripe . This collaboration positions TrueLayer as the backbone of Stripe's Pay by Bank service across its UK payment products, marking a significant milestone in the adoption of Open Banking technology. The partnership comes at a crucial time for the fintech industry, as businesses increasingly seek alternatives to traditional payment methods. Pay by Bank, which Stripe unveiled in May , allows merchants to accept payments directly from customers' bank accounts, bypassing the need for credit card transactions. This approach not only streamlines the payment process but also promises substantial reductions in transaction fees – a key consideration for businesses operating on tight margins. Francesco Simoneschi, Co-founder and CEO of TrueLayer, says: “We're thrilled to be Stripe's open banking partner in the UK. By collaborating on Pay by Bank, we're offering customers the option to pay with their preferred bank account instead of a credit card. This is a significant milestone in the evolution of digital commerce.” Stripe: Removing barriers to checkout flows The move aligns closely with Stripe's stated objectives. In its annual letter published in March, the company emphasised the importance of removing barriers in online purchases and checkout flows. TrueLayer's open banking technology is well-positioned to support this vision, powering flexible, real-time and Strong Customer Authentication (SCA) compliant account-to-account payments. Industry analysts suggest that this partnership could accelerate the adoption of Open Banking payments in the UK. TrueLayer: Expanding Open Banking in the UK According to recent data from Open Banking Limited, the UK's open banking ecosystem now boasts over 7 million active users, with transaction volumes growing at an average rate of 15% month-on-month throughout 2023. TrueLayer has been at the forefront of this growth, becoming the first UK Open Banking provider to deliver commercial Variable Recurring Payments (VRP) through an API. The company reached a significant milestone last year, powering 1 million monthly VRP transactions – a clear indicator of the growing appetite for more flexible payment solutions. Eileen O'Mara, Chief Revenue Officer at Stripe, adds: “We're thrilled to partner with TrueLayer to help British businesses selling high-value goods and services save tens of thousands of pounds in payment fees every month.” The partnership is expected to particularly benefit sectors dealing with high-value transactions, such as luxury retail, travel and B2B services. These industries often grapple with significant card processing fees, which can eat into profit margins. But, by leveraging open banking technology, businesses can reduce these costs while offering customers a more streamlined payment experience. However, the road to widespread adoption of Pay by Bank solutions is not without challenges. Consumer trust and familiarity remain key hurdles, with many still preferring the perceived security and rewards associated with credit card transactions. Education and user experience will be crucial factors in driving adoption. Francesco Simoneschi of TrueLayer is, however, optimistic for the future: “This partnership with Stripe is just the beginning. We believe Open Banking payments have the potential to become the default way people pay online, offering a faster, more secure, and cost-effective alternative to traditional methods. “As we continue to innovate and expand our offerings, we're excited to see how businesses and consumers alike will benefit from this transformation in digital payments.” ************** Make sure you check out the latest edition of FinTech Magazine and also sign up to our global conference series – FinTech LIVE 2024 . **************

TrueLayer Frequently Asked Questions (FAQ)

When was TrueLayer founded?

TrueLayer was founded in 2016.

Where is TrueLayer's headquarters?

TrueLayer's headquarters is located at 40 Finsbury Square, London.

What is TrueLayer's latest funding round?

TrueLayer's latest funding round is Series E.

How much did TrueLayer raise?

TrueLayer raised a total of $271.8M.

Who are the investors of TrueLayer?

Investors of TrueLayer include Stripe, Tiger Global Management, Connect Ventures, Anthemis, Northzone and 14 more.

Who are TrueLayer's competitors?

Competitors of TrueLayer include Bud, Yaspa, Here, Vyne, Meniga and 7 more.

What products does TrueLayer offer?

TrueLayer's products include Data API and 3 more.

Loading...

Compare TrueLayer to Competitors

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Meniga specializes in digital banking solutions within the financial technology sector. The company offers a suite of products that enhance digital banking experiences by leveraging data consolidation, customer engagement, and revenue generation strategies. Meniga primarily serves financial institutions looking to improve their digital services. It was founded in 2009 and is based in London, United Kingdom.

Here engages in enterprise productivity through its specialized browser technology within the technology sector. It offers an enterprise browser that aims to improve productivity and security for various work applications, without the need for technical knowledge. It primarily serves sectors such as the financial services industry, government agencies, and contact centers, providing tailored solutions for workflow and operational automation. It was formerly known as OpenFin and changed its name to Here in June 2024. The company was founded in 2010 and is based in New York, New York.

Leveris has developed an end-to-end platform to allow financial institutions and fintech startups such as digital-only banks or challenger banks to run their services.

Teller is a company that focuses on providing API solutions for bank accounts in the financial technology sector. Their main service involves offering an easy-to-use API that allows users to connect their bank accounts to applications, enabling account verification, money transfers, payments, and transaction viewing. The company primarily serves the financial technology industry. It was founded in 2014 and is based in London, England.

Trustly Group is a global company that focuses on providing open banking solutions in the financial services sector. The company offers a range of services including facilitating secure and low-cost payments, instant payouts, and expedited customer onboarding. Additionally, it serves various sectors of the economy including the eCommerce industry, financial services, and gaming. It was founded in 2008 and is based in Stockholm, Sweden.

Loading...