Vanta

Founded Year

2018Stage

Series C | AliveTotal Raised

$353MValuation

$0000Last Raised

$150M | 2 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+1 points in the past 30 days

About Vanta

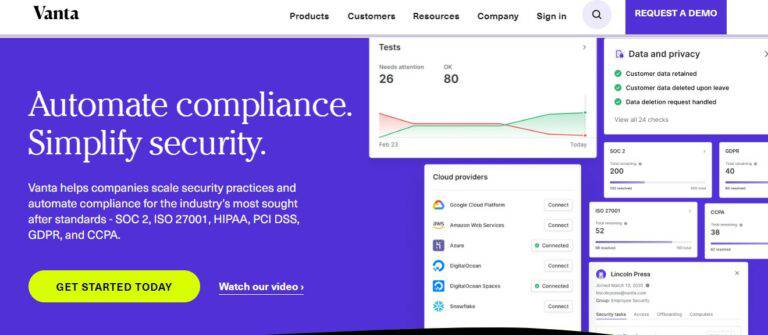

Vanta specializes in trust management for organizations, focusing on automated compliance and security within the technology sector. The company offers a product suite that streamlines the compliance process for various frameworks, manages vendor risks, and automates security questionnaires. Vanta's solutions cater to startups, mid-market companies, and enterprises, providing scalable security and compliance tools. It was founded in 2018 and is based in San Francisco, California.

Loading...

Loading...

Research containing Vanta

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Vanta in 4 CB Insights research briefs, most recently on Jun 10, 2022.

Expert Collections containing Vanta

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Vanta is included in 2 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Cybersecurity

9,489 items

These companies protect organizations from digital threats.

Vanta Patents

Vanta has filed 2 patents.

The 3 most popular patent topics include:

- computer security

- data laws

- information privacy

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/26/2022 | Information privacy, Computer security, Privacy, Data laws, Information technology management | Application |

Application Date | 5/26/2022 |

|---|---|

Grant Date | |

Title | |

Related Topics | Information privacy, Computer security, Privacy, Data laws, Information technology management |

Status | Application |

Latest Vanta News

Sep 21, 2024

AI causing problems? Fix it with AI96 sup { font-size: 100% !important;vertical-align: .5em !important;mso-text-raise: -1.5% !important;line-height: 0 !important; } ul { margin-left:0px !important; margin-right:10px !important; margin-top:20px !important; margin-bottom:20px !important; } ul li { margin-left: 0px !important; mso-special-format: decimal; } ol { margin-left:0px !important; margin-right:10px !important; margin-top:20px !important; margin-bottom:20px !important; } ol li { margin-left: 0px !important; mso-special-format: decimal; } li.listItem { margin-left:15px !important; margin-top:0px !important; } .paddingDesktop { padding: 10px 0 !important; } .edm_outlooklist { margin-left: -20px !important; } .embedImage { display:none !important; } Read Online AI causing problems? Fix it with AI Erika Remigio September 20, 2024 • Estimated Reading Time: 6 minutes Top NewsNvidia tackles AI-related issues using AI: Nvidia thinks its AI-RAN platform could be the key to solving the network strain that AI itself is causing. By teaming up with T-Mobile, Nokia, and Ericsson, Nvidia plans to use AI to make networks smarter, finding optimal network adjustments and predicting capacity needs. This technology could also help telcos offer AI-as-a-Service for things like robotics and autonomous driving, paving the way for the next generation of networks, including 6G. If anyone can take on an ambitious AI project like this, it’ll be Nvidia. Indian EdTech unicorn lands another round: Physics Wallah, an Indian EdTech startup, has raised $210 million in Series B funding, led by Hornbill Capital, valuing the company at $2.8 billion. Despite the challenging environment for EdTech in India, Physics Wallah continues to thrive with over 46 million students, $96.2 million in revenue, and 2.5x revenue growth from March 2023-2024. With this much momentum, a fruitful exit (or potentially an IPO) seems increasingly likely in the near future. Qualcomm starts talks to buy Intel: Qualcomm has reportedly approached Intel about a potential takeover, though no deal is confirmed. This comes at a challenging time for Intel, which has struggled with financial losses, workforce downsizing, and manufacturing issues. Meanwhile, its rivals, including Qualcomm, have gained ground in areas like AI, mobile processors, and gaming. A successful acquisition would mark a major shift in the semiconductor industry, strengthening Qualcomm's position in the desktop processor market. Top Investors Pass on OpenAI One of our latest additions to the TWiST500 has constantly been in the news, and for good reason. With 200 million weekly active users and an annualized revenue of $3.4 billion, OpenAI is on track to be the world’s most valuable AI company. That’s why its latest fundraising round has attracted so much interest (and mystery). Investors are betting big on OpenAI as it finalizes a $6 billion-plus round, valuing the company at $150 billion. While major players like Apple, Nvidia, and Microsoft are eyeing the round, Andreessen Horowitz and Sequoia Capital are sitting this out, according to sources close to the matter. While it may seem unthinkable not to throw money at an AI giant like OpenAI, some investors may not want to throw all their eggs in one basket. To get a substantial return on investment at this scale, OpenAI would need to be worth at least $1.5 trillion. And it has its fair share of challenges ahead, too. Fierce competition from the likes of Google and Meta and a substantial burn rate of $5 billion a year may be leading some investors to take a more conservative approach. There’s no doubt that this round will continue to make waves until it closes, so we’ll be sure to update you when there’s news. — ErikaA message from Squarespace Turn your idea into a beautiful website! Go to http://www.squarespace.com/twist for a free trial. When you’re ready to launch, use offer code TWIST to save 10% off your first purchase of a website or domain. This Week in StartupsStartup Legal Basics: Wilson Sonsini partner Becki DeGraw covers the challenges faced by distressed companies, including VCs stepping down from boards and the complexities of insider-led down rounds and pay-to-play scenarios. She highlights the legal actions and stockholder lawsuits involved in successful turnarounds, the importance of conducting market checks during financing, and ethical issues in the startup ecosystem. E2011: Comma’s Harald Schäfer chats with Jason about their approach to self-driving technology, including cost, installation, and open-source contributions. Harald compares strategies between Comma, Waymo, and Tesla FSD, discusses Lidar vs. camera-based systems, and explores the global adoption of self-driving technology. They also cover future predictions, developments in China, and the role of AI in robotics. E2010: Sankari Nair, Cofounder of Recall, joins Jason to walk us through the features of their platform, including automatic taxonomy creation, augmented browsing, and indexing of web content. They explore B2B applications, multiplayer collaboration, AI summarization costs, and personalized learning options. They finish it off with topics like LinkedIn integration, the concept of "luxury software," and investment opportunities in Recall's startup journey. TWiST Partner Offers.Tech Domains: Don’t miss our “Jam with JCal” contest! To apply and get more details go to https://jamwithjcal.tech brought to you by .tech domains. Vanta: Compliance and security shouldn't be a deal-breaker for startups to win new business. Vanta makes it easy for companies to get a SOC 2 report fast. TWiST listeners can get $1,000 off for a limited time at https://www.vanta.com/twistMicro1: Micro1 is an AI recruitment engine to hire world class engineers fast.. Visit https://www.micro1.ai/twist to open a talent search and get a 2 week free trial per hire. Founder University Applications are open for Founder University Cohort 9, a 12-week remote pre-accelerator program tailored towards navigating early-startup practices, building an MVP, and growing traction. Submit your application at Founder University — Cohort 9 begins on October 25th! The TWiST500 newsletter is the new, updated, and improved TWiST Ticker. Update your email preferences or unsubscribe here © 2024 TWiST Ticker 548 Market Street PMB 72296San Francisco, California 94104, United States of America Powered by beehiiv Terms of Service

