Unqork

Founded Year

2017Stage

Series C | AliveTotal Raised

$367.17MValuation

$0000Last Raised

$207M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-99 points in the past 30 days

About Unqork

Unqork is a company focused on providing a codeless application development platform for the enterprise sector. Their main offerings include a visual designer for creating complex, mission-critical enterprise applications without the need for traditional coding. The company primarily serves sectors such as financial services, insurance, government, and healthcare. It was founded in 2017 and is based in New York, New York.

Loading...

Loading...

Research containing Unqork

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Unqork in 12 CB Insights research briefs, most recently on Dec 18, 2023.

Dec 18, 2023

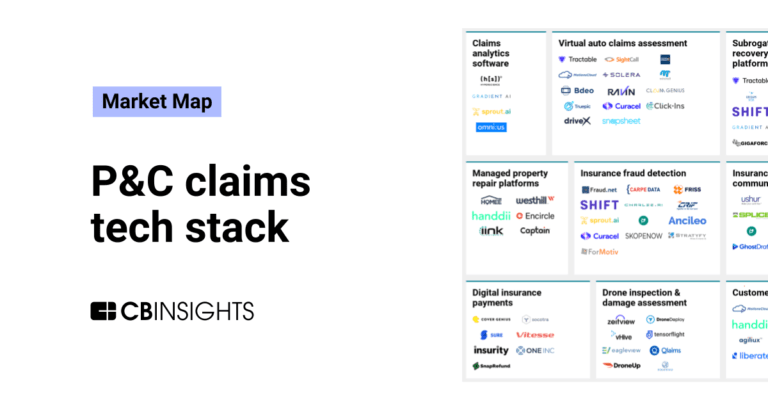

The P&C claims tech stack market map

Nov 10, 2023

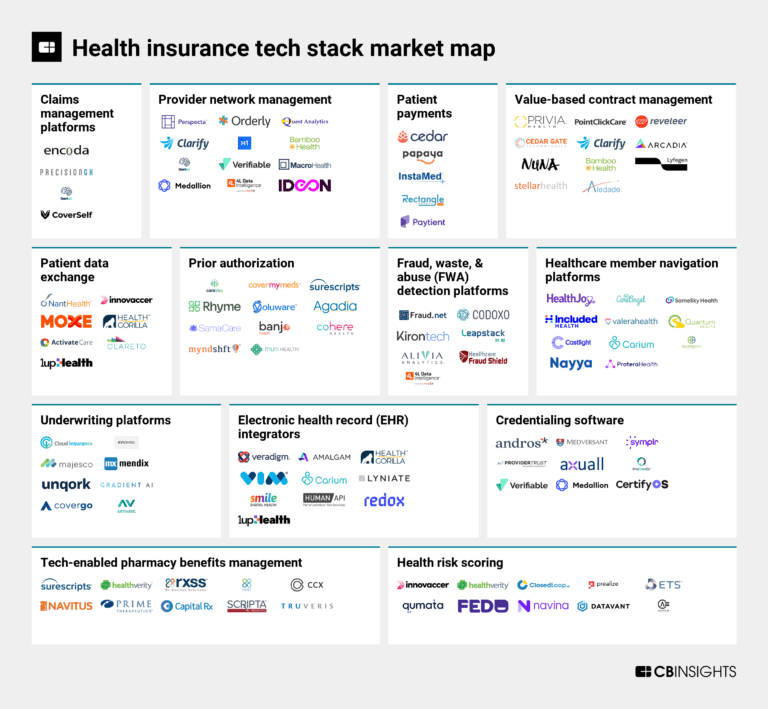

The health insurance tech stack market map

Apr 20, 2022 report

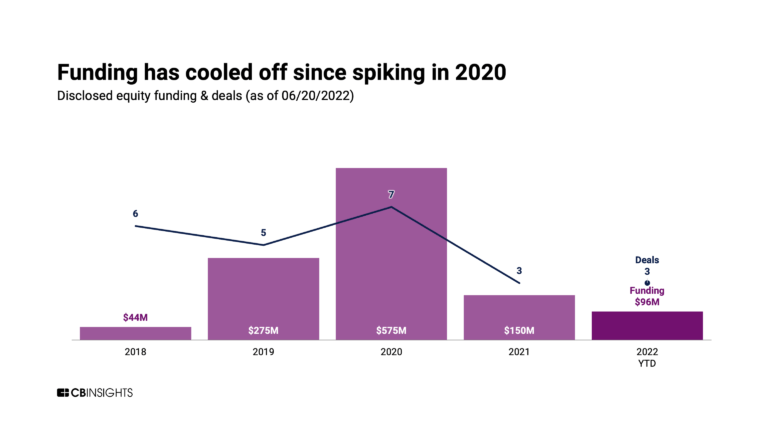

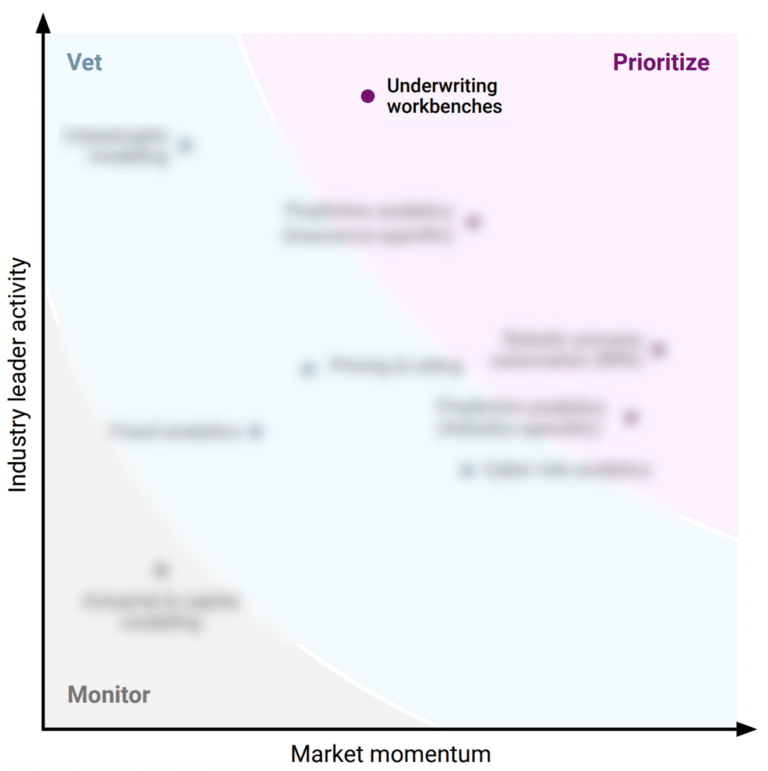

Why P&C insurance underwriters are prioritizing underwriting workbenchesExpert Collections containing Unqork

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Unqork is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Capital Markets Tech

1,119 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Robotic Process Automation

322 items

RPA refers to the software-enabled automation of data-intensive tasks that are low-skill but highly sensitive operationally, including data entry, transaction processing, and compliance.

Insurtech

4,354 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,297 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Unqork Patents

Unqork has filed 4 patents.

The 3 most popular patent topics include:

- software design patterns

- web frameworks

- cloud platforms

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/2/2018 | 5/9/2023 | Web frameworks, Graphical user interfaces, Integrated development environments, Java platform, Agile software development | Grant |

Application Date | 7/2/2018 |

|---|---|

Grant Date | 5/9/2023 |

Title | |

Related Topics | Web frameworks, Graphical user interfaces, Integrated development environments, Java platform, Agile software development |

Status | Grant |

Latest Unqork News

Sep 10, 2024

Unqork’s Platform Gains New Features: Aims to Sidestep Technical Debt Unqork, the first Enterprise App Cloud solution, has unveiled its latest platform enhancements: UDesigner, a next-generation application builder, and Vega, a new high-performance runtime. The company says that these releases tackle the widespread issue of technical debt that 92% of organizations are afflicted by, as revealed in a new Unqork-commissioned study. Here are the details FYI; Hidden Cost of Technical Debt and Legacy Systems According to Unqork’s survey of 500 business and technology leaders across financial services, insurance, healthcare, and the public sector, 85% reported that time spent maintaining legacy systems hampers their ability to launch new solutions. This ongoing battle with technical debt and legacy systems exhausts vital resources, strangling most organizations’ capacity to innovate. “Our study highlights a critical challenge: technical debt isn’t just a technical issue; it’s a strategic one,” said Thierry Bonfante, Chief Product and Technology Officer of Unqork. “UDesigner and Vega were created to break this cycle, empowering organizations to redirect their efforts from merely keeping the lights on to driving innovation.” UDesigner: Empowering Innovation with Modern Development Tools UDesigner, the centerpiece of Unqork’s new platform, reduces the time and complexity associated with enterprise application development. The next-generation Integrated Development Environment (IDE) integrates seamlessly with existing workflows, enabling teams to collaborate more effectively and accelerate time to market. “With 79% of respondents indicating that technical debt forces them to divert resources away from core objectives, UDesigner is a game-changer,” Bonfante continued. “Its intuitive interface and enhanced collaboration tools make it easier for teams to build and scale enterprise-grade applications, giving them the freedom to focus on what truly matters: innovation.” In addition to enhanced collaboration tools, UDesigner also comes equipped with a new, intuitive navigation interface, as well as improved integrated application lifecycle management. UDesigner was built entirely on Unqork’s data-driven architecture, using zero code. As a result, Unqork was able to accelerate its own software development, as well as completely eliminate code and the tech debt that comes with it. “The introduction of new components and full backward compatibility truly amplifies EY’s commitment to a smoother working environment and a better client experience,” says Filip Kobielski, Head of EMEIA Low-Code/No-Code Hub for Ernst & Young. “This release is undoubtedly a significant step torwards modernizing our client’s ecosystems and reducing technical debt.” Vega: The New Standard for Scalable, High-Performance Application Complementing UDesigner is Vega, Unqork’s latest runtime, which is engineered for composability and performance. The runtime features a new Embedded UI, Tables and Operations Builder, as well as modular extensibility. “We have been an early adopter of the new Vega components and see the combining of all grid features into a single component as a major improvement for this key functionality,” states Arron Lamp, Chief Information Officer of Tokio Marine HCC. As companies grapple with the complexities of innovating on top of a long list of fragmented legacy systems, Vega provides the foundation needed to compose next-generation applications that merge all systems into high-value applications. “In our survey, 77% of business leaders expressed fear of falling behind due to ‘innovation paralysis,'” Bonfante added. “By providing powerful composable application capabilities, Vega enables organizations to unlock business agility without being held back by the limitations of their existing infrastructure.” Share this:

Unqork Frequently Asked Questions (FAQ)

When was Unqork founded?

Unqork was founded in 2017.

Where is Unqork's headquarters?

Unqork's headquarters is located at 85 5th Avenue, New York.

What is Unqork's latest funding round?

Unqork's latest funding round is Series C.

How much did Unqork raise?

Unqork raised a total of $367.17M.

Who are the investors of Unqork?

Investors of Unqork include BlackRock, CapitalG, WiL, Goldman Sachs, Aquiline Capital Partners and 12 more.

Who are Unqork's competitors?

Competitors of Unqork include Planck, UniBlox, Inari, Federato, Groundspeed and 7 more.

Loading...

Compare Unqork to Competitors

Convr specializes in AI-driven underwriting analysis for the commercial property and casualty (P&C) insurance sector. The company offers a modular end-to-end underwriting management platform that processes commercial insurance data, automates risk assessment, and supports underwriting decisions with a patented AI decisioning engine. Convr's platform is designed to enhance underwriting productivity, improve risk classification accuracy, and streamline the submission intake process. It was founded in 2015 and is based in Schaumburg, Illinois.

Kalepa focuses on enhancing underwriting performance in the commercial insurance industry. The company's main service is an artificial intelligence(AI) powered underwriting workbench, which helps underwriters focus on high return on investment opportunities, quickly evaluate submissions, and understand the hidden risks associated with each case. It primarily serves the commercial insurance industry. It was founded in 2018 and is based in New York, New York.

Cytora specializes in the digitization of commercial insurance workflows, operating within the insurance technology sector. The company offers a platform that digitizes incoming risks, augments them with additional data, evaluates them against various business rules, and routes them to appropriate systems for underwriting. Cytora's platform is designed to improve premium growth, profitability, and service in the commercial and specialty insurance segments by streamlining core underwriting processes and enabling data-driven decision-making. Cytora was formerly known as Bisomotion Ltd. It was founded in 2014 and is based in London, England.

Carpe Data is a company that focuses on data science and artificial intelligence in the insurance industry. The company offers services that automate and optimize insurance claims and underwriting workflows, using advanced data science techniques and artificial intelligence to detect fraud, validate claimant information, and evaluate business profiles. The company primarily sells to the insurance industry. It was founded in 2016 and is based in Santa Barbara, California.

IntellectAI is a company that focuses on artificial intelligence and data insights, operating primarily in the financial services industry. The company offers a range of AI-powered products designed to streamline underwriting processes, provide risk analysis, and automate invoice processing in the insurance sector. IntellectAI primarily serves the insurance industry, with a particular focus on commercial and specialty insurance providers. It is based in Piscataway, New Jersey.

Instanda specializes in providing no-code software solutions for the insurance industry, focusing on policy administration and product innovation. The company offers a platform that enables carriers, MGAs, and brokers to design, build, and launch insurance products rapidly, with capabilities for seamless integration into existing systems. Instanda's platform is utilized by various sectors within the insurance industry, including property & casualty and life & health. It was founded in 2012 and is based in London, England.

Loading...