Uni

Founded Year

2020Stage

Debt | AliveTotal Raised

$94.94MValuation

$0000Last Raised

$6.44M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+116 points in the past 30 days

About Uni

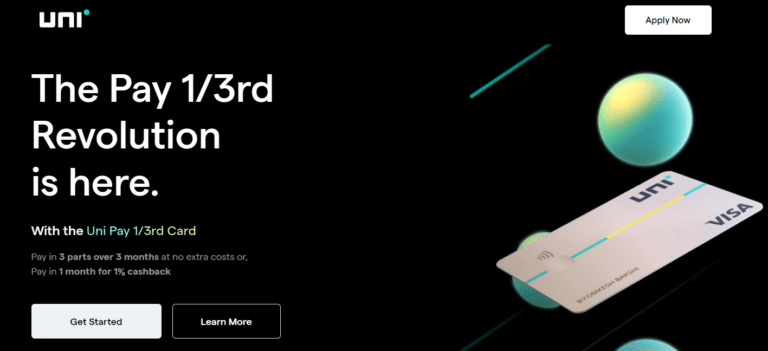

Uni is a fintech company focused on redefining the credit card experience within the financial services industry. The company offers next-generation credit cards with features such as cashback rewards, zero foreign exchange markup, and a user-friendly mobile application for managing finances. Uni primarily serves the consumer finance sector with its innovative credit card solutions. It was founded in 2020 and is based in Bengaluru, India.

Loading...

Loading...

Research containing Uni

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uni in 1 CB Insights research brief, most recently on Dec 17, 2021.

Expert Collections containing Uni

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uni is included in 1 Expert Collection, including Payments.

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Uni Patents

Uni has filed 9 patents.

The 3 most popular patent topics include:

- dresses

- electronics manufacturing

- engineered wood

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/3/2024 | 7/2/2024 | Light sources, Geometrical optics, Printed circuit board manufacturing, Electronics manufacturing, Soldering | Grant |

Application Date | 1/3/2024 |

|---|---|

Grant Date | 7/2/2024 |

Title | |

Related Topics | Light sources, Geometrical optics, Printed circuit board manufacturing, Electronics manufacturing, Soldering |

Status | Grant |

Latest Uni News

Sep 23, 2024

Tom Quinn 23 September 2024, 10.17am Researchers predict that by 2040, emissions from computing could take up more than half of the world’s carbon budget needed to keep global warming below 1.5°C above pre-industrial levels. Students at the University of Glasgow’s School of Computing Science will be the first in the UK to have lessons on the sustainability and environmental impact of digital technologies included in their undergraduate curriculum. The School’s updated curriculum aims to help future generations of computing scientists play leading roles in reducing ecological harms of the digital world. It will focus on understanding and assessing the problem of emissions from computing at a global scale, with a focus on specific systems that students will design and develop. Professor Wim Vanderbauwhede, who created and leads the School of Computing Science’s Low Carbon and Sustainable Computing Group, said: “The ever-increasing complexity of integrated circuits, and the reduction of repairability in favour of planned obsolescence, has outpaced our ability to use every generation of computers in the most energy-efficient ways. “Rethinking our approach to education is one way to help ensure that the next generation of computing scientists, who will be increasingly greatly impacted by the effects of the climate crisis, can be equipped with tools to help them tackle it.” Researchers predict that by 2040, emissions from computing could take up more than half of the world’s carbon budget needed to keep global warming below 1.5°C above pre-industrial levels. The energy demands of powering computers and data centres make up around 70% of the computing sector’s carbon emissions, while around a quarter of further emissions come from the production of computing hardware. That hardware is often replaced before it reaches the end of its useful lifespan and contains complex layers of metals, plastics and chemicals, which make them difficult and expensive to recycle. Dr Lauritz Thamsen, the School’s sustainability subject adviser, who led the push to integrate environmental considerations into the curriculum alongside Professor Vanderbauwhede, said: “We believe we are the first computing science department in the UK to embed this level of awareness and action in our curriculum, where students will be encouraged to consider questions of climate impact throughout their learning. “In addition to actively preparing new sustainability-focused material for core courses of our undergraduate programmes, we are now also starting to look at advanced courses and our postgraduate teaching.” Recommended reading

Uni Frequently Asked Questions (FAQ)

When was Uni founded?

Uni was founded in 2020.

Where is Uni's headquarters?

Uni's headquarters is located at Indiqube Sigma No.3/B, Nexus Koramangala 3rd Block SBI Colony, Bengaluru.

What is Uni's latest funding round?

Uni's latest funding round is Debt.

How much did Uni raise?

Uni raised a total of $94.94M.

Who are the investors of Uni?

Investors of Uni include Stride Ventures, Accel, General Catalyst, Elevation Capital, Eight Roads Ventures and 6 more.

Who are Uni's competitors?

Competitors of Uni include Slice, KB NBFC, Kissht, OneCard, Kiwi and 7 more.

Loading...

Compare Uni to Competitors

Slice operates as a financial technology company focusing on providing consumer payment solutions. The company offers a digital prepaid account for everyday payments, a fast and simple way to make payments via credit or UPI. The company primarily serves the financial services industry. Slice was formerly known as Slice Pay. It was founded in 2016 and is based in Bengaluru, India.

OneCard specializes in offering a metal credit card with a focus on simplicity and transparency in the financial services sector. The company provides a co-branded credit card that allows users to manage various aspects through a mobile app, including transaction limits and payment types, and offers a digital on-boarding process. OneCard's products are designed to cater to individual and family financial management needs, with features like shared credit limits and rewards on spending. It was founded in 2019 and is based in Pune, India.

Stashfin is a financial services platform. It provides instant personal loans to borrowers in India. Stashfin offers a variety of repayment options, including equated monthly installments (EMIs), lump sum payments, and flexible repayments. Stashfin was founded in 2016 and is based in New Delhi, India.

Galaxy Card is a financial services company that operates in the credit industry. The company offers an instant credit limit service, allowing customers to pay for daily needs, order from restaurants, pay bills, and shop online. Galaxy Card primarily serves the financial services industry. It was founded in 2017 and is based in Gurugram, India.

KB NBFC serves as a financial services provider focused on credit solutions for students in India. The company offers a range of products including financing for online purchases, loans for two-wheelers and college tuition, as well as cash loans, all tailored to the needs of college students with flexible repayment options. It was founded in 2016 and is based in Bangalore, India.

CRED is a members-only platform that offers financial and lifestyle progress for creditworthy individuals in the financial services sector. The company provides tools for managing credit cards, improving credit scores, and rewarding financial decisions with exclusive perks and privileges. CRED's services cater to individuals looking for secure financial management and lifestyle benefits. It was founded in 2018 and is based in Bengaluru, India.

Loading...