Vanta Frequently Asked Questions (FAQ)

When was Vanta founded?

Vanta was founded in 2018.

Where is Vanta's headquarters?

Vanta's headquarters is located at 369 Hayes Street, San Francisco.

What is Vanta's latest funding round?

Vanta's latest funding round is Series C.

How much did Vanta raise?

Vanta raised a total of $353M.

Who are the investors of Vanta?

Investors of Vanta include Y Combinator, CrowdStrike Falcon Fund, Sequoia Capital, HubSpot Ventures, Craft Ventures and 11 more.

Who are Vanta's competitors?

Competitors of Vanta include FairNow, SafeBase, Sprinto, Scrut, anecdotes and 7 more.

Loading...

Compare Vanta to Competitors

Drata is a security and compliance automation platform that specializes in streamlining audit readiness and maintaining compliance across various frameworks. The company offers solutions for continuous control monitoring, automated evidence collection, and workflow optimization to ensure companies are audit-ready. Drata's platform is designed to serve startups, growth-stage companies, and enterprises by providing scalable compliance automation tools and support for custom frameworks. It was founded in 2020 and is based in San Diego, California.

Secureframe focuses on providing automated compliance solutions. The company offers a platform that streamlines compliance tasks and manages security and risk. The company primarily sells to the business sector, including small businesses and enterprises. It was founded in 2020 and is based in San Francisco, California.

Thoropass specializes in end-to-end compliance solutions within the information security and data privacy sectors. The company offers services such as achieving and maintaining compliance, automating compliance processes, conducting security audits, and providing integrations for various compliance frameworks. Thoropass primarily serves sectors such as health technology and finance technology. Thoropass was formerly known as Laika. It was founded in 2019 and is based in New York, New York.

HyperProof develops a compliance solution designed for simplicity. The solution works alongside end user applications such as outlook and gmail to slack, trello and more. The company was founded in 2018 and is based in Seattle, Washington.

Hicomply specializes in information security management systems within the data security and compliance sector. The company offers a software platform that facilitates the building, automation, and management of an ISMS, helping businesses adhere to regulatory standards like ISO 27001, SOC 2, and GDPR. Hicomply's platform serves various sectors that require stringent information security and compliance solutions. It was founded in 2019 and is based in Durham, England.

Scrut specializes in governance, risk, and compliance for modern businesses within the GRC sector. The company offers a platform that focuses on these processes, amis to make them more accessible and manageable for companies. It was founded in 2022 and is based in Delhi, India.

Loading...