Veracode

Founded Year

2006Stage

Acq - Fin - II | AliveTotal Raised

$114.3MValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+22 points in the past 30 days

About Veracode

Veracode focuses on intelligent software security in the technology industry. The company offers a software security platform to continuously find and fix flaws and vulnerabilities in software throughout the development lifecycle using artificial intelligence (AI). It primarily sells to sectors such as the public sector, financial services, software and technology, retail and e-commerce, and healthcare. Veracode was formerly known as Veracode Securities Corporation. It was founded in 2006 and is based in Burlington, Massachusetts.

Loading...

ESPs containing Veracode

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The software composition analysis (SCA) market is focused on providing tools and solutions to help companies manage the risks associated with open-source software in development. With the widespread use of open-source software, it has become essential for security and risk management leaders to expand their toolsets to include detection of malicious code, operational and supply chain risks. The SC…

Veracode named as Leader among 15 other companies, including Microsoft, Snyk, and JFrog.

Loading...

Research containing Veracode

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Veracode in 6 CB Insights research briefs, most recently on Feb 20, 2024.

Feb 20, 2024

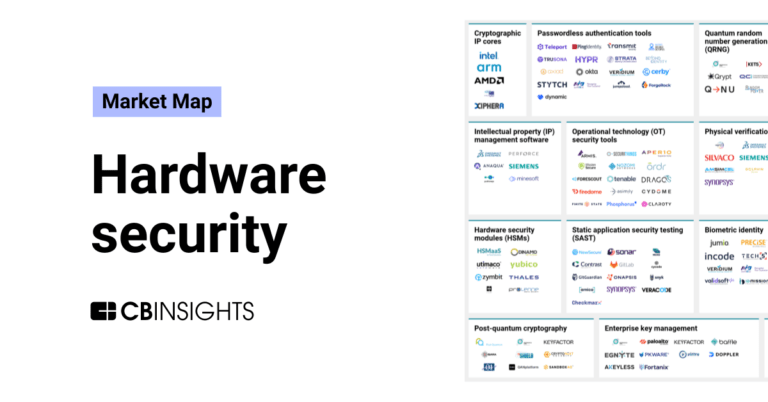

The hardware security market mapExpert Collections containing Veracode

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Veracode is included in 4 Expert Collections, including Regtech.

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Cybersecurity

9,528 items

These companies protect organizations from digital threats.

Advanced Manufacturing

6,353 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Defense Tech

1,268 items

Defense tech is a broad field that encompasses everything from weapons systems and equipment to geospatial intelligence and robotics. Company categorization is not mutually exclusive.

Veracode Patents

Veracode has filed 47 patents.

The 3 most popular patent topics include:

- software testing

- software design patterns

- computer network security

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/24/2020 | 8/27/2024 | Programming paradigms, Operating system security, Software design patterns, Web frameworks, Software architecture | Grant |

Application Date | 4/24/2020 |

|---|---|

Grant Date | 8/27/2024 |

Title | |

Related Topics | Programming paradigms, Operating system security, Software design patterns, Web frameworks, Software architecture |

Status | Grant |

Latest Veracode News

Sep 18, 2024

Posted on IBM (US), HCLTech (India), Synopsys (US), OpenText (UK), Cigniti (US), Qualitest (UK), Intertek (UK), DXC Technology (US), eInfochips (US), Checkmarx (US), HackerOne (US), Invicti (US), DataArt (US), Cobalt Labs (US), Trustwave (US), Contrast Security (US), Veracode (US), Qualys (US), OffSec (US). Security Testing Market by Type (Network, Application, Device, Social Engineering), Network Security Testing (Penetration Testing, Vulnerability Scanning, Firewall), Application Testing Tools (RASP, SAST, DAST, IAST) – Global Forecast to 2029. The global security testing market size is projected to grow from USD 14.5 billion in 2024 to USD 43.9 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 24.7% during the forecast period. The sophistication and frequency of cyberattacks are rising, forcing enterprises to proactively detect and address vulnerabilities, which is driving the expansion of security testing. In addition, frequent security testing must ensure compliance and protect sensitive data due to strict regulatory requirements such as GDPR, HIPAA, and PCI DSS further fuels the market growth. Based on the application testing tools, SAST accounts for the highest market size during the forecast period. The adoption of Static Application Security Testing (SAST) tools is increasing as organizations prioritize secure software development. SAST tools enable developers to identify and fix security vulnerabilities early in the coding process, reducing the risk of security flaws in production. This shift is driven by the growing emphasis on integrating security into the software development lifecycle (SDLC) and the need to comply with stringent security standards. As a result, more companies are adopting SAST tools to enhance code security, improve development efficiency, and ensure that applications are robust against cyber threats from the outset. By Application security testing type, web application security testing accounts for the highest market size during the forecast period. The adoption of web application security testing is growing as organizations increasingly rely on web-based platforms for business operations and customer interactions. With the rise in cyber threats targeting web applications, such as SQL injection and cross-site scripting (XSS), companies are prioritizing security testing to identify and mitigate vulnerabilities before they can be exploited. This proactive approach is driven by the need to protect sensitive data, ensure compliance with regulations, and maintain customer trust in an environment where web applications are a critical part of the business landscape. By Region, Asia Pacific will grow at the highest CAGR during the forecast period. The adoption of security testing services in the Asia Pacific region is rapidly increasing due to the region’s expanding digital economy and the rising threat of cyberattacks. As busin esses in Asia-Pacific embrace digital transformation and cloud computing, the need to identify and address vulnerabilities in their systems has become crucial. Regulatory pressures and growing awareness of cybersecurity risks are also driving organizations to invest in security testing solutions to ensure the resilience of their IT infrastructure and protect sensitive data from breaches. This trend is further fueled by the region’s diverse and complex threat landscape, prompting a proactive approach to cybersecurity. Unique Features in the Security Testing Market One unique feature driving the security testing market is the increasing sophistication and frequency of cyberattacks. As cybercriminals adopt advanced tactics, enterprises are compelled to implement security testing solutions that proactively identify and address vulnerabilities before they can be exploited. Regulatory Compliance as a Growth Driver Another distinctive aspect of the security testing market is the strong influence of regulatory compliance requirements. Organizations must adhere to stringent standards such as GDPR, HIPAA, and PCI DSS to protect sensitive data and maintain customer trust. Adoption of Automation and AI in Testing The growing adoption of automation, artificial intelligence (AI), and machine learning (ML) technologies is a unique trend in the security testing market. These technologies enable faster, more efficient, and accurate identification of vulnerabilities across complex IT environments. Cloud-Based Security Testing Solutions Another unique feature is the shift toward cloud-based security testing solutions. As organizations increasingly migrate to cloud environments, the demand for security testing tools designed specifically for cloud infrastructures is on the rise. Increased Focus on Application Security Lastly, the focus on application security is a notable feature in the market. With the rapid growth of web and mobile applications, ensuring the security of these applications has become a critical priority for businesses. Major Highlights of the Security Testing Market Rising Need for Proactive Vulnerability Detection Another key highlight is the growing need for proactive vulnerability detection. As cyberattacks become more frequent and complex, businesses are prioritizing the identification and mitigation of security flaws before they can be exploited. Regulatory Compliance Driving Market Expansion A major driving force in the market is regulatory compliance. Stringent standards such as GDPR, HIPAA, and PCI DSS require organizations to implement regular security testing to ensure the protection of sensitive data and avoid penalties. Increasing Adoption of AI and Automation The increasing integration of artificial intelligence (AI) and automation in security testing is another notable highlight. These technologies enhance the efficiency and accuracy of testing processes by enabling automated vulnerability detection, continuous monitoring, and predictive analysis. Growth in Cloud-Based Security Solutions The market is also witnessing a significant shift toward cloud-based security testing solutions. With more organizations migrating to cloud infrastructures, the demand for security tools specifically designed for cloud environments has surged. Top Companies in the Security Testing Market The security testing market is led by some of the globally established players, such as IBM (US), HCLTech (India), Synopsys (US), OpenText (UK), Cigniti (US), Qualitest (UK), Intertek (UK), DXC Technology (US), eInfochips (US), Checkmarx (US), HackerOne (US), Invicti (US), DataArt (US), Cobalt Labs (US), Trustwave (US), Contrast Security (US), Veracode (US), Qualys (US), OffSec (US), NCC Group (UK), GitHub (US), Bugcrowd (US), Applause (US), Rapid7 (US), and Parasoft (US). Partnerships, agreements, collaborations, acquisitions, and product developments are various growth strategies these players use to increase their market presence. IBM (US) is a computer, technology, and IT consulting corporation. The company operates through various segments, such as cognitive solutions, global business services, technology services and cloud platforms, systems, and global financing. IBM’s clients comprise individual users, specialized businesses, and institutions, such as government, IT, defense, and educational organizations. In the category of security testing services, IBM offers X-Force Red Penetration Testing Services, X-Force Red Social Engineering Services, and X-Force Red Offensive Security Services. With the geographic presence across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, the company caters to various industries, such as IT, healthcare, life sciences, government, telecom, automobile, manufacturing, chemicals and petroleum, electronics, energy and power, media and entertainment, mining, retail, BFSI, travel and transportation, education, and others. Synopsys (Canada) provides advanced technologies for chip design, verification, IP integration, and software security and quality testing. The company’s security IP solutions segment includes a range of cryptography cores, security protocol accelerators and processors, embedded security IP modules, secure boot and cryptography middleware as well as content protection IP for integration into system-on-chips. These IP solutions also provide the highest levels of security for a range of products in the mobile, automotive, digital home, lot, and cloud computing markets. These integrated solutions enable the most efficient silicon design and the highest level of security to help prevent a wide range of evolving threats in connected devices. For security testing, Synopsys provides software tools such as Polaris, an AppSec which is used from development to deployment; Coverity which find security and quality defects in code; Seeker which automates web application security testing in DevOps; as well as Static Application Security Testing (SAST); Interactive Application Security Testing (IAST); and Defensics Fuzz Testing. It also provides services such as penetration testing services, MAST and others. With more than 30 years of experience, Synopsys has more than 14,000 employees and is present across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Media Contact

Veracode Frequently Asked Questions (FAQ)

When was Veracode founded?

Veracode was founded in 2006.

Where is Veracode's headquarters?

Veracode's headquarters is located at 65 Network Drive, Burlington.

What is Veracode's latest funding round?

Veracode's latest funding round is Acq - Fin - II.

How much did Veracode raise?

Veracode raised a total of $114.3M.

Who are the investors of Veracode?

Investors of Veracode include TA Associates, Thoma Bravo, CA Technologies, Founders Circle Capital, Accomplice and 13 more.

Who are Veracode's competitors?

Competitors of Veracode include ReversingLabs, Chainguard, Oxeye, GuardRails, CodeSecure and 7 more.

Loading...

Compare Veracode to Competitors

Checkmarx operates as an application security testing company. It provides software solutions to identify, fix, and block security vulnerabilities in websites and mobile applications. It also provides a way for organizations to introduce security into their software development lifecycle. The company was founded in 2006 and is based in Atlanta, Georgia.

Snyk focuses on developer security within the technology industry. The company offers services that help developers build secure applications and allow security teams to meet the demands of the digital world. Its services include finding and fixing vulnerabilities in code, dependencies, containers, and infrastructure as code. It was founded in 2015 and is based in Reading, United Kingdom.

Lookout is a data-centric cloud security company that specializes in defense-in-depth strategies across various stages of cybersecurity threats. The company offers a range of products including mobile endpoint security, threat intelligence, and data loss prevention, all designed to protect sensitive data from modern cyber threats. Lookout's solutions cater to a diverse set of industries, including healthcare, education, government, financial services, and manufacturing. Lookout was formerly known as Flexilis. It was founded in 2007 and is based in San Jose, California.

Vantage Point Security specializes in testing and application security within the digital transformation sector. The company offers security testing services for applications, networks, and cloud infrastructure to identify vulnerabilities and protect business digital assets. Its services cater to industries such as banking and finance, insurance, telecommunications, healthcare, and fintech. Vantage Point Security was founded in 2014 and is based in Singapore.

Contrast Security provides application security software. It enables software applications to protect against cyber attacks and offers solutions such as compliance testing, automated penetration testing, application security monitoring, and more. The company provides solutions for government, financial services, healthcare, and more. It was founded in 2014 and is based in Los Altos, California.

Zimperium provides enterprise mobile threat defense. The Zimperium Mobile Threat Defense system delivers enterprise-class protection for Android and iOS devices against the next generation of advanced mobile threats. Developed for mobile devices, Zimperium uses patented, behavior-based analytics that continuously runs on the device to protect mobile devices against WiFi, cellular, and host-based threats wherever business takes them. It was founded in 2010 and is based in Dallas, Texas.

Loading